Argonaut Gold Inc. (TSX: AR) (the “Company”, “Argonaut Gold” or

“Argonaut”) is pleased to announce that the Board of Directors has

approved the construction of the Company’s 100%-owned Magino gold

project in Ontario, Canada. Argonaut is also pleased to announce it

has received a fixed bid pricing proposal for a significant portion

of the initial capital requirement for the Magino project and that

it has secured debt financing of up to US$175 million by way of a

US$50 million bought deal offering of senior unsecured convertible

debentures and the extension and expansion of its existing

revolving credit facility (“RCF”) for up to US$125 million.

Magino Construction Approval

and Financing PlanManagement recommended and the

Board of Directors has approved the construction of the Magino

project. Argonaut anticipates a two year construction

period commencing in January 2021 following the closure plan

filing and posting of a financial assurance bond with the province

of Ontario. The first gold pour is anticipated during the first

half of 2023. In the Magino Feasibility Study Technical Report

filed December 2017 (“Magino FS”), initial capital was estimated at

US$321 million and has recently been estimated at between US$360

million and US$380 million, including contingency and inflation.

Therefore, the Company has provided an allowance in its total

financing plan in excess of US$400 million. Funding announced today

is expected to more than fully satisfy such financing requirements

including the following financial sources:

|

Sources |

US$ |

|

Unaudited cash balance at September 30, 2020 |

$178M |

|

Senior unsecured convertible debentures¹ |

$50M |

|

Ana Paula sale² |

$30M |

|

Cash flow from existing producing mines through 2022³ |

$142M+ |

|

Total |

$400M+ |

¹Excludes potential over-allotment, if any.²See

press release dated September 11, 2020, sale is subject to the

conditions described therein.³Assumes a gold price of at or above

US$1,600 per ounce.

The Company anticipates that these sources will

provide in excess of US$400 million through 2022, assuming a gold

price at or above US$1,600 per ounce. Therefore, the Company will

allow its extended and expanded corporate RCF of up to US$125

million to act as a backstop to the financing plan. The Company,

with assistance from its financial advisor, Endeavour Financial,

evaluated a number of funding options to finance the Magino

project. After reviewing the available alternatives, the Company

chose to pursue the corporate RCF and convertible package as

it:

- Provides a very attractive, low

cost of capital;

- Provides balance sheet

flexibility;

- Does not require gold hedging;

- Provides corporate flexibility;

and

- Ensures operating flexibility to

pursue future Magino expansion opportunities and/or advance other

projects in parallel.

The timing of capital spend for the construction

is expected to be approximately as follows:

- 2020 – 10% (primarily securing long

lead time items and posting financial assurance with the province

of Ontario)

- 2021 – 40%

- 2022 – 40%

- 2023 – 10%

Fixed Bid Pricing

ProposalThe Company has recently received a fixed

bid pricing proposal that covers approximately 50% of the recent

initial capital estimate of between US$360 million and US$380

million. Argonaut is currently reviewing the fixed bid pricing

proposal and, if satisfactory terms can be met, anticipates

entering into a negotiated contract before the commencement of

construction in January 2021.

Bought Deal Offering of Senior Unsecured

Convertible DebenturesThe Company also announces today

that it has entered into an agreement with BMO Capital Markets and

Scotiabank (the “Underwriters”), under which the Underwriters have

agreed to buy on a bought deal basis US$50 million of senior

unsecured convertible debentures (the “Debentures”) at a price of

US$1,000 per debenture (the “Offering”). The Company has granted

the Underwriters an option, exercisable at the offering price for a

period of 30 days following the closing of the Offering, to

purchase up to an additional 15% of the Offering to cover

over-allotments, if any. The Offering is expected to close on or

about October 30, 2020 and is subject to Argonaut Gold receiving

approval of the Toronto Stock Exchange and all necessary regulatory

approvals.

