High-level EBITDA margin and increase in third-quarter sales

despite a macroenvironment remaining challenging, notably in

Europe

Sales of €2.4 billion, up by 2.9%

year-on-year:

- Volumes up by 2.2% in an environment of global weak demand,

particularly in Europe, while supported by certain markets such as

energy, sports, healthcare and packaging

- Broadly stable price effect at a negative 0.2%, reflecting

dynamic management of selling prices in a raw materials environment

that has stabilized overall

EBITDA up by 5.4% to €407 million (€386

million in Q3'23), driven in particular by strong growth in

Adhesive Solutions and Advanced Materials, and better resilience in

the US and Asia

EBITDA margin up, reaching the high level of 17.0%

(16.6% in Q3'23), reflecting the quality of the Group's positioning

and technologies, its balanced geographical footprint, as well as

strict management of its operations

Adjusted net income down slightly to €168 million,

representing €2.25 per share (€2.38 in Q3'23)

Solid recurring cash flow of €190 million and

net debt tightly controlled at €3.1 billion

(including hybrid bonds), down from €3.3 billion at the end of June

and representing 2.0x last twelve-months EBITDA

2024 guidance: As the rebound of the macroeconomic

environment has not materialized yet, the Group is targeting for

2024 an EBITDA at the lower end of its guidance range of €1.53

billion.

Regulatory News:

Arkema (Paris:AKE):

Following Arkema’s Board of Directors’ meeting held on 5

November 2024 to review the Group’s consolidated financial

information for the third quarter of 2024, Chairman and CEO Thierry

Le Hénaff said:

“Arkema's Specialty Materials sales grew by 4% year-on-year

despite a third quarter marked by a challenging environment,

particularly in Europe. After an encouraging July, the end of the

quarter was marked by weaker demand. I would like to congratulate

our teams, whose efforts in this unfavorable environment have

enabled the Group to achieve a strong financial performance. In

particular, our EBITDA margin increased to reach 17%, showing our

resilience and validating our strategy of focusing on Specialty

Materials.

Over the coming months, we will be maintaining our efforts on

strict management of costs, capital expenditure and working

capital. We will also continue to progress on our major growth

projects in order to start 2025 in the best possible position. We

are also looking forward to welcoming Dow’s teams very soon,

following the closing of the acquisition of the flexible packaging

laminating adhesives business, expected by the end of the year, and

which will mark a new chapter in Bostik's growth in

high-performance adhesives.”

KEY FIGURES FOR THIRD-QUARTER 2024

in millions of euros

Q3'24 Q3'23 Change

Sales

2,394

2,326

+2.9% EBITDA

407

386

+5.4% Specialty Materials

377

346

+9.0% Intermediates

51

55

-7.3%

Corporate

-21

-15

EBITDA margin

17.0%

16.6%

Specialty Materials

17.2%

16.4%

Intermediates

26.7%

26.7%

Recurring operating income (REBIT)

246

246

-

REBIT margin

10.3%

10.6%

Adjusted net income

168

177

-5.1%

Adjusted net income per share (in €)

2.25

2.38

-5.5%

Recurring cash flow

190

312

Free cash flow

175

273

Net debt including hybrid bonds

3,111

2,419

€2,930m as of 31/12/2023

THIRD-QUARTER 2024 BUSINESS PERFORMANCE

At €2,394 million, Group sales were up by 2.9%

compared with third-quarter 2023, supported by Specialty Materials,

which benefited in particular from positive organic growth in Asia

and North America, while Europe was down, and from PIAM

integration. In a macroeconomic environment still challenging, with

no recovery in demand and marked by customer destocking at the end

of the quarter, Group volumes were nevertheless up 2.2% on last

year. Specialty Materials volumes increased by 3.8%, supported by

some more buoyant markets such as energy, sports, packaging and

healthcare, while construction is showing no signs of improvement

and the automotive sector is slowing down, notably in Europe.

Intermediates volumes were down by 12.1%, impacted by existing

quota mechanisms in refrigerant gases. The price effect remained

broadly stable (down 0.2%), with a slight decrease in Specialty

Materials (down 0.7%), in line with the overall raw materials’

evolution, offset by a positive dynamic in refrigerant gases. The

2.3% positive scope effect corresponds essentially to the

acquisition of PIAM in Advanced Materials. The currency effect was

a negative 1.4%, reflecting the depreciation of the US dollar and

Latin American currencies against the euro.

