Tamarack Valley Energy Ltd. (“

Tamarack” or the

“

Company”) (TSX:TVE) is pleased to announce its

financial and operating results for the three months ended March

31, 2018. Selected financial and operational information is

outlined below and should be read in conjunction with Tamarack’s

unaudited condensed consolidated interim financial statements

(“Financial Statements”) for the three months ended March 31, 2018

and related management’s discussion and analysis (“MD&A”) which

are available on SEDAR at www.sedar.com and on Tamarack’s website

at www.tamarackvalley.ca.

Q1 2018 Financial and Operating Highlights

- Achieved record corporate production in Q1/18 of 23,532 boe/d,

up 3% over Q4/17 of 22,807 boe/d and up 32% over Q1/17 volumes of

17,796 boe/d.

- Oil and natural gas liquids (“NGL”) weighting was 63% in Q1/18

compared to 57% in the same period of 2017, representing an

increase of 11%, which positively contributed to the Company’s

stronger netbacks year-over-year.

- Total adjusted operating field netbacks (previously referred to

as “adjusted funds flow”; see Non-IFRS Measures) increased 81% to

$58.5 million in Q1/18 ($0.26/share basic and $0.25/share diluted),

from $32.4 million in Q1/17 ($0.15/share basic and diluted).

- Maintained healthy net debt to annualized Q1/18 adjusted

operating field netback ratio of 0.8 times at the end of Q1/18,

compared to 1.3 times at the end of Q1/17.

- Operating netbacks of $30.11/boe in Q1/18 increased by 31% over

Q1/17 primarily due to the 11% increase in oil and NGL weighting,

and the 18% increase in the combined average realized prices for

oil and NGL.

- Net production and transportation expenses in Q1/18 were 6%

lower at $10.76/boe compared to $11.42/boe in Q1/17.

- Invested $69.6 million on drilling, completing and equipping

nine (9.0 net) Cardium oil wells, 29 (28.0 net) Viking oil wells

and five (4.7 net) Redwater oil wells. The Company also completed

and brought on production 15 (14.4 net) Viking oil wells that were

drilled in late Q4/17 and drilled eight (8.0 net) Viking oil wells

that will be brought on production in the second quarter of

2018.

- Executing on the Company’s strategy of continuing to add high

quality drilling inventory, closed one tuck-in acquisition totaling

$2.5 million in the Wilson Creek area of Alberta, adding 18 boe/d

and 3.3 (2.1 net) sections of undeveloped land. The Company drilled

two Cardium wells on these lands in Q1/18.

- Tamarack maintained the $290 million borrowing base on its

revolving credit facility (the “Facility”). The Company’s syndicate

of lenders provided an option to increase the borrowing base during

the formal annual review period, which is expected to be completed

by the end of May 2018.

