Improved profitability in a still

challenging health situation: Slight organic decrease in

revenue of 2.0% compared to a strong Q1 in 2020

Stable adjusted EBITDA with an increase in margin to

25.1%

Regulatory News:

Verallia (Paris:VRLA):

Highlights

- Decrease in revenue of -6.2% to €605 million in Q1 2021

(-2.0% at constant exchange rates and scope)(1), compared to

high pre-pandemic figures from Q1 2020

- Adjusted EBITDA stable at €152 million compared to Q1

2020

- Strong improvement in the adjusted EBITDA margin to

25.1%, up 161 basis points

- Reduction in net debt leverage to 2.1x adjusted EBITDA

for the last 12 months, compared to 2.5x as of 30 March 2020 and

2.0x as of 31 December 2020

- Verallia bought back its own shares for a

total of €60 million (1.7% of the capital)

(1) Drop in revenue at constant exchange rates and scope

(excluding Argentina) of -3.7% in Q1 2021 compared to Q1 2020.

"Amid multiple lockdowns and restrictions due to the COVID-19

pandemic, Verallia has reported a decrease in sales in the first

quarter compared to an extremely dynamic first quarter in 2020.

Nevertheless, the Group has continued to improve its profitability,

benefiting from its Performance Action Plan and a positive

inflation spread. Despite uncertainty about the pandemic’s end,

Verallia can confirm its 2021 objectives thanks to its agility and

resilience.” commented Michel Giannuzzi, Chairman and CEO of

Verallia.

Revenue

In € million

Q1 2021

Q1 2020

Revenue

604.9

644.8

Reported growth

-6.2%

Organic growth

-2.0%

In the first quarter of the year, Verallia recorded a

revenue of €605 million, compared to €645 million in

the first quarter of 2020, representing a 6.2% decrease in

reported revenue. The impact of exchange rates variation

was -4.1% over the first quarter (-€27 million), primarily linked

to the depreciation of Latin American currencies and, to a lesser

extent, the depreciation of currencies in Eastern Europe.

At constant exchange rates and scope, revenue decreased

by 2.0% in the first quarter of the year (and by -3.7%

excluding Argentina), compared to high figures from the prior year.

Organic growth had reached +4.0% in the first quarter of 2020 (vs.

Q1 2019), even when the effects of the pandemic began to be felt in

mid-March. In addition, countries in which the Group operates

continue to experience various disruptions due to lockdown

measures. While Verallia’s sales volume in Europe has decreased

compared to the previous year, it continues to record a strong

performance in Latin America. In terms of pricing policy at Group

level, sales price increases were more moderate compared to the

previous year, in line with expectations and Verallia’s objective

to offset cost increases. The product mix effect was also positive

over the quarter.

Revenue breakdown by region:

- In Southern and Western Europe,

trends vary from one country to the other, with a more marked

decline in sales in France and Iberia compared to Italy, where

Verallia has reported almost stable sales. Operations in France

were impacted by social movements until the end of February, when

the Group completed its transformation plan.

- The Northern and Eastern Europe

region saw a general decline in sales, affected by lockdown

measures and an extremely unfavourable comparative basis.

- In Latin America, all countries in

the region reported a strong increase in volume over the

quarter.

Adjusted EBITDA

In € million

Q1 2021

Q1 2020

Adjusted EBITDA

151.7

151.3

Adjusted EBITDA margin

25.1%

23.5%

The adjusted EBITDA remained stable compared to Q1 2020,

at €152 million. Despite a negative impact on

activity, the adjusted EBITDA improved on account of a positive

spread1 and a net reduction in production costs (Performance Action

Plan, a.k.a. PAP) of €9 million in the first quarter of 2021.

Meanwhile, the adjusted EBITDA margin increased by 161 basis

points to 25.1%.

Well-managed net debt

Over the first quarter of the year, Verallia continued to

control its debt level. Net debt rose to €1,297

million at the end of March 2021, after the Group bought back

its own shares for €60 million. This corresponds to a net debt

ratio of 2.1x the adjusted EBITDA for the last 12 months,

compared to 2.0x on 31 December 2020 and down from 2.5x on 31 March

2020.

Benefiting from a high level of liquidity2 of €1,059 million as

of 31 March 2021, Verallia has decided not to extend its additional

credit line of €250 million (RCF2), implemented in April 2020.

As it continues to diversify funding sources, Verallia may

consider “green funding”, a sustainability-linked instrument in

line with its ESG strategy presented in January 2021, the proceeds

of which would be allocated to the refinancing of part of the

Group’s existing financial indebtedness.

