Fredonia Mining Inc. (“

Fredonia” or the

“

Company”) (TSXV:FRED) announces the successful

completion of its phase III drilling program, consisting of 6 HQ

diamond drill holes totaling 1,812.00 m. at Herradura Hill, and 6

HQ diamond drill holes totaling 1,143.00 m. at the Monserrat

sector, for an aggregate of 12 holes and 2,955 m.

“We are very encouraged by the first assays

received from the 6 drill holes at the Herradura Hill target, while

we wait for the assays from the remaining 6 drill holes at the

Monserrat sector,” said Estanislao Auriemma, Chief Executive

Officer of Fredonia. "These positive drill results confirm the

existence of a significant mineralized body with the constant

presence of high-grade intercepts, which increase the confidence

and potential of the Herradura Hill target. Most importantly, these

results increase the potential as this target remains open in all

directions and gold and silver values increase at depth. We are

very excited and impressed by the high proportion of holes that are

showing high grade intercepts."

HDDH045 intercepted the

stockwork deeper than prior holes, while at the same time

intercepted the previously defined veins at shallower depths. The

drill hole included an intercept of 84 m

@ 0.82 g/t Au Eq.; including high

grade gold mineralization in veins and hydrothermal breccia with

0.50 m @ 4.80 g/t Au

Eq.; 0.97 m @

5.49 g/t Au Eq., 1.00 m @

4.46 g/t Au Eq. The sulfide-rich hydrothermal

breccias show mineralization both in the matrix and vein clasts,

and the system remains open to the west and at depth.

HDDH047 also intercepted the

stockwork deeper than previously drilled, extending its magnitude

at depth. The drill hole intercepted wide hydrothermal breccias

with fine sulfides vein clasts, with 6 m

@ 1.36 g/t Au Eq.; and multiple

high-grade veins including 8 m @

6.00 g/t Au Eq.

HDDH048 confirms the larger

size of the stockwork to the east of HDDH047 and also at depth,

consistent with structures seen deeper in HDDH040. The drill hole

intercepted 12 m @ 1.10

g/t Au Eq., including high grade gold mineralization in

veins and hydrothermal breccia including 0.4 m

@ 5.04 g/t Au Eq., 0.5

m @ 5.19 g/t Au Eq.; and

9.60 m @ 1.04 g/t Au

Eq., including 0.6 m @

4.27 g/t Au Eq., and 1.2 m

@ 3.42 g/t Au Eq.

Gold and silver mineralized hosted in

colloform-crustiform banded vein related to Adularia and bladed

calcite from 233.00 m, indicates that the system is open at

depth.

HDDH049 intercepted a huge

colloform banded vein at 42.00 m, 5.6 m

@ 2.26 g/t Au Eq. Additionally,

at the bottom of the drill hole it intercepted a hydrothermal

breccia with sulfides clasts at 253.65 m, 0.75 m

@ 1.03 g/t Au Eq., which extends

the system to the east, beyond HDDH029.

HDDH050 intercepted the

down-deep continuity and increases the size of the stockworks

defined in HDDH033. The hydrothermal breccias present again rich

sulfides both in the matrix and in the vein clasts, showing that

the system is open at depth. However, the oriented core of the

drill hole indicates that some veins dip to the north, and require

evaluation with a new drill hole.

HDDH046 was designed as a step

back of HDDH037; drilling was located on a block that has been

displaced by a fault and shows unmineralized andesite.

Map showing phase III: drilled collar

locations at the Herradura Hill:

Table of drill-hole

statistics:

|

ID |

Target |

Easting |

Northing |

Altitud |

Acimuth |

Dip |

EOH |

|

HDDH045 |

La Herradura |

2531990 |

4632843 |

188 |

17 |

-60 |

269.00 |

|

HDDH046 |

La Herradura |

2532061 |

4632731 |

179 |

17 |

-45 |

284.00 |

|

HDDH047 |

La Herradura |

2532243 |

4632687 |

192 |

17 |

-45 |

380.00 |

|

HDDH048 |

La Herradura |

2532364 |

4632755 |

206 |

17 |

-50 |

335.00 |

|

HDDH049 |

La Herradura |

2532455 |

4632728 |

194 |

17 |

-55 |

272.00 |

|

HDDH050 |

La Herradura |

2532169 |

4632779 |

210 |

17 |

-60 |

272.00 |

|

Total |

|

|

|

|

|

|

1,812.00 |

Long Section showing the best

intercepts, including the current phase III drilling at Herradura

Hill:

Herradura Hill consists of a

maar-volcano-diatreme surrounded by an extensive brecciated host

system, the dimensions of which are yet undefined being

geologically open in all directions.