Financial & Operating Results

|

|

Three months endedMarch 31, |

|

|

|

|

|

2018 |

|

|

2017 |

|

% change |

|

| ($ thousands,

except per share) |

|

|

|

|

|

|

|

|

| Total Revenue |

|

98,736 |

|

|

62,870 |

|

57 |

|

| Adjusted operating

field netback 1 |

|

58,545 |

|

|

32,356 |

|

81 |

|

| Per share

– basic 1 |

$ |

0.26 |

|

$ |

0.15 |

|

73 |

|

| Per share

– diluted 1 |

$ |

0.25 |

|

$ |

0.15 |

|

67 |

|

| Net income (loss) |

|

3,294 |

|

|

2,290 |

|

44 |

|

| Per share

– basic |

$ |

0.01 |

|

$ |

0.01 |

|

– |

|

| Per share

– diluted |

$ |

0.01 |

|

$ |

0.01 |

|

– |

|

| Net debt 1 |

|

(186,732 |

) |

|

(165,561 |

) |

13 |

|

| Capital

Expenditures 2 |

|

69,630 |

|

|

63,721 |

|

9 |

|

|

Weighted average shares outstanding

(thousands) |

|

|

|

|

|

|

|

|

|

Basic |

|

228,621 |

|

|

217,655 |

|

5 |

|

|

Diluted |

|

231,713 |

|

|

219,679 |

|

5 |

|

| Share

Trading (thousands, except share

price) |

|

|

|

|

|

|

|

|

| High |

$ |

3.09 |

|

$ |

3.59 |

|

(14 |

) |

| Low |

$ |

2.31 |

|

$ |

2.60 |

|

(11 |

) |

| Trading

volume (thousands) |

|

30,945 |

|

|

80,868 |

|

(62 |

) |

|

Average daily production |

|

|

|

|

|

|

|

|

| Light oil

(bbls/d) |

|

13,239 |

|

|

7,891 |

|

68 |

|

| Heavy oil

(bbls/d) |

|

299 |

|

|

484 |

|

(38 |

) |

| NGLs

(bbls/d) |

|

1,347 |

|

|

1,779 |

|

(24 |

) |

| Natural

gas (mcf/d) |

|

51,879 |

|

|

45,852 |

|

13 |

|

|

Total (boe/d) |

|

23,532 |

|

|

17,796 |

|

32 |

|

|

Average sale prices |

|

|

|

|

|

|

|

|

| Light oil

($/bbl) |

|

67.92 |

|

|

63.02 |

|

8 |

|

| Heavy oil

($/bbl) |

|

45.23 |

|

|

44.64 |

|

1 |

|

| NGLs

($/bbl) |

|

45.14 |

|

|

26.46 |

|

71 |

|

| Natural

gas ($/mcf) |

|

2.25 |

|

|

2.89 |

|

(22 |

) |

|

Total ($/boe) |

|

46.62 |

|

|

39.25 |

|

19 |

|

|

Operating netback ($/Boe)

1 |

|

|

|

|

|

|

|

|

| Average

realized sales |

|

46.62 |

|

|

39.25 |

|

19 |

|

| Royalty

expenses |

|

(5.16 |

) |

|

(4.15 |

) |

24 |

|

|

Production expenses |

|

(10.76 |

) |

|

(11.42 |

) |

(6 |

) |

|

Operating field netback

($/Boe) 1 |

|

30.70 |

|

|

23.68 |

|

30 |

|

|

Realized commodity hedging gain (loss) |

|

(0.59 |

) |

|

(0.77 |

) |

23 |

|

|

Operating netback 1 |

|

30.11 |

|

|

22.91 |

|

31 |

|

|

Adjusted operating field netback

($/Boe) 1 |

|

27.64 |

|

|

20.20 |

|

37 |

|

| Notes: |

|

(1) |

Adjusted

operating field netback, net debt and operating netback do not have

any standardized meaning prescribed by IFRS and therefore may not

be comparable with the calculation of similar measures for other

issuers. See “Oil and Gas Metrics” and “Non-IFRS Measures”. |

| (2) |

Capital

expenditures include exploration and development expenditures, but

exclude asset acquisitions and dispositions. |

First Quarter Review

Tamarack demonstrated another strong quarter

with positive momentum and results coming from each of its core

areas: the Cardium light oil play at Wilson Creek/Alder Flats; the

Viking oil play across Alberta and Saskatchewan; and the Barons

Sand oil play at Penny. The first quarter is typically one of

Tamarack’s most active operational periods which attracts a higher

proportion of capital expenditures, and 2018 proved consistent with

historical trends.

Successful Operational

Execution

During the first quarter of 2018, the Company

drilled, completed and equipped nine (9.0 net) Cardium oil wells,

29 (28.0 net) Viking oil wells, five (4.7 net) Redwater oil wells

and completed and brought on production 15 (14.4 net) Viking oil

wells that were drilled in late Q4/17. Due to the prolonged winter,

Tamarack elected to drill two additional Cardium wells, the first

of which spud on March 28, 2018, that are expected to be completed

later in Q2/18. In addition to the two wells drilled late in Q1/18,

the Company has numerous wells expected to come on production in

Q2/18 after spring breakup which will positively impact volumes in

that period, including two Cardium wells drilled and completed

during Q1, along with eight (8.0 net) Viking oil wells that were

drilled late in Q1/18. In addition, Tamarack expects to spud the

first of three wells at Penny later in Q2/18.

