High Arctic Announces Renewal of Normal Course Issuer Bid

13 Dezember 2021 - 1:54PM

High Arctic Energy Services Inc. (TSX: HWO) (“High Arctic” or the

“Corporation”) is pleased to announce that it has made the

necessary filings and received the necessary approvals to conduct a

normal course issuer bid (“NCIB”) through the facilities of the

Toronto Stock Exchange (“TSX”).

The TSX has accepted the Corporation’s notice to

conduct the NCIB to purchase outstanding common shares on the open

market, in accordance with the rules of the TSX. As approved by the

TSX, the Corporation is authorized to purchase up to 2,420,531

common shares, representing approximately 10% of the public float

for High Arctic. There were 48,733,145 common shares outstanding as

of December 1, 2021. The maximum number of common shares that High

Arctic may purchase on any given day is 12,719 common shares, which

represents 25% of the average daily trading volume of 50,878 common

shares on the TSX for the six-month period ended November 30, 2021.

High Arctic may also make one weekly block repurchase which exceeds

the daily limit subject to prescribed rules. All common shares

acquired under the NCIB will be cancelled.

The Corporation is authorized to make purchases

during the period from December 15, 2021 to December 14, 2022, or

until such earlier time as the NCIB is completed or terminated at

the option of the Corporation. Any common shares the Corporation

purchases under the NCIB will be purchased on the open market

through the facilities of the TSX or alternative Canadian markets,

at the prevailing market price at the time of the transaction. The

Corporation has appointed an independent brokerage agent to conduct

the NCIB transactions under an automatic purchase plan agreement

(“APPA”) dated December 13, 2021. The APPA will allow the broker to

purchase common shares under the bid during internal blackout

periods when the Corporation would normally not be permitted to

trade in its shares. Such purchases will be at the sole discretion

of the broker based on direction received from High Arctic prior to

any blackout period and in accordance with all regulatory and

securities law.

The Corporation believes that from time to time

the market price of the High Arctic common shares may not reflect

their underlying value and that, at such times, the purchase of

common shares for cancellation will increase the proportionate

interest of, and be advantageous to, all remaining shareholders. In

addition, the purchases by High Arctic under the NCIB may increase

liquidity to the Corporation’s shareholders wishing to sell their

common shares. The Corporation’s previous NCIB expired on December

10, 2021, and under that program, a total of 78,804 common shares

at a weighted average price of $1.29 per share have been

repurchased for cancellation.

About High Arctic

High Arctic’s principal focus is to provide

drilling and specialized well completion services, equipment

rentals and other services to the oil and gas industry. High Arctic

is a market leader providing drilling and specialized well

completion services and supplies rig matting, camps, and drilling

support equipment on a rental basis in Papua New Guinea. The

Western Canadian operation provides well servicing, well

abandonment, snubbing and nitrogen services and equipment on a

rental basis to a large number of oil and natural gas exploration

and production companies.

For further information contact:

Lance

Mierendorf Chief

Financial

Officer P:

+1 (587) 318 2218P: +1 (800) 688

7143 High

Arctic Energy Services Inc.Suite 500, 700 – 2nd Street S.W.Calgary,

Alberta, Canada T2P 2W1website: www.haes.caEmail: info@haes.ca

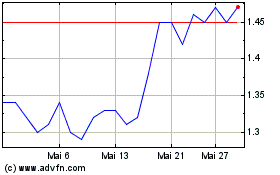

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

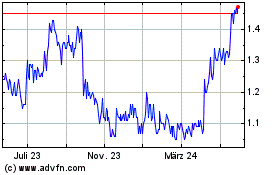

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025