STEP Energy Services Ltd. (the “Company” or “STEP”) is providing a

first quarter 2023 operational and financial update as well as

reporting continued improvement in its balance sheet.

Operational Update

Canada

STEP’s Canadian operations had a robust first quarter 2023 in

both fracturing and coiled tubing, leading to its best quarterly

revenue performance. Favourable weather conditions and client

alignment resulted in solid utilization in both service lines.

STEP’s four large fracturing crews operated primarily in the gas

and condensate rich areas of the Montney while its smaller

low-pressure crew was active in the oil rich Cardium and Viking

formations, driving record fracturing revenue for the quarter. The

extended cold weather into late March provided a longer operating

cycle for STEP’s nine coiled tubing units, with the service line

recognizing its best top line performance since the third quarter

of 2018. In line with the strong operating performance, Canada is

expected to produce strong Adjusted EBITDA for the quarter.

Effective January 1, 2023, STEP started to record fracturing

fluid ends as maintenance expense rather than sustaining capital.

This change in accounting estimate was made after a detailed

analysis of the useful life for these components. Canadian

operations is expected to recognize between $2.5-3.0 million for

fluid end expense in the first quarter, which includes an

approximately $1.0 million expense to reflect the change in useful

life.

United States

STEP’s U.S. operations saw mixed results in the first quarter.

Coiled tubing continued its trend of sequential quarterly

increases, leading to record top line performance, with strong

demand from leading public E&Ps across all basins for STEP’s

industry leading coiled tubing capabilities. As disclosed in STEP’s

2022 fourth quarter public release, STEP’s U.S. fracturing service

line was negatively impacted by shifting client schedules related

to drilling delays and commodity price pressures. With these

changes coming at the start of the year, STEP was unable to secure

sufficient spot work for the crews, resulting in lower revenues

relative to the fourth quarter of 2022. Additional sustaining

capital and maintenance expense was deployed to improve

efficiencies and reliability of the equipment, but the fracturing

service line downtime will negatively impact the U.S.’s Adjusted

EBITDA margins.

Consolidated Results for the First Quarter

Aggregating the performance of STEP’s four service lines, first

quarter 2023 revenue is expected to range between $260 million and

$265 million and Adjusted EBITDA is expected to range between

$43-$48 million, which includes an expense of approximately

$2.5-$3.0 million for fluid end expenses. This compares to the

approximately $37.0 million of Adjusted EBITDA reported in Q1 2022

and the $48.6 million in Q4 2022, neither of which recognized

Canadian fluid ends in maintenance expense. Notwithstanding the

sequential decline in Adjusted EBITDA, first quarter 2023 results

are expected to rank as one of the Company’s strongest.

Outlook

Canada

STEP has aligned itself with a Canadian client base that

recognizes the advantages of operating in the second quarter and

expects to see good utilization for its fracturing service line

through much of the quarter, particularly for the larger crews.

STEP’s smaller fracturing crew is more susceptible to road bans due

to the typical spring break up conditions in the areas in which it

operates, which may limit activity for this crew in the second

quarter of 2023. Coiled tubing is also more likely to be impacted

by spring break up conditions, which could result in a moderating

of utilization in that service line in the second quarter of

2023.

Visibility into the second half of the year is solid, with

steady utilization anticipated across the Company’s core client

group in both service lines.

United States

The U.S. is expected to see higher utilization for the

fracturing service line in the second quarter. The recent

strengthening of WTI oil prices above $80 will likely provide

support to activity but the ongoing weakness in the natural gas

price will remain a limiting factor in the U.S. and as a result

STEP has deferred its plan to expand to four fracturing crews until

market conditions can support additional capacity. Coiled tubing is

expected to remain steady, with some impact from spring break up

conditions expected in the northern districts.

Utilization on STEP’s fracturing and coiled tubing fleets is

expected to remain steady into the second half of the year.

Balance Sheet and Capital Budget Update

Net debt1 at the close of Q1 2023 is expected to be between $130

and $135 million, continuing the deleveraging trend that has seen

debt come down from $310 million in 2018. Debt reduction has been

an important priority for the Company and a means to return value

to shareholders.

STEP will continue to monitor the allocation of free cash flow

to capital, ensuring that the spend is in line with expectations

for 2023. The priority will be on continuing the Company’s Tier 4

dual fuel upgrade program, with completion of the first fleet

expected before the end of the second quarter 2023. Eight of the

sixteen pumps are already in the field, consistently providing

diesel substitution rates of up to 85% for our client.

The change in accounting for fluid ends will remove

approximately $4.2 million from the 2023 sustaining capital budget.

These expenditures will now be accounted for in maintenance

expense, so STEP expects no change to its free cash flow as a

result of this change in accounting treatment.