ESG

In response to the climate emergency, we have decided to align

our CO2 emission reduction targets by following the Science Based

Targets initiative (SBTi) and joining the well-below 2°C

trajectory, which aims to limit the rise in temperatures to

less than 2 degrees Celsius above pre-industrial temperatures. Our

new target is therefore to reduce our CO2 emissions by 27.5% by

20303. In March 2021, this objective to reduce CO2

emissions was approved by SBTi.

Fulfilling the commitments we have set ourselves would not be

possible without the involvement and engagement of our staff,

despite the COVID-19 pandemic. Demonstrating their agility and

responsiveness, they have been involved in each stage of our value

chain and stepped up the pace of innovation in all plans, whether

in terms of energy consumption, the efficiency of our production

facilities, introducing renewable energies in the long term and

even designing our products and transportation.

On Friday 30 April 2021, the 2020 Statement of Extra-Financial

Performance will be published and made available on Verallia’s

website.

2021 Outlook

In these uncertain times, Verallia is well-equipped to match its

2019 volumes in 2021 and generate a positive organic growth. 2021’s

adjusted EBITDA is also expected to increase from the previous year

to around €650 million, with the adjusted EBITDA margin projected

to exceed the medium-term target of 25%.

As announced last February, Verallia has decided to build an

additional furnace at its plant in Jacutinga (Brazil). This new

strategic investment, totalling approximately €60 million, will be

spread across 2021 and 2022.

2021 Annual General Shareholders’

Meeting and 2020 dividend

Verallia’s Board of Directors met on Wednesday, 28 April 2021

and made a decision regarding the organisation of the 2021 Annual

General Shareholders' Meeting, scheduled to take place on Tuesday,

15 June 2021.

Due to the ongoing health crisis, the French Government,

following the order of 2 December 2020, extended the order issued

on 25 March 20204, which simplifies and adjusts the rules regarding

the convocation, information, meeting and deliberation of general

meetings and governing bodies for legal persons. Verallia’s Board

of Directors therefore decided to hold its Annual General

Shareholders' meeting in a closed session. The meeting will

be webcast on Verallia’s website: www.verallia.com.

Shareholders are invited to cast their vote remotely (via the

secure Votaccess website or paper form) and submit their questions

in writing in accordance with the procedures which will be detailed

in the notice of meeting.

As announced on 24 February 2021, the Board of Directors will

also submit, for the approval of shareholders during the Annual

General Shareholders' Meeting, the payment of a dividend of

€0.95 per share, in cash for payment on 5 July 2021.

About Verallia — At Verallia, our purpose is to

re-imagine glass for a sustainable future. We want to redefine how

glass is produced, reused and recycled, to make it the world’s most

sustainable packaging material. We are joining forces with our

customers, suppliers and other partners across the value chain to

develop new, healthy and sustainable solutions for all. With around

10,000 employees and 32 glass production facilities in 11

countries, we are the European leader and the world's third-largest

producer of glass packaging for beverages and food products. We

offer innovative, customised and environmentally friendly solutions

to over 10,000 businesses around the world. In 2020, Verallia

produced more than 16 billion glass bottles and jars and posted a

revenue of €2.5 billion. Verallia is listed on compartment A of the

regulated market of Euronext Paris (Ticker: VRLA – ISIN:

FR0013447729) and is included in the following indices: SBF 120,

CAC Mid 60, CAC Mid & Small et CAC All-Tradable. For more

information: www.verallia.com

The analysts' conference call will be held on Thursday, 29 April

2021 at 9.00 am (CET) via an audio webcast service (live and

replay) and the results presentation will be available at

www.verallia.com.

Financial calendar

- 15 June 2021: Annual General

Shareholders’ Meeting.

- 29 July 2021: results for H1 2021

- Press release before the market opening and

conference call/presentation at 9.00 am (CET) of that day.

- 28 October 2021: financial results

for Q3 2021 - Press release before the market opening

and conference call at 9.00 am (CET) of that day.

Disclaimer

Certain information included in this press release does not

constitute historical data but constitutes forward-looking

statements. These forward-looking statements are based on current

beliefs, expectations and assumptions, including, without

limitation, assumptions regarding present and future business

strategies and the environment in which Verallia operates, and

involve known and unknown risks, uncertainties and other factors,

which may cause actual results, performance or achievements, or

industry results or other events, to be materially different from

those expressed or implied by these forward-looking statements.

