With income inequality issues and economic protests dominating

the headlines as of late, the so-called ‘one percent’ have been in

focus. These wealthy individuals—in case you have been living under

a rock the past few months—consist of the richest 1% of the

populace in the country and control a disproportionate amount of

the nation’s wealth.

In fact, some reports suggest that this small group of people

possesses more than 40% of all financial assets in the country

including half of all stocks, bonds, and funds. Furthermore, they

only have just 5% of the debt and are taking home more of the

national pay than any time in the past 90 years.

Yet despite these trends and the growing backlash against these

ultra-wealthy, little seems likely to be done in order to change

the status quo. The major political parties seem unwilling and

unable to compromise on any economic issues, especially in an

election year, so it looks as though these trends will continue at

least into the foreseeable future (see more in the Zacks

ETF Center).

While this certainly isn’t good news for those in any of the

protest ‘movements’ across the country, there are definitely ways

for investors to play the scenario. After all, many of the

techniques and strategies being used by the 1% are well known and

easy to employ in a personal portfolio and could be great choices

for investors seeking to make a similar play with their assets.

This is especially true given the vast proliferation of ETFs

over the past few years and all the strategies that these products

have opened up to regular investors. Now, mom and pop investors can

use many of the techniques that were once reserved for the ultra

rich of the country that have millions in liquid assets (One

Percenters should also read the Complete Guide to Preferred Stock

ETF Investing).

Below, we have highlighted three ETFs in order to help people

invest like the one percent. These products look to target many of

the methods that ultra-high net worth investors have been using for

years in their own portfolios, but in a way that is accessible and

cheap to buy for the ’99%’ of investors out there.

iShares S&P National Municipal Bond Fund (MUB)

Municipal bonds are securities that are issued by local and

state governments in order to build or finance any number of

projects ranging from infrastructure improvements to general budget

uses as well. Often times, in order to encourage investment, these

securities are exempt from federal income tax and are often free

from inclusion in AMT calculations as well.

Since regular taxable bonds are taxed at 35% for the top

bracket, this can be a huge selling point for rich investors who

are seeking to keep their tax liabilities low while still

participating in the fixed income world. Luckily for investors

looking to apply this strategy with funds, there are a number of

muni bond ETFs available.

One of the most popular is iShares’ MUB, a $3 billion dollar

fund that has over 2,000 securities in its basket and has an

investment grade debt focus. Additionally, the product charges a

modest 25 basis points a year in fees while tilting exposure to

bonds from California, New York, and Texas (see The Forgotten

Municipal Bond ETFs).

In terms of yield, the fund pays out a taxable equivalent yield

of about 3% in 30 Day SEC Yield terms while possessing a modest

effective duration. While the yield may not sound that impressive,

investors should consider that comparable Treasury bond ETFs pay

out just 1.5% in comparison, and that is without the tax

benefit.

Clearly, for those in the top tax brackets, muni bond funds can

provide a decent low risk yield that is far in excess of Treasury

bills. With these benefits, investors who are looking to a make a

bond investment like the 1% could be well served by looking at the

muni space.

Vanguard Dividend Appreciation ETF (SDY)

For high income individuals who find themselves in the top

income brackets, dividend investing is another popular avenue. That

is because dividends are currently taxed at a favorable rate of 15%

for high income earners, far less than other types of income.

Thanks to this, it can be beneficial to steer assets towards

dividend paying stocks, keep the investment in there for the long

haul, and live off the dividend income taxed at the favorable rate.

Luckily for investors looking to do this in ETF form, there are a

number of quality choices (see 11 Great Dividend ETFs).

One of the more popular is SDY, a fund that tracks the S&P

High Yield Dividend Aristocrats Index. This benchmark measures the

performance of the 60 highest dividend yielding S&P Composite

15000 constituents that have consistently increased dividends every

year for at least the past quarter century.

In a way, this fund represents the ‘one percent’ of dividend

stocks, focusing on the top securities in the space that have been

among the most consistent dividend growers. Furthermore, the very

name of the benchmark—with the focus on ‘Aristocrats’—screams ‘1%’

to many.

In terms of its portfolio, consumer, financials, and industrials

comprise the top three sectors, while energy, technology, and

telecom are the bottom three. While the yield isn’t enormous, only

3.2% at this point, it is likely to give investors a stable yield

at a relatively cheap cost (0.35%), making it an interesting pick

for investors looking to mimic the strategies of those in the top

income brackets.

iShares FTSE NAREIT Mortgage REIT ETF (REM)

In another strong dividend play, investors can consider REM. Not

only is its payout impressive, but the fund focuses on real estate,

a hallmark of one percenter investing. While it is true that

regular investors can miss out on certain tax benefits that

can come with outright real estate purchases, there are also a

number of headaches—tenants, repairs, etc.—that can be avoided with

an ETF/REIT approach.

Furthermore, REM’s dividend will be extremely tough to beat as

the product currently has a 30 Day SEC Yield of 13.4%. While the

fees are a little high at 48 basis points, this still means that

after fees, the payout on the product will be approaching 13% a

year.

Add in the tax benefits that are afforded to dividend income,

and investors could have a solid choice on their hands with this 28

security fund. Furthermore, the product has a very reasonable PE

ratio—below 14.25—while the beta is less than 0.7 (read Top Three

High Yield Real Estate ETFs).

This suggests that the product will be relatively stable,

allowing investors to sit back and watch the dividends roll in,

just like the real members of the one percent!

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

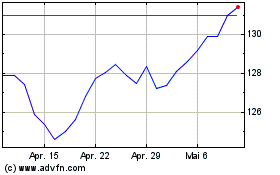

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

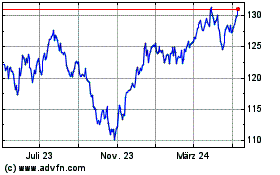

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Dez 2023 bis Dez 2024