Gavilan Files for Chapter 11 -- WSJ

18 Mai 2020 - 9:02AM

Dow Jones News

By Patrick Fitzgerald

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 18, 2020).

Gavilan Resources LLC, an oil-and-gas company formed by buyout

firm Blackstone Group Inc., has filed for bankruptcy protection, a

victim of the collapse in energy prices and a long-running

commercial dispute with a rival Texas shale driller.

The Houston-based company Friday night sought protection from

creditors under chapter 11, prompted by the "precipitous decline in

oil prices from the combined effect of the Covid-19 pandemic and

the flooding of oil markets by warring international producers,"

namely Russia and Saudi Arabia, David E. Roberts, Jr., Gavilan's

chief executive, said in papers filed with the U.S. Bankruptcy

Court in Houston.

Mr. Roberts also blamed Gavilan's financial difficulties on "an

increasingly unworkable relationship" with Sanchez Energy Corp., a

rival Texas oil-and-gas company that filed for bankruptcy last

year.

Since the fall of 2018, the two companies have been sparring

over the rights to oil and gas acreage in the Eagle Ford Shale in

Texas they jointly acquired from Anadarko Petroleum Corp. for $2.3

billion.

Gavilan is putting its assets on the bankruptcy-auction block

while continuing its legal fight with Sanchez over the Eagle Ford

rights, Mr. Roberts said.

Sanchez and Gavilan have each accused the other of defaulting on

a joint development agreement to operate the oil and gas assets

they acquired. Gavilan has alleged that Sanchez deviated from an

agreed-upon work plan for at least 20 wells and then refused to

divide up the assets, a claim Gavilan disputes.

Representatives for Sanchez couldn't be reached for comment

Saturday.

Formed in 2017 with Blackstone money, Gavilan buckled under

pressure from the meltdown in U.S. oil prices, which have rebounded

since hitting a 21-year low of $11.57 a barrel last month.

That rebound in prices proved too late for Gavilan, which The

Wall Street Journal had reported in March was preparing for a

bankruptcy filing.

More than 200 oil and gas drillers have filed for bankruptcy

since prices nosedived five year ago, according to Texas law firm

Haynes & Boone LLP. But the coronavirus pandemic, coupled with

a global glut of oil supply, is pushing more companies to the

brink. Ultra Petroleum Corp., Whiting Petroleum Corp., Southland

Royalty Co. and Sheridan Holding Company I LLC are among the oil

and gas drillers that have filed for bankruptcy this year.

Gavilan's bankruptcy advisers include Lazard Ltd. and law firms

Weil Gotshal & Manges LLP and Vinson & Elkins LLP.

Bankruptcy Judge David R. Jones has scheduled an initial hearing in

the case, number 20-32656, for Monday in Houston.

Write to Patrick Fitzgerald at patrick.fitzgerald@wsj.com

(END) Dow Jones Newswires

May 18, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

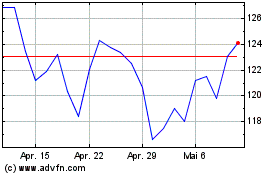

Blackstone (NYSE:BX)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Blackstone (NYSE:BX)

Historical Stock Chart

Von Apr 2023 bis Apr 2024