Ericsson Net Profit Fell, Revenue Rose; Backs Guidance -- Earnings Review

22 April 2020 - 12:43PM

Dow Jones News

By Dominic Chopping

STOCKHOLM--Sweden's Ericsson AB reported first-quarter earnings

Wednesday. Here's what we watched:

NET PROFIT: The telecom-equipment maker reported a net profit

attributable to shareholders of 2.16 billion Swedish kronor ($214.2

million), just shy of the SEK2.23 seen in a consensus provided by

FactSet and down from SEK2.32 billion last year.

REVENUE: Sales rose 1.7% to SEK49.75 billion, driven by the

company's key networks unit. Analysts polled by FactSet expected

sales of SEK52.92 billion.

WHAT WE WATCHED:

--5G PROGRESS: Ericsson said it has experienced a limited impact

from the coronavirus pandemic. The networks unit grew strongly in

North America, Japan and Saudi Arabia during the quarter, while

Latin America, India and North East Asia had sales declines. In

China, Ericsson said it has grown market share, but it expressed

concern over the delayed investment in the technology in Europe,

saying it risks falling behind the rest of the world and urged

governments to restart their economies by investing in 5G. In North

America, the closing of the Sprint-T Mobile merger is expected to

boost investments in the second half.

--MARGINS: In its key networks unit, the gross margin increased

to 44.4% from 43.2%, after experiencing high activity across

multiple regions. A favorable business mix more than compensated

for an increased portion of strategic contracts and the expected

negative effect from the acquired antenna and filter business.

Group gross margin reached 39.8% from 38.4%.

--GUIDANCE: Ericsson said there is near-term uncertainty around

sales volumes due to the coronavirus and the macroeconomic

situation, but with current visibility it has no reason to change

its financial targets for 2020 and 2022. Ericsson targets 2020

sales of between SEK230 billion and SEK240 billion with an

operating margin excluding restructuring charges at over 10% of

sales. The 2022 margin target is 12%-14%, excluding restructuring

charges. It added that with uncertainties from the pandemic hitting

short-term growth, it expects somewhat lower than normal sequential

sales growth in the second quarter.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

April 22, 2020 06:28 ET (10:28 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

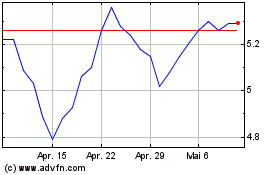

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024