Group EBITDA was up 5.4% year-on-year to €407

million (€386 million in Q3'23). With an increase in each of

its three segments and particularly in Adhesive Solutions and

Advanced Materials, Specialty Materials EBITDA increased

significantly by 9.0%. Intermediates remained at a solid level,

although down on the prior year. EBITDA included the contribution

of major organic growth projects, which will continue to ramp up

over the coming quarters to serve attractive markets such as

sustainable consumer goods, green energy, mobility, sports and

efficient housing. The EBITDA margin was up 40 bps on last

year, at a very good level of 17.0% (16.6% in Q3'23),

reflecting, in this lackluster market environment, the quality of

the Group's positioning and technology portfolio, its balanced

geographical footprint as well as its strict management of

operations.

At €246 million, recurring operating income

(REBIT) was stable compared with third-quarter 2023, including €161

million in recurring depreciation and amortization, up €21 million

year-on-year, mainly reflecting the consolidation of PIAM and the

start-up of new production units for Advanced Materials. REBIT

margin in the third quarter of 2024 thus amounted to 10.3%

(10.6% in Q3’23).

Adjusted net income came to €168 million (€177

million in Q3’23), representing €2.25 per share, including a

tax rate, excluding exceptional items, of 22% of recurring

operating income.

CASH FLOW AND NET DEBT AT 30 SEPTEMBER 2024

Arkema delivered a solid recurring cash flow of €190

million. It was down compared with the prior year (€312 million

in Q3'23), reflecting a less significant change in working capital

and an increase in capital expenditure to €167 million (€137

million in Q3'23) corresponding to the implementation of major

projects. Working capital remained well controlled, representing

16.4% of annualized sales at end-September 2024 (16.3% at

end-September 2023). Over the full year, capital expenditure is

expected to come in at around €770 million, in line with full-year

guidance. After fine-tuning its analysis of potential future

capital expenditure, and taking into account a slower pace of

ramp-up of the electric vehicle market, the Group has adjusted the

envelop of capital expenditure that was announced at the Capital

Markets Day in September 2023, and now plans to spend between €650

million and €700 million a year.

At €175 million, free cash flow included a

non-recurring cash outflow of €15 million related notably to

start-up costs for the Singapore platform and restructuring

expenses.

Net debt (including hybrid bonds) remained tightly

controlled and decreased slightly over the quarter to €3,111

million (€3,270 million at end-June 2024), returning to the

level of 2x last twelve-months EBITDA.

THIRD-QUARTER 2024 PERFORMANCE BY SEGMENT

ADHESIVE SOLUTIONS (29% OF TOTAL GROUP SALES)

in millions of euros

Q3'24 Q3'23 Change

Sales

682

682

-

EBITDA

107

98

+9.2% EBITDA margin

15.7%

14.4%

Recurring operating income (REBIT)

86

77

+11.7% REBIT margin

12.6%

11.3%

Sales in the Adhesive Solutions segment were stable

year-on-year at €682 million. This was supported by a 1.9%

rise in volumes, reflecting notably a good dynamic in the packaging

and labelling markets, while the construction sector remained

challenging. At negative 1%, the price effect was limited and

reflected the lower price of certain raw materials. The positive

scope effect of 0.6% corresponds to the integration of Arc Building

Products, and the currency effect was a negative 1.5%.

At €107 million, EBITDA was up significantly by

9.2% compared with the previous year, and EBITDA margin

reached a record level at 15.7%, up 130 bps on third-quarter

2023. This very good performance confirms the relevance of the

segment's development strategy, which is based on product mix

improvement toward higher value-added solutions, targeted

high-quality acquisitions, active price and cost management as well

as operational excellence initiatives.

ADVANCED MATERIALS (37% OF TOTAL GROUP SALES)

in millions of euros

Q3'24 Q3'23 Change

Sales

885

856

+3.4% EBITDA

189

172

+9.9% EBITDA margin

21.4%

20.1%

Recurring operating income (REBIT)

95

100

-5.0%

REBIT margin

10.7%

11.7%

Sales in the Advanced Materials segment were up by 3.4%

compared with third-quarter 2023 to €885 million. The

segment’s volumes rose by 2.0%, supported by the sports, energy and

healthcare markets. However, they were negatively impacted by the

slowdown in the automotive sector, notably in Europe, and the

temporary shutdown of our German organic peroxides facility

following the exceptional flooding of the Danube in early June. The

price effect was a negative 2.3%, mainly reflecting changes in raw

material prices. The segment's sales also benefited from a positive

5.7% scope effect due to the contribution of PIAM, and the currency

was a negative 2.0%.

