Henkel Shares Tumble After Cutting 2022 Earnings Margin Outlook

29 April 2022 - 10:11AM

Dow Jones News

By Ed Frankl and Joshua Kirby

Henkel AG shares dived Friday after it said it expects a lower

earnings margin this year, as raw-material prices surge on the war

in Ukraine.

Shares were down 8.0% to EUR58.12 at 0730 GMT.

The German consumer-goods company now expects an adjusted

earnings before interest and taxes margin of 9%-11%, from

11.5%-13.5% previously.

Full-year adjusted earnings per share is now expected to decline

15%-35%, from between a positive rise of 5% and a decline of 15%

previously, Henkel said.

The new outlook is due to rising raw-material prices and higher

logistics costs stemming from the Russia-Ukraine war, as well as

the effects of exiting operations in Russia and Belarus following

the invasion, the Dusseldorf-based company said.

"Due to these developments, we now expect significantly higher

pressure on our earnings for the rest of the year than at the

beginning of the year," Chief Executive Carsten Knobel said.

The company now sees additional raw-material costs for the full

year at around 2 billion euros ($2.10 billion), twice as much as

had been assumed at the end of January.

The company nevertheless said it expects higher sales growth for

the year than previously targeted, after first-quarter sales rose

on higher prices and with a slight decline in volumes, it said.

According to preliminary figures, the company's sales rose by

7.1% to around EUR5.3 billion in the quarter.

Henkel said it is now aiming for full-year organic growth

between 3.5% and 5.5% in fiscal 2022, compared with a previous

targeted range of 2% to 4%.

The company will set out full first-quarter results on May

5.

Write to Ed Frankl at edward.frankl@dowjones.com

(END) Dow Jones Newswires

April 29, 2022 03:56 ET (07:56 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

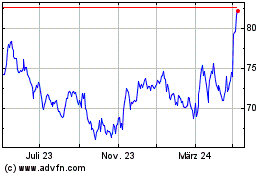

Henkel AG & Co KGAA (TG:HEN3)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

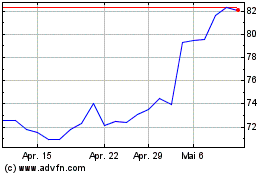

Henkel AG & Co KGAA (TG:HEN3)

Historical Stock Chart

Von Apr 2023 bis Apr 2024