Cameco (TSX: CCO; NYSE: CCJ) today reported its consolidated

financial and operating results for the first quarter ended March

31, 2022 in accordance with International Financial Reporting

Standards (IFRS).

“With the recent uranium price increase, we are beginning to

enjoy the benefits of the strategic and deliberate decisions we

have made. And, with leverage to rising prices, we are

well-positioned to continue to capture value from the market

transition we believe is underway, and that is supported by the

fundamentals; fundamentals characterized by durable, full-cycle

demand against a backdrop of growing concerns about security of

supply,” said Tim Gitzel, Cameco’s president and CEO.

“Durable demand is being driven by the accountability for

achieving net-zero carbon targets, while balancing the need for

affordable, reliable and secure baseload electricity, all while

diversifying away from reliance on Russian energy supplies.

Governments and policy makers are increasingly recognizing the role

that nuclear plays in achieving those objectives. It is why, since

the start of 2022, we have seen announcements from countries like

the United States, the United Kingdom, France, South Korea and

Belgium focused on preserving and expanding the life of their

existing reactor fleets as well as on building new reactors. There

is also momentum building for non-traditional commercial uses of

nuclear power around the world such as development of small modular

reactors and advanced reactors, with numerous companies and

countries pursuing projects. We’re seeing countries and companies

turn to nuclear with an appetite that I’m not sure I’ve ever seen

in my four decades in this business.

“The supply side is quite a different picture. For some time now

we have said that we believed the uranium market was as vulnerable

to a supply shock as it has ever been due to persistently low

prices. The low prices and resulting lack of investment have put

productive capacity at risk and not just for uranium, but for

conversion and enrichment as well. We have seen the deepening of

geopolitical and origin risk as supply has become increasingly

concentrated. With Russia’s invasion of Ukraine, whether because of

sanctions or because of conflict with company values, the industry

now faces the challenge of disentangling its supply chain from

dependence on Russian nuclear fuel supplies. It is still early

days, but we are seeing what we believe is an unprecedented

geopolitical realignment occurring in the nuclear fuel cycle.

“With geopolitics complicating and potentially bottlenecking

nuclear fuel supplies, we are seeing not just utilities but some of

the intermediaries and service providers beginning to shift their

attention to securing material for their uncovered requirements,

and to derisk some of their origin dependencies. And we are seeing

the continued thinning of the spot market by physical uranium

investors. As a result, uranium prices have increased significantly

with the spot price up 38% and the long-term price up 15% since the

start of the year. The conversion spot price is up 65% and the

long-term price is up 25%.

“As the market continues to transition, we expect to continue to

place our uranium and conversion services under long-term contracts

and to meet rising demand with production from our best margin

operations. While we have not concluded any new contracts in 2022

beyond the 40 million pounds disclosed in our fourth quarter

MD&A, we have a significant pipeline of contract discussions

underway. However, we will continue to exercise strategic patience

in our contracting activity.

“We will also take a balanced and disciplined approach to our

supply decisions. Even though we have seen considerable pricing

pressure resulting from the geopolitical uncertainty, we will not

change our production plans. We will not front-run demand with

supply. As we announced in February, we are continuing with

indefinite supply discipline. Starting in 2024, with McArthur

River/Key Lake and Cigar Lake operating at less than licensed

capacity, we plan to be operating at about 40% below our productive

capacity (100% basis). This will remain our production plan until

we see further improvements in the uranium market and have made

further progress in securing the appropriate homes for our

unencumbered, in-ground inventory under long-term contracts, once

again demonstrating that we are a responsible supplier of uranium

fuel.

“Thanks to our deliberate actions and conservative financial

management we have been and continue to be resilient. Our strong

balance sheet, with $1.5 billion in cash and cash equivalents and

short-term investments, positions us well to self-manage risk,

including any global macro-economic or geopolitical uncertainty and

volatility that may arise.

“We are optimistic about Cameco’s role in capturing long-term

value across the fuel chain and supporting the transition to a

net-zero carbon economy. We have tier-one assets that are licensed,

permitted, long-lived, are proven reliable, and that have expansion

capacity. These tier-one assets are backed up by idle tier-two

assets and what we think is the best exploration portfolio that

leverages existing infrastructure. We are vertically integrated

across the nuclear fuel cycle. We have locked in significant value

for the fuel services segment of our business and we are exploring

opportunities to further our reach in the nuclear fuel cycle and in

innovative, non-traditional commercial uses of nuclear power in

Canada and around the world.

