Athabasca Minerals Inc. Announces Q1 2014 Results and Submits

Conservation and Reclamation Business Plan to Alberta Government

EDMONTON, ALBERTA--(Marketwired - Apr 28, 2014) - Athabasca

Minerals Inc. ("Athabasca" or the "Corporation") (TSX-VENTURE:ABM)

is pleased to announce its financial results for the three months

ended February 28, 2014. The Corporation's unaudited interim

financial statements and management's discussion and analysis

("MD&A") for the three months ended February 28, 2014 are

available on SEDAR at www.sedar.com and on the Athabasca Minerals

website at www.athabascaminerals.com.

Q1 2014 Highlights

- Issued common shares for gross proceeds totalling $5.75 million

through a private placement;

- The Corporation initiated production and sales from its

corporate-owned Cowper aggregate operation, the first operation

brought into production under its agreement with a First Nations

company;

- Built up strategically stockpiled aggregate inventory with cost

in excess of $8.1 million, providing a competitive advantage by

ensuring a guaranteed supply to service construction demand in

2014;

- Commencement of the winter drilling program at the Richardson

Project in order to further investigate granite and dolomite

resource potential;

- Construction of corporate-owned camp to accommodate employees

at Conklin versus using third party camp facilities in order to

reduce accommodation costs.

Q1 2014 sales from corporate-owned aggregate operations were

negatively impacted as a result of disruption in planned sales

activities involving two customer contracts. A customer suspended a

Logan pit contract when they put their project on hold.

Approximately 165,000 tonnes of fully processed gravel remains to

be hauled pending notification of contract resumption from the

customer. The majority of the remaining contract was expected to be

delivered and invoiced during Q1 2014. Secondly, a sales agreement

had been reached with a customer to purchase aggregates produced

from the Cowper pit. However, the agreement was cancelled and as a

result, a further amount of Q1 2014 planned sales did not

occur.

Due to the seasonality of the industry, during Q1 2014 Athabasca

also focused effort on equipment repair, and the setup of its

corporate-owned Conklin stockpile work camp to accommodate its

workers.

President and CEO Dom Kriangkum states, "While aggregate demand

within the region was considerably lighter than normal during the

first fiscal quarter, we are pleased to see that sales have picked

up in the second quarter, both at Susan Lake and at our

corporate-owned pits. During Q1 2014 management had noted a

significant reduction in inventory stockpiling outside of the Susan

Lake pit by our customers in advance of Q2 construction activity.

This was seen as a contributing factor in reduced aggregate sales

this past quarter. Despite the light sales volume in the early

months of fiscal 2014, management anticipates full year results

will normalize. As well as focusing on Q2 sales opportunities, the

executive team is currently undertaking a review of current

operating parameters and operational execution intended to identify

continued efficiency improvements. A detailed strategic analysis is

being performed to ensure key performance indicators are being

benchmarked, cost control measures are being achieved and maximum

productivity and efficiency are being achieved."

Operations Update

Aggregate demand has begun to ramp up during Q2, and management

anticipates Susan Lake demand will continue to accelerate as Q2

progresses. By the mid-point of Q2, Susan Lake sales had already

surpassed Q1 2014 Susan Lake sales. Management anticipates further

acceleration in Q2 aggregate demand, followed by strong demand

through the remainder of the fiscal year.

Activity at our corporate-owned pits is ongoing.

- Initial fiscal 2014 sales from the Kearl pit got underway in

mid-April, when hauling of aggregates to its nearby major customer

began and remains in progress;

- Unsold gravel processed at the Cowper pit has been hauled to a

new third party stockpile site near a major highway north of

Conklin, where it is available for year round delivery. Crushing

operations at the now depleted Cowper pit had concluded during Q2

2014, and reclamation activity at the pit is currently

underway;

- Some recent tree clearing has been initiated at the

corporate-owned Pelican Hill pit in order to prepare for future

production at that location.

Mining and crushing activity at the Logan and House River pits

is not expected to resume before late fall.

Financial Highlights

|

|

Three months ended February 28 |

|

|

|

Q1 2014 |

|

Q1 2013 |

|

|

Aggregate management fees |

$ |

554,567 |

|

$ |

1,489,017 |

|

|

Net aggregate sales |

$ |

2,863,278 |

|

$ |

5,194,379 |

|

|

Total revenue |

$ |

3,417,845 |

|

$ |

6,683,396 |

|

|

Aggregate operating expenses |

$ |

4,576,715 |

|

$ |

5,810,597 |

|

|

Gross (loss) profit |

$ |

(1,158,870 |

) |

$ |

872,799 |

|

|

Total aggregate tonnes sold |

|

578,537 |

|

|

1,516,224 |

|

|

Net loss from land use agreement |

$ |

Nil |

|

$ |

(227,796 |

) |

|

Net loss from aggregate operations |

$ |

(1,910,393 |

) |

$ |

(146,786 |

) |

|

Net loss and comprehensive loss |

$ |

(1,910,393 |

) |

$ |

(374,582 |

) |

|

Basic loss per common share |

$ |

(0.063 |

) |

$ |

(0.013 |

) |

|

Basic cash flow per share |

$ |

(0.029 |

) |

$ |

0.026 |

|

The $3,265,551 decline in Q1 2014 revenue compared to Q1 2013

was the primary reason for the resulting net loss of $1,910,393, an

increase of $1,535,811 over Q1 2013. The sales decline includes a

$934,450 reduction in aggregate management fees, resulting from a

62.5% reduction in aggregate tonnes sold from Susan Lake; and, a

$2,331,101 reduction in net aggregate sales, resulting from a 57.2%

reduction in aggregate tonnes sold from corporate-owned pits.

