Source Energy Services Ltd. (“Source” or the “Company”)

(

TSX: SHLE) is pleased to announce that it has

completed a comprehensive refinancing of its credit facilities by

entering into a new five year $135 million (USD) term loan (the

“Term Loan”) with Silver Point Finance, LLC (“Silver Point”) and a

new $40 million (CND) revolving asset-backed loan (“CIBC ABL”)

facility with the Canadian Imperial Bank of Commerce (“CIBC”).

Proceeds from the Term Loan will be used to redeem the outstanding

10.5% Senior Secured Notes due March 15, 2025 (the “Notes”) and

repay the outstanding amounts drawn on the Company’s current asset

backed loan facility.

The refinancing package provides Source with:

- a lower cost of borrowing;

- increased financial flexibility;

- enhanced liquidity, with an undrawn CIBC ABL and approximately

$10.0 million of cash on the balance sheet at close;

- neutrality to its current leverage position; and

- maturities out to 2029.

“The new credit facilities strengthen our

balance sheet and enhance our liquidity, which further positions us

to execute on our long-term growth strategies, while continuing to

de-lever the business,” said Derren Newell, Chief Financial

Officer. “We are excited to partner with Silver Point and CIBC for

the next chapter of our business and we would like to thank both

FGI and the noteholders for their past commitments.”

The Term Loan agreement with Silver Point

matures on December 20, 2029 and bears interest at Term SOFR plus

an applicable margin. The Term Loan agreement contains covenants

and principal amortization typical for this type of facility.

The CIBC ABL facility remains undrawn at close,

matures on December 20, 2027, and may be drawn in Canadian or U.S.

dollars. Interest rates are determined, using Prime, Base rate,

CORRA or SOFR plus an applicable margin, based on average monthly

amounts drawn on the facility. The borrowing base formula is

applied to accounts receivable and inventory, and the facility

contains covenants that are typical for this type of facility.

Source has delivered a notice of redemption (the

“Redemption Notice”), effective December 19, 2024, for all of its

outstanding Notes, representing an aggregate principal value of

$140.5 million. As set forth in the Redemption Notice, the

redemption date will be January 20, 2024 (the “Redemption Date”)

and the redemption price is 100% of the principal amount of the

Notes outstanding plus accrued and unpaid interest up to but

excluding the Redemption Date, in accordance with the provisions of

the indenture governing the Notes (the “Redemption”).

This press release does not constitute a notice

of redemption of the Notes. Information concerning the terms and

conditions of the Redemption is described in the Redemption Notice

distributed to holders of the Notes by Computershare Trust Company,

as trustee, with respect to the Notes. Beneficial holders of the

Notes with any questions about the Redemption should contact their

respective brokerage firm or financial institution.

A redacted copy of the Silver Point Term Loan

agreement and the CIBC ABL agreement will be available on Source’s

SEDAR Plus Profile at www.sedarplus.ca in accordance with National

Instrument 51-102 – Continuous Disclosure Obligations as adopted by

the Canadian Securities regulatory authorities.

ABOUT SOURCE ENERGY

SERVICES

Source is a company that focuses on the

integrated production and distribution of frac sand, as well as the

distribution of other bulk completion materials not produced by

Source. Source provides its customers with an end-to-end solution

for frac sand supported by its Wisconsin and Peace River mines and

processing facilities, its Western Canadian terminal network and

its “last mile” logistics capabilities, including its trucking

operations, and Sahara, a proprietary well site mobile sand storage

and handling system.

Source’s full-service approach allows customers

to rely on its logistics platform to increase reliability of supply

and to ensure the timely delivery of frac sand and other bulk

completion materials at the well site.

ABOUT SILVER POINT

Silver Point is a leading global credit

investing firm founded in 2002. With a dedicated team of more than

320 employees, Silver Point oversees $37 billion in investable

assets across a comprehensive credit platform that includes public

and private investment strategies. Silver Point's Direct Lending

business has delivered customized financing solutions to

middle-market companies across a broad range of industries. It

works in close partnership with borrowers, developing a thorough

understanding of their businesses and addressing a wide variety of

capital needs with speed and certainty. Silver Point's flexible

mandate allows clients to execute on M&A activity, refinancings

and growth capital, among a range of transaction types. Along with

its affiliates, Silver Point's Direct Lending business manages over

$15 billion in investable capital. For more information, please

visit www.silverpointcapital.com.

ABOUT CIBC

CIBC is a leading North American financial

institution with 14 million personal banking, business, public

sector and institutional clients. Across Personal and Business

Banking, Commercial Banking and Wealth Management, and Capital

Markets, CIBC offers a full range of advice, solutions and services

through its leading digital banking network, and locations

across Canada, in the United States and around the

world. Ongoing news releases and more information about CIBC can be

found

at https://www.cibc.com/en/about-cibc/media-centre.html.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press

release constitute forward-looking statements relating to, without

limitation, expectations, intentions, plans and beliefs, including

information as to the future events, results of operations and

Source’s future performance (both operational and financial) and

business prospects. In certain cases, forward-looking statements

can be identified by the use of words such as “expects”,

“believes”, “continues”, “focus”, “trend”, or variations of such

words and phrases, or state that certain actions, events or results

“may” or “will” be taken, occur or be achieved. Such

forward-looking statements reflect Source’s beliefs, estimates and

opinions regarding its future growth, results of operations, future

performance (both operational and financial), and business

prospects and opportunities at the time such statements are made,

and Source undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions or

circumstances should change unless required by applicable law.