________________________1 Net debt is a non-IFRS financial

measure that is not defined and has not standardized meaning under

IFRS. See Non-IFRS Measures. Estimated March 31, 2023 results are

preliminary and have not been audited or reviewed by the Company’s

auditors. See Forward-Looking Information & Statements, Future

Oriented Financial Information and Financial Outlooks.

CEO’s Comments

STEP’s President and CEO, Steve Glanville, commented “The first

quarter of 2023 continued to show the strength of our story. We’ve

had disciplined growth through M&A; sustained investment in our

people and equipment; and strategic geographic diversification in

the busiest North American operating areas, all of which produced

among the best return on equity in our peer group in 2022.”

"Pressure pumping is a project-based business that is influenced

by many different factors, which we saw in the U.S. in the first

quarter. Client delays happen occasionally, but the market is

typically dynamic enough that work can be backfilled. In this case,

we saw a steep drop in frac activity in the Permian from January to

February. This was seen in statistics from Rystad Energy, which

showed a drop in fracturing jobs started between January to

February of nearly 20%. Despite that, three of our four service

lines had great results, which we’re very proud of. We’re seeing

the U.S. market firm up and expect that our fracturing service line

will contribute more meaningfully for the rest of the year.”

NON-IFRS MEASURES

This press release includes terms and performance measures

commonly used in the oilfield services industry that are not

defined under IFRS. The terms presented are intended to provide

additional information and should not be considered in isolation or

as a substitute for measures of performance prepared in accordance

with IFRS. These non-IFRS measures have no standardized meaning

under IFRS and therefore may not be comparable to similar measures

presented by other issuers. The non-IFRS measure should be read in

conjunction with the Company’s quarterly financial statements and

annual financial statements and the accompanying notes thereto.

“Adjusted EBITDA” is a financial measure not presented in

accordance with IFRS and is equal to net (loss) income before

finance costs, depreciation and amortization, (gain) loss on

disposal of property and equipment, current and deferred income tax

provisions, and recoveries, equity and cash-settled share-based

compensation, transaction costs, foreign exchange forward contract

(gain) loss, foreign exchange (gain) loss, and impairment losses.

Adjusted EBITDA is presented because it is widely used by the

investment community as it provides an indication of the results

generated by the Company’s normal course of business activities

prior to considering how the activities are financed and the

results are taxed. The Company uses Adjusted EBITDA internally to

evaluate operating and segment performance because management

believes it provides better comparability between periods.

Reconciliations of the non-IFRS financial measure of Adjusted

EBITDA to the IFRS financial measure of net income (loss) can be

found in STEP’s Management Discussion and Analysis for the fourth

quarter of 2022 dated as of March 1, 2023 (under “Non-IFRS Measures

and Ratios”) which is available on SEDAR (www.sedar.com) and

incorporated herein by reference.

“Net debt” is equal to loans and borrowings before deferred

financing charges less cash and cash equivalents and CCS

derivatives. Net debt is presented to provide additional

information about items on the statement of financial position. The

Company’s Net debt for the first quarter of 2023 is forward-looking

in nature. The following table presents the equivalent historical

composition of the Company’s Net debt as at December 31, 2022,

which composition is not anticipated to differ significantly from

the composition of the Company’s Net debt as at March 31, 2023,

other than a reduction in loans and borrowings:

|

As at December 31, |

|

|

|

|

|

($000s) |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

Loans and borrowings |

|

$ |

140,794 |

|

$ |

189,957 |

|

$ |

207,630 |

|

|

Add back: Deferred financing costs |

|

2,704 |

|

|

626 |

|

|

2,371 |

|

|

Less: Cash and cash equivalents |

|

|

(2,785 |

) |

|

(3,698 |

) |

|

(1,266 |

) |

|

Less: CCS Derivatives Asset |

|

|

1,511 |

|

|

- |

|

|

- |

|

|

Net debt |

|

$ |

142,224 |

|

$ |

186,885 |

|

$ |

208,735 |

|

FORWARD-LOOKING INFORMATION & STATEMENTS AND FUTURE-ORIENTED

FINANCIAL INFORMATION AND FINANCIAL OUTLOOKS

Certain statements contained in this press release constitute

“forward-looking statements” or “forward-looking information”

within the meaning of applicable securities laws (collectively,

“forward-looking statements”). These statements relate to the

expectations of management about future events, results of

operations and the Company’s future performance (both operational

and financial) and business prospects. All statements other than

statements of historical fact are forward-looking statements. The

use of any of the words “expects”, “expected”, “guidance”,

“opportunity”, “may”, “project”, “should”, and similar expressions

are intended to identify forward-looking statements. These

statements involve known and unknown risks, uncertainties, and

other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements. While STEP believes the expectations reflected in the

forward-looking statements included in this press release are

reasonable, such statements are not guarantees of future

performance or outcomes and may prove to be incorrect and should

not be unduly relied upon.

