High Arctic Energy Services Inc. (TSX: HWO) "High Arctic" or the

"Corporation” has entered into an asset purchase agreement with

Precision Drilling Corporation (“Precision”) to sell High Arctic’s

Canadian well servicing business for an aggregate purchase price of

$38.2 million payable in cash (the “Well Servicing Transaction”).

Additionally, the Corporation has entered into an asset purchase

agreement with Team Snubbing Services Inc. (“Team”) to sell High

Arctic’s Canadian snubbing business for 42% of the post-closing

total outstanding shares in Team and a note receivable of $3.4

million (the “Snubbing Transaction”).

Both the Well Servicing Transaction and the

Snubbing Transaction retain working capital, are subject to

customary commercial closing conditions and are expected to close

before the end of July 2022.

Michael Binnion, Chairman of High Arctic,

commented, “After reflection on High Arctic’s core strength and

future opportunities, the Board made a strategic decision to divest

certain assets in Canada and focus on resurgent opportunities

associated with our existing business in Papua New Guinea (“PNG”).

PNG is a market where we have a dominant position, a history of

high profit margins and free cash flow generation, and where the

Corporation’s future fortunes are inextricably tied.

We take great pride in the development of our

Canadian well servicing and snubbing businesses. These

transactions, we believe, set our employees up for success as most

transition to a larger organization wherein their safety, service

acumen and operational skill set them up for career success.”

The Well Servicing Transaction

includes High Arctic’s Canadian Well Servicing fleet marketed under

the Concord Well Servicing brand comprising of 51 marketable rigs

and 29 inactive and out of service rigs, as well as oilfield rental

equipment associated with well servicing including 17 modern

hydraulic catwalks purchased in 2021. The transaction will result

in the transfer of High Arctic’s Well Servicing employees and a

large majority of support personnel to Precision.

The consideration includes $10.2 million payable

at closing and the remaining $28.0 million payable in January 2023,

with High Arctic expecting to retain approximately $3.0 million in

closing working capital. Title to four Alberta real estate

locations owned by the Corporation will transfer to Precision on

final payment, with High Arctic retaining owned Alberta properties

in Whitecourt and Clairmont. Precision will assume the lease

obligations for High Arctic’s properties in Cold Lake and

Acheson.

Mike Maguire, CEO of High Arctic, said,

“Consolidation in the well servicing market is necessary to realize

the scale and synergies to deliver profitability to shareholders.

This transaction delivers to Precision high quality assets and

people, and provides High Arctic with access to the capital tied up

in our business. We are pleased to have found in Precision’s Well

Servicing team, people who share a culture grounded in service

quality and believe there is no better place to vend in Concord

Well Servicing.”

Precision’s President and CEO, Kevin Neveu,

stated, “This acquisition significantly expands our well servicing

division with high quality rigs and field personnel, strategic

regional positioning, and alignment with key customers. High

Arctic’s people are well known for their focus on safety and field

execution and will complement Precision’s High Performance, High

Value operating strategy. The Transaction accomplishes needed

consolidation in the well servicing industry, providing greater

opportunities for our combined team, while bolstering service

capabilities for our customers. I am excited to welcome High Arctic

employees to the Precision family.”

Paradigm Capital Inc. is acting as exclusive

financial advisor to High Arctic in connection with the Well

Servicing Transaction.

The Snubbing Transaction

includes High Arctic’s Canadian Snubbing fleet comprising 7

marketable packages and 32 inactive and out of service snubbing

units, underbalance hoists and associated support equipment.

Commensurate with the Snubbing Transaction, High Arctic will

appoint two directors to the 5-person board of Team, and an

affiliate of Team will enter into a five-year lease of High

Arctic’s owned property in Clairmont, Alberta on current market

terms. The transaction will result in the transfer of High Arctic’s

snubbing employees to Team.

The Snubbing Transaction recognizes the

contributed High Arctic assets at $11.1 million. As part of the

consideration, High Arctic will receive a convertible promissory

note from Team for $3.4 million with a five-year term, interest

accruing at 4.5% from January 1, 2023 and principal repayments

commencing July of 2024. High Arctic will receive the remainder of

the consideration in the form of 420,000 common voting shares in

Team, representing 42% of the post-closing total outstanding shares

in Team.

Mike Maguire, CEO of High Arctic, said, “We are

thrilled to become a significant shareholder of Team Snubbing

Services Inc., a Canadian snubbing specialist on a rapid growth

trajectory. Ownership in Team retains for our shareholders an

exposure to the Canadian energy services sector, in a bespoke

service offering that realizes high margins overseen by skilled and

passionate management, while at the same time releasing our

management to focus efforts elsewhere.”