These risks and uncertainties include those discussed or identified

under Chapter 3 "Risk Factors" in the Universal Registration

Document approved by the AMF and available on the Company's website

(www.verallia.com) and the AMF's website (www.verallia.com). These

forward-looking information and statements are not guarantees of

future performances.

This press release includes only summary information and does

not purport to be comprehensive.

Personal data protection

You can unsubscribe from our press release distribution list at

any time by sending your request to the following email address:

investors@verallia.com. Press releases will still be available to

access via the website https://www.verallia.com/en/investors/.

Verallia SA, as data controller, processes personal data for the

purpose of implementing and managing its internal and external

communication. This processing is based on legitimate interests.

The data collected (last name, first name, professional contact

details, profiles, relationship history) is essential for this

processing and is used by the relevant departments of the Verallia

group and, where applicable, its subcontractors. Verallia SA

transfers personal data to its service providers located outside

the European Union, who are responsible for providing and managing

technical solutions related to the aforementioned processing.

Verallia SA ensures that the appropriate guarantees are obtained in

order to supervise these data transfers outside of the European

Union. Under the conditions defined by the applicable regulations

for the protection of personal data, you may access and obtain a

copy of the data concerning you, object to the processing of this

data and request for it to be rectified or erased. You also have a

right to restrict the processing of your data. To exercise one of

these rights, please contact the Group Financial Communication

Department at investors@verallia.com. If, after having contacted

us, you believe that your rights have not been respected or that

the processing does not comply with data protection regulations,

you may submit a complaint to CNIL (Commission nationale de

l'informatique et des libertés — French regulatory body).

APPENDICES

Key figures during the first

quarter

In € million

Q1 2021

Q1 2020

Revenue

604.9

644.8

Reported growth

-6.2%

Organic growth

-2.0%

Adjusted EBITDA

151.7

151.3

Adjusted EBITDA margin

25.1%

23.5%

Net debt at the end of March

1,296.6

1,574.1

Last 12 months adjusted EBITDA

626.1

624.5

Net debt / last twelve months adjusted

EBITDA

2.1x

2.5x

Evolution of revenue per nature in €

million during the first quarter

In € million

Revenue Q1 2020

644.8

Volumes

(32.5)

Price/Mix

19.3

Exchange rates

(26.7)

Revenue Q1 2021

604.9

Evolution of adjusted EBITDA per nature

in € million during the first quarter

In € million

Adjusted EBITDA Q1 2020 (i)

151.3

Activity contribution

(30.4)

Spread price mix/costs

28.0

Net productivity (ii)

8.5

Exchange rates

(9.6)

Other

3.9

Adjusted EBITDA Q1 2021 (i)

151.7

(i) Adjusted EBITDA is calculated based on operating profit

adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal‐related effects and contingencies, plant

closure costs and other items. (ii) Impact of the Performance

Action Plan ("PAP") amounting to €9 million.

Reconciliation of operating profit to

adjusted EBITDA

In € million

Q1 2021

Q1 2020

Operating profit

83.5

79.5

Depreciation and amortisation (i)

66.9

70.0

Restructuring costs

(0.3)

0.5

IAS 29 Hyperinflation (Argentina) (ii)

(0.1)

0.2

Management share ownership plan and

associated costs

1.7

1.0

Other

0.0

0.1

Adjusted EBITDA

151.7

151.3

(i) Includes depreciation and amortisation of intangible assets

and property, plant and equipment, amortisation of intangible

assets acquired through business combinations and impairment of

property, plant and equipment, including those linked to the

transformation plan implemented in France. (ii) The Group has

applied IAS 29 (Hyperinflation) since the second half of 2018.

Financial structure

In € million

Nominal amount or max. amount

drawable

Nominal rate

Final maturity

31/03/2021

Term Loan A

1,500

Euribor +1.50%

07/10/24

1,493.4

Revolving Credit Facility 1

500

Euribor +1.10%

07/10/24

-

Revolving Credit Facility 2 (i)

250

Euribor +1.95%

24/04/21

-

Commercial Papers Neu CP

400

151.8

Other debt

112.5

Total borrowings

1,757.7

Cash

(461.1)

Net Debt

1,296.6

(i) RCF2 maturing in April 2021 – The 6 months extension option

has not been activated.

IAS 29: Hyperinflation in

Argentina

Since the second half of 2018, the Group has applied IAS 29 in

Argentina. The adoption of this standard requires the restatement

of non‐monetary assets and liabilities and of the income statement

to reflect changes in purchasing power in the local currency,

leading to a gain or loss on the net monetary position included in

the finance costs.

