Fredonia Mining Inc. (“

Fredonia” or the

“

Company”) (TSXV:FRED) announces its maiden

Mineral Resource Estimate (“MRE”) at its wholly-owned El Dorado

Monserrat (“EDM”) Project, Santa Cruz province, Argentina. The MRE

includes the Main Vein, Abanico, Bajo Pedernal and Monserrat West

targets at in-pit Northern Monserrat Sector, and only the Herradura

Hill target at in-pit Southern Mineralized Corridor.

Estanislao Auriemma, CEO stated: “This

transformative initial mineral resource estimate arose from our

team’s vision and perseverance and our investors’ long-standing

support. From the start we believed that we would be successful in

defining a significant resource in one of the best gold/silver

districts in Argentina, with the added bonus of being very close to

AngloGold Ashanti’s long-running world-class mine. While we

now have a much better understanding of the gold/silver structures,

we have just scratched the surface of our deposit and look forward

to maximizing its potential for the benefit of our investors.

Significant areas of mineralization were not able to be included in

this maiden resource estimate and all targets remain open in all

directions as well as at depth, where drilling showed us that the

grade improves. As such, we feel confident that with continued work

we can increase the size and quality of the resource. We therefore

very much look forward to the upcoming exploration season.”

TABLE 1. MINERAL RESOURCE ESTIMATE

STATEMENT (1-6)

|

Category |

Ktons |

Au Eq* g/t |

Au g/t |

Ag g/t |

Au Eq* Moz |

Au Moz |

Ag Moz |

|

| |

| |

|

|

|

|

|

|

|

|

|

|

North |

Measured |

35,554.4 |

0.93 |

0.66 |

20.26 |

1.064 |

0.756 |

23.159 |

|

|

Indicated |

36,481.3 |

0.81 |

0.56 |

18.52 |

0.950 |

0.660 |

21.721 |

|

|

Inferred |

180.1 |

1.01 |

0.61 |

29.71 |

0.006 |

0.004 |

0.172 |

|

| |

|

|

|

|

|

|

|

|

|

|

South |

Measured |

1,406.1 |

0.75 |

0.58 |

12.64 |

0.034 |

0.026 |

0.571 |

|

|

Indicated |

7,906.3 |

0.78 |

0.60 |

14.22 |

0.199 |

0.151 |

3.616 |

|

|

Inferred |

386 |

0.78 |

0.57 |

15.62 |

0.010 |

0.007 |

0.194 |

|

| |

|

|

|

|

|

|

|

|

|

|

Total (M&I) |

81,348.1 |

0.86 |

0.61 |

18.76 |

2.248 |

1.593 |

49.067 |

|

| |

|

Total (Inferred) |

566.1 |

0.85 |

0.58 |

20.10 |

0.015 |

0.011 |

0.366 |

|

| Note: |

Ktons:

thousands of tonnes. |

| |

Moz: millions of ounces. |

| |

Figures may not add exactly due to rounding. |

| |

|

(1) Mineral resources which are not mineral reserves do not have

demonstrated economic viability. The estimate of mineral resources

may be materially affected by environmental, permitting, legal,

title, taxation, socio-political, marketing, or other relevant

issues. It is noted that no specific issues have been identified as

yet.

(2) The quantity and grade of reported Inferred mineral

resources in this estimation are uncertain in nature and there has

been insufficient exploration to define these Inferred mineral

resources as an Indicated or Measured mineral resources and it is

uncertain if further exploration will result in upgrading them to

an Indicated or Measured mineral resource category.

(3) Mineral Resources were estimated utilizing S-Gems and

Rec-Min software and conventional block modeling within 3D

wireframes defined on a 0.40% gold cut-off, capped composites and

inverse distance grade interpolation.

(4) The mineral resources in this report were estimated using

the Canadian Institute of Mining, Metallurgy and Petroleum (CIM),

CIM Standards on Mineral Resources and Reserves, Definitions and

Guidelines prepared by the CIM Standing Committee on Reserve

Definitions and adopted by the CIM Council.

(5) The 0.40% gold resource cut-off grade was

derived from long term average Gold price of US$1,800/oz, 90.0%

process recovery, 4.5% royalties, US$ 7.0/t process cost, US$ 5.0/t

transportation & refining and US$ 4.0/t G&A cost. An

optimized pit shell was utilized for resource reporting that

utilized a US$ 2.0/t mining cost and 45 degree pit slopes.

(6) Gold grade equivalent (Au Eq) is derived

from gold metal price US$1,800/oz, and silver metal price US$24/oz.

Au Eq assume Au and Ag recoveries of 90.0%. The limited

metallurgical studies by Fredonia (selective Bottle rolls from Main

Veins material) have indicated high (>90%) recovery of gold in

oxide material. The Cerro Vanguardia mine to the east of EDM with

similar mineralization reports recoveries in the high 90% for Au.