In a district scale, Herradura Hill lies in a

roughly east-west mineralization trend which extends eastwards on

strike with AngloGold Ashanti’s Cerro Vanguardia Mine that is

nearby.

Drill holes confirm very broad stockworks,

hydrothermal breccias and colloform-crustiform banded veins, hosted

in a phreatomagmatic breccias, felsic domes and dykes that intrude

the andesite flows that form the country rock.

Gold mineralization is related to a strong

quartz + sericite alteration, bladed calcite and adularia, evidence

of a boiling zone in a low sulphidation epithermal system.

The hydrothermal breccias show mineralization in

the matrix, as well as in the veins clasts, indicating that the

system extends at depth, and hasn’t been drilled yet.

The current drill program has been designed to

extend mineralization both to the east and west of the known

mineralized zone at Herradura Hill, as well as at depth. Except for

HDDH046, all drill holes intercepted gold and silver mineralization

extending the system in all directions.

Fredonia’s targets are focused mainly on two

main corridors. The northern corridor includes Abanico, Main Veins,

Bajo Pedernal, Monserrat West and Monserrat East as main targets.

Herradura Hill is part of the main southern corridor, more than 5

km long, where additional targets occur such as the Beethoven

veins, the geyserite sector and Pamela.

Map showing the location of the main

targets of the EDM project.

The intercepts of Phase III drilling in

Herradura Hill are shown below:

|

Including |

from |

to |

Interval(*) |

Au Eq g/t (**) |

Au g/t |

Ag g/t |

|

HDDH045 |

38.50 |

39.25 |

0.75 |

2.11 |

1.97 |

10.24 |

|

HDDH045 |

55.00 |

60.00 |

5.00 |

0.62 |

0.57 |

3.50 |

|

HDDH045 |

159.00 |

243.00 |

84.00 |

0.82 |

0.38 |

32.74 |

|

including |

167.00 |

167.50 |

0.50 |

4.80 |

0.71 |

307.10 |

|

and |

175.90 |

176.87 |

0.97 |

5.49 |

4.34 |

86.08 |

|

and |

226.00 |

227.00 |

1.00 |

4.46 |

1.79 |

200.50 |

|

|

|

|

|

|

|

|

|

HDDH046 |

92.00 |

93.00 |

1.00 |

1.39 |

0.11 |

96.26 |

|

|

|

|

|

|

|

|

|

HDDH047 |

83.00 |

84.00 |

1.00 |

4.58 |

3.14 |

107.98 |

|

HDDH047 |

91.00 |

91.55 |

0.55 |

2.02 |

1.90 |

8.76 |

|

HDDH047 |

99.00 |

107.00 |

8.00 |

0.50 |

0.45 |

3.92 |

|

HDDH047 |

142.00 |

148.00 |

6.00 |

1.36 |

0.90 |

34.74 |

|

HDDH047 |

269.00 |

277.00 |

8.00 |

6.00 |

5.26 |

55.65 |

|

including |

274.00 |

277.00 |

3.00 |

12.65 |

11.77 |

66.12 |

|

HDDH047 |

285.20 |

288.50 |

3.30 |

1.79 |

1.73 |

3.88 |

|

including |

286.60 |

287.30 |

0.70 |

4.92 |

4.81 |

8.04 |

|

|

|

|

|

|

|

|

|

HDDH048 |

62.00 |

71.00 |

9.00 |

0.63 |

0.57 |

4.63 |

|

including |

67.00 |

70.00 |

3.00 |

1.60 |

1.47 |

9.99 |

|

HDDH048 |

113.00 |

116.40 |

3.40 |

1.97 |

1.51 |

34.65 |

|

HDDH048 |

149.00 |

161.00 |

12.00 |

1.10 |

0.89 |

15.89 |

|

including |

149.00 |

149.40 |

0.40 |

5.04 |

4.81 |

17.07 |

|

and |

155.50 |

156.00 |

0.50 |

5.19 |

5.07 |

8.64 |

|

HDDH048 |

186.00 |

191.00 |

5.00 |

1.07 |

0.52 |

41.67 |

|

including |

187.00 |

190.00 |

3.00 |

1.54 |

0.76 |

58.22 |

|

HDDH048 |

220.60 |

230.20 |

9.60 |

1.04 |

0.76 |

21.16 |

|

including |

224.00 |

224.60 |

0.60 |

4.27 |

3.67 |

44.75 |

|

and |

229.00 |

230.20 |

1.20 |

3.42 |

3.26 |

12.21 |

|

HDDH048 |

233.00 |

233.40 |

0.40 |

2.77 |

2.60 |

12.59 |

|

|

|

|

|

|

|

|

|

HDDH049 |

42.00 |

47.60 |

5.60 |

2.26 |

1.92 |

25.92 |

|

including |

45.20 |

47.00 |

1.80 |

4.66 |

4.19 |

35.06 |

|

HDDH049 |

253.65 |

254.40 |

0.75 |

1.03 |

0.91 |

8.80 |

|

|

|

|

|

|

|

|

|

HDDH050 |

39.00 |

40.00 |

1.00 |

3.67 |

3.37 |

22.21 |

|

HDDH050 |

54.00 |

62.00 |

8.00 |

1.70 |

1.35 |

26.30 |

|

including |

60.00 |

62.00 |

2.00 |

4.81 |

3.78 |

77.32 |

|

HDDH050 |

71.00 |

72.00 |

1.00 |

1.26 |

1.02 |

17.99 |

|

HDDH050 |

81.00 |

88.00 |

7.00 |

1.51 |

0.62 |

66.54 |

|

including |

86.10 |

88.00 |

1.90 |

3.42 |

1.54 |

141.23 |

(*) Reported interval length are down

hole widths and not true widths.

(**) Gold equivalent (“AuEq”) is

calculated using metal prices of US$ 1,800/oz for Au and US$ 24/oz

for Ag. The equation used is: AuEq g/t = Au g/t + (Ag g/t ÷

75).

AuEq assumes Au recovery of 90%. The

limited metallurgical studies by Fredonia (selective Bottle rolls

from Main Veins material) have indicated high (>90%) recovery of

gold in oxide material. The Cerro Vanguardia mine to the east of

EDM with similar mineralization reports recoveries in the high 90%

for Au.

The Phase III drilling has confirmed the

presence of extensive intersections of mineralized material with

high grade veins, extending known mineralization to the east, west

and at depth.

The Fredonia geological team believes that a new

phase of drilling is warranted, to further extend the known

mineralization zone, include down-dip and along strike delineation

of the mineralization and affiliated host rocks discovered during

the Phases I to III programs, and to test additional targets at

Herradura Hill.

Historical drill holes intercepts not

previously reported from Herradura Hill, and including Fredonia

Mining Phase I and II are shown below:

|

Hole ID |

From |

To |

Length (*) |

Au Eq g/t (**) |

Au g/t |

Ag g/t |

|

HDDH001 |

124.00 |

140.00 |

16.00 |

1.01 |

0.61 |

29.70 |

|

HDDH007 |

83.00 |

92.00 |

9.00 |

1.34 |

1.17 |

12.70 |

|

HDDH011 |

126.50 |

128.10 |

1.60 |

5.54 |

5.49 |

3.80 |

|

HDDH011 |

147.70 |

199.00 |

51.30 |

1.72 |

1.11 |

45.80 |

|

including |

174.00 |

177.00 |

3.00 |

4.53 |

3.29 |

93.10 |

|

HDDH013 |

68.00 |

163.70 |

95.70 |

1.04 |

0.90 |

10.30 |

|

including |

68.00 |

77.00 |

9.00 |

8.12 |

7.43 |

51.70 |

|

and |

149.70 |

180.00 |

30.30 |

1.16 |

0.72 |

32.90 |

|

HDDH015 |

139.00 |

153.50 |

14.50 |

1.13 |

0.86 |

20.50 |

|

HDDH022 |

150.00 |

168.00 |

18.00 |

1.36 |

1.16 |

14.70 |

|

HDDH023 |

109.80 |

110.50 |

0.70 |

10.20 |

9.26 |

70.40 |

|

HDDH027 |

216.00 |

229.00 |

13.00 |

2.50 |

1.38 |

83.70 |

|

HDDH031 |

161.00 |

198.00 |

37.00 |

1.39 |

1.04 |

26.10 |

|

HDDH034 |

84.00 |

84.50 |

0.50 |

6.17 |

5.90 |

19.91 |

|

HDDH035 |

99.70 |

101.00 |

1.30 |

2.11 |

1.93 |

13.62 |

|

HDDH035 |

120.00 |

120.50 |

0.50 |

3.78 |

3.28 |

37.59 |

|

HDDH036 |

77.70 |

78.20 |

0.50 |

3.81 |

3.55 |

19.81 |

|

HDDH036 |

180.60 |

181.20 |

0.60 |

2.33 |

1.65 |

50.99 |

|

HDDH036 |

220.40 |

221.50 |

1.10 |

3.39 |

2.52 |

65.37 |

|

HDDH036 |

224.00 |

225.00 |

1.00 |

5.47 |

4.89 |

43.40 |

|

including |

224.00 |

224.50 |

0.50 |

9.55 |

8.54 |

75.61 |

|

HDDH037 |

162.00 |

176.50 |

14.50 |

1.08 |

0.91 |

12.69 |

|

including |

163.10 |

164.20 |

1.10 |

2.35 |

1.91 |

33.16 |

|

and |

166.00 |

166.50 |

0.50 |

8.45 |

7.57 |

66.19 |

|

and |

176.00 |

176.50 |

0.50 |

7.05 |

6.26 |

59.39 |

|

HDDH037 |

189.00 |

190.00 |

1.00 |

2.02 |

1.73 |

21.59 |

|

HDDH038 |

34.00 |

55.00 |

21.00 |

1.01 |

0.91 |

7.43 |

|

including |

42.00 |

42.60 |

0.60 |

4.72 |

4.53 |

14.53 |

|

and |

51.50 |

54.00 |

2.50 |

3.02 |

2.91 |

8.42 |

|

including |

101.00 |

102.00 |

1.00 |

2.30 |

2.10 |

14.70 |

|

and |

114.00 |

114.50 |

0.50 |

7.36 |

6.49 |

65.29 |

|

and |

116.00 |

116.64 |

0.64 |

13.74 |

12.83 |

68.39 |

|

and |

123.60 |

124.15 |

0.55 |

2.24 |

2.12 |

9.04 |

|

including |

234.50 |

235.10 |

0.60 |

6.42 |

5.85 |

42.88 |

|

and |

244.80 |

246.50 |

1.70 |

5.42 |

4.35 |

79.95 |

|

and |

248.00 |

249.30 |

1.30 |

2.99 |

2.93 |

4.76 |

|

HDDH038 |

251.00 |

251.50 |

0.50 |

4.94 |

4.87 |

5.33 |

|

HDDH039 |

107.50 |

108.00 |

0.50 |

1.59 |

1.52 |

5.61 |

|

HDDH040 |

157.00 |

157.50 |

0.50 |

4.29 |

3.68 |

45.49 |

|

HDDH040 |

168.80 |

191.00 |

22.20 |

1.78 |

1.58 |

14.72 |

|

including |

174.00 |

175.00 |

1.00 |

9.83 |

9.53 |

22.39 |

|

and |

177.30 |

178.00 |

0.70 |

9.26 |

8.75 |

38.14 |

|

and |

180.00 |

180.65 |

0.65 |

5.72 |

4.69 |

77.30 |

|

and |

184.00 |

187.00 |

3.00 |

3.86 |

3.43 |

32.60 |

|

HDDH040 |

198.00 |

200.00 |

2.00 |

3.92 |

2.72 |

90.36 |

|

including |

209.00 |

210.00 |

1.00 |

3.06 |

2.96 |

7.16 |

|

including |

226.00 |

227.00 |

1.00 |

2.56 |

2.44 |

8.66 |

|

HDDH040 |

255.00 |

262.00 |

7.00 |

1.91 |

1.88 |

2.57 |

|

including |

255.50 |

255.90 |

0.40 |

26.74 |

26.47 |

20.16 |

|

HDDH041 |

59.90 |

60.80 |

0.90 |

1.64 |

1.52 |

9.01 |

|

HDDH041 |

98.50 |

99.20 |

0.70 |

3.29 |

3.01 |

20.70 |

|

including |

110.00 |

110.60 |

0.60 |

2.72 |

2.57 |

11.11 |

(*) Reported interval length are down

hole widths and not true widths.

(**) Gold equivalent (“AuEq”) is

calculated using metal prices of US$ 1,800/oz for Au and US$ 24/oz

for Ag. The equation used is: AuEq g/t = Au g/t + (Ag g/t ÷

75).