Financial information of the Argentinian subsidiary is converted

into euros using the closing exchange rate for the relevant

period.

In the first quarter of 2021, the net impact on revenue amounted

to +€0.4 million. The hyperinflation impact has been excluded from

Group adjusted EBITDA as shown in the table “Reconciliation of

operating profit to adjusted EBITDA”.

GLOSSARY

Activity category: corresponds to

the sum of the volumes variations plus or minus changes in

inventories variation.

Organic growth: corresponds to

revenue growth at constant exchange rates and scope. Revenue growth

at constant exchange rates is calculated by applying the average

exchange rates of the comparative period to revenue for the current

period of each Group entity, expressed in its reporting

currency.

Adjusted EBITDA: This is a non-IFRS

financial measure. It is an indicator for monitoring the underlying

performance of businesses adjusted for certain expenses and/or

non-recurring items liable to distort the company’s performance.

The Adjusted EBITDA is calculated based on operating profit

adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal-related effects and contingencies, plant

closure costs and other items.

Capex: Short for “capital

expenditure”, this represents purchases of property, plant and

equipment and intangible assets necessary to maintain the value of

an asset and/or adapt to market demand or to environmental and

health and safety constraints, or to increase the Group’s capacity.

It excludes the purchase of securities.

Recurring investments: Recurring

Capex represent acquisitions of property, plant and equipment and

intangible assets necessary to maintain the value of an asset

and/or adapt to market demands and to environmental, health and

safety requirements. It mainly includes furnace renovation and

maintenance of IS machines.

Strategic investments: Strategic

investments represent the acquisitions of strategic assets that

significantly enhance the Group's capacity or its scope (for

example, the acquisition of plants or similar facilities,

greenfield or brownfield investments), including the building of

additional new furnaces. From 2021 onwards, they will also include

investments related to the implementation of the plan to reduce CO2

emissions.

Cash conversion: refers to the

ratio between cash flow and adjusted EBITDA. Cash flow refers to

adjusted EBITDA less Capex.

The segment Southern and Western

Europe comprises production plants located in France, Spain,

Portugal and Italy. It is also denominated as “SWE”.

The segment Northern and Eastern

Europe comprises production plants located in Germany,

Russia, Ukraine and Poland. It is also denominated as “NEE”.

The segment Latin America comprises

production plants located in Brazil, Argentina and Chile.

Liquidity: calculated as the Cash +

Undrawn Revolving Credit Facilities – Outstanding Commercial

Papers.

Amortisation of intangible assets acquired

through business combinations: Corresponds to the

amortisation of customer relations recorded during the acquisition

of the Saint-Gobain packaging business in 2015 (initial gross value

of €740 million over a useful life of 12 years).

1 Spread represents the difference between (i) the increase in

sales prices and mix applied by the Group after passing the

increase in its production costs on to these prices, if required,

and (ii) the increase in its production costs. The spread is

positive when the increase in sales prices applied by the Group is

greater than the increase in its production costs. The increase in

production costs is recorded by the Group at constant production

volumes and before production gap and the impact of the Performance

Action Plan (PAP). 2 Calculated as the Cash + Undrawn Revolving

Credit Facilities – Outstanding Commercial Papers. 3 (Scopes 1 and

2), in absolute terms, using 2019 as the baseline year. The

validation by SBTi in early 2021 of this ambitious goal is a

fundamental achievement for the Group. 4 Ordinance n°2020-321 dated

March 25, 2020 (as amended pursuant to ordinance n°2020-1497 dated

December 2nd, 2020) and decree n°2020-418 of April 10th, 2020 (as

amended pursuant to decree n°2020-1614 dated December 18th, 2020

and decree n°2021-255 dated March 9th, 2021).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210428005919/en/

Press Verallia - Cécile

Fages - cecile.fages@verallia.com Brunswick - Benoit Grange,

Hugues Boëton, Tristan Roquet Montegon -

verallia@brunswickgroup.com - +33 1 53 96 83 83

Verallia Investor Relations

Alexandra Baubigeat Boucheron -

alexandra.baubigeat-boucheron@verallia.com

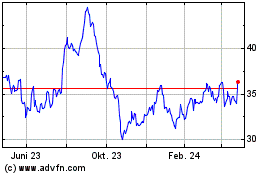

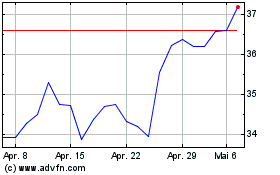

VERALLIA (EU:VRLA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

VERALLIA (EU:VRLA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024