Accordingly, the formula used for gold grade equivalent (Au Eq)

is:

Au Eq (g/t) = Au (g/t) + [Ag (g/t) x (24/1,800)

x (0.9/0.9)]

The modeling and geostatistics analysis of the

deposit was carried out using four different software packages:

RecMin and S-Gems (kriging and block model construction, modeling

and exploratory data analysis, model validation) and GSLIB and

AlphaRho (variography and exploratory data analysis).

Log - probability graphs were used in

conjunction with the statistical distribution of the different

populations to define the threshold to cap the outliers of the

studied populations. The objective is to limit the influence of

very high values on the interpolation of grades.

To estimate gold and silver, it is necessary to

bring all sample lengths to a constant length. All samples have a

constant support equal to 1.0 meter.

The North and South geological models are open

in all directions, so they do not allow the spatial delimitation of

mineralization.

The indicator method was used to find the limits

of the three-dimensional body; them, ordinary kriging is the best

linear estimator of the grade of a three-dimensional set.

The block model contains unit blocks of 5m x 5m

x 5m, a reasonable value for this type of deposits. Kriging assigns

a weight to each sample and these weights are calculated in such a

way as to minimize the estimation error.

From the specific gravity tests, the constant

value of 2.61 ton/m3 was used for the two northern and southern

sectors.

The method used to the mineral resource

categorized (Inferred, Indicated and Measured) is based on the

relative geostatistical estimation error (for gold) of each unit

block.

The Mineral Resource Estimate was derived from

applying a gold cut-off grade to the block model and reporting the

resulting tonnes and grade for potentially mineable areas.

A 0.40 g/t Au lower cut-off grade inside a

US$1,800 optimised open pit has been used to report that part of

the MRE that has reasonable prospects of future economic extraction

via open pit mining. The surface optimization parameters reflect

internally researched costs and assumptions for similar style

projects in Argentina.

Open Pit gold Cut-Off Grade Calculation:

| A. Gold

price |

US$1,800/oz |

| B. Ore Mining cost |

US$ 2.0/t |

| C. Waste Mining cost |

US$ 2.0/t |

| D. Process cost |

US$ 7.0/t |

| E. Transportation & Refining |

US$ 5.0/t |

| F. General & Administration |

US$ 4.0/t |

| G. Gold Recovery |

90.0 % |

| H. Royalties |

4.5 % |

| |

|

Therefore, the gold cut-off grade for the open

pit resource estimate is calculated as follows:

Cut-Off Grade: (B+C+D+E+F) / (A x G x H) = 0.40

g/t Au

The resulting MRE is tabulated in Table 1 above.

The qualified persons for the estimate (“QPs”) consider that the

mineralization of the El Dorado Monserrat Project is potentially

amenable to open-pit extraction.

Project-specific metallurgical test work for

metal recovery is at a very preliminary stage at El Dorado

Monserrat. Six cyanidation tests were conducted on different grind

sizes on 1,000 g charges. After 48 hours, gold recoveries ranging

from 92.1% to 97.3% were achieved, while silver recoveries ranged

from 62.1% to 83.7%, varying according to grind size and cyanide

concentration. The Cerro Vanguardia mine to the east of EDM

with similar mineralization reports recoveries in the high 90% for

Au.

Mineral resources are sensitive to the selection

of the reporting criteria for the gold cut-off grade. The

sensitivities of the cut-off are demonstrated for the North and

South pits constrained resource in following table:

TABLE 2. SUMMARY OF SENSITIVITY RESULTS

FOR GOLD CUT-OFF GRADE

|

Cut-off |

Ktons |

Au Eq* g/t |

Au g/t |

Ag g/t |

Au Eq* Moz |

Moz Au |

Moz Ag |

|

| |

| |

|

|

|

|

|

|

|

|

|

0.1 |

131,223.6 |

0.71 |

0.49 |

16.53 |

3.016 |

2.086 |

69.754 |

|

|

0.2 |

128,674.0 |

0.72 |

0.50 |

16.73 |

2.995 |

2.072 |

69.224 |

|

|

0.3 |

110,174.7 |

0.78 |

0.54 |

17.48 |

2.747 |

1.921 |

61.916 |

|

|

0.4 |

81,348.1 |

0.86 |

0.61 |

18.76 |

2.248 |

1.593 |

49.067 |

|

|

0.5 |

46,884.5 |

1.02 |

0.72 |

21.87 |

1.534 |

1.092 |

33.111 |

|

|

0.6 |

21,994.5 |

1.24 |

0.93 |

23.74 |

0.878 |

0.654 |

16.786 |

|

|

0.7 |

12,666.9 |

1.45 |

1.13 |

24.06 |

0.592 |

0.461 |

9.797 |

|

Notes: the base case estimate presented above is

subject to the same assumptions and qualifications described in

Notes 1-6 of Table 1 above.

Figure 1. Plan view of the north and south

deposits (resource area in green) and their proximity in relation

to the Cerro Vanguardia Mine.

Figure 2. Plan view of the north and south deposit at El Dorado

Monserrat. (Blue measured, green indicated, red inferred).

Figure 3. Gold grade Shell with a view to the West. Long Section

of the MRE at Northern Monserrat Sector.