First quarter production of 23,532 boe/d was

slightly above the upper end of Tamarack’s first half guidance

range of 22,750 to 23,250 boe/d with an oil and NGL weighting of

63%. During the first quarter, new wells in Veteran came on stream

at higher rates than expected causing higher operating pressures in

the gathering system and production from older legacy wells being

backed out. The Company completed the second phase of the Veteran

oil battery expansion on March 21, 2018, slightly ahead of schedule

and on budget, which brought capacity up to 10,000 bbls of oil per

day. With completion of the Veteran gas plant recommissioning

expected in late Q2/18, volume constraints are expected to be

addressed and operating costs will be reduced as solution gas can

be processed by Tamarack rather than third parties. During the

first quarter, the Company invested $72.4 million in capital

expenditures and property acquisitions (net of dispositions),

funded approximately 81% by Tamarack’s $58.5 million adjusted

operating field netback (previously referred to as “adjusted funds

flow”; see Non-IFRS Measures) generated in the period.

Revenue for the quarter increased 57% over Q1/17

primarily due to increased production volumes and realized oil and

NGL prices, while revenue increased 3% over Q4/17. Increased

production volumes, a higher oil and NGL weighting and a reduction

in operating costs positively contributed to Tamarack’s operating

netback which averaged $30.11/boe in Q1/18, representing a 31%

increase compared to Q1/17. As a result of increased production

volumes from the Veteran area, where operating costs are lower than

the corporate average, overall production and transportation

expenses per boe were lower in the quarter compared to Q1/17.

Tamarack has further allocated capital to incremental projects

designed to support the ongoing management of increased production

at facilities controlled by the Company and to further reduce the

associated operating costs. The first of the two phases of the

battery expansion at Veteran in Q3/17 positively contributed to the

overall reduction in operating costs while the second phase, which

was finalized in Q1/18, will increase emulsion processing capacity

that will also reduce operating costs. Tamarack has allocated

initial costs to reactivate the Veteran gas plant which will

address current curtailment issues and accommodate the Company’s

expected production growth through 2018.

Strengthening Commodity

Environment

WTI crude oil markets remained strong during the

first quarter of 2018 and into May showed continued growth,

reaching two-year highs that surpassed US$70.00/bbl. The average

first quarter WTI price of US$62.91/bbl was 14% higher than the

average fourth quarter price of US$55.39/bbl. With significant

improvements in the WTI markets, despite widening Edmonton Par /

WTI differentials, Tamarack’s realized Q1/18 light oil price

increased 4% to $67.92/bbl from $65.08/bbl in Q4/17.

The Company’s realized natural gas prices

increased 19% to $2.25/mcf in the first quarter of 2018 compared to

$1.89/mcf in the previous quarter. This was slightly less than the

AECO daily benchmark price increase of 23% however, still a premium

to the AECO daily index for the first quarter of 2018, reflecting

Tamarack’s efforts to reduce exposure to the persistently weak

local Alberta gas market. As previously announced, effective April

1, 2018, approximately 40% of Tamarack’s natural gas production

receives pricing from various markets that have historically

outperformed AECO, including Malin (16%), Chicago (8%), Dawn (8%)

and Mich Con (8%). Tamarack has committed to continue to

proactively take steps to mitigate gas price weakness by reducing

exposure to the AECO pricing hub in concert with increasing its oil

and NGL weighting.

Outlook

Tamarack intends to continue building on the

operational momentum realized in the first four months of 2018 with

a robust Q2/Q3 2018 drilling program which anticipates the

drilling, completing and equipping of 8.5 net Cardium oil wells,

39.4 net Alberta Viking oil wells, 7.6 net Saskatchewan Viking oil

wells and 3 Penny oil wells.

In response to the current low natural gas price

environment, the Company has shut-in approximately 400 boe/d of

natural gas production. As Tamarack is currently ahead of

production guidance, the Company anticipates the shut- in gas will

not affect the original 2018 production forecast.

For the full year 2018, Tamarack is targeting

10-15% debt-adjusted production per share growth over 2017 with

increased liquids weighting and higher netbacks, while maintaining

net debt to annualized Q4/18 total adjusted field operating netback

ratio of less than one times.