“We believe we have the right strategy to achieve our vision of

‘energizing a clean-air world’ and we will do so in a manner that

reflects our values. Embedded in all our decisions is a commitment

to addressing the environmental, social and governance risks and

opportunities that we believe will make our business sustainable

over the long term.”

- Net earnings of $40 million; adjusted net earnings of $17

million: first quarter results are driven by normal quarterly

variations in contract deliveries and the continued execution of

our strategy in a market that we believe is in the early stages of

transition. Adjusted net earnings is a non-IFRS measure, see

below.

- Strong performance in the uranium and fuel services

segments: First quarter results reflect the impact of increased

average realized prices in both the uranium and fuel services

segments. In our uranium segment we produced 1.9 million pounds

(our share) during the quarter and sold 5.9 million pounds at an

average realized price 34% higher than the same period last year.

In our fuel services segment average realized prices were 8% higher

than in the first quarter of 2021.

- Significant pipeline of contract discussions in strengthened

price environment: As we announced in February, in our uranium

segment, since the beginning of 2022, we had been successful in

adding 40 million pounds to our portfolio of long-term uranium

contracts. While we have not concluded any additional contracts in

2022, we continue to have a significant pipeline of contract

discussions underway. Origin risk is driving interest in securing

uranium supply as well as conversion services. We are being

strategically patient in our discussions to capture as much value

as possible in our contract portfolio. In addition to the

off-market contracting interest, there has been a re-emergence of

on-market requests for proposals from utilities looking to secure

their future requirements and reduce origin risk.

- Operational readiness for McArthur River/Key Lake is

on-track: During the first quarter, at the McArthur River mine

and Key Lake mill we focused on recruitment and training

activities. There are now approximately 600 employees and long-term

contractors employed at the mine and mill. When we resume

operations later this year, we expect to have approximately 850

employees and long-term contractors. In addition, we advanced the

work necessary to complete critical projects and the maintenance

readiness checks at both the mine and mill. We expensed the

operational readiness costs directly to cost of sales, which

totaled approximately $40 million during the quarter. We continue

to expect we could produce up to 5 million pounds (100% basis) this

year depending on our success in completing operational readiness

activities and managing the potential risks of the COVID-19

pandemic and related supply chain challenges.

- JV Inkai shipments: The geopolitical situation arising

as a result of the Russian invasion of Ukraine is creating

transportation risk in the region. Sanctions on Russia and

restrictions on and cancellations of some cargo insurance coverage

create uncertainty about the ability to ship uranium products from

Central Asia, potentially complicating the logistics for deliveries

from those areas, including JV Inkai’s final product. We are

working with Inkai and our joint venture partner, Kazatomprom, to

secure an alternate shipping route that doesn’t rely on Russian

rail lines or ports. In the meantime, we have decided to delay a

near-term delivery for our share of production from JV Inkai. In

the event that it takes longer than anticipated to secure an

alternate shipping route, we could experience further delays in our

expected Inkai deliveries this year. To mitigate the risk, we have

inventory, long-term purchase agreements and loan arrangements in

place that we can draw on. See Uranium 2022 Q1 updates in our first

quarter MD&A for more information.

- 2022 guidance updated: Our outlook has been amended to

reflect the increases in uranium prices. See Outlook for 2022 in

our first quarter MD&A for more information.

- Strong balance sheet: As of March 31, 2022, we had $1.5

billion in cash and cash equivalents and short-term investments and

$996 million in long-term debt. In addition, we have a $1 billion

undrawn credit facility.

- Received dividends from JV Inkai in April: On April 28,

we received dividend payments from JV Inkai totaling $83 million

(US). JV Inkai distributes excess cash, net of working capital

requirements, to the partners as dividends.

Consolidated financial results

THREE MONTHS

HIGHLIGHTS

ENDED MARCH 31

($ MILLIONS EXCEPT WHERE INDICATED)

2022

2021

CHANGE

Revenue

398

290

37%

Gross profit (loss)

50

(40)

>100%

Net earnings (losses) attributable to

equity holders

40

(5)

>100%

$ per common share (basic)

0.10

(0.01)

>100%

$ per common share (diluted)

0.10

(0.01)

>100%

Adjusted net earnings (losses) (non-IFRS,

see below)

17

(29)

>100%

$ per common share (adjusted and

diluted)

0.04

(0.07)

>100%

Cash provided by operations (after working

capital changes)

172

45

>100%

The financial information presented for the three months ended

March 31, 2021 and March 31, 2022 is unaudited.