At €189 million, the segment's EBITDA rose sharply

by 9.9% year-on-year (€172 million in Q3'23). High Performance

Polymers EBITDA was up significantly, benefiting from the

contribution of new projects, the integration of PIAM and good

momentum in high value-added fluorospecialties. Performance

Additives EBITDA was down on the Q3’23 high comparison base and

included the negative impact of the temporary shutdown of the

organic peroxides facility in Germany, estimated at approximately

€8 million over the quarter. The EBITDA margin was

substantially up reaching a very good level at 21.4% (20.1%

in Q3’23).

COATING SOLUTIONS (26% OF TOTAL GROUP SALES)

in millions of euros

Q3'24 Q3'23 Change

Sales

627

572

+9.6% EBITDA

81

76

+6.6% EBITDA margin

12.9%

13.3%

Recurring operating income (REBIT)

49

43

+14.0% REBIT margin

7.8%

7.5%

Sales in the Coating Solutions segment were up by a sharp

9.6% compared with third-quarter 2023 to €627 million.

Compared with last year's baseline, which was marked by destocking,

volumes rose by 8.7% in an environment that remains relatively

challenging, particularly in the upstream, and were supported

mainly by the coatings, notably architectural, hygiene and water

treatment markets. At a positive 2.1%, the price effect mainly

reflected the impact of higher propylene prices in the United

States on acrylic monomer prices, and the currency effect was a

negative 1.2%.

At €81 million, the segment's EBITDA rose

substantially by 6.6% (€76 million in Q3'23), supported by positive

volume trends, strict management of costs and operations and the

ramp-up of Sartomer's organic project in China. In this

environment, the EBITDA margin held up well and stood at

12.9% (13.3% in Q3'23).

INTERMEDIATES (8% OF TOTAL GROUP SALES)

in millions of euros

Q3'24 Q3'23 Change

Sales

191

206

-7.3%

EBITDA

51

55

-7.3%

EBITDA margin

26.7%

26.7%

Recurring operating income (REBIT)

39

42

-7.1%

REBIT margin

20.4%

20.4%

Sales in the Intermediates segment totaled €191

million, down by 7.3% compared with third-quarter 2023. Volumes

were down 12.1%, impacted by the effect of existing quota

mechanisms in refrigerant gases, partly offset by higher acrylics

volumes in China. Prices rose by 4.8%, driven essentially by the

impact of quota mechanisms in refrigerant gases.

In this context, segment EBITDA came in at €51

million (€55 million in Q3’23) and the EBITDA margin

remained at a good level at 26.7% (26.7% in Q3’23).

HIGHLIGHTS

On 29 August 2024, Arkema announced several appointments to its

Executive Committee. Sophie Fouillat has been appointed as

Executive Vice President, Strategy, replacing Bernard Boyer who is

retiring. Tilo Quink has joined the Group to take up the role of

Senior Vice President, Performance Additives. Laurent Tellier, who

previously held this position, has been appointed Senior Vice

President High Performance Polymers and Fluorogases, replacing

Erwoan Pezron. Erwoan Pezron becomes advisor to the Chairman and

Chief Executive Officer, while remaining a member of the Executive

Committee until his retirement at the end of the year.

On 5 September 2024, Arkema successfully completed a €500

million senior bond issue with a 10-year maturity and an annual

coupon of 3.50%. This operation will enable the Group to continue

to refinance its upcoming bond maturities and extend the average

maturity of its debt.

On 30 October 2024, Arkema finalized a share capital increase

reserved for employees, for a total of close to 8,700 subscriptions

and a global amount of €61.8 million, thus demonstrating the strong

commitment of Group employees and their confidence in Arkema’s

development opportunities. The newly issued shares are fully

assimilated to the existing shares and will be entitled to the

dividend payment in 2025.

OUTLOOK FOR 2024

With a still lackluster macroeconomic environment expected for

the rest of the year, marked by limited visibility and a continued

weak demand environment, the Group will focus on strictly managing

its operating costs and optimizing its working capital in line with

demand. In parallel, work on the longer term will continue, with

the ongoing ramp-up of the organic projects, the closing of the

acquisition of Dow's flexible packaging laminating adhesives

business, as well as the first steps in the start-up of the

HFO-1233zd fluorospecialties unit in the United States.

In this context, based on the results of the first nine months,

Arkema expects to achieve in 2024 an EBITDA at the lower end of its

guidance range of €1.53 billion.

Finally, the Group will continue to implement its strategic

roadmap, leveraging its cutting-edge innovation, strengthening

partnerships with its customers, and deploying its portfolio of

technologies to support the development of solutions for a less

carbon-intensive and more sustainable world.