In the interest of preserving and enhancing

shareholder value, the Company recently implemented a normal course

issuer bid (“NCIB”) through the facilities of the Toronto Stock

Exchange and alternate trading platforms. Tamarack believes that

its share price is undervalued at times and accordingly, will make

use of excess total adjusted operating field netbacks (see Non-IFRS

Measures) to purchase shares through the NCIB program. As of May 9,

2018, the Company spent $836,827 to purchase and cancel 243,500

outstanding common shares under the NCIB. In addition to utilizing

excess total adjusted operating field netbacks for the NCIB,

Tamarack intends to continue supplementing its attractive asset

base by completing tuck-in acquisitions within core areas where the

Company has a low-cost operating advantage. These actions, along

with increased production volumes and a higher weighting of oil and

NGL in the production mix, demonstrate the value and benefit of the

Company’s unique returns- based growth model.

The Company also announces the retirement of Mr.

Dean Setoguchi from the Company’s board of directors. Mr. Setoguchi

served on the Board of Tamarack since the business combination and

reorganization was completed in June, 2010. Tamarack’s board and

management team would like to thank Mr. Setoguchi for his numerous

contributions to the Company as a Director and Chairman of the

Audit Committee and wish him all the best in his future

endeavors.

2018 Guidance

The Company’s 2018 guidance is reiterated

below:

- Tamarack expects first half average production to be within the

upper end of the original guidance range of 22,750 to 23,250

boe/d.

- The original $195-205 million capital budget for 2018 remains

unchanged with approximately 50% expected to be spent during the

first half of 2018. The Company may elect to accelerate capital

into Q2/18 from Q3 if spring break-up ends early.

Tamarack’s key 2018 guidance is summarized in the

following table:

| 2018 Guidance |

| Average annual

production (boe/d) |

|

22,500 - 23,500 |

| Liquids

weighting (%) |

|

~64 -

66 |

| Exit production

(boe/d) |

|

24,000

- 24,500 |

| Liquids

weighting (%) |

|

~65 -

67 |

| Annual capital

expenditure range ($millions) |

|

$195 to

$205 |

| Year end 2018 net

debt(1) to Q4 annualized adjusted operating field netback(2) ratio

(including hedges) |

|

<1.0

times |

| Liquidity on existing

credit facilities ($millions) |

|

~$100 |

| 2018 price

assumptions: |

|

|

| WTI

($US/bbl) |

|

$56.75 |

| Edmonton

Par ($CDN/bbl) |

|

$64.60 |

| AECO

($CDN/GJ) |

|

$1.65 |

|

Canadian/US dollar exchange rate |

|

$0.79 |

| (1) |

Refer to definition of

net debt under “Non-IFRS Measures” |

| (2) |

Refer to definition of

adjusted operating field netback under “Non-IFRS Measures” |

About Tamarack Valley Energy Ltd.

Tamarack is an oil and gas exploration and

production company committed to long-term growth and the

identification, evaluation and operation of resource plays in the

Western Canadian Sedimentary Basin. Tamarack’s strategic direction

is focused on two key principles – targeting repeatable and

relatively predictable plays that provide long-life reserves, and

using a rigorous, proven modeling process to carefully manage risk

and identify opportunities. The Company has an extensive inventory

of low-risk, oil development drilling locations focused primarily

in the Cardium and Viking fairways in Alberta that are economic

over a range of oil and natural gas prices. With this type of

portfolio and an experienced and committed management team,

Tamarack intends to continue delivering on its strategy to maximize

shareholder returns while managing its balance sheet.

