Americas Gold and Silver Corporation Announces Upsize of Private Placement to up to C$7.5 Million

21 März 2024 - 2:03AM

Americas Gold and Silver Corporation (TSX: USA, NYSE

American: USAS) (the “

Company”) is

pleased to announce that it has entered into an amending agreement

with Eight Capital, as agent, to upsize the previously announced

private placement. In connection with the upsized offering, the

Company will issue up to 25,000,000 units of the Company (the

“

Units”) at a price of C$0.30 per Unit (the

“

Offering”) for aggregate gross proceeds of up to

C$7,500,000. In addition, the Company and Eight Capital have agreed

that Eight Capital shall be granted an option to sell an additional

1,000,000 Units for additional gross proceeds of up to C$300,000.

Each Unit will be comprised of one common share

of the Company (each, a “Common Share”) and one

common share purchase warrant of the Company (a

“Warrant”). Each Warrant will entitle the holder

thereof to purchase one common share of the Company (each, a

“Warrant Share”) at an exercise price of C$0.40

per Warrant Share for a period of 36 months following the closing

of the Offering.

The net proceeds of the Offering will be used

for working capital requirements at the Company’s Cosalá Operations

and Galena Complex, in order to transition to additional

silver-copper ore production at the Company’s operations in the

U.S. and Mexico, and for general and administrative purposes.

The Offering is expected to close on or about

March 27, 2024, or such other date as the Company and Eight Capital

may agree and is subject to certain conditions including, but not

limited to, the receipt of all necessary regulatory and other

approvals including the conditional listing approval of the Toronto

Stock Exchange and the NYSE American Market.

Subject to compliance with applicable regulatory

requirements and in accordance with National Instrument 45-106 –

Prospectus Exemptions (“NI 45-106”): (i) up to

21,667,000 Units under the Offering (the “LIFE

Units”) will be offered for sale to purchasers resident in

Canada and/or other qualifying jurisdictions pursuant to the listed

issuer financing exemption under Part 5A of NI 45-106 (the

“Listed Issuer Financing Exemption”) for gross

proceeds of up to C$6,500,100; and (ii) any additional Units under

the Offering (the “Non-LIFE Units”) will be

offered for sale to purchasers resident in Canada and/or other

qualifying jurisdictions pursuant to other exemptions under NI

45-106 and in accordance with other applicable securities laws. The

LIFE Units (including the Common Shares, Warrants, and any Warrant

Shares underlying such LIFE Units) issued to Canadian resident

subscribers in the Offering will not be subject to a hold period

pursuant to applicable Canadian securities laws. The Non-LIFE Units

(including the Common Shares, Warrants, and any Warrant Shares

underlying such Non-LIFE Units) will be subject to a hold period

pursuant to applicable Canadian securities laws expiring four

months and one day from the date of issuance of such Non-LIFE

Units.

There is an offering document related to the

LIFE Units issuable under the Offering that can be accessed under

the Company’s profile at www.sedarplus.ca and on the Company’s

website at www.americas-gold.com. Prospective investors should read

this offering document before making an investment decision in any

LIFE Units.

About Americas Gold and Silver

Corporation

Americas Gold and Silver Corporation is a

high-growth precious metals mining company with multiple assets in

North America. The Company owns and operates the Cosalá Operations

in Sinaloa, Mexico, manages the 60%-owned Galena Complex in Idaho,

USA, and is re-evaluating the Relief Canyon mine in Nevada, USA.

The Company also owns the San Felipe development project in Sonora,

Mexico. For further information, please see SEDAR+ or

www.americas-gold.com.

For more information

Stefan AxellVP, Corporate Development &

CommunicationAmericas Gold and Silver Corporations416-874-1708

Darren BlasuttiPresident and CEOAmericas Gold

and Silver Corporation416‐848‐9503

Cautionary and Forward-Looking

Statements

This news release does not constitute an offer

to sell or a solicitation of an offer to buy nor shall there be any

sale of any of the securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful, including any of the

securities in the United States of America. The securities have not

been and will not be registered under the United States Securities

Act of 1933, as amended (the “1933 Act”) or any state securities

laws and may not be offered or sold within the United States or to,

or for account or benefit of, U.S. Persons (as defined in

Regulation S under the 1933 Act) unless registered under the 1933

Act and applicable state securities laws, or an exemption from such

registration requirements is available.

This news release includes certain

forward-looking statements concerning the potential additional

increase in the size of the Offering, use of proceeds of the

Offering, the closing date of the Offering, the reliance on the

Lister Issuer Financing Exemption, acceptance of the TSX or NYSE

American Market, the future performance of our business, its

operations and its financial performance and condition, as well as

management’s objectives, strategies, beliefs and intentions.

Forward-looking statements are frequently identified by such words

as “may”, “will”, “plan”, “expect”, “anticipate”, “estimate”,

“intend” and similar words referring to future events and results.

Forward-looking statements are based on the current opinions and

expectations of management. All forward-looking information is

inherently uncertain and subject to a variety of assumptions, risks

and uncertainties, including the speculative nature of mineral

exploration and development, fluctuating commodity prices,

competitive risks and the availability of financing, as described

in more detail in our recent securities filings available at

www.sedarplus.ca. Actual events or results may differ materially

from those projected in the forward-looking statements and we

caution against placing undue reliance thereon. We assume no

obligation to revise or update these forward-looking statements

except as required by applicable law.

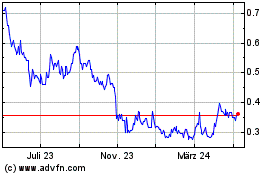

Americas Gold and Silver (TSX:USA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Americas Gold and Silver (TSX:USA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024