Xali Gold Corp. (TSXV:XGC) ("Xali Gold” and/or the “Company”) is

pleased to announce that the Company has entered into an option

agreement to acquire 100% interest in the Victoria Property in the

Central Region of Newfoundland and Labrador, named as one of the

top 10 mining jurisdictions in the world (Fraser Institute 2021).

“While we are still very committed to and

enthusiastic about our gold projects in Mexico, we couldn’t pass up

the opportunity to acquire such an exciting gold exploration play

in Newfoundland where recent exploration successes have already

defined two new gold deposits and several discoveries,” stated

Joanne Freeze, President and CEO of Xali Gold. “Our team has spent

various years working in Newfoundland in the past and we are very

excited to be back, especially with a project in such close

proximity to Atlantic Canada’s largest undeveloped gold

resource.”

Xali Gold’s new Victoria Property is located

just 3 kilometres (“km”) southwest of Marathon’s Valentine Gold

Project (“Marathon”), within a structurally controlled gold belt of

Central Newfoundland, an emerging significant exploration

jurisdiction in Canada. The new gold district occurs within a

northeast-trending structural corridor defined by crustal-scale

faults extending from southwestern to north-central Newfoundland.

Marathon has defined (Measured and Indicated) reserves of 3.14

million ounces (“Moz”) gold and Inferred resources of 1.00 Moz

(https://marathon-gold.com/valentine-gold-project/). Marathon’s

mine construction is expected to commence in early 2022, on

schedule to build the largest gold mine in Atlantic Canada. *There

are no assurances that similar results would be obtained on Xali

Gold’s Victoria Property.

The Victoria Property, comprising 79 claims

covering 1975 hectares, is also situated 65km southwest of the

historic mining town of Buchans where mining was continuous for 57

years starting in 1905. From 1928 to 1984, ASARCO mined

approximately 16 million tonnes from five high grade orebodies,

with an average mill head grade of 14.51% zinc, 7.56% lead, 1.33%

copper, 126 g/t silver and 1.37 g/t gold.

Xali Gold’s new Victoria Property demonstrates

excellent exploration potential for gold mineralization, due to its

location within the structurally controlled gold belt as well as

distinctive magnetic-geophysical anomalies identified and high

grade gold discovered in glacial till samples on the property. The

high grade gold intervals reaching 178 grams per tonne (“gpt”),

66.7 gpt and 10.1 gpt were discovered by Rubicon Minerals

Corporation in 2003. There are no records of the gold bearing

samples being followed up nor of systematic exploration being

performed on the property, although some exploration for base

metals was conducted. Exploration was likely hampered by the lack

of ground access which required helicopter support, however,

several quad trails have now opened up access on the

property.

An exploration permit application was submitted

to the Newfoundland government on June 30 and the permit is

expected to be issued prior to early September 2021 when field work

is planned to commence.

Terms of the Agreement

Xali Gold has entered into an Option Agreement

(“Agreement”) which provides for the following:

Acquire 100% interest, subject to a 2% Net

Smelter Royalty* (“NSR”) by:

- Issuing a total of 3.5 million

(“M”) shares over 3 years

- Making payments of a total of CDN

$100,000 over 3 years

- Funding exploration activities of

CDN $650,000 over 3 years

*Xali Gold has the right to buyback 1% of the

NSR for CDN $1M at any time.

Of the above, the following is a firm

commitment:

- Payment of CDN $25,000

- Issue 500,000 common shares

- Funding exploration activities of

CDN $50,000 within one year

About Xali Gold

Xali Gold has launched a comprehensive growth

strategy to acquire gold and silver projects with near surface

exploration potential, near-term production potential and

previous mining histories. Xali Gold plans to

advance our growing bank of Mexican assets internally and/or with

industry partners.

The acquisition of the SDA Plant, suitable

for treating high grade gold and silver mineralization, along

with the acquisition of rights to the El Dorado gold and silver

historic mines was the initial step in this strategy.

The profit-sharing agreement on the potentially

leachable Cocula Gold Project was the second step and is a key

component of our asset base. In addition to the potential for in

expensive extraction processes such as leaching, it has excellent

near surface exploration potential.

The Company is currently evaluating other

properties complementary to the SDA plant and El Dorado or stand

alone such as the Cocula Gold Project.

El Oro, remains as our flagship asset, as it is

a district scale gold project encompassing a well-known prolific

high-grade gold-silver epithermal vein system in

Mexico. The project covers 20 veins with past

production and more than 57 veins in total, from which

approximately 6.4 million ounces of gold and 74 million ounces of

silver were reported to have been produced from just two of these

veins (Ref. Mexico Geological Service Bulletin No. 37, Mining of

the El Oro and Tlapujahua Districts. 1920, T. Flores*).

Modern understanding of such systems indicates that several of the

El Oro district’s veins hold excellent discovery potential.

Xali Gold is dedicated to being a responsible

Community partner.

Joanne C. Freeze, P.Geo., President, CEO and

Matthew Melnyk, CPG., Director Operations, are Qualified Persons as

defined by National Instrument 43-101 for the projects discussed

above. Ms. Freeze and Mr. Melnyk have reviewed and approved the

contents of this release.

Neither the TSX Venture Exchange nor its

Regulation Services Provider accepts responsibility for the

adequacy or accuracy of this release.

Forward-looking Information

This news release may contain forward-looking

information (as such term is defined under Canadian securities

laws) including but not limited to the potential for discovery on

the El Dorado, Cocula and El Oro Properties and other statements

that are not historical facts. While such forward-looking

information is expressed by Xali Gold in good faith and believed by

Xali Gold to have a reasonable basis, they address future events

and conditions and are therefore subject to inherent risks and

uncertainties including those set out in Xali Gold’s MD&A.

Factors that cause the actual results to differ materially from

those in forward-looking information include, without limitation,

gold prices, results of exploration and development activities,

regulatory changes, defects in title, availability of materials and

equipment, timeliness of government approvals, potential

environmental issues, availability of capital and financing and

general economic, market or business conditions. Xali

Gold expressly disclaims any intention or obligation to update or

revise any forward-looking information, whether as a result of new

information, future events or otherwise, except in accordance with

applicable securities laws.

On behalf of the Board of Xali Gold

Corp.

“Joanne Freeze” P.Geo.President, CEO and

Director

For further information please contact:Joanne

FreezePresident & CEO Tel: + 1 (604)

689-1957 info@xaligold.com

NR 097

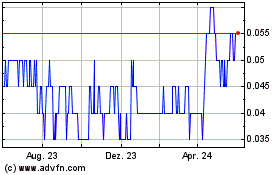

Xali Gold (TSXV:XGC)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

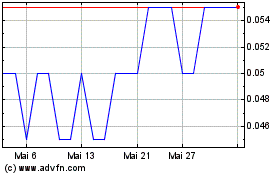

Xali Gold (TSXV:XGC)

Historical Stock Chart

Von Jan 2024 bis Jan 2025