A smaller than expected contraction for the

quarter

- €88 million in Q1 2021-2022 revenue down -2% year-over-year

vs. an initial guidance of -5%1

- A very strong quarterly performance by Avanquest with an

+18% increase in revenue

This press release presents unaudited Group

consolidated revenue, prepared in accordance with IFRS.

“Against the backdrop of particularly unusual economic and

technology market conditions, we once again demonstrated the

strength of our business portfolio in Q1 2021-2022. With revenue of

€88 million, the decrease announced for the beginning of the year

has accordingly been narrowed.

After a marked improvement in Avanquest's operating

profitability over the previous fiscal year, the division is back

on track with double-digit growth and confirms the success of its

strategic shift to a SaaS2 subscription-based business

model. This performance by our software businesses highlights the

relevance of the buyout of Avanquest’s minority interests whose

completion was announced in early November.

For the first time in five years since its creation, PlanetArt

registered a drop in sales in response to a post-Covid lockdown

decrease in online traffic and Apple's new App Tracking

Transparency feature. Yet, because of our unique business model

(fabless3, multi-channel web & mobile), our global

presence and our digital marketing know-how, we were able to resist

better than our competitors", commented Pierre Cesarini, CEO of

Claranova.

Regulatory News:

Claranova (Paris:CLA) today announced revenue for Q1 2021-2022

(July - September 2021) of €88 million, decreasing marginally by 2%

at current exchange rates and -5% at constant exchange rates

compared to the same period last year. This decrease was minimized

thanks to the excellent momentum for Avanquest’s activities

(software publishing) with double-digit growth in the first quarter

(+18% at current exchange rates, +14% at constant exchange rates).

This increase largely offset the impact from the exceptional

industry wide downturn of PlanetArt activities during the

quarter.

The Group is still expecting a gradual return to growth for

these activities in Q2 2021-2022. At constant exchange rates and

excluding the impact of the CafePress and I See Me! acquisitions4,

Group revenue declined 10% on a like-for-like basis5 in Q1.

Revenue trends by division for Q1 2021-2022:

In €m

Jul. to Sep. 2021 (3

months)

Jul. to Sep. 2020 (3

months)

Change

Change at constant exchange

rates

Change at constant consolidation

scope

Change at constant consolidation

scope and exchange rates

PlanetArt

64

69

-8%

-10%

-16%

-17%

Avanquest

23

20

18%

14%

18%

14%

myDevices

1

1

-8%

-7%

-8%

-7%

Revenue

88

90

-2%

-5%

-8%

-10%

PlanetArt: a temporary downturn in response to post-lockdown

developments and constraints related to Apple’s iOS 14

release

PlanetArt had revenue in Q1 2021-2022 of €64 million, down 8% at

current exchange rates (10% at constant exchange rates). Excluding

the impact of the CafePress and I See Me! acquisitions, the

personalized e-commerce activities decreased 17% like-for-like.

As announced last September, this unfavorable trend is the

result of two exceptional developments affecting all e-commerce

players worldwide: a general post-lockdown decline in online

traffic and new constraints for targeted marketing linked to the

App Tracking Transparency feature integrated into in Apple's new

operating system, iOS 14.

To counteract these trends, PlanetArt is able to successfully

leverage the geographic diversification of its activities, its

fabless manufacturing model, its sales channels mixing web and

mobile and its extensive product range.

Adjustments to marketing investments since iOS 14’s rollout

(reallocating a portion of expenditures to Android, the

diversification of customer acquisition channels, the signature of

new advertising partnerships agreements, etc.) and the expected

easing of post-lockdown effects on online consumption, should

facilitate the return to operating activities in the coming

months.

Avanquest: resumption of double-digit growth in software

publishing activities

Avanquest ended the first quarter of FY 2021-2022 with revenue

of €23 million. The software publishing division is back on track

with double-digit growth path, with revenue up 18% at current

exchange rates. Excluding currency effects, growth at constant

exchange rates also remained solid at +14%.