Figure 4. Gold grade Shell with a view to the

west. Cross Section of the MRE at Southern Mineralized Corridor

(included only Herradura Hill).

Preparation of Mineral Resource

Calculation

The mineral resource estimate was prepared by

independent QP Mario Alfaro Cortés of Chile, commissioned by

Fredonia Mining, and is calculated for two deposits, North and

South. The estimate was prepared according to NI 43-101 standards

and the CIM Standards on Mineral Resources and Reserves:

Definitions and Guidelines (CIM 2014).

Quality Assurance/Quality

Control

All core samples were submitted to the principal

Alex Stewart Laboratories in San Julián city for preparation and in

Mendoza city for the analysis. All samples were analyzed for Au and

Ag by fire assay/ AA finish 50 g, plus a 39-element ICP-AR finish.

Fredonia followed industry standard procedures for the work with a

quality assurance/quality control (QA/QC) program. Blanks and

reference material of High grade/ Low grade Gold and High grade/

Low grade Silver standards were included with all sample shipments

to the principal laboratory. Field duplicates were made from coarse

reject. Fredonia detected no significant QA/QC issues during review

of the data.

Mr. Fernando Ganem, is a QP as defined by

Canadian National Instrument 43-101. Mr. Ganem visited the property

and has read and approved the technical contents of this

release.

Data Verification

Mr. Ganem has previous experience with the EDM

property and the historical QA/QC procedures undertaken for the

preparation of previous results and has previously conducted the

verification activities on drilling and sampling results described

in Fredonia’s technical report entitled “Technical Report on the El

Dorado-Monserrat Property in Santa Cruz Province, Argentina” dated

February 15th , 2021.

Mr. Ganem was physically present to inspect and

take verification samples from drill core in the most recent

drilling campaign, and verify drill results against data-base

information provided by management to ensure the assay results

presented are those in the database. Digital ‘original’ final assay

reports (certificates) were provided to the QP at the time of

disclosure for verification.

About Fredonia

Fredonia holds gold and silver license areas

totaling approximately 18,300 ha. in the prolific Deseado Massif

geological region in the Province of Santa Cruz, Argentina,

including the following principal areas: its flagship - the

advanced El Dorado-Monserrat project (approx. 6,200 ha.) located

close to AngloGold Ashanti’s 300,000 oz./yr Au-Ag Cerro Vanguardia

mine, the El Aguila project (approx. 9,100 ha.), and the

Petrificados project (approx. 3,000 ha).

For further information: Please

visit the Company’s website at www.fredoniamanagement.com or

contact: Estanislao Auriemma, Chief Executive Officer, Direct +54

91 149 980 623, Email: estanislao.auriemma@gmail.com.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains certain

“Forward-Looking Statements” within the meaning of applicable

securities legislation relating to the Company and the EDM project,

including statements regarding the prospectivity of the EDM project

for gold and silver mineralization, including the potential for

metal recoveries from any mineral processing activity, the mineral

resource estimate at the Project, and the Company’s future

exploration plans. Words such as “might”, “will”, “should”,

“anticipate”, “plan”, “expect”, “believe”, “estimate”, “forecast”

and similar terminology are used to identify forward looking

statements and forward-looking information. Such statements and

information are based on assumptions, estimates, opinions and

analysis made by the Company considering its experience, current

conditions and its expectations of future developments as well as

other factors which it believes to be reasonable and relevant.

Forward-looking statements and information involve known and

unknown risks, uncertainties and other factors, including, without

limitation, the factors described in the Company’s filing statement

dated June 22, 2021 available on SEDAR at www.sedar.com under the

heading “Risk Factors” that may cause actual results to differ

materially from those expressed or implied in the forward-looking

statements and information and accordingly, readers should not

place undue reliance on such statements and information and the

Company can give no assurance that they will prove to be correct.

The statements in this press release are made as of the date of

this release. The Company undertakes no obligation to update

forward-looking statements made herein, or comment on analyses,

expectations or statements made by third parties in respect of the

Company or its securities, other than as required by law.

Photos accompanying this announcement are available

athttps://www.globenewswire.com/NewsRoom/AttachmentNg/778fb068-9281-4b8c-95a0-94af146cd52ahttps://www.globenewswire.com/NewsRoom/AttachmentNg/2101e5d9-c8aa-4b1e-95a4-e54d5b3431f9https://www.globenewswire.com/NewsRoom/AttachmentNg/b40ef7cc-e24c-414a-8ea7-4b15eb80ae9dhttps://www.globenewswire.com/NewsRoom/AttachmentNg/4cb31c33-bbd1-46ba-9aa9-9977798e17c6

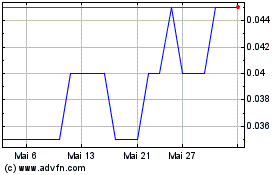

Fredonia Mining (TSXV:FRED)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Fredonia Mining (TSXV:FRED)

Historical Stock Chart

Von Jan 2024 bis Jan 2025