Starboard Eases Campaign Against Bristol-Myers Deal for Celgene

29 März 2019 - 6:54PM

Dow Jones News

By Maria Armental

Starboard Value LP is throttling down its campaign against

Bristol-Myers Squibb Co.'s acquisition of Celgene Corp. after two

influential proxy advisory firms recommended shareholders approve

the proposed deal.

The activist investor said Friday it wouldn't actively solicit

votes against the transaction ahead of a special shareholder

meeting on April 12. However, it said it will still vote against

the transaction, saying the deal is too risky, and urged others to

follow suit.

The investment firm said it "recognizes that "despite the

substantial swell of support against this transaction, it is

extremely difficult for shareholders to prevail without a

supportive recommendation from ISS and Glass Lewis to vote against

the transaction."

Institutional Shareholder Services and Glass, Lewis & Co.

published reports Friday advising investors back the deal. ISS said

in its report the deal appears to have strategic merit because it

replenishes Bristol-Myers's late-stage pipeline and diversifies its

offerings.

Bristol-Myers reached a roughly $74 billion deal to buy Celgene

in January.

Starboard had nominated five potential directors, including its

chief executive, Jeffrey Smith, to join the Bristol-Myers board. It

wasn't immediately clear whether the nominations stand.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

March 29, 2019 13:39 ET (17:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

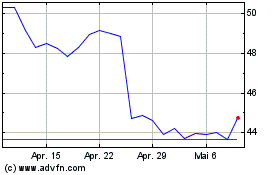

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

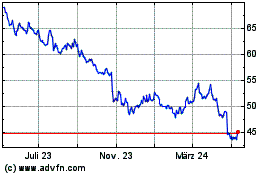

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024