Further details concerning the Group's third-quarter 2024

results are provided in the "Third-quarter 2024 results and

outlook" presentation and the "Factsheet", both available on

Arkema's website at:

www.arkema.com/global/en/investor-relations/

FINANCIAL CALENDAR

27 February 2025: Publication of full-year results 7 May 2025:

Publication of first-quarter 2025 results

DISCLAIMER

The information disclosed in this press release may contain

forward-looking statements with respect to the financial position,

results of operations, business and strategy of Arkema.

In a context of significant geopolitical tensions, where the

outlook for the global economy remains uncertain, the retained

assumptions and forward-looking statements could ultimately prove

inaccurate.

Such statements are based on management's current views and

assumptions that could ultimately prove inaccurate and are subject

to risk factors such as (but not limited to) changes in raw

material prices, currency fluctuations, the pace at which

cost-reduction projects are implemented, escalating geopolitical

tensions, and changes in general economic and financial conditions.

Arkema does not assume any liability to update such forward-looking

statements whether as a result of any new information or any

unexpected event or otherwise. Further information on factors which

could affect Arkema's financial results is provided in the

documents filed with the French Autorité des marchés

financiers.

Balance sheet, income statement and cash flow statement data, as

well as data relating to the statement of changes in shareholders'

equity and information by segment included in this press release

are extracted from the consolidated financial information at 30

September 2024, as reviewed by Arkema's Board of Directors on 5

November 2024. Quarterly financial information is not audited.

Information by segment is presented in accordance with Arkema's

internal reporting system used by management.

Details of the main alternative performance indicators used by

the Group are provided in the tables appended to this press

release. For the purpose of analyzing its results and defining its

targets, the Group also uses EBITDA margin, which corresponds to

EBITDA expressed as a percentage of sales, EBITDA equaling

recurring operating income (REBIT) plus recurring depreciation and

amortization of tangible and intangible assets, as well as REBIT

margin, which corresponds to recurring operating income (REBIT)

expressed as a percentage of sales.

For the purpose of tracking changes in its results, and

particularly its sales figures, the Group analyzes the following

effects (unaudited analyses):

scope effect: the impact of changes in

the Group's scope of consolidation, which arise from acquisitions

and divestments of entire businesses or as a result of the

first-time consolidation or deconsolidation of entities. Increases

or reductions in capacity are not included in the scope effect;

currency effect: the mechanical impact

of consolidating accounts denominated in currencies other than the

euro at different exchange rates from one period to another. The

currency effect is calculated by applying the foreign exchange

rates of the prior period to the figures for the period under

review;

price effect: the impact of changes in

average selling prices is estimated by comparing the weighted

average net unit selling price of a range of related products in

the period under review with their weighted average net unit

selling price in the prior period, multiplied, in both cases, by

the volumes sold in the period under review; and

volume effect: the impact of changes

in volumes is estimated by comparing the quantities delivered in

the period under review with the quantities delivered in the prior

period, multiplied, in both cases, by the weighted average net unit

selling price in the prior period.

Building on its unique set of expertise in materials science,

Arkema offers a portfolio of first-class technologies to

address ever-growing demand for new and sustainable materials. With

the ambition to become a pure player in Specialty Materials, the

Group is structured into three complementary, resilient and highly

innovative segments dedicated to Specialty Materials – Adhesive

Solutions, Advanced Materials, and Coating Solutions – accounting

for some 92% of Group sales in 2023, and a well-positioned and

competitive Intermediates segment. Arkema offers cutting-edge

technological solutions to meet the challenges of, among other

things, new energies, access to water, recycling, urbanization and

mobility, and fosters a permanent dialogue with all its

stakeholders. The Group reported sales of around €9.5 billion in

2023, and operates in some 55 countries with 21,100 employees

worldwide.

ARKEMA financial

statements

Consolidated financial information at the

end of September 2024

Consolidated financial statements as end of December 2023 have

been audited.