The Debentures will mature on November 30, 2025

(the “Maturity Date”) and will bear interest at an annual rate of

4.625% payable semi-annually in arrears on May 31 and November 30

of each year, commencing on May 31, 2021. At the holder’s option,

the Debentures may be converted into common shares of the Company

(“Common Shares”) at any time prior to the close of business on the

earlier of the last business day immediately preceding the Maturity

Date and the date fixed for redemption at a conversion rate

of 350.1155 per US$1,000 principal amount of Debentures

(equal to a Conversion Price of approximately US$2.86 per Common

Share, subject to adjustment in certain circumstances in accordance

with the trust indenture governing the Debentures.

The Debentures will not be redeemable before

November 30, 2023. On or after November 30, 2023, the Debentures

may be redeemed in whole or in part from time to time at the option

of the Company at par plus accrued and unpaid interest, if any, to

but excluding the date of redemption, provided that the volume

weighted average trading price of the Common Shares on the TSX

converted daily into U.S. dollars at the Bank of Canada single rate

of exchange for such date, and such U.S. dollar prices averaged for

the 20 consecutive trading days ending five trading days preceding

the date on which the notice of redemption is given is not less

than 125% of the Conversion Price. Argonaut intends to use the net

proceeds of the Offering for the advancement of the Company’s

Magino project and for general corporate purposes.

The Debentures to be issued under the Offering

will be offered by way of a short-form prospectus in each of the

provinces of Canada, excluding Quebec, and may be offered in the

United States on a private placement basis pursuant to an exemption

from the registration requirements of the United States Securities

Act of 1933, as amended (the “U.S. Securities Act”), and certain

other jurisdictions.

This press release does not constitute an offer

of securities for sale in the United States. The securities have

not been and will not be registered under the U.S. Securities Act,

and may not be offered or sold in the United States or to a U.S.

person (as defined in Regulation S under the U.S. Securities Act)

absent registration or an application exemption from the

registration requirements of the U.S. Securities Act.

Corporate Revolving Credit

FacilityThe Company has received commitments to extend and

expand its existing RCF with the Bank of Montreal and Bank of Nova

Scotia to US$100 million, with an accordion feature of US$25

million. The RCF has a three-year term and bears a sliding scale

interest rate of LIBOR plus 2.25% to 3.50%. Standby fees for the

undrawn portion of the RCF are also on a similar sliding scale

basis between 0.56% and 0.79%. The RCF is subject to commitment

reductions in the final six months of the term as show below:

|

|

Accordion + Commitment |

|

|

|

US$ |

|

|

Initial |

$125M |

|

|

30-Apr-23 |

$115M |

|

|

31-May-23 |

$100M |

|

|

30-Jun-23 |

$85M |

|

|

31-Jul-23 |

$70M |

|

|

31-Aug-23 |

$55M |

|

Magino FS HighlightsThe Magino

FS demonstrated that the Magino project is a strategic, scalable,

long-life asset in the attractive mining jurisdiction of Ontario,

Canada. Highlights from the Magino FS include:

- A 10,000 tonne per day processing

facility;

- Average annual gold production of

150,000 ounces over the first five years;

- A 17-year mine life;

- Cash cost of US$669 per ounce

sold*; and

- All-in sustaining cost of US$711

per gold ounce sold*.

*See Non-IFRS Measures Section

For further information on the Magino project,

please see the report as listed below on the Company’s website or

on www.sedar.com:

|

Magino Gold Project |

Feasibility Study Technical Report on the Magino Project, Ontario,

Canada dated December 21, 2017 (effective date November 8,

2017) |

Non-IFRS MeasuresThe Company

has included certain non-IFRS measures including “Cash cost per

gold ounce sold” and “All-in sustaining cost per gold ounce sold”

in this press release, which are presented in accordance with

International Financial Reporting Standards (“IFRS”). Cash cost per

gold ounce sold is equal to production costs divided by gold ounces

sold. All-in sustaining cost per gold ounce sold is equal to

production costs plus general and administrative expenses,

exploration expenses, accretion of reclamation provision and

sustaining capital expenditures divided by gold ounces sold. The

Company believes that these measures provide investors with an

improved ability to evaluate the performance of the Company.