NET EARNINGS

The following table shows what contributed to the change in net

earnings and adjusted net earnings (non-IFRS measure, see below) in

the first quarter of 2022, compared to the same period in 2021.

THREE MONTHS

ENDED MARCH 31

($ MILLIONS)

IFRS

ADJUSTED

Net losses – 2021

(5)

(29)

Change in gross profit by segment

(We calculate gross profit by deducting

from revenue the cost of products and services sold, and

depreciation and amortization (D&A))

Uranium

Higher sales volume

(11)

(11)

Higher realized prices ($US)

82

82

Lower costs

17

17

Change – uranium

88

88

Fuel services

Lower sales volume

(4)

(4)

Higher realized prices ($Cdn)

5

5

Higher costs

(2)

(2)

Change – fuel services

(1)

(1)

Other changes

Higher administration expenditures

(47)

(47)

Higher exploration expenditures

(2)

(2)

Change in reclamation provisions

(2)

1

Higher earnings from equity-accounted

investee

22

22

Change in gains or losses on

derivatives

1

(1)

Change in foreign exchange gains or

losses

(4)

(4)

Canadian Emergency Wage Subsidy in

2021

(12)

(12)

Change in income tax recovery or

expense

(1)

(1)

Other

3

3

Net earnings – 2022

40

17

Non-IFRS measures

ADJUSTED NET EARNINGS

Adjusted net earnings (ANE) is a measure that does not have a

standardized meaning or a consistent basis of calculation under

IFRS (non-IFRS financial measure). We use this measure as a more

meaningful way to compare our financial performance from period to

period. Adjusted net earnings is our net earnings attributable to

equity holders, adjusted to better reflect the underlying financial

performance for the reporting period. We believe that, in addition

to conventional measures prepared in accordance with IFRS, certain

investors use this information to evaluate our performance.

Adjusted net earnings is one of the targets that we measure to form

the basis for a portion of annual employee and executive

compensation (see Measuring our results in our 2021 annual

MD&A).

In calculating ANE we adjust for derivatives. We do not use

hedge accounting under IFRS and, therefore, we are required to

report gains and losses on all hedging activity, both for contracts

that close in the period and those that remain outstanding at the

end of the period. For the contracts that remain outstanding, we

must treat them as though they were settled at the end of the

reporting period (mark-to-market). However, we do not believe the

gains and losses that we are required to report under IFRS

appropriately reflect the intent of our hedging activities, so we

make adjustments in calculating our ANE to better reflect the

impact of our hedging program in the applicable reporting period.

See Foreign exchange in our 2021 annual MD&A for more

information.

We also adjust for changes to our reclamation provisions that

flow directly through earnings. Every quarter we are required to

update the reclamation provisions for all operations based on new

cash flow estimates, discount and inflation rates. This normally

results in an adjustment to an asset retirement obligation asset in

addition to the provision balance. When the assets of an operation

have been written off due to an impairment, as is the case with our

Rabbit Lake and US ISR operations, the adjustment is recorded

directly to the statement of earnings as “other operating expense

(income)”. See note 8 of our interim financial statements for more

information. This amount has been excluded from our ANE

measure.

Adjusted net earnings is a non-IFRS financial measure and should

not be considered in isolation or as a substitute for financial

information prepared according to accounting standards. Other

companies may calculate this measure differently, so you may not be

able to make a direct comparison to similar measures presented by

other companies.

The following table reconciles adjusted net earnings with net

earnings for the first quarter and compares it to the same period

in 2021.

THREE MONTHS

ENDED MARCH 31

($ MILLIONS)

2022

2021

Net earnings (losses) attributable to

equity holders

40

(5)

Adjustments

Adjustments on derivatives

(11)

(9)

Adjustments to other operating income

(19)

(22)

Income taxes on adjustments

7

7

Adjusted net earnings (losses)

17

(29)

Selected segmented highlights

THREE MONTHS

ENDED MARCH 31

HIGHLIGHTS

2022

2021

CHANGE

Uranium

Production volume (million lbs)

1.9

-

>100%

Sales volume (million lbs)

5.9

5.0

18%

Average realized price1

($US/lb)

43.24

32.25

34%

($Cdn/lb)

55.05

41.05

34%

Revenue ($ millions)

322

205

57%

Gross profit (loss) ($ millions)

24

(64)

>100%

Fuel services

Production volume (million kgU)

4.1

4.0

2%

Sales volume (million kgU)

2.2

2.6

(15)%

Average realized price 2

($Cdn/kgU)

34.49

31.91

8%

Revenue ($ millions)

76

84

(10)%

Gross profit ($ millions)

26

27

(4)%

1

Uranium average realized price is

calculated as the revenue from sales of uranium concentrate,

transportation and storage fees divided by the volume of uranium

concentrates sold.

