Current Report Filing (8-k)

27 September 2021 - 12:26PM

Edgar (US Regulatory)

false

0001673358

0001673358

2021-09-23

2021-09-23

0001673358

dei:OtherAddressMember

2021-09-23

2021-09-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 23, 2021

Yum China Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

|

001-37762

|

|

81-2421743

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

7100 Corporate Drive

Plano, Texas 75024

United States of America

|

|

Yum China Building

20 Tian Yao Qiao Road

Shanghai 200030

People’s Republic of China

|

|

(Address, including zip code, of principal executive offices)

|

(469) 980-2898

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

YUMC

|

New York Stock Exchange

|

|

9987

|

The Stock Exchange of Hong Kong Limited

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On September 23, 2021, the Compensation Committee (the “Committee”) of the Board of Directors of Yum China Holdings, Inc. (the “Company”) adopted the Yum China Holdings, Inc. Executive Severance Plan (the “Plan”), effective immediately.

The Plan provides severance benefits to certain key management employees of the Company and its affiliates who are selected by the Committee to participate in the Plan (each, a “Participant”), and whose employment is terminated by the Company without Cause (as defined in the Plan) or, for Participants subject to the laws of the People’s Republic of China (“PRC Law”), termination for any statutory reason and subject to severance pay under PRC Law (a “Qualifying Termination”). On September 23, 2021, Joey Wat, the Chief Executive Officer of the Company (the “CEO”), Andy Yeung, the Chief Financial Officer of the Company, Johnson Huang, General Manager, KFC, Danny Tan, Chief Supply Chain Officer of the Company, and Aiken Yuen, Chief People Officer of the Company, were each designated as a Participant under the Plan.

If a Participant’s employment terminates in a Qualifying Termination, he or she will receive, in lieu of any severance benefits under any other arrangement with the Participant (including, without limitation, the Yum China Holdings, Inc. Change in Control Severance Plan (the “CIC Plan”), provided that in the event of a qualifying termination under the CIC Plan, the terms of the CIC Plan will govern), the following severance benefits:

|

|

•

|

Cash severance benefits consisting of the greater of (i) the sum of statutory severance payable under PRC Law (the “Statutory Severance”) and an amount equal to five times the Participant’s average monthly salary in the 12 months prior to the Qualifying Termination as consideration for compliance with certain restrictive covenants, including covenants relating to non-competition (the “Non-compete Compensation”) and (ii) the sum of the Participant’s monthly base salary plus 1/12 of the Participant’s target annual bonus, multiplied by a severance multiple of 24, in the case of the CEO, and 12 for all other Participants;

|

|

|

•

|

any accrued, but unpaid as of the date of the Qualifying Termination, annual cash bonus for any completed fiscal year preceding a Qualifying Termination; and

|

|

|

•

|

if the Qualifying Termination occurs on or after June 30, a pro-rated annual bonus for the year of Qualifying Termination based on actual performance and pro-rated for the employment period during the year.

|

Upon at least three months’ prior written notice to an affected Participant, the Plan may be terminated or amended by the Committee (including removal of a Participant), provided that any termination or amendment of the Plan may not materially impair the rights of a Participant whose Qualifying Termination occurred prior to such termination or amendment.

The foregoing summary is qualified in its entirety by reference to the Yum China Holdings, Inc. Executive Severance Plan attached hereto as Exhibit 10.1 and incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

The following exhibits are furnished with this report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

YUM CHINA HOLDINGS, INC.

|

|

|

|

|

|

|

|

By:

|

|

/s/ Joseph Chan

|

|

|

|

|

|

Name:

|

|

Joseph Chan

|

|

|

|

|

|

Title:

|

|

Chief Legal Officer

|

|

Date: September 27, 2021

|

|

|

|

|

|

|

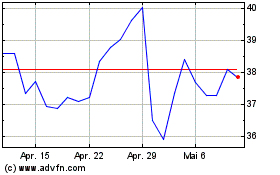

Yum China (NYSE:YUMC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Yum China (NYSE:YUMC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024