CONSOLIDATED INCOME STATEMENT 3rd quarter 2024 3rd quarter 2023 (In millions of euros)

Sales

2,394

2,326

Operating expenses

(1,917)

(1,835)

Research and development expenses

(47)

(68)

Selling and administrative expenses

(222)

(209)

Other income and expenses

(24)

(32)

Operating income

184

182

Equity in income of affiliates

(2)

(2)

Financial result

(20)

(9)

Income taxes

(42)

(54)

Net income

120

117

Attributable to non-controlling interests

2

3

Net income - Group share

118

114

Earnings per share (amount in euros)

1.43

1.39

Diluted earnings per share (amount in euros)

1.42

1.37

End of September 2024

End of September 2023 (In

millions of euros)

Sales

7,271

7,292

Operating expenses

(5,755)

(5,757)

Research and development expenses

(184)

(204)

Selling and administrative expenses

(695)

(661)

Other income and expenses

(101)

(71)

Operating income

536

599

Equity in income of affiliates

(4)

(7)

Financial result

(53)

(44)

Income taxes

(130)

(146)

Net income

349

402

Attributable to non-controlling interests

7

4

Net income - Group share

342

398

Earnings per share (amount in euros)

4.36

5.12

Diluted earnings per share (amount in euros)

4.34

5.09

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

3rd quarter 2024

3rd

quarter 2023 (In millions of

euros)

Net income

120

117

Hedging adjustments

13

(13)

Other items

—

0

Deferred taxes on hedging adjustments and other items

(1)

0

Change in translation adjustments

(155)

109

Other recyclable comprehensive income

(143)

96

Impact of remeasuring unconsolidated investments

0

0

Actuarial gains and losses

(14)

26

Deferred taxes on actuarial gains and losses

3

(5)

Other non-recyclable comprehensive income

(11)

21

Total income and expenses recognized directly in equity

(154)

117

Total comprehensive income

(34)

234

Attributable to non-controlling interest

2

3

Total comprehensive income - Group share

(36)

231

End of September

2024 End of September

2023 (In millions of euros)

Net income

349

402

Hedging adjustments

10

(51)

Other items

0

0

Deferred taxes on hedging adjustments and other items

(1)

2

Change in translation adjustments

(84)

(34)

Other recyclable comprehensive income

(75)

(83)

Impact of remeasuring unconsolidated investments

(1)

0

Actuarial gains and losses

4

19

Deferred taxes on actuarial gains and losses

(1)

(4)

Other non-recyclable comprehensive income

2

15

Total income and expenses recognized directly in equity

(73)

(68)

Total comprehensive income

276

334

Attributable to non-controlling interest

(4)

2

Total comprehensive income - Group share

280

332

INFORMATION BY SEGMENT

3rd

quarter 2024 (In millions of

euros)

Adhesive Solutions Advanced Materials

Coating Solutions Intermediates Corporate

Total Sales

682

885

627

191

9

2,394

EBITDA

107

189

81

51

(21)

407

Recurring depreciation and amortization of property, plant and

equipment and intangible assets

(21)

(94)

(32)

(12)

(2)

(161)

Recurring operating income (REBIT)

86

95

49

39

(23)

246

Depreciation and amortization related to the revaluation of

property, plant and equipment and intangible assets as part of the

allocation of the purchase price of businesses

(28)

(8)

(2)

-

-

(38)

Other income and expenses

(9)

(13)

0

0

(2)

(24)

Operating income

49

0

74

47

39

(25)

184

Equity in income of affiliates

-

(2)

-

-

-

(2)

Intangible assets and property, plant, and equipment

additions

21

100

28

3

15

167

Of which: recurring capital expenditure

21

100

28

3

15

167

3rd quarter 2023

(In millions of euros)

Adhesive Solutions Advanced

Materials Coating Solutions Intermediates

Corporate Total Sales

682

856

572

206

10

2,326

EBITDA

98

172

76

55

(15)

386

Recurring depreciation and amortization of property, plant and

equipment and intangible assets

(21)

(72)

(33)

(13)

(1)

(140)

Recurring operating income (REBIT)

77

100

43

42

(16)

246

Depreciation and amortization related to the revaluation of

property, plant and equipment and intangible assets as part of the

allocation of the purchase price of businesses

(26)

(5)

(1)

0

-

-

(32)

Other income and expenses

(10)

(21)

0

0

(1)

0

(32)

Operating income

41

74

42

0

41

(16)

182

Equity in income of affiliates

-

(2)

-

0

-

-

(2)

Intangible assets and property, plant, and equipment

additions

15

93

23

0

7

4

142

Of which: recurring capital expenditure

15

88

23

0

7

4

137

INFORMATION BY SEGMENT

End of September 2024 (In

millions of euros)

Adhesive Solutions Advanced

Materials Coating Solutions Intermediates

Corporate Total Sales

2,068

2,681

1,890

603

29

7,271

EBITDA

321

541

247

174

(75)

1,208

Recurring depreciation and amortization of property, plant and

equipment and intangible assets

(65)

(263)

(93)

(32)

(5)

(458)

Recurring operating income (REBIT)

256

278

154

142

(80)