Mike Watts, CEO of Team, said, “We are genuinely

excited for the future of Team. The addition of the top-tier

snubbing assets of High Arctic will enable us to realize our

business plans for rapid expansion of operations in Canada and

abroad. Team management has been working diligently over the past

number of years to create a strong corporate and operational

foundation given the uncertain times in the Canadian energy

industry. This transaction has helped solidify management’s efforts

and adds an exciting portfolio to the Team group. Through this

transaction we get a strengthened balance sheet, board members with

vast experience and knowledge of the energy services industry and

capital markets, and employees who are as passionate about high

quality, reliable and safe snubbing practices as we are.”

Elimination of Production Services

Segment. Combined, the two transactions represent the

effective divestment of High Arctic’s Canadian Production Services

segment. Post-closing, High Arctic will retain in Canada its

Ancillary Services Segment comprised of the Nitrogen Pumping

business and a smaller Rentals business focused on pressure control

while keeping the HAES Rental Services branding. These Ancillary

Services businesses will be supported from our Whitecourt facility,

and a small corporate headquarters in Calgary.

The book value of the net assets transferring

under the Well Servicing Transaction is estimated to be $42.4

million and under the Snubbing Transaction are estimated to be

$11.1 million, at the respective closings. The minority interest in

Team will be reported as an investment on High Arctic’s balance

sheet, with the net movements in Team’s profit and loss recognized

to High Arctic’s income statement on a proportionate basis.

Mike Maguire, CEO of High Arctic, said, “The

divestment of High Arctic’s Canadian Production Services allows our

management to streamline the remaining Canadian business and focus

attention on the growth opportunities in PNG where we are excited

about the opportunities for our Drilling Services segment as the

next round of gas development projects materialize there.

The net proceeds of the Well Servicing

Transaction provides additional liquidity to the Corporation. The

timing of the second Well Servicing Transaction payment provides

the opportunity for management to evaluate the need and sources for

both working and growth capital in PNG. The Corporation has a

history of returning surplus cash to shareholders, and will

consider capacity to distribute funds to shareholders at that

time.

On behalf of High Arctic’s Board of Directors

and management I acknowledge all the employees affected by these

transactions and thank them for their dedicated service and their

commitment to operational excellence at High Arctic.”

DLA Piper (Canada) LLP is acting as legal

advisor to High Arctic on both transactions.

Forward-Looking Statements

This press release contains forward-looking

statements. When used in this document, the words “may”, “would”,

“could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “seek”,

“propose”, “estimate”, “expect”, and similar expressions are

intended to identify forward-looking statements. Such statements

reflect the Corporation’s current views with respect to future

events and are subject to certain risks, uncertainties and

assumptions. Many factors could cause the Corporation’s actual

results, performance or achievements to vary from those described

in this press release.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this press release as intended,

planned, anticipated, believed, estimated or expected. Specific

forward-looking statements in this press release include, but are

not limited to, statements pertaining to the following: the

expected benefits of the transactions; the expected closing date of

the transactions; the expected transfer of assets and employees;

the estimated book value of assets transferred; the expected impact

on financial reporting; the expected working capital at close of

the transactions, and the expected market developments and growth

in PNG.

The Corporation’s actual results could differ

materially from those anticipated in these forward-looking

statements as a result of the risk factors set forth above and

elsewhere in this press release.

The forward-looking statements contained in this

press release are expressly qualified in their entirety by this

cautionary statement. These statements are given only as of the

date of this press release. The Corporation does not assume any

obligation to update these forward-looking statements to reflect

new information, subsequent events or otherwise, except as required

by law.

About High Arctic

High Arctic is an energy services provider. High

Arctic is a market leader in Papua New Guinea providing drilling

and specialized well completion services and supplies rental

equipment including rig matting, camps, material handling and

drilling support equipment. In western Canada High Arctic provides

nitrogen services and pressure control equipment on a rental basis

to a number of exploration and production companies.

For further information, please contact:

Lance MierendorfChief Financial

Officer1.587.318.22181.800.668.7143

High Arctic Energy Services Inc.Suite 2350, 330–5th Avenue

SWCalgary, Alberta, Canada T2P 0L4website: www.haes.caEmail:

info@haes.ca

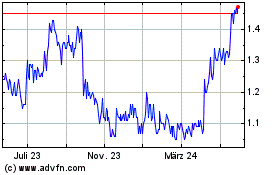

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

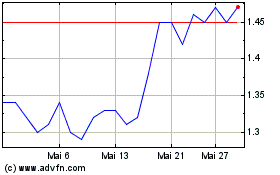

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025