In particular, but without limitation, this press release

contains forward-looking statements pertaining to: activity levels

and utilization of the Company’s services, the effect of oil prices

on utilization, first-quarter 2023 financial results including

projected revenue and Adjusted EBITDA, activity levels in 2023,

anticipated STEP fleet capacity, the effect of spring break up

conditions on utilization and activity, expected timing of the

Company’s Tier 4 dual fuel upgrade program, future debt levels,

STEP’s ability to return value to shareholders through debt

retirement, and expected improvements to balance sheet

fundamentals.

The forward-looking information and statements contained in this

press release reflect several material factors and expectations and

assumptions of STEP including, without limitation: the general

continuance of current or, where applicable, assumed industry

conditions; client activity levels and spending; the effect of

inflation on the cost of goods and equipment; pricing of STEP’s

services; predictable effect of seasonal weather on STEP’s

operations; expected Tier IV dual fuel substitution rates; STEP’s

ability to market successfully to current and new clients; the

effect of competition on STEP; STEP’s ability to utilize its

equipment; STEP’s ability to collect on trade and other

receivables; STEP’s ability to obtain and retain qualified staff

and equipment in a timely and cost-effective manner; levels of

deployable equipment in the marketplace; future capital

expenditures to be made by STEP; future funding sources for STEP’s

capital program; STEP’s future debt levels; the availability of

unused credit capacity on STEP’s credit lines. STEP believes the

material factors, expectations, and assumptions reflected in the

forward-looking information and statements are reasonable, but no

assurance can be given that these factors, expectations, and

assumptions will prove correct.

This press release also contains future-oriented financial

information and financial outlook information (collectively,

"FOFI") about STEP’s expected first-quarter 2023 revenues and

Adjusted EBITDA, leverage, and Net debt levels, all of which are

subject to the same assumptions, risk factors, limitations, and

qualifications as set forth in the above paragraphs. In addition,

the estimated Net debt at March 31, 2023 is based on the Company’s

internally generated monthly financial statements for the month of

March 2023 and the assumption that these internally generated

monthly financial statements will not differ materially from the

first quarter 2023 financial statements. The actual results of

operations of STEP and the resulting financial results and Net debt

will likely vary from the amounts set forth in this press release

and such variation may be material. STEP and its management believe

that the FOFI has been prepared on a reasonable basis, reflecting

management's best estimates and judgments as of the date hereof;

however, because this information is subjective and subject to

numerous risks, it should not be relied on as necessarily

indicative of future results.

The forward-looking information and FOFI contained in this press

release speak only as of the date of the document, and none of STEP

or its subsidiaries assumes any obligation to publicly update or

revise them to reflect new events or circumstances, except as may

be required pursuant to applicable laws. Actual results could also

differ materially from those anticipated in these forward‐looking

statements and FOFI due to the risk factors set forth under the

heading “Risk Factors” in STEP’s Annual Information Form for the

year ended December 31, 2022, dated March 1, 2023.

ABOUT STEP

STEP is an energy services company that provides hydraulic

fracturing, fluid and nitrogen pumping, and coiled tubing

solutions. Our combination of modern equipment along with our

commitment to safety and quality execution has differentiated STEP

in plays where wells are deeper, have longer laterals, and higher

pressures. STEP has a high-performance, safety-focused culture, and

our experienced technical office and field professionals are

committed to providing innovative, reliable, and cost-effective

solutions to our clients.

Founded in 2011 as a specialized deep capacity coiled tubing

company, STEP has grown into a North American service provider

delivering completion and stimulation services to exploration and

production companies in Canada and the U.S. Our Canadian services

are focused in the Western Canadian Sedimentary Basin, while in the

U.S., our fracturing and coiled tubing services are focused in the

Permian and Eagle Ford basins in Texas, the Uinta-Piceance and

Niobrara-DJ basins in Colorado and the Bakken basin in North

Dakota.

Our four core values; Safety, Trust, Execution, and

Possibilities inspire our team of professionals to provide

differentiated levels of service, with a goal of flawless execution

and an unwavering focus on safety.

For more information please contact:

|

Steve GlanvillePresident and Chief Executive Officer |

|

Klaas DeemterChief Financial Officer |

|

Telephone: 403-457-1772Web: www.stepenergyservices.com |

|

Telephone: 587-390-0761 |

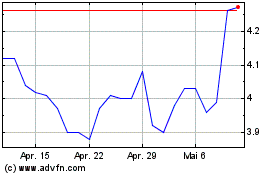

STEP Energy Services (TSX:STEP)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

STEP Energy Services (TSX:STEP)

Historical Stock Chart

Von Jan 2024 bis Jan 2025