750

Depreciation and amortization related to the revaluation of

property, plant and equipment and intangible assets as part of the

allocation of the purchase price of businesses

(81)

(27)

(5)

-

-

(113)

Other income and expenses

(25)

(64)

0

(1)

(11)

(101)

Operating income

150

187

149

141

(91)

536

Equity in income of affiliates

-

(4)

-

-

-

(4)

Intangible assets and property, plant, and equipment

additions*

48

276

71

14

27

436

Of which: recurring capital expenditure*

48

276

71

14

27

0

436

*includes a correction related to Q1’24 data resulting from

a transfer of figures between Coating Solutions and Intermediates

End of September 2023

(In millions of euros)

Adhesive Solutions Advanced

Materials Coating Solutions Intermediates

Corporate Total Sales

2,072

2,705

1,850

636

29

7,292

EBITDA

286

517

258

173

(64)

1,170

Recurring depreciation and amortization of property, plant and

equipment and intangible assets

(62)

(207)

(94)

(38)

(4)

(405)

Recurring operating income (REBIT)

224

310

164

135

(68)

765

Depreciation and amortization related to the revaluation of

property, plant and equipment and intangible assets as part of the

allocation of the purchase price of businesses

(77)

(13)

(5)

—

—

(95)

Other income and expenses

(22)

(37)

(1)

(1)

(10)

(71)

Operating income

125

260

158

134

(78)

599

Equity in income of affiliates

—

(7)

—

—

—

(7)

Intangible assets and property, plant, and equipment

additions

48

230

62

15

11

366

Of which: recurring capital expenditure

48

213

62

15

11

349

CONSOLIDATED CASH FLOW STATEMENT

End of September 2024

End of September 2023

(In millions of euros)

Operating cash flows

Net income

349

402

Depreciation, amortization and impairment of assets

582

512

Other provisions and deferred taxes

16

(70)

(Gains)/losses on sales of long-term assets

3

(29)

Undistributed affiliate equity earnings

4

7

Change in working capital

(262)

(27)

Other changes

22

15

Cash flow from operating activities

714

810

Investing cash flows Intangible assets and

property, plant, and equipment additions

(436)

(366)

Change in fixed asset payables

(75)

(131)

Acquisitions of operations, net of cash acquired

(29)

(66)

Increase in long-term loans

(63)

(45)

Total expenditures

(603)

(608)

Proceeds from sale of intangible assets and property, plant,

and equipment

5

8

Proceeds from sale of operations, net of cash transferred

—

32

Repayment of long-term loans

52

56

Total divestitures

57

96

Cash flow from investing activities

(546)

(512)

Financing cash flows Issuance (repayment) of

shares and paid-in surplus

—

0

Purchase of treasury shares

(24)

(32)

Issuance of hybrid bonds

399

—

Redemption of hybrid bonds

(400)

—

Dividends paid to parent company shareholders

(261)

(253)

Interest paid to bearers of subordinated perpetual notes

(16)

(16)

Dividends paid to non-controlling interests and buyout of minority

interests

(2)

(3)

Increase in long-term debt

494

397

Decrease in long-term debt

(764)

(63)

Increase / (Decrease) in short-term debt

327

(31)

Cash flow from financing activities

(247)

(1)

Net increase/(decrease) in cash and cash equivalents

(79)

297

Effect of exchange rates and changes in scope

29

11

Cash and cash equivalents at beginning of period

2,045

1,592

Cash and cash equivalents at end or the period

1,995

1,900

CONSOLIDATED BALANCE SHEET

30 September 2024

31 December 2023 (In

millions of euros)

ASSETS Goodwill

3,011

3,040

Intangible assets, net

2,331

2,416

Property, plant and equipment, net

3,735

3,730

Equity affiliates: investments and loans

11

13

Other investments

56

52

Deferred tax assets

111

157

Other non-current assets

258

251

TOTAL NON-CURRENT ASSETS

9,513

9,659

Inventories

1,392

1,208

Accounts receivable

1,412

1,261

Other receivables and prepaid expenses

195

170

Income tax receivables

106

142

Other current financial assets

24

32

Cash and cash equivalents

1,995

2,045

Assets held for sale

19

—

TOTAL CURRENT ASSETS

5,143

4,858

TOTAL ASSETS

14,656

14,517

LIABILITIES AND SHAREHOLDERS' EQUITY

Share capital

750

750

Paid-in surplus and retained earnings

6,402

6,304

Treasury shares

(44)

(21)