Aggregate operating expenses during Q1 2014 had decreased by

$1,233,882 compared to Q1 2013, primarily as a result of reduced

costs associated with lower sales volume from corporate-owned

pits.

Management attributes the sales decline to a reduction in

inventory stockpiling outside of the Susan Lake pit, and a slower

ramp up of civil projects during Q1 2014 in the Fort McMurray

area.

Outlook

Athabasca's core business relies on aggregate demand from

Alberta's oil, natural gas and mining industries in addition to

municipal and road construction projects. Historically Athabasca

has stronger third and fourth quarters following typically slower

first and second quarters due to seasonal considerations such as

winter conditions and spring break-up conditions.

The Corporation determines demand for the year by discussing

expected aggregate requirements with its major customers.

- Improving sales demand during Q2 and expected strong demand

during Q3 and Q4 is expected to offset the Q1 sales shortfall.

- Existing inventory turnover during fiscal 2014, along with the

efficient production of further processed aggregates from its

corporate-owned pits is a management priority;

- Cost savings have been targeted for near term implementation,

including equipment repair and maintenance costs, work crew

accommodation costs, and reduced hauling rates for aggregates

delivery. These initiatives will provide improved productivities

and increased efficiencies, resulting in measurable performance

gains;

- Athabasca plans for strategic crushing at its corporate-owned

pits during Q2 and continuing through Q4 based on market

demand.

The conservation, reclamation and business plan (CRBP) for the

Firebag Project has now been submitted for government approval;

meanwhile further work will be performed for the 43-101 resource

report.

AGGREGATE OPERATIONS:

Corporate-Owned

Pits

Management is focussed on opportunities to sell its existing

aggregate inventory, and is actively negotiating with various

customers who have expressed interest for the purchase of

aggregates, which involves all of the Corporation's inventory

locations.

Currently, processed and stockpiled inventory includes

approximately 530,000 tonnes of gravel and 440,000 tonnes of sand

located across Athabasca's corporate-owned pits and stockpile

sites. This leaves the Corporation well positioned to supply

aggregates to regional customers from its existing inventory of

processed aggregate products.

- Fiscal 2014 Kearl pit sales are now underway, with current

hauling in progress to its nearby major customer. Based on

additional purchasing interest expressed by other parties for its

crushed aggregate products, management anticipates strong overall

sales at the Kearl pit during fiscal 2014 from its inventory which

includes over 250,000 tonnes of gravel and 389,000 tonnes of

sand;

- Logan pit inventory sales discussions are occurring with oil

and gas developers in the area. The majority of aggregate sales are

expected to resume in late fall 2014 when winter haul road

conditions improve access to the pit. Currently 121,000 tonnes of

gravel remains available for sale at the Logan pit;

- 68,000 tonnes of gravel at Athabasca's Conklin stockpile site

is currently available for year round sales and delivery;

- 50,000 tonnes of processed sand remaining onsite at Athabasca's

Cowper pit. A further 46,000 tonnes of processed gravel and 20,000

tonnes of pit run is now available at a stockpile site near

Conklin, Alberta for year round sales.

The Logan pit is currently accessible only during the winter

months. The Corporation is considering the construction of an

all-season road during the summer of 2014, to allow for year round

access and product delivery, and help enable an earlier sale of its

existing inventory.

Under an agreement with a First Nations company, the Corporation

is awaiting approval from the Alberta Government to open a second

new pit later this year, and anticipates the pit will be available

to commence production during fiscal 2014.

During fiscal 2014 Athabasca seeks to improve its corporate pit

cost efficiencies, through its improved Kearl pit dewatering

method, and other experience gained during its first year of

operation within the pit. Improvement in the overall rate of

aggregate processing is anticipated, resulting in a reduction in

production cost per tonne.

Susan Lake Public

Pit

Q1 2014 was subject to frozen conditions and periods of extreme

cold and snow resulting in very little construction activity

requiring sand and gravel. Despite the soft first quarter in 2014,

the Corporation is observing increased activity at the Susan Lake

gravel pit during Q2. Increasing demand for aggregate is evident as

Q2 Susan Lake sales to date have already surpassed what was sold

during all of Q1. Indications from its customers point to a return

to solid demand for aggregates beginning in Q2, with strong sales

in Q3 and Q4.