AuEq assumes Au recovery of 90%. The

limited metallurgical studies by Fredonia (selective Bottle rolls

from Main Veins material) have indicated high (>90%) recovery of

gold in oxide material. The Cerro Vanguardia mine to the east of

EDM with similar mineralization reports recoveries in the high 90%

for Au.

Quality Assurance/Quality

Control:

All core samples were submitted to the principal

Alex Stewart Laboratories in San Julián city for preparation, and

in Mendoza city for the analysis. All samples were analyzed for Au

and Ag by fire assay/ AA finish 50 g, plus a 39-element ICP-AR

finish. Fredonia followed industry standard procedures for the work

with a quality assurance/quality control (QA/QC) program. Blanks

and reference material of High grade/ Low grade Gold and High

grade/ Low grade Silver standards were included with all sample

shipments to the principal laboratory. Field duplicates were made

from Coarse Reject. Fredonia detected no significant QA/QC issues

during review of the data.

Mr. Fernando Ganem, Professional Geoscientist,

VP - Exploration of the Company, is a qualified person

(“QP”) as defined by Canadian National Instrument

43-101. Mr. Ganem visited the property and has read and approved

the technical contents of this release.

Data Verification

Mr. Ganem has previous experience with the EDM

property and the historical QA/QC procedures undertaken for the

preparation of previous results and has previously conducted the

verification activities on drilling and sampling results described

in Fredonia’s technical report entitled “Technical Report on the El

Dorado-Monserrat Property in Santa Cruz Province, Argentina” dated

February 15th, 2021 (the “EDM Technical

Report”).

Mr. Ganem was physically present to inspect and

take verification samples from drill core in the most recent

drilling campaign, and verify drill results against data-base

information provided by management to ensure the assays results

presented are those in the database. Digital ‘original’ final assay

reports (certificates) were provided to the QP at the time of

disclosure for verification.

About Fredonia

Fredonia indirectly owns a 100% interest in

certain license areas (totaling approximately 18,300 ha.)

(Collectively, the “Project”), all within the Deseado Massif

geological region in the Province of Santa Cruz, Argentina,

including the following principal areas: El Aguila, approx.

9,100ha, Petrificados, approx. 3,000ha, and the flagship, advanced

El Dorado-Monserrat property covering approx. 6,200ha located close

to AngloGold Ashanti’s Cerro Vanguardia mine, subject to a 1.5% net

smelter return royalty on the EDM project, and a 0.5% net profits

interest on Winki II, El Aguila I, El Aguila II and Hornia (ex

Petrificados).

For further information: Please

visit the Company website www.fredoniamanagement.com or contact:

Omar Salas, Chief Financial Officer, Direct: +1-416-846-7807,

Email: omar.salas@icloud.com.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains certain

“Forward-Looking Statements” within the meaning of applicable

securities legislation relating to the Company and the EDM project,

including statements regarding the prospectivity of the EDM project

for gold and silver mineralization, including the potential for

metal recoveries from any mineral processing activity, the

potential for a mineral resource estimate at the Project, and the

Company’s future exploration plans. Words such as “might”, “will”,

“should”, “anticipate”, “plan”, “expect”, “believe”, “estimate”,

“forecast” and similar terminology are used to identify forward

looking statements and forward-looking information. Such statements

and information are based on assumptions, estimates, opinions and

analysis made by the Company considering its experience, current

conditions and its expectations of future developments as well as

other factors which it believes to be reasonable and relevant.

Forward-looking statements and information involve known and

unknown risks, uncertainties and other factors, including, without

limitation, the factors described in the Company’s filing statement

dated June 22, 2021 available on SEDAR at www.sedar.com under the

heading “Risk Factors” that may cause actual results to differ

materially from those expressed or implied in the forward-looking

statements and information and accordingly, readers should not

place undue reliance on such statements and information and the

Company can give no assurance that they will prove to be correct.

The statements in this press release are made as of the date of

this release. The Company undertakes no obligation to update

forward-looking statement made herein, or comment on analyses,

expectations or statements made by third parties in respect of the

Company or its securities, other than as required by law.

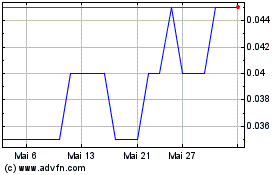

Fredonia Mining (TSXV:FRED)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Fredonia Mining (TSXV:FRED)

Historical Stock Chart

Von Nov 2023 bis Nov 2024