Altius Announces First Renewable Energy Royalty Transaction

07 Februar 2019 - 12:30PM

Business Wire

- US$30MM transaction with leading U.S. wind

energy developer -

Altius Minerals Corporation (“Altius”) (ALS:TSX, ATUSF:OTCQX) is

pleased to announce that its recently formed subsidiary, Altius

Renewable Royalties Corp. (“ARR”), has entered into a transaction

with Tri Global Energy, LLC (“TGE”), to gain future royalties

related to a portfolio of wind energy development projects.

Dallas-based Tri Global Energy is a leading developer of wind

energy in the U.S. TGE’s goal is to develop clean energy through

the development of wind energy projects. The company has pioneered

a unique way to generate local economic benefits through the

development of renewable energy projects by partnering with

landowners, communities and industry-leading investors. Its wind

energy projects are traditionally vended to various renewable

energy operating companies, which allows TGE to focus its expertise

on development initiatives. TGE is committing its current portfolio

of over 1,500 megawatts (MW) of development projects, which

excludes projects already vended, and any additional projects added

in the future, to this new royalty investment structure with

Altius, until a minimum total royalty portfolio valuation threshold

is achieved. The currently committed development portfolio includes

projects located in Texas, Nebraska and Illinois.

Transaction Terms

The US$30 million royalty investment into TGE will be invested

in tranches over approximately the next three years as TGE achieves

certain project advancement milestones, with an initial investment

upon closing of US$7.5 million.

As individual pipeline projects are developed, ARR will receive

a 3% gross revenue royalty on each project. This will continue

until a target minimum total royalty portfolio valuation threshold

is achieved. It is expected that this threshold would be met based

upon a portion of the total currently committed TGE development

pipeline reaching operational status. Once created, individual

royalties will apply during the full life of the respective

projects.

Using current assumptions concerning development timeframes,

output levels and realized power prices, the created ARR royalty

portfolio from this investment is estimated to generate US$3 - 4

million in new annual royalty revenues once the target threshold is

met and before factoring in any potential longer-term project

extensions, output expansions or power price changes.

Funding for the TGE transaction will be provided from Altius’

available cash on hand. Depending upon the scale of the overall

opportunity set that develops for ARR, Altius may also consider

adding additional future investment partners as either direct

subsidiary level participants or through the creation of limited

partnership structures.

Altius Renewable

Royalties

As part of its founding, ARR has acquired a private company,

Great Bay Renewables, Inc. (“GBR”), which holds a paying royalty on

the 4.7 MW Clyde River hydroelectric/solar facility located in

Vermont. Importantly, the GBR management will also continue as the

operational management team of ARR and lead the business of further

introducing the renewable energy royalty financing concept within

the U.S. and elsewhere. This management team, led by Frank Getman

(President and CEO), has a long and successful track record of

developing and operating small and large-scale renewable energy

projects.

In addition, ARR is pleased to take this opportunity to announce

that Mr. Earl Ludlow has been appointed as Chairman of the Board of

Directors, joining Mr. Getman and parent level appointees of Altius

Minerals Corporation that include its CEO and CFO. Earl retired at

the end of 2017 from Fortis Inc. which is a major international

electrical utility company. Earl held the position of Executive

Vice President at retirement following successive VP Operations

roles at Fortis subsidiaries Maritime Electric, Newfoundland Power

and Fortis Alberta and then CEO roles at subsidiaries Fortis

Properties and Newfoundland Power.

Brian Dalton, President and CEO of Altius, commented, “Altius

has now taken the creation of a royalty business based around

long-life renewable energy projects from concept to reality. This

is an important step in executing our strategy to ultimately

replace our Alberta electrical coal royalties, which are being

phased out by 2030 as a result of government policy changes.” He

then added, “Innovating this royalty product and forging a mutually

beneficial relationship with such a successful and highly regarded

renewable energy development partner like TGE is a great credit to

the new ARR team. The transaction also highlights to other sector

players that royalty-based financing and partnerships with ARR are

an attractive alternative for them as well.”

“The Tri Global Energy team is continuing its track record of

strong execution and strategic growth,” said John Billingsley,

Chairman and CEO of Tri Global Energy. “2018 also was one of our

best years for completing and initiating renewable energy

development projects. This transaction with Altius will accelerate

our development and allow us to extend our involvement in these

projects though their financial closings. This investment will help

power the company forward through 2021 and beyond. I believe the

time is right for innovative financing products like the renewable

royalty investment provided by Altius.”

More information on the transaction and ARR, including an

investor presentation, can be found at

http://www.altiusminerals.com/.

About Altius

Altius directly and indirectly holds diversified royalties and

streams which generate revenue from 15 operating mines. These

producing royalties are located in Canada and Brazil and provide

exposure to copper, zinc, nickel, cobalt, iron ore, potash, thermal

(electrical) and metallurgical coal. The portfolio also includes

development stage royalties in copper and renewable energy and

numerous predevelopment stage royalties covering a wide spectrum of

mineral commodities and jurisdictions. Altius also holds a large

portfolio of exploration stage projects which it has generated for

deal making with industry partners that results in newly created

royalties and equity and minority interests. Altius has 42,851,726

common shares issued and outstanding that are listed on Canada’s

Toronto Stock Exchange. It is a member of both the S&P/TSX

Small Cap and S&P/TSX Global Mining Indices.

About Tri Global Energy

TGE is a leading developer of wind energy in the U.S. The

company is based in Dallas, Texas. Founded in 2009, TGE’s goal

is to develop clean energy at an affordable cost through the

development of wind projects. The company develops and owns

utility-scale wind projects in Texas, Nebraska, Illinois and other

U.S. locations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190207005365/en/

For further information, please contact:Chad Wells

(cwells@altiusminerals.com) orFlora Wood

(fwood@altiusminerals.com) at 1.877.576.2209

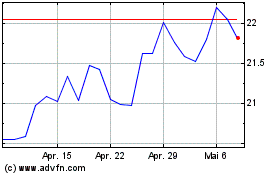

Altius Minerals (TSX:ALS)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

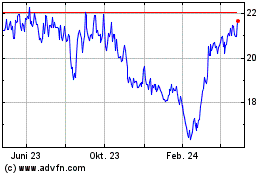

Altius Minerals (TSX:ALS)

Historical Stock Chart

Von Dez 2023 bis Dez 2024