The Corporation has received sand and gravel orders from

existing users for significant quantities to be fulfilled during

fiscal 2014. Management also received substantial gravel requests

from new customers who are bidding on works for a new oil sands

project at the north end of the Susan Lake pit. Management

anticipates construction of the project will last between two to

three years before being placed into production. Oil sands projects

typically consume 5 to 8 million tonnes of aggregates for plant

construction and another 0.5 to 1.0 million tonnes annually to

maintain roads and other infrastructure.

INDUSTRIAL METALLIC

MINERALS PROJECTS:

Firebag Project (Silica

Sand)

- The Firebag silica sand has been tested and found to be

suitable as frac sand for the oil and gas industry;

- In February 2014 the Corporation received notification from

Alberta Environment and Sustainable Resources Development ("ESRD")

that the department has completed its review of Athabasca's silica

sand surface material lease application at the Firebag Project. The

notice confirms that ESRD has, in principle, completed its review

of the lease boundary that is approximately 80 acres in size, and

forms a part of the larger Firebag Project;

- Athabasca previously submitted a technical memo documenting

development and reclamation.

- On April 23, 2014 the Corporation submitted a Conservation and

Reclamation Business Plan ("CRBP") to ESRD for their review before

receiving final approval. The CRBP is a normal course requirement

of the approval process;

- The Corporation is currently in discussion with a major

engineering firm being considered to perform a preliminary economic

assessment of the Firebag Project in order to confirm the economic

potential of the Firebag deposit.

Athabasca has also been in discussion with a major railway

company for developing a future frac sand trans-loading facility,

wet sand facility, drying facility and storage terminal east of

Fort McMurray, within a strategically situated location. Management

is preparing preliminary cost estimates and examining alternatives

for processing and trans-loading of products.

Next steps include progress towards the completion of a National

Instrument 43-101 resource report for the Firebag Project.

The Firebag project consists of a silica sand deposit located

139 km north of Fort McMurray and is accessible via Highway 63. The

Corporation has completed laboratory testing of silica sand from

the Firebag project as previously disclosed. Testing indicates the

viability as a potential frac sand for use in hydraulic fracking

for the oil and gas industry.

Richardson Project

(Granite and Dolomite)

Work continues on development of the Richardson Project.

- Detailed core logging and sampling has recently been completed

at Athabasca's Edmonton facility;

- Samples are next being sent to a major independent testing lab

in Calgary in order to verify the materials are suitable as

aggregate for use in concrete, asphalt and road base.

These 2014 drill holes coupled with additional drilling from the

same area in 2013 will provide the information necessary to

complete a National Instrument 43-101 (NI 43-101) resource estimate

for the Richardson granite and dolomite in fiscal 2014. Following

completion of the NI 43-101 report, the Corporation intends to

apply for a mineral lease on a portion of the Richardson Project

currently held by Athabasca under mineral permits; and

subsequently, the submission of a development application to

operate a hard rock quarry.

The complete financial statements for Athabasca for the three

months ended February 28, 2014 and Management's Discussion &

Analysis for the same period are available for viewing on the

Corporation's website at www.athabascaminerals.com and on SEDAR at

www.sedar.com.

About Athabasca Minerals

The Corporation is a resource company involved in the

management, exploration and development of aggregate projects.

These activities include contracts works, aggregate pit management,

aggregate production and sales from corporate-owned pits, new

aggregate development and acquisitions of sand and gravel

operations. The Corporation also has industrial mineral land

holdings for the purpose of locating and developing sources of

industrial minerals and aggregates essential to high growth

economic development.

Neither the TSX Venture nor its Regulation Services Provider

(as that term is defined in the policies of the TSX Venture)

accepts responsibility for the adequacy or accuracy of this

release.

This news release contains forward-looking statements that

involve risks and uncertainties. Forward-looking statements or

information are based on current expectations, estimates and

projections that involve a number of risks and uncertainties which

could cause actual results to differ materially from those

anticipated by the Corporation. The forward-looking statements or

information contained in this news release are made as of the date

hereof and the Corporation does not undertake any obligation to

update publicly or revise any forward-looking statements or

information, whether as a result of new information, future events

or otherwise, unless so required by applicable securities

laws.

The securities of Athabasca have not been, nor will be,

registered under the United States Securities Act of 1933, as

amended, and may not be offered or sold within the United States or

to, or for the account or benefit of, U.S. persons absent U.S.

registration or an applicable exemption from U.S. registration

requirements. This release does not constitute an offer for sale of

securities in the United States.

Athabasca Minerals Inc.Dean

Stuart403-517-2270dean@boardmarker.netwww.athabascaminerals.com

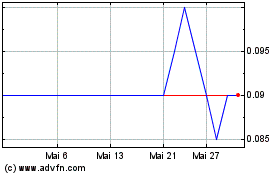

Aben Minerals (TSXV:ABM)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Aben Minerals (TSXV:ABM)

Historical Stock Chart

Von Jan 2024 bis Jan 2025