Translation adjustments

97

170

SHAREHOLDERS' EQUITY - GROUP SHARE

7,205

7,203

Non-controlling interests

247

252

TOTAL SHAREHOLDERS' EQUITY

7,452

7,455

Deferred tax liabilities

407

436

Provisions for pensions and other employee benefits

391

397

Other provisions and non-current liabilities

429

416

Non-current debt

3,540

3,734

TOTAL NON-CURRENT LIABILITIES

4,767

4,983

Accounts payable

993

1,036

Other creditors and accrued liabilities

472

392

Income tax payables

71

83

Other current financial liabilities

23

27

Current debt

866

541

Liabilities related to assets held for sale

12

—

TOTAL CURRENT LIABILITIES

2,437

2,079

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

14,656

14,517

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS’

EQUITY Shares issued Treasury

shares Shareholders' equity - Group share

Non-controlling interests Shareholders' equity (In

millions of euros)

Number Amount Paid-in

surplus Hybrid bonds Retained earnings

Translation adjustments Number Amount At 1

January 2024

75,043,514

750

1,067

700

4,537

170

(228,901)

(21)

7,203

252

7,455

Cash dividend

-

-

-

-

(277)

-

-

-

(277)

(2)

(279)

Issuance of share capital

-

-

-

-

-

-

-

-

-

-

-

Capital decrease by cancellation of treasury shares

-

-

-

-

-

-

-

-

-

-

-

Purchase of treasury shares

-

-

-

-

-

-

(271,070)

(24)

(24)

-

(24)

Cancellation of purchased treasury shares

-

-

-

-

-

-

-

-

-

-

-

Grants of treasury shares to employees

-

-

-

-

(1)

-

12,601

1

0

-

0

Sale of treasury shares

-

-

-

-

-

-

-

-

-

-

-

Share-based payments

-

-

-

-

21

-

-

-

21

-

21

Issuance of hybrid bonds

-

-

-

400

(1)

-

-

-

399

-

399

Redemption of hybrid bonds

-

-

-

(400)

-

-

-

-

(400)

-

(400)

Other

-

-

-

-

3

-

-

-

3

1

4

Transactions with shareholders

-

-

-

0

(255)

-

(258,469)

(23)

(278)

(1)

(279)

Net income

-

-

-

-

342

-

-

-

342

7

349

Total income and expense recognized directly through equity

-

-

-

-

11

(73)

-

-

(62)

(11)

(73)

Comprehensive income

-

-

-

-

353

(73)

-

-

280

(4)

276

At 30 September 2024

75,043,514

750

1,067

700

4,635

97

(487,370)

(44)

7,205

247

7,452

ALTERNATIVE PERFORMANCE INDICATORS To

monitor and analyse the financial performance of the Group and its

activities, the Group management uses alternative performance

indicators. These are financial indicators that are not defined by

the IFRS. This note presents a reconciliation of these indicators

and the aggregates from the consolidated financial statements under

IFRS.

RECURRING OPERATING INCOME (REBIT) AND EBITDA

(In millions of euros)

End of

September 2024 End of September

2023 3rd quarter 2024

3rd

quarter 2023 OPERATING

INCOME

536

599

184

182

- Depreciation and amortization related to the revaluation of

tangible and intangible assets as part of the allocation of the

purchase price of businesses

(113)

(95)

(38)

(32)

- Other income and expenses

(101)

(71)

(24)

(32)

RECURRING OPERATING INCOME (REBIT)

750

765

246

246

- Recurring depreciation and amortization of tangible and

intangible assets

(458)

(405)

(161)

(140)

EBITDA

1,208

1,170

407

386

Details of depreciation and

amortization of tangible and intangible assets:

(In millions of euros)

End of September

2024 End of September

2023 3rd quarter 2024

3rd

quarter 2023

Depreciation and amortization of tangible and intangible

assets

(582)

(512)

(200)

(178)

Of which: Recurring depreciation and amortization of tangible and

intangible assets

(458)

(405)

(161)

(140)

Of which: Depreciation and amortization related to the revaluation

of assets as part of the allocation of the purchase price of

businesses

(113)

(95)

(38)

(32)

Of which: Impairment included in other income and expenses

(11)

12

(1)

(6)

ADJUSTED NET INCOME AND ADJUSTED EARNINGS PER

SHARE (In millions of euros)

End of September 2024 End of September 2023 3rd quarter 2024 3rd quarter 2023 NET INCOME - GROUP

SHARE

342

398

118

114

- Depreciation and amortization related to the revaluation of

tangible and intangible assets as part of the allocation of the

purchase price of businesses

(113)

(95)

(38)

(32)