Forward-looking statements are necessarily based upon a number of

estimates and assumptions made by Source that are inherently

subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Forward-looking

statements are not guarantees of future performance. In particular,

this press release contains forward-looking statements pertaining,

but not limited to: the Company’s ability to use the proceeds of

the Term Loan to redeem the Notes and repay the outstanding amounts

drawn on the current asset backed loan facility; the Company’s

ability to execute on its long-term growth strategies; the

Company’s ability to de-lever its business over time; and

expectations relating to the Redemption, including the terms and

conditions of such Redemption and the anticipated timing

thereof.

By their nature, forward-looking statements

involve numerous current assumptions, known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Source to differ materially from

those anticipated by Source and described in the forward-looking

statements.

With respect to the forward-looking statements

contained in this press release assumptions have been made

regarding, among other things: future oil, natural gas and

liquefied natural gas prices; future global economic and financial

conditions; future commodity prices, demand for oil and gas and the

product mix of such demand; levels of activity in the oil and gas

industry in the areas in which Source operates; future capital

expenditures to be made by Source; future sources of funding for

Source’s capital program; Source’s future debt levels; the impact

of competition on Source; and Source’s ability to obtain financing

on acceptable terms.

A number of factors, risks and uncertainties

could cause results to differ materially from those anticipated and

described herein including, among others: the effects of

competition and pricing pressures; risks inherent in key customer

dependence; effects of fluctuations in the price of proppants;

risks related to indebtedness and liquidity, including Source’s

leverage, restrictive covenants in Source’s debt instruments and

Source’s capital requirements; risks related to interest rate

fluctuations and foreign exchange rate fluctuations; changes in

general economic, financial, market and business conditions in the

markets in which Source operates; changes in the technologies used

to drill for and produce oil and natural gas; Source’s ability to

obtain, maintain and renew required permits, licenses and approvals

from regulatory authorities; the stringent requirements of and

potential changes to applicable legislation, regulations and

standards; the ability of Source to comply with unexpected costs of

government regulations; liabilities resulting from Source’s

operations; the results of litigation or regulatory proceedings

that may be brought by or against Source; the ability of Source to

successfully bid on new contracts and the loss of significant

contracts; uninsured and underinsured losses; risks related to the

transportation of Source’s products, including potential rail line

interruptions or a reduction in rail car availability; the

geographic and customer concentration of Source; the impact of

extreme weather patterns and natural disasters; the impact of

climate change risk; the ability of Source to retain and attract

qualified management and staff in the markets in which Source

operates; labour disputes and work stoppages and risks related to

employee health and safety; general risks associated with the oil

and natural gas industry, loss of markets, consumer and business

spending and borrowing trends; limited, unfavorable, or a lack of

access to capital markets; uncertainties inherent in estimating

quantities of mineral resources; sand processing problems;

implementation of recently issued accounting standards; the use and

suitability of Source’s accounting estimates and judgments; the

impact of information systems and cyber security breaches; the

impact of inflation on capital expenditures; and risks and

uncertainties related to pandemics such as COVID-19, including

changes in energy demand.

Although Source has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in the

forward-looking statements, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking statements

will materialize or prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. The forward-looking statements contained in this

press release are expressly qualified by this cautionary statement.

Readers should not place undue reliance on forward-looking

statements. These statements speak only as of the date of this

press release. Except as may be required by law, Source expressly

disclaims any intention or obligation to revise or update any

forward-looking statements or information whether as a result of

new information, future events or otherwise.

Any financial outlook and future-oriented

financial information contained in this press release regarding

prospective financial performance, financial position or cash flows

is based on assumptions about future events, including economic

conditions and proposed courses of action based on management’s

assessment of the relevant information that is currently available.

Projected operational information contains forward-looking

information and is based on a number of material assumptions and

factors, as are set out above. These projections may also be

considered to contain future oriented financial information or a

financial outlook. The actual results of Source’s operations for

any period will likely vary from the amounts set forth in these

projections and such variations may be material. Actual results

will vary from projected results. Readers are cautioned that any

such financial outlook and future-oriented financial information

contained herein should not be used for purposes other than those

for which it is disclosed herein. The forward-looking information

and statements contained in this document speak only as of the date

hereof and have been approved by the Company’s management as at the

date hereof. The Company does not assume any obligation to publicly

update or revise them to reflect new events or circumstances,

except as may be required pursuant to applicable laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Scott MelbournChief Executive Officer(403) 262-1312

investorrelations@sourceenergyservices.com

Derren NewellChief Financial Officer(403) 262-1312

investorrelations@sourceenergyservices.com

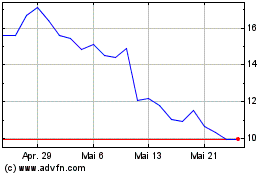

Source Energy Services (TSX:SHLE)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Source Energy Services (TSX:SHLE)

Historical Stock Chart

Von Feb 2024 bis Feb 2025