Lion One Announces C$20 Million “Bought Deal” Private Placement of Units

23 Juli 2020 - 1:16PM

Lion One Metals Limited (TSX-V: LIO) (OTCQX: LOMLF) (ASX: LLO)

("

Lion One" or the "

Company") is

pleased to announce that it has entered into an agreement with

Haywood Securities Inc. and Echelon Wealth Partners Inc. as co-lead

underwriters on behalf of a syndicate of underwriters

(collectively, the "

Underwriters"), pursuant to

which the Underwriters have agreed to purchase, on a "bought deal"

private placement basis, 11,765,000 units of the Company (the

"

Units") at a price of C$1.70 per Unit (the

“

Issue Price”), for total gross proceeds of

C$20,000,500 (the "

Offering"). Each Unit will

consist of one common share (a “

Common Share”) in

the capital of the Company and one-half (1/2) of one common share

purchase warrant (each whole common share purchase warrant, a

“

Warrant”) of the Company. Each Warrant shall be

exercisable to acquire one Common Share (a “

Warrant

Share”) at a price per Warrant Share of C$2.35 for a

period of 12 months from the closing date of the Offering.

The Company has granted the Underwriters an option to purchase up

to an additional 15% of the Offering in Units (the

"

Underwriters’ Option"), exercisable in whole or

in part at any time up to 48 hours prior to the closing date.

The net proceeds from the sale of the Units will

be used for exploration and development of the Company’s Tuvatu

Gold Project, as well as working capital and general corporate

purposes.

The Offering is expected to close on or about

August 11, 2020 and is subject to certain conditions including, but

not limited to, the receipt of all necessary approvals including

the approval of the TSX Venture Exchange and the applicable

securities regulatory authorities. The Units to be issued under the

Offering will be subject to a hold period in Canada expiring four

months and one day from the closing date of the Offering.

In connection with the Offering, the

Underwriters will receive a cash commission of 6.0% of the gross

proceeds of the Offering and that number of non-transferable

compensation options (the “Compensation Options”)

as is equal to 6.0% of the aggregate number of Units sold under the

Offering. Each Compensation Option is exercisable into one Common

Share of the Company at the Issue Price for a period of 24 months

from the closing date of the Offering.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy nor shall there be any sale of the securities in

any State in which such offer, solicitation or sale would be

unlawful.

About Lion One Metals

Limited

Lion One’s flagship asset is 100% owned high

grade Tuvatu Gold Project, located in Navilawa Caldera, a 5 mile

diameter alkaline gold system in Fiji. Lion One’s CEO Walter

Berukoff leads an experienced team of explorers and mine builders

and has owned or operated over 20 mines in 7 countries. As

the founder and former CEO of Miramar Mines, Northern Orion, and La

Mancha Resources, Walter is credited with building over $3 billion

of value for shareholders.

For further informationContact Investor RelationsToll Free

(North America) Tel: 1-855-805-1250Email:

info@liononemetals.comWebsite: www.liononemetals.com

Neither the TSX Venture Exchange nor its

Regulation Service Provider accepts responsibility for the adequacy

or accuracy of this release.

This press release may contain statements that

may be deemed to be "forward-looking statements" within the meaning

of applicable Canadian securities legislation. All statements,

other than statements of historical fact, included herein are

forward looking information. Generally, forward-looking information

may be identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "proposed", "is expected",

"budget", "scheduled", "estimates", "forecasts", "intends",

"anticipates" or "does not anticipate", or "believes", or

variations of such words and phrases, or by the use of words or

phrases which state that certain actions, events or results may,

could, would, or might occur or be achieved. This forward-looking

information reflects Lion One Metals Limited's current beliefs and

is based on information currently available to Lion One Metals

Limited and on assumptions Lion One Metals Limited believes are

reasonable. These assumptions include, but are not limited to, the

actual results of exploration projects being equivalent to or

better than estimated results in technical reports, assessment

reports, and other geological reports or prior exploration results.

Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of Lion One Metals

Limited or its subsidiaries to be materially different from those

expressed or implied by such forward-looking information. Such

risks and other factors may include, but are not limited to: the

stage development of Lion One Metals Limited, general business,

economic, competitive, political and social uncertainties; the

actual results of current research and development or operational

activities; competition; uncertainty as to patent applications and

intellectual property rights; product liability and lack of

insurance; delay or failure to receive board or regulatory

approvals; changes in legislation, including environmental

legislation, affecting mining, timing and availability of external

financing on acceptable terms; not realizing on the potential

benefits of technology; conclusions of economic evaluations; and

lack of qualified, skilled labour or loss of key individuals.

Although Lion One Metals Limited has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking information. Lion One

Metals Limited does not undertake to update any forward-looking

information, except in accordance with applicable securities

laws.

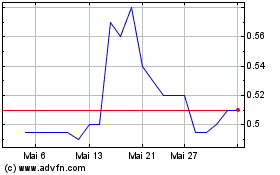

Lion One Metals (TSXV:LIO)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Lion One Metals (TSXV:LIO)

Historical Stock Chart

Von Feb 2024 bis Feb 2025