2

Fuel services average realized

price is calculated as revenue from the sale of conversion and

fabrication services, including fuel bundles and reactor

components, transportation and storage fees divided by the volumes

sold.

Management's discussion and analysis (MD&A) and financial

statements

The first quarter MD&A and unaudited condensed consolidated

interim financial statements provide a detailed explanation of our

operating results for the three months ended March 31, 2022, as

compared to the same period last year. This news release should be

read in conjunction with these documents, as well as our audited

consolidated financial statements and notes for the year ended

December 31, 2021, and annual MD&A, and our most recent annual

information form, all of which are available on our website at

cameco.com, on SEDAR at sedar.com, and on EDGAR at

sec.gov/edgar.shtml.

Qualified persons

The technical and scientific information discussed in this

document for our material properties McArthur River/Key Lake, Cigar

Lake and Inkai was approved by the following individuals who are

qualified persons for the purposes of NI 43-101:

MCARTHUR RIVER/KEY LAKE

- Greg Murdock, general manager, McArthur River/Key Lake,

Cameco

CIGAR LAKE

- Lloyd Rowson, general manager, Cigar Lake, Cameco

INKAI

- Sergey Ivanov, deputy director general, technical services,

Cameco Kazakhstan LLP

Caution about forward-looking information

This news release includes statements and information about our

expectations for the future, which we refer to as forward-looking

information. Forward-looking information is based on our current

views, which can change significantly, and actual results and

events may be significantly different from what we currently

expect.

Examples of forward-looking information in this news release

include: our views that we have leverage to rising prices and are

well-positioned to continue to capture value from the market

transition we believe is underway; our view that uranium

fundamentals are characterized by durable, full-cycle demand

against a backdrop of growing concerns about security of supply;

our view that governments and policy makers are increasingly

recognizing the role that nuclear plays in achieving net-zero

carbon targets and other objectives; our view that there is

momentum building for non-traditional commercial uses of nuclear

power around the world; our belief that the uranium market is

vulnerable to a supply shock; our belief that we are seeing an

unprecedented geopolitical realignment occurring in the nuclear

fuel cycle; our belief that we are seeing utilities and some

intermediaries and service providers beginning to shift their

attention to securing material for their uncovered requirements;

our expectation to continue to place our uranium under long-term

contracts and to meet rising demand with production from our best

margin operations; our continuing commitment to our supply

discipline strategy; our plan, starting in 2024, to be operating at

about 40% below our productive capacity (100% basis); our intention

to maintain our announced production plan pending further

improvements in the uranium market and progress in our long-term

contracting; our anticipation that we will continue to be

resilient; our views regarding our balance sheet and ability to

self-manage risk; our optimism about Cameco’s ability to capture

long-term value across the fuel chain and support the transition to

a net-zero carbon economy; the reliability and expansion capacity

of our tier-one assets and quality of our exploration portfolio;

our efforts to further our reach into the nuclear fuel cycle and

innovative uses of nuclear power; our commitment to addressing

environmental, social and governance risks and opportunities that

we believe will make our business sustainable; our belief that we

are in early stages of a market transition; our view that we have a

significant pipeline of contract discussions in a strengthened

price environment; our view that operational readiness for McArthur

River/Key Lake is on track; our expectation that in 2022 we could

produce up to 5 million pounds (100% basis) of uranium at McArthur

River/Key Lake; we have inventory, long-term purchase agreements

and loan arrangements in place that mitigate the risk of delay of

Inkai deliveries in 2022; and the expected date for announcement of

our 2022 second quarter results.