Abbreviations

| bbls |

barrels |

|

bbls/d |

barrels

per day |

| boe |

barrels

of oil equivalent |

|

boe/d |

barrels

of oil equivalent per day |

| Mboe |

thousands

barrels of oil equivalent |

| mcf |

thousand

cubic feet |

| GJ |

gigajoule |

| MMcf |

million

cubic feet |

|

Mbbls |

thousand

barrels |

|

mcf/d |

thousand

cubic feet per day |

| WTI |

West

Texas Intermediate, the reference price paid in U.S. dollars at

Cushing, Oklahoma for the crude oil standard grade |

| AECO |

the

natural gas storage facility located at Suffield, Alberta connected

to TransCanada’s Alberta System |

| IFRS |

International Financial Reporting Standards as issued by the

International Accounting Standards Board |

Oil and Gas

Advisories

Unit Cost Calculation. For the

purpose of calculating unit costs, natural gas volumes have been

converted to a barrel of oil equivalent using six thousand cubic

feet equal to one barrel unless otherwise stated. A boe conversion

ratio of 6:1 is based upon an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead. This conversion conforms with

Canadian Securities Administrators’ National Instrument 51–101

Standards of Disclosure for Oil and Gas Activities. Boe may be

misleading, particularly if used in isolation.

Oil and Gas Metrics. This press

release contains metrics commonly used in the oil and natural gas

industry, such as operating field netback and operating

netback.

|

|

“Operating field

netback” equals total petroleum and natural gas

sales less royalties and operating costs calculated on a boe

basis.“Operating netback” is the

operating field netback with realized gains and losses on commodity

derivative contracts on a boe basis. |

These terms have been calculated by management and do not have a

standardized meaning and may not be comparable to similar measures

presented by other companies, and therefore should not be used to

make such comparisons. Management uses these oil and gas metrics

for its own performance measurements and to provide shareholders

with measures to compare Tamarack’s operations over time. Readers

are cautioned that the information provided by these metrics, or

that can be derived from the metrics presented in this press

release, should not be relied upon for investment or other

purposes.

Forward-Looking Information

This press release contains certain

forward-looking information (collectively referred to herein as

“forward-looking statements”) within the meaning of applicable

Canadian securities laws. Forward-looking statements are often, but

not always, identified by the use of words such as “target”,

“plan”, “continue”, “intend”, “ongoing”, “estimate”, “expect”,

“may”, “should”, or similar words suggesting future outcomes. More

particularly, this press release contains statements concerning:

Tamarack’s business strategy, objectives, strength and focus; an

increase in netbacks; the ability of the Company to achieve

drilling success consistent with management’s expectations;

strategies to minimize exposure to Alberta gas market fluctuations,

including hedging and diversifying gas sales; drilling plans

including the timing of drilling; the reactivation of the Veteran

gas plant; the NCIB; the payout of wells and the timing thereof;

tuck-in acquisitions in Tamarack’s core areas: oil and natural gas

production levels, including the impact of shut-in gas thereon; the

availability, terms, use and renewal of the Facility; timing and

level of 2018 capital expenditures; 2018 exit debt; forecast 2018

annual production range and liquid weighting percentage; 2018

production guidance; 2018 drilling program; and shareholder

returns. The forward-looking statements contained in this document

are based on certain key expectations and assumptions made by

Tamarack relating to prevailing commodity prices, the availability

of drilling rigs and other oilfield services, the cost of such

oilfield services, the timing of past operations and activities in

the planned areas of focus, the drilling, completion and tie-in of

wells being completed as planned, the performance of new and

existing wells, the application of existing drilling and fracturing

techniques, the continued availability of capital and skilled

personnel, the ability to maintain or grow the banking facilities

and the accuracy of Tamarack’s geological interpretation of its

drilling and land opportunities. Although management considers

these assumptions to be reasonable based on information currently

available to it, undue reliance should not be placed on the

forward-looking statements because Tamarack can give no assurances

that they may prove to be correct.

By their very nature, forward-looking statements

are subject to certain risks and uncertainties (both general and

specific) that could cause actual events or outcomes to differ

materially from those anticipated or implied by such

forward-looking statements. These risks and uncertainties include,

but are not limited to: risks associated with the oil and gas

industry (e.g. operational risks in development, exploration and

production; delays or changes in plans with respect to exploration

or development projects or capital expenditures); commodity prices;

the uncertainty of estimates and projections relating to

production, cash generation, costs and expenses; health, safety,

litigation and environmental risks; and access to capital. Due to

the nature of the oil and natural gas industry, drilling plans and

operational activities may be delayed or modified to react to

market conditions, results of past operations, regulatory approvals

or availability of services causing results to be delayed. Please

refer to Tamarack’s annual information form for the year ended

December 31, 2017 (the “AIF”) for additional risk factors relating

to Tamarack. The AIF can be accessed either on Tamarack’s website

at www.tamarackvalley.ca or under the Company’s profile on

www.sedar.com.

