Carney Says BoE Ready To Take More Steps To Support Economy

11 März 2020 - 9:33AM

RTTF2

The Bank of England is prepared to take more measures to combat

the economic impact of the coronavirus outbreak, Governor Mark

Carney said at a press conference on Wednesday, after the central

bank announced a slew of measures including a surprise interest

rate cut earlier in the day.

The BoE's role is to help UK businesses and households manage

through an economic shock that could prove large and sharp but

should be temporary, outgoing governor said.

The bank is ready to initiate further action if needed and is

open to quantitative easing, he told reporters.

Carney said the bank is coordinating its actions with the

Chancellor on the budget day, in order to ensure that measures have

maximum impact.

Carney observed that the economic damage caused by the virus

remained unclear, but the economy is likely to shrink in months

ahead.

The governor said the UK financial system is strong enough to

withstand all scenarios.

He said, "There is no reason for it to be as bad as 2008 if we

act as we have, and if there is that targeted support." Earlier in

the day, the BoE unexpectedly cut its key interest rate and

launched a new funding scheme for small businesses as it expects

the UK economy to take a major hit due to the coronavirus, or

Covid-19, outbreak. Policymakers unanimously decided to cut the

bank rate by 50 basis points to a record low 0.25 percent.

Andrew Bailey will take charge as the BoE Governor after Carney

steps down on March 15.

Attending the conference, Bailey said the bank will ensure

availability of credit to both households and businesses.

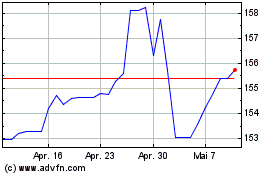

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

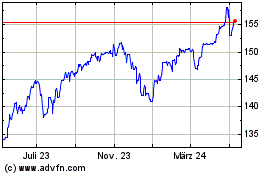

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Apr 2023 bis Apr 2024