- Other income and expenses

(101)

(71)

(24)

(32)

- Other income and expenses - Non-controlling interests

—

—

—

—

- Taxes on depreciation and amortization related to the revaluation

of assets as part of the allocation of the purchase price of

businesses

25

23

9

10

- Taxes on other income and expenses

17

14

5

6

- One-time tax effects

(6)

(19)

(2)

(15)

ADJUSTED NET INCOME

520

546

168

177

Weighted average number of ordinary shares

74,699,795

74,636,305

Weighted average number of potential ordinary shares

75,114,108

75,043,514

ADJUSTED EARNINGS PER SHARE (in euros)

6.96

7.32

2.25

2.38

DILUTED ADJUSTED EARNINGS PER SHARE (in euros)

6.92

7.28

2.23

2.36

RECURRING CAPITAL

EXPENDITURE

(In millions of euros)

End of

September 2024 End of September

2023 3rd quarter 2024

3rd

quarter 2023 INTANGIBLE

ASSETS AND PROPERTY, PLANT, AND EQUIPMENT ADDITIONS

436

366

167

142

- Exceptional capital expenditure

—

17

—

5

- Investments relating to portfolio management operations

—

—

—

—

- Capital expenditure with no impact on net debt

—

—

—

—

RECURRING CAPITAL EXPENDITURE

436

349

167

137

CASH FLOWS (In millions of euros)

End of September 2024

End of September 2023

3rd

quarter 2024 3rd quarter 2023 Cash flow from operating

activities

714

810

334

393

+ Cash flow from investing activities

(546)

(512)

(160)

(125)

NET CASH FLOW

168

298

174

268

- Net cash flow from portfolio management operations

(42)

(44)

(1)

(5)

FREE CASH FLOW

210

342

175

273

Exceptional capital expenditure

—

(17)

—

(5)

- Non-recurring cash flow

(52)

(77)

(15)

(34)

RECURRING CASH FLOW

262

436

190

312

- Recurring capital expenditure

(436)

(349)

(167)

(137)

OPERATING CASH FLOW

698

785

357

449

Operating cash flow corresponds to recurring cash flow before

recurring capital expenditure Net cash flow from portfolio

management operations corresponds to the impact of acquisition and

disposal operations. Non-recurring cash flow corresponds to cash

flow from other income and expenses.

NET DEBT

(In millions of euros)

End of

September 2024 End of December

2023 Non-current debt

3,540

3,734

+ Current debt

866

541

- Cash and cash equivalents

1,995

2,045

NET DEBT

2,411

2,230

+ Hybrid bonds

700

700

NET DEBT AND HYBRID BONDS

3,111

2,930

WORKING CAPITAL (In millions of euros)

End of September 2024

End of December 2023

Inventories

1,392

1,208

+ Accounts receivable

1,412

1,261

+ Other receivables including income taxes

301

312

+ Other current financial assets

24

32

- Accounts payable

993

1,036

- Other liabilities including income taxes

543

475

- Other current financial liabilities

23

27

WORKING CAPITAL

1,570

1,275

CAPITAL EMPLOYED (In millions of euros)

End of September 2024

End of December 2023

Goodwill, net

3,011

3,040

+ Intangible assets (excluding goodwill), and property, plant and

equipment, net

6,066

6,146

+ Investments in equity affiliates

11

13

+ Other investments and other non-current assets

314

303

+ Working capital

1,570

1,275

CAPITAL EMPLOYED

10,972

10,777

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105902148/en/

Investor relations Béatrice Zilm +33 (0)1 49 00 75 58

beatrice.zilm@arkema.com James Poutier +33 (0)1 49 00 73 12

james.poutier@arkema.com Alexis Noël +33 (0)1 49 00 74 37

alexis.noel@arkema.com Colombe Boiteux +33 (0)1 49 00 72 07

colombe.boiteux@arkema.com

Media Gilles Galinier +33 (0)1 49 00 70 07

gilles.galinier@arkema.com Anne Plaisance +33 (0)6 81 87 48 77

anne.plaisance@arkema.com

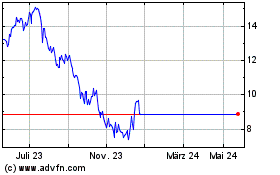

Alikem (TSX:AKE)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

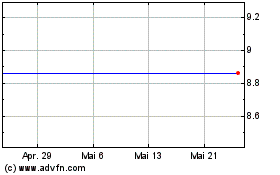

Alikem (TSX:AKE)

Historical Stock Chart

Von Dez 2023 bis Dez 2024