Material risks that could lead to different results include:

unexpected changes in uranium supply, demand, long-term

contracting, and prices; changes in consumer demand for nuclear

power and uranium as a result of changing societal views and

objectives regarding nuclear power, electrification and

decarbonization; our expectations regarding the market fundamentals

and demand for nuclear power, geopolitical realignment in the

nuclear fuel cycle, and the shifting attention of utilities and

some intermediaries and service providers may be incorrect; our

contract portfolio may not realize the expected benefits of rising

uranium prices or we may not be successful in our contracting

strategy; we may not have the expected degree of financial strength

and ability to self-manage risk; our tier-one assets may not have

the expected levels of reliability or expansion capacity; our

exploration portfolio may not have the expected quality; we may be

unsuccessful in furthering our reach in the nuclear fuel cycle, or

pursuing innovative uses of nuclear power, or capturing value from

a transition to a net-zero carbon economy; the risk that we may not

continue with our supply discipline strategy; the risk that we may

not be able to implement changes to future operating and production

levels for Cigar Lake and McArthur River/Key Lake to the planned

levels within the expected timeframes; the risk that we may not be

able to meet sales commitments for any reason; the risk that we may

not be able to continue to be resilient; the risks to our business

associated with the ongoing COVID-19 pandemic, related global

supply chain disruptions, global economic and political uncertainty

and volatility; the risk that we may not be able to implement our

business objectives in a manner consistent with our environmental,

social, governance and other values; the risk that the strategy we

are pursuing may prove unsuccessful, or that we may not be able to

execute it successfully; disruption or delay in the transportation

of our products, including our share of Inkai production; we fail

to mitigate the consequences of delay in delivery of our share of

Inkai production; and the risk that we may be delayed in announcing

our future financial results.

In presenting the forward-looking information, we have made

material assumptions which may prove incorrect about: uranium

demand, supply, consumption, long-term contracting, and prices;

growth in the demand for and global public acceptance of nuclear

energy; our production, purchases, sales, deliveries and costs; our

ability to expand into additional areas of the nuclear fuel cycle

and pursue innovative uses of nuclear power; our ability to address

ESG risks and opportunities successfully; plans to transport our

products succeed, including our share of Inkai production; our

ability to mitigate adverse consequences of delay in delivery of

our share of Inkai production; the market conditions and other

factors upon which we have based our future plans and forecasts;

the success of our plans and strategies, including planned

operating and production changes; the absence of new and adverse

government regulations, policies or decisions; that there will not

be any significant unanticipated adverse consequences to our

business of the ongoing COVID-19 pandemic, supply disruptions, and

economic or political uncertainty and volatility; and our ability

to announce future financial results when expected.

Please also review the discussion in our 2021 annual MD&A

and most recent annual information form for other material risks

that could cause actual results to differ significantly from our

current expectations, and other material assumptions we have made.

Forward-looking information is designed to help you understand

management’s current views of our near-term and longer-term

prospects, and it may not be appropriate for other purposes. We

will not necessarily update this information unless we are required

to by securities laws.

Conference call

We invite you to join our first quarter conference call on

Thursday, May 5, 2022 at 8:00 a.m. Eastern.

The call will be open to all investors and the media. To join

the call, please dial (800) 319-4610 (Canada and US) or (604)

638-5340. An operator will put your call through. The slides and a

live webcast of the conference call will be available from a link

at cameco.com. See the link on our home page on the day of the

call.

A recorded version of the proceedings will be available:

- on our website, cameco.com, shortly after the call

- on post view until midnight, Eastern, June 5, 2022, by calling

(800) 319-6413 (Canada and US) or (604) 638-9010 (Passcode

8606)

2022 second quarter report release date

We plan to announce our 2022 second quarter results before

markets open on July 27, 2022.

Profile

Cameco is one of the largest global providers of the uranium

fuel needed to energize a clean-air world. Our competitive position

is based on our controlling ownership of the world’s largest

high-grade reserves and low-cost operations. Utilities around the

world rely on our nuclear fuel products to generate power in safe,

reliable, carbon-free nuclear reactors. Our shares trade on the

Toronto and New York stock exchanges. Our head office is in

Saskatoon, Saskatchewan.

As used in this news release, the terms we, us, our, the Company

and Cameco mean Cameco Corporation and its subsidiaries unless

otherwise indicated.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220504006226/en/

Investor inquiries: Rachelle Girard 306-956-6403

rachelle_girard@cameco.com

Media inquiries: Jeff Hryhoriw 306-385-5221

jeff_hryhoriw@cameco.com

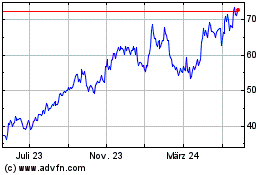

Cameco (TSX:CCO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

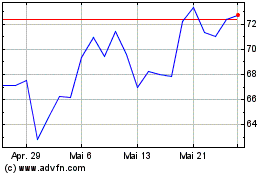

Cameco (TSX:CCO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025