Exchange Income Corporation Announces $100,000,000 Bought Deal Financing of 5.25% Convertible Unsecured Subordinated Debentures

16 November 2021 - 10:12PM

Exchange Income Corporation (TSX: EIF) (“EIC” or the “Corporation”)

announced today that it has reached an agreement with a syndicate

of underwriters co-led by National Bank Financial Inc. and CIBC

Capital Markets (the “Underwriters”), pursuant to which the

Corporation will issue on a bought deal basis, subject to

regulatory approval, $100,000,000 aggregate principal amount of

convertible unsecured subordinated debentures (the “Debentures”) at

a price of $1,000 per principal amount of Debentures (the

“Offering”). The Corporation has granted to the Underwriters an

over-allotment option to purchase up to an additional $15,000,000

aggregate principal amount of Debentures at the same price,

exercisable in whole or in part at any time for a period of up to

30 days following closing of the Offering, to cover

over-allotments.

The Debentures will bear interest from the date

of closing at 5.25% per annum, payable semi-annually in arrears on

January 15 and July 15 each year commencing July 15, 2022. The

Debentures will have a maturity date of January 15, 2029 (the

“Maturity Date”).

The Debentures will be convertible at the

holder’s option at any time prior to the close of business on the

earlier of the Maturity Date and the business day immediately

preceding the date specified by the Corporation for redemption of

the Debentures into common shares of the Corporation (“Common

Shares”) at a conversion price of $60.00 per Common Share, being a

conversion rate of 16.6667 Common Shares for each $1,000

principal amount of Debentures, subject to adjustment as provided

in the indenture governing the Debentures.

The Corporation intends to use the net proceeds

of the Offering to repay indebtedness, including the Corporation’s

existing series of convertible debentures maturing December 31,

2022, which become redeemable as of December 31, 2021, and for

general corporate purposes.

Closing of the Offering is expected to occur on

or about December 6, 2021. The Offering is subject to normal

regulatory approvals, including approval of the Toronto Stock

Exchange of the listing of the Debentures and the Common Shares to

be issued upon conversion of the Debentures. The Debentures will be

offered in each of the provinces of Canada by way of a short form

prospectus, and by way of private placement in the United States to

Qualified Institutional Buyers pursuant to Rule 144A.

About Exchange Income

Corporation

Exchange Income Corporation is a diversified

acquisition-oriented company, focused in two sectors: aerospace

& aviation services and equipment, and manufacturing. The

Corporation uses a disciplined acquisition strategy to identify

already profitable, well-established companies that have strong

management teams, generate steady cash flow, operate in niche

markets and have opportunities for organic growth. For more

information on the Corporation, please visit

www.ExchangeIncomeCorp.ca. Additional information relating to the

Corporation, including all public filings, is available on SEDAR

(www.sedar.com).

Caution Concerning Forward-Looking

Statements

The statements contained in this news release

that are forward-looking are based on current expectations and are

subject to a number of uncertainties and risks, and actual results

may differ materially. These uncertainties and risks include, but

are not limited to, COVID-19 and pandemic related risks, the

dependence of the Corporation on the operations and assets

currently owned by it, the degree to which its subsidiaries are

leveraged, the fact that cash distributions are not guaranteed and

will fluctuate with the Corporation’s financial performance,

dilution, restrictions on potential future growth, the risk of

shareholder liability, competitive pressures (including price

competition), changes in market activity, the cyclicality of the

industries, seasonality of the businesses, poor weather conditions,

and foreign currency fluctuations, legal proceedings, commodity

prices and raw material exposure, dependence on key personnel, and

environmental, health and safety and other regulatory requirements.

Except as required by Canadian Securities Law, the Corporation does

not undertake to update any forward-looking statements; such

statements speak only as of the date made. Further information

about these and other risks and uncertainties can be found in the

disclosure documents filed by the Corporation with the securities

regulatory authorities, available at www.sedar.com.

| For further information, please contact: |

|

|

|

| Mike Pyle |

|

|

Pam Plaster |

| Chief Executive Officer |

|

|

Vice President, Investor Development |

| Exchange Income Corporation |

|

|

Exchange Income Corporation |

| (204) 982-1850 |

|

|

(204) 953-1314 |

| MPyle@eig.ca |

|

|

pplaster@eig.ca |

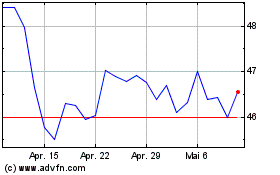

Exchange Income (TSX:EIF)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

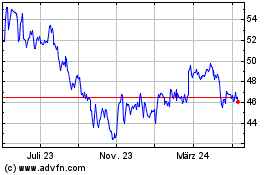

Exchange Income (TSX:EIF)

Historical Stock Chart

Von Jan 2024 bis Jan 2025