The significant increase in profitability in FY 2020-2021 after

completing the transition of the business model to

subscription-based sales (SaaS), is now accompanied by a return to

strong business growth. This growth is driven by very good momentum

by for PDF (SodaPDF) and Security (Adaware) software. Each of these

business lines registered double-digit growth in the quarter.

Recurring revenue is continuing to grow and now represent 61% of

the division's revenues for the quarter, up from 54% for the same

period last year and 58% from FY 2020-2021.

myDevices: +44% growth adjusted for non-recurring items,

driven by an increase in subscription revenues (ARR up +85% at

September 30)

myDevices, the Group's IoT6 division, reported revenue of €1.0

million in Q1 2021-2022 compared to €1.1 million in the same period

of the previous fiscal year. Adjusted for exceptional items related

to the partnership with the US carrier Sprint, recognized in Q1

2020-2021, business growth was +44%.

As expected, this performance reflects the acceleration of

commercial rollouts, bolstered by easing health restrictions in the

division's main business sectors. This development is in particular

fueled by the increase in subscription revenues. At September 30,

2021, myDevices recorded Annual Recurring Revenue (ARR) of €1.8

million, up 85% from one year earlier at constant exchange

rates.

Financial calendar: December 1, 2021:

Combined Ordinary and Extraordinary Annual General Meeting

About Claranova:

As a diversified global technology company, Claranova manages

and coordinates a portfolio of majority interests in digital

companies with strong growth potential. Supported by a team

combining several decades of experience in the world of technology,

Claranova has acquired a unique know-how in successfully turning

around, creating and developing innovative companies.

With average annual growth of more than 40% over the last three

years and revenue of €472 million in FY 2020-2021, Claranova has

proven its capacity to turn a simple idea into a worldwide success

in just a few short years. Present in 15 countries and leveraging

the technology expertise of nearly 800 employees across North

America and Europe, Claranova is a truly international company,

with 95% of its revenue derived from international markets.

Claranova’s portfolio of companies is organized into three

unique technology platforms operating in all major digital sectors.

As a leader in personalized e-commerce, Claranova also stands out

for its technological expertise in software publishing and the

Internet of Things, through its businesses PlanetArt, Avanquest and

myDevices. These three technology platforms share a common vision:

empowering people through innovation by providing simple and

intuitive digital solutions that facilitate everyday access to the

very best of technology.

For more information on Claranova Group:

https://www.claranova.com or

https://twitter.com/claranova_group

Disclaimer:

All statements other than statements of historical fact included

in this press release about future events are subject to (i) change

without notice and (ii) factors beyond the Company’s control.

Forward-looking statements are subject to inherent risks and

uncertainties beyond the Company’s control that could cause the

Company’s actual results or performance to be materially different

from the expected results or performance expressed or implied by

such forward-looking statements.

CODES Ticker: CLA ISIN: FR0013426004

www.claranova.com

1 The Group published a press release on September 30, 2021,

issuing guidance for a decrease in consolidated revenue of

approximately -5% in Q1 2021-2022 at current exchange rates and

constant consolidation scope. 2 Software as a Service. 3 A business

model that involves outsourcing production to third-party partners.

4 This excludes September 2020 for CafePress and July 2021 through

September 2021 for I See Me! 5 Like-for-like (organic) growth

equals the increase in revenue at constant consolidation scope and

exchange rates. 6 Internet of Things.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211109006313/en/

ANALYSTS - INVESTORS +33 1 41 27 19 74

ir@claranova.com

FINANCIAL COMMUNICATION +33 1 75 77 54 65

ir@claranova.com

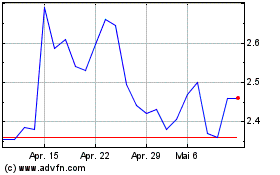

Claranova (EU:CLA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Claranova (EU:CLA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024