Killam Apartment REIT Announces Voting Results from 2019 Annual Meeting

22 Mai 2019 - 3:22PM

Killam Apartment REIT (TSX: KMP.UN) ("Killam") today announced the

voting results of matters voted on at its annual meeting of

unitholders (the "Meeting"), which was held in Moncton on May 17,

2019. The voting results of each of the matters considered at the

Meeting are presented below.

1) Election of TrusteesAll candidates proposed

in the Management Proxy Circular dated April 9, 2019, were elected

as trustees. The voting results of the trustees were as

follows:

|

Candidate |

Votes For |

% For |

Votes Withheld |

% Withheld |

|

Timothy R. Banks |

39,208,596 |

67.81% |

18,611,028 |

32.19% |

|

Philip D. Fraser |

56,336,322 |

97.43% |

1,483,302 |

2.57% |

|

Robert G. Kay |

50,746,898 |

87.77% |

7,072,726 |

12.23% |

|

Aldéa M. Landry |

56,428,931 |

97.59% |

1,390,693 |

2.41% |

|

James C. Lawley |

34,118,933 |

59.01% |

23,700,691 |

40.99% |

|

Arthur G. Lloyd |

51,803,647 |

89.60% |

6,015,977 |

10.40% |

|

Karine L. MacIndoe |

57,113,207 |

98.78% |

706,417 |

1.22% |

|

Robert G. Richardson |

50,671,318 |

87.64% |

7,148,306 |

12.36% |

|

Manfred J. Walt |

56,547,103 |

97.80% |

1,272,521 |

2.20% |

|

G. Wayne Watson |

50,277,981 |

86.96% |

7,541,643 |

13.04% |

2) Appointment of AuditorsErnst & Young LLP

was reappointed as the auditors of Killam, to hold office until the

next annual meeting of unitholders at remuneration to be fixed by

the board of trustees. The voting results for the reappointment of

the auditors were as follows:

|

Votes For |

% For |

Votes Withheld |

% Withheld |

|

56,623,165 |

97.93 |

% |

1,196,459 |

2.07 |

% |

3) Executive Compensation Advisory

VoteThe non-binding advisory say-on-pay resolution on

executive compensation was approved. The voting results for the

executive compensation advisory vote were as follows:

|

Votes For |

% For |

Votes Against |

% Against |

|

53,401,249 |

92.36 |

% |

4,418,375 |

7.64 |

% |

About Killam Apartment REIT

Killam Apartment REIT, based in Halifax, Nova

Scotia, is one of Canada's largest residential landlords, owning,

operating, managing and developing a $2.8 billion portfolio of

apartments and manufactured home communities. Killam’s strategy to

enhance value and profitability focuses on three priorities: 1)

increasing earnings from existing operations, 2) expanding the

portfolio and diversifying geographically through accretive

acquisitions, with an emphasis on newer properties, and 3)

developing high-quality properties in its core markets.

For information, please contact:

Nancy Alexander, CPA, CASenior Director,

Investor Relations & Performance

Analyticsnalexander@killamreit.com(902) 442-0374

Note: The Toronto Stock Exchange has neither

approved nor disapproved of the information contained

herein.

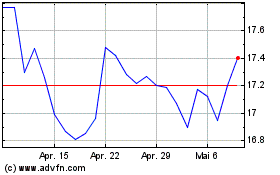

Killam Apartment REIT (TSX:KMP.UN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Killam Apartment REIT (TSX:KMP.UN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025