Brompton Announces Special Meeting of Brompton Oil Split Corp.

06 Oktober 2023 - 7:09PM

(TSX: OSP, OSP.PR.A) Brompton Funds Limited

(

“Brompton” or the

“Manager”),

announces that it will hold a special meeting (the

“

Meeting”) of holders of Class A Shares and

Preferred Shares (the “

Shareholders”) of Brompton

Oil Split Corp. (the

“Fund”). The purpose of the

Meeting is to consider and vote upon an extraordinary resolution to

implement amendments to update and modernize the investment

objectives and investment restrictions of the Fund among other

things (the

“Amendments”).

The Fund currently invests in a portfolio of

equity securities of large capitalization North American oil and

gas issuers, primarily focused on those with significant exposure

to oil. The Manager believes that the oil and gas industry

continues to be an attractive area for investment, however, the

number of companies that currently qualify for inclusion in the

Fund’s portfolio has decreased by approximately 25% since the

Fund’s initial public offering in February 2015 as a result of

consolidation within the industry and a decline in the number of

oil and gas issuers included in the S&P 500 Index and

S&P/TSX Composite Index. Given the changing business and

investment environment, oil and gas companies are seeking to

diversify their operations over the course of the next decade

beyond traditional oil and gas operations which may further limit

the investment opportunities that the Fund will have given its

current investment restrictions and guidelines.

The Manager proposes to expand the investment

universe of the Fund from oil and gas issuers listed in the S&P

500 Index and S&P/TSX Composite Index to a portfolio of equity

securities of dividend-paying global energy issuers, which may

include companies operating in energy subsectors and related

industries such as oil and gas exploration and production,

equipment, services, pipelines, transportation, infrastructure,

utilities, and renewables, among others. In addition, the Manager

proposes that the Fund be permitted to hold up to 25% of its total

assets in other global natural resource companies which include

companies that own, explore, mine, process or develop natural

resource commodities or supply goods and services to those

companies.

The Manager believes that the Amendments will

enhance the Fund’s long-term returns as well as provide the

following benefits:

(a) Expanded Investment Universe

– The Manager estimates that the Fund’s investable universe would

increase significantly to approximately three times larger than its

current universe.

(b) Increased Opportunity for Capital

Appreciation – An expanded investment universe will

provide additional opportunities to increase the value of the

Fund’s portfolio which in turn could result in a higher net asset

value for the Class A Shares and potentially result in the Fund

being able to make monthly cash distributions to the holders of

Class A Shares. Holders of Preferred Shares will also benefit from

the Amendments if there is an increase in the net asset value of

the Class A Shares which will provide greater asset coverage for

the Preferred Shares.

(c) Increased Opportunity for Call

Writing – The Fund is permitted to write covered call

options on the securities held in its portfolio, accordingly, by

expanding the Fund’s investment universe the Manager will have more

opportunities to write covered call options and potentially

generate additional returns for the Fund.

(d) Portfolio Diversification –

Diversifying the Fund’s portfolio holdings should reduce the

volatility of the Fund’s portfolio and mitigate the potential for

large declines in the net asset value per Class A Share.

In addition, the management fee payable

by the Fund will remain unchanged and will not be

increased.

As a result of the changes described above, the

Manager is also proposing to change the name of the Fund to

“Brompton Energy Split Corp.” and the ticker symbols in respect of

the Fund’s Class A Shares and Preferred Shares to ESP and ESP.PR.A,

respectively.

A special meeting of Shareholders will be held

on December 5, 2023 to consider and vote on the proposed

Amendments. Shareholders of record at the close of business on

November 3, 2023 will be entitled to vote at the Meeting. If

approved, the Manager expects to implement the Amendments as soon

as possible following the Meeting. Details of the proposed

Amendments will be further outlined in the Fund’s notice of meeting

and management information circular that will be prepared and

delivered to Shareholders in connection with the Meeting and will

be available on www.sedarplus.ca.

About Brompton FundsFounded in

2000, Brompton is an experienced investment fund manager with

income focused investment solutions including exchange-traded funds

(ETFs) and other TSX traded investment funds. For further

information, please contact your investment advisor, call

Brompton’s investor relations line at 416-642-6000 (toll-free at

1-866-642-6001), email info@bromptongroup.com or visit our website

at www.bromptongroup.com.

You will usually pay brokerage fees to your

dealer if you purchase or sell shares of an investment fund on the

Toronto Stock Exchange or other alternative Canadian trading system

(an “exchange”). If the shares are purchased or sold on an

exchange, investors may pay more than the current net asset value

when buying shares of an investment fund and may receive less than

the current net asset value when selling them.

There are ongoing fees and expenses associated

with owning shares of an investment fund. An investment fund must

prepare disclosure documents that contain key information about the

Fund. You can find more detailed information about the Fund in the

public filings available at www.sedarplus.ca. Investment funds are

not guaranteed, their values change frequently and past performance

may not be repeated.

Certain statements contained in this news

release constitute forward-looking information within the meaning

of Canadian securities laws. Forward-looking information may relate

to matters disclosed in this press release and to other matters

identified in public filings relating to the Fund, to the future

outlook of the Fund and anticipated events or results and may

include statements regarding the future financial performance of

the Fund. In some cases, forward-looking information can be

identified by terms such as “may”, “will”, “should”, “expect”,

“plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”,

“potential”, “continue” or other similar expressions concerning

matters that are not historical facts. Actual results may vary from

such forward-looking information. Investors should not place undue

reliance on forward-looking statements. These forward-looking

statements are made as of the date hereof and we assume no

obligation to update or revise them to reflect new events or

circumstances.

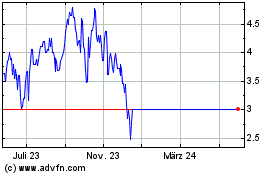

Brompton Oil Split (TSX:OSP)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Brompton Oil Split (TSX:OSP)

Historical Stock Chart

Von Dez 2023 bis Dez 2024