Five Major Residential Rental REITs launch ForAffordable.ca

14 November 2022 - 11:00PM

Canada’s five (5) largest residential rental real estate

investments trusts (REITs) announce the launch of ForAffordable.ca,

a new website from Canadian rental housing providers that sets out

the facts on how residential REITs operate in Canada’s rental

market, as well as their ideas for helping to solve Canada’s

housing supply and affordability crisis.

ForAffordable.ca has been developed by Canadian rental housing

providers for affordable housing, which is made up of Canada’s five

largest publicly traded residential rental REITs: Canadian

Apartment Properties REIT (CAPREIT), Boardwalk REIT, Killam

Apartment REIT, InterRent REIT and Minto Apartment REIT.

“Canada is experiencing the worst crisis of housing

affordability and supply in a generation. Put simply, there just

haven’t been enough new homes built to match the country’s

population growth. That is making housing less affordable for an

increasing number of Canadians,” said Mark Kenney, President and

CEO of CAPREIT. “Governments across Canada are looking for

solutions to this historic challenge, but some of the discussion

around solutions has been driven by misperceptions about how REITs

do business. ForAffordable.ca aims to make sure that policymakers’

search for workable solutions is informed by facts and

evidence.”

Canadian residential rental REITs deeply understand that housing

is first and foremost about people. They know that safe,

affordable, quality homes are the safe harbour of Canadian family

life in all of its diversity. Housing is the vital thread that

connects and enlivens the fabric of livable cities, towns, and

villages.

ForAffordable.ca sets out the facts about how Canadian rental

housing providers for affordable housing do business and how

they’re taxed, including:

- They are majority owned by Canadians including small investors’

retirement accounts

- Publicly-traded residential rental REITs represent

approximately 3% Canada’s rental market

- More than half of their 120,000 suites are rented at rates that

meet the government’s definition of affordable: less than 30% of

local median renter household income

- Rent increases over the last 10 years are in line with the

government’s target rate of inflation

- They do not do “renovictions”

- They invest heavily in their properties for the health and

safety of residents

- They attract investment to the affordable housing sector while

generating a similar level of tax revenue for governments compared

to corporations. Increasing taxes on residential rental REITs would

weaken the supply of affordable housing

- They are accountable for, and focused on, environmental, social

and governance (ESG) practices

As owners and managers of affordable rental units in Canada,

residential rental REITs also have insight into what is needed to

deliver the housing Canada needs and the homes Canadians want.

ForAffordable.ca lays out comprehensive proposals that these

providers have shared with governments, including:

- Securing more affordable housing for Canadians by helping

non-profits, cooperatives and community land trusts acquire

existing properties in a way that makes government affordable

housing dollars go further.

- More income support for Canadians by expanding the Canada

Housing Benefit to help more families and introduce an emergency

support benefit to prevent homelessness.

- Creating a national standard for land-use by aligning land use

policies with national housing, infrastructure and immigration

goals and investments.

- Maintaining the existing tax treatment of REITs to support

needed investment in housing.

ForAffordable.ca provides access to the group’s submission to

the House of Commons’ Standing Committee on Finance’s (FINA)

Pre-Budget Consultations as well as a Fall 2022 study by Ernst

& Young which demonstrates that changing the tax treatment of

REITs would disincentivize needed investment in residential supply,

put upward pressure on rents, and have a marginal — and possibly

negative — impact on government revenues.

Delivering the housing Canada needs and the homes Canadians want

requires a partnership between housing providers, governments, and

civil society to make needed policy changes and invest the

necessary capital. Learn more by visiting ForAffordable.ca.

For more information, please contact:

Boardwalk REITSam Kolias, Chairman and

CEOmediarelations@bwalk.com

Canadian Apartment Properties REIT Mark Kenney,

President & CEOmedia@capreit.net

InterRent REITMike McGahan, Executive

Chairinvestorinfo@interrentreit.com

Killam Apartment REITPhilip Fraser, President

& CEO investorrelations@killamreit.com

Minto Apartment REITMichael Waters, CEO

info@mintoapartmentreit.com

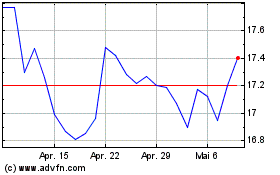

Killam Apartment REIT (TSX:KMP.UN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Killam Apartment REIT (TSX:KMP.UN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025