The forward-looking statements contained in this

press release are made as of the date hereof and the Company does

not undertake any obligation to update publicly or to revise any of

the included forward-looking statements, except as required by

applicable law. The forward-looking statements contained herein are

expressly qualified by this cautionary statement.

This press release contains future-oriented

financial information and financial outlook information

(collectively, “FOFI”) about Tamarack’s prospective results of

operations, production, net debt, debt adjusted production per

share, net debt to adjusted operating field netback ratio, adjusted

operating field netback, operating netbacks, operating costs,

capital expenditures and components thereof, all of which are

subject to the same assumptions, risk factors, limitations and

qualifications as set forth in the above paragraphs and the

assumption outlined in the Non-IFRS Measures section below. FOFI

contained in this press release was made as of the date of this

press release and was provided for the purpose of providing further

information about Tamarack’s anticipated future business

operations. Tamarack disclaims any intention or obligation to

update or revise any FOFI contained in this press release, whether

as a result of new information, future events or otherwise, unless

required pursuant to applicable law. Readers are cautioned that the

FOFI contained in this press release should not be used for

purposes other than for which it is disclosed herein.

Non-IFRS Measures

Certain financial measures referred to in this

press release, such as net debt, adjusted funds flow, net debt to

annualized adjusted operating field netback, cash flow, adjusted

operating field netbacks and net debt to adjusted operating field

netback ratio are not prescribed by IFRS. Tamarack uses these

measures to help evaluate its financial and operating performance

as well as its liquidity and leverage. These non-IFRS financial

measures do not have any standardized meaning prescribed by IFRS

and therefore may not be comparable to similar measures presented

by other issuers.

|

|

“Net debt” is calculated as long-term debt plus working capital

surplus or deficit adjusted for risk management contracts.“Total

adjusted operating field netback” is calculated as net income or

loss before taxes and adding back items including: transaction

costs; and deducting non-cash items including: stock-based

compensation; accretion expense on decommissioning obligations;

depletion, depreciation and amortization; and impairment;

unrealized gain or loss on financial instruments; and gain or loss

on dispositions.“Adjusted funds flow” is calculated based on cash

flows from operating activities before changes in non- cash working

capital, transaction costs and abandonment expenditures are

incurred.“Net debt to annualized adjusted operating field netback

ratio” is calculated as net debt divided by annualized adjusted

operating field netback for the most recent quarter.“Debt-adjusted

production per share” represents the Tamarack’s production per

share after adjusting for debt.“Cash flow” is determined as gross

oil, natural gas and natural gas liquids revenues including

realized gains on commodity risk management contracts, less the

following: royalties, operating costs, transportation costs,

general and administrative costs and finance expenses. |

Please refer to the MD&A for additional

information relating to non-IFRS measures. The MD&A can be

accessed either on Tamarack’s website at www.tamarackvalley.ca or

under the Company’s profile on www.sedar.com.

For additional information, please contact:

Brian

SchmidtPresident &

CEOTamarack Valley Energy

Ltd.Phone:

403.263.4440www.tamarackvalley.ca

Ron HozjanVP Finance & CFOTamarack Valley Energy

Ltd.Phone: 403.263.4440

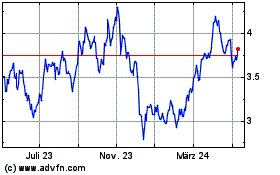

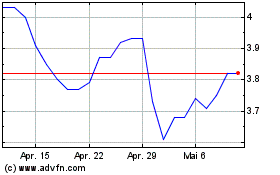

Tamarack Valley Energy (TSX:TVE)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Tamarack Valley Energy (TSX:TVE)

Historical Stock Chart

Von Feb 2024 bis Feb 2025