Non-IFRS measures do not have any standardized meaning prescribed

under IFRS. Therefore they may not be comparable to similar

measures employed by other companies. The data is intended to

provide additional information and should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with IFRS. Please see the most recent management's

discussion and analysis for full disclosure on non-IFRS

measures.

Cautionary Note Regarding

Forward-looking StatementsThis press release contains

certain “forward-looking statements” and “forward-looking

information” under applicable Canadian securities laws concerning

the proposed transaction and the business, operations and financial

performance and condition of Argonaut Gold Inc. (“Argonaut” or

“Argonaut Gold”). Forward-looking statements and forward-looking

information include, but are not limited to, uncertainties related

successful approval and completion of the transactions described

therein; commodity price volatility; uncertainty of exploration and

development; uncertainty in the estimation of Mineral Reserves and

Mineral Resources; permitting risk; mineral and surface rights; the

benefits of the development potential of the properties of

Argonaut; the future price of gold, copper, and silver; the

realization of mineral reserve estimates; the timing and amount of

estimated future production; costs of production; success of

exploration activities; statements with respect to estimated

production and mine life of the various mineral projects of

Argonaut; and currency exchange rate fluctuations. Except for

statements of historical fact relating to Argonaut, certain

information contained herein constitutes forward-looking

statements. Forward-looking statements are frequently characterized

by words such as “plan,” “expect,” “project,” “intend,” “believe,”

“anticipate”, “estimate” and other similar words, or statements

that certain events or conditions “may” or “will” occur.

Forward-looking statements are based on the opinions and estimates

of management at the date the statements are made, and are based on

a number of assumptions and subject to a variety of risks and

uncertainties and other factors that could cause actual events or

results to differ materially from those projected in the

forward-looking statements. Many of these assumptions are based on

factors and events that are not within the control of Argonaut and

there is no assurance they will prove to be correct.

Factors that could cause actual results to vary

materially from results anticipated by such forward-looking

statements include changes in market conditions; the ability to

obtain regulatory approvals and the conditions therefor; the timing

and ability to successfully complete elements of the transaction,

including regulatory approvals; variations in ore grade or recovery

rates; fluctuating metal prices and currency exchange rates;

possible exposure to undisclosed risks of liabilities arising in

relation to recent transactions; changes in project parameters; the

possibility of project cost overruns or unanticipated costs and

expenses; risk relating to international operations; labour

disputes and other risks of the mining industry; failure of plant,

equipment or processes to operate as anticipated. Although Argonaut

has attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors

that cause actions, events or results not to be anticipated,

estimated or intended. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Argonaut undertakes no obligation

to update forward-looking statements if circumstances or

management’s estimates or opinions should change except as required

by applicable securities laws. The reader is cautioned not to place

undue reliance on forward-looking statements. Statements concerning

mineral reserve and resource estimates may also be deemed to

constitute forward-looking statements to the extent they involve

estimates of the mineralization that will be encountered if the

property is developed. Comparative market information is as of a

date prior to the date of this document.

About Argonaut

Gold

Argonaut Gold is a Canadian gold company engaged

in exploration, mine development and production. Its primary assets

are the El Castillo mine and San Agustin mine, which together form

the El Castillo Complex in Durango, Mexico, the La Colorada mine in

Sonora, Mexico and the Florida Canyon mine in Nevada, USA. Advanced

exploration projects include the Magino project in Ontario, Canada

and the Cerro del Gallo project in Guanajuato, Mexico. The Company

holds several other exploration stage projects, all of which are

located in North America.

For more information, contact:

Argonaut Gold Inc.Dan

SymonsVice President, Corporate Development & Investor

RelationsPhone:

416-915-3107Email: dan.symons@argonautgold.com

Source: Argonaut Gold Inc.

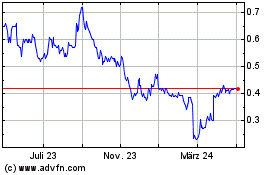

Argonaut Gold (TSX:AR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

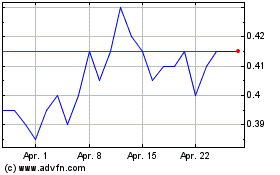

Argonaut Gold (TSX:AR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025