U.S. markets stole the show in 2013, as broad benchmarks had one of

their best years in recent memory. The S&P 500 added over 30%

on the year, while small caps performed even better than that.

Thanks to this solid economic environment, and hopes for more gains

this year, ETFs targeting the U.S. economy have been seeing solid

inflows as of late. In fact, over the past year, more than $117

billion has flowed into U.S. equity funds (per data from XTF.com),

showcasing how much interest there has been in American-focused

investments.

With these kind of inflows, it shouldn’t be too surprising to note

that some ETF issuers have put out new funds targeting the U.S.

market in recent months. While many of these funds are ‘me-too’

products, there are still a few novel funds hitting the market,

even in the crowded U.S.-equity space (see all the Total Market US

ETFs).

In particular, the latest addition from PowerShares, the

NYSE Century Portfolio—trading under the symbol of

NYCC—could be an interesting (and safe) way for

investors to play the broad U.S. market. We have highlighted some

of the key details below regarding this new fund, and how this

product might be a solid way for some investors to use it to

establish broad market U.S. exposure:

NYCC ETF in Focus

NYCC tracks the NYSE Century Index, a benchmark of companies that

have been incorporated in the U.S. for at least 100 years. Firms

also must be listed on major US exchanges, and have a market

capitalization of at least $1 billion.

This approach is designed to give exposure to some of the largest

and oldest public companies in the United States. The technique

could also tilt towards safer companies that have endured both

recessions and boom periods, and seem poised to survive the next

round of trouble as well (see Play Safe with These 3 ETFs).

“The PowerShares NYSE Century Portfolio invests in household names

that have defined the American economy for more than a century,”

said Martin L. Flanagan, president and CEO of Invesco. "We believe

NYCC offers investors targeted exposure to companies that have

demonstrated the ability to innovate, transform and grow through

decades of varying economic cycles, political conditions and social

change.”

The fund is a bit pricey though, as its expense ratio comes in at

50 basis points a year. This is far higher than what many other

U.S. market ETFs charge, and considering that there is only an

annual rebalancing—and probably minimal turnover—it does look to be

a profitable fund for PowerShares should the assets under

management increase.

NYCC Holdings

In a bit of a surprise, the fund does hold nearly 375 companies, so

there is apparently a pretty large basket of century-old firms out

there. Additionally, just 30% of its portfolio is in large caps, so

there are quite a large number of mid and small cap securities that

have stood the test of time (also see 3 Small Cap Value ETFs Poised

to Outperform).

Financials take the top spot in terms of a sector allocation, at

just under 24% of assets. This is closely followed by industrials

at 20%, and then both the consumer sectors and utilities take up

roughly 10% of NYCC as well.

How does it fit in a portfolio?

The fund could be an interesting choice for investors who want

broad U.S. market exposure with a tilt towards safety. It may also

be appropriate for those seeking to avoid tech names, as technology

and telecom combine to make up less than 5% of the portfolio.

NYCC might not be the best choice for those seeking a low cost

option, as there are plenty of cheaper funds out there.

Additionally, the fund might not be a great pick in high growth

environments (due to its tilt towards safer sectors), though the

underlying index did outperform the S&P 500 in 2013.

ETF Competition

There aren’t really any direct competitors for NYCC, though there

are several broad market ETFs out there. A popular example in this

respect is the

Vanguard Total Stock Market ETF

(VTI) which costs just five basis points a year and has

nearly $40 billion in AUM.

In terms of other funds with a ‘time’ component, there are several

dividend ETFs that only hold securities that have been raising

dividends for at least a decade. These include

VIG

and

SDY, though this focus on dividend

appreciation is obviously different than what NYCC is zeroing in on

(see 4 Ways to Grow Dividends with ETFs).

Bottom Line

Given the differences between the new PowerShares fund and what

else is on the market, there may be room for NYCC in what is

otherwise a very crowded space. The product does manage to

find an interesting niche in a very competitive market, so we will

have to see if investors want to embrace this approach.

However, the somewhat steep cost—at least compared to others in the

multi-cap market—could be prohibitive in terms of gaining assets in

the near term. NYCC will have to outperform broad markets this year

in order to prove its mettle, and demonstrate to investors that

focusing on century old companies can be a time-tested strategy for

gains.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days.

Click to get this free report

>>

SPDR-SP DIV ETF (SDY): ETF Research Reports

VANGD-DIV APPRC (VIG): ETF Research Reports

VIPERS-TOT STK (VTI): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

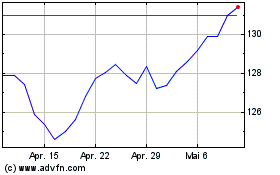

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

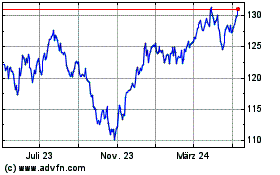

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Mai 2023 bis Mai 2024