Aberdeen International Reports Value of Investment Portfolio and Cash of $0.65 Per Share for First Quarter Ending April 30, 2...

28 Mai 2013 - 11:09PM

Marketwired Canada

ABERDEEN INTERNATIONAL INC. ("Aberdeen", or the "Company") (TSX:AAB) today

announces that the value of its investment portfolio as at April 30, 2013, the

end of its 2014 first fiscal quarter, was approximately $55.4 million including

a cash balance of $3.7 million. This equates to a value of $0.65 per basic share

outstanding based on Aberdeen's investment portfolio alone. This report of the

portfolio value is not equivalent to the net asset value that has been

previously reported by Aberdeen as it does not include assets and liabilities of

the Company that are not treated as investments. Rather, this report refers only

to the cash, equity investments (private and public), option-type investments

(for example, warrants) and corporate debt/loans receivable of the Company.

The value of the investment portfolio decreased from the value as at January 31,

2013 by approximately $14.5 million or 20.7 percent. First quarter financial

results are expected to be released on or before June 14, 2013, which include

the Company's other assets and liabilities.

April 30, 2013 January 31, 2013 April 30, 2012

Shares

outstanding 85,994,602 85,994,602 86,898,239

$/ $/ $/

$ Shares $ Shares $ Shares

-----------------------------------------------------------

Cash on hand 3,698,793 0.04 10,417,577(i) 0.12 2,034,272 0.02

Investments

Publicly traded 21,829,533 0.254 29,844,393 0.347 41,332,712 0.476

Private 21,307,053 0.248 21,039,834 0.245 12,902,827 0.148

Non-trading

warrants

Intrinsic

value - - 1,032,114 0.012 - -

Option value 929,322 0.011 1,415,665 0.016 1,154,730 0.013

-----------------------------------------------------------

929,322 0.011 2,447,779 0.028 1,154,730 0.013

-----------------------------------------------------------

Portfolio

Investments 44,065,908 0.512 53,332,006 0.620 55,390,269 0.637

Loans / preferred

shares 7,682,603 0.089 6,116,040 0.071 4,383,312 0.050

-----------------------------------------------------------

Total 55,447,304 0.645 69,865,623 0.812 61,807,853 0.711

-----------------------------------------------------------

-----------------------------------------------------------

(i) Includes cash from trades made at the end of January 2013 but settled in

February 2013.

About Aberdeen International Inc.:

Aberdeen is a publicly traded global investment and merchant banking company

focused on small cap companies in the resource sector. Aberdeen will seek to

acquire significant equity participation in pre-IPO and/or early stage public

resource companies with undeveloped or undervalued high-quality resources.

Aberdeen will focus on companies that: (i) are in need of managerial, technical

and financial resources to realize their full potential; (ii) are undervalued in

foreign capital markets; and/or (iii) operate in jurisdictions with moderate

local political risk. Aberdeen will seek to provide value-added managerial and

board advisory services to companies. The Corporation's intention will be to

optimize the return on its investment over an 24 to 36 month investment time

frame.

For additional information, please visit our website at

www.aberdeeninternational.ca and follow us on Facebook and Twitter: AberdeenAAB.

Cautionary Note

Except for statements of historical fact contained herein, the information in

this press release constitutes "forward-looking information" within the meaning

of Canadian securities law. Such forward-looking information may be identified

by words such as "plans", "proposes", "estimates", "intends", "expects",

"believes", "may", "will" and include without limitation, statements regarding

past success as an indicator of future success; net asset value of the Company;

the potential of investee companies and the appreciation of their share price;

the Company's plan of business operations; and anticipated returns. There can be

no assurance that such statements will prove to be accurate; actual results and

future events could differ materially from such statements. Factors that could

cause actual results to differ materially include, among others, metal prices,

competition, financing risks, acquisition risks, risks inherent in the mining

industry, and regulatory risks. Most of these factors are outside the control of

the Company. Investors are cautioned not to put undue reliance on

forward-looking information. Except as otherwise required by applicable

securities statutes or regulation, the Company expressly disclaims any intent or

obligation to update publicly forward-looking information, whether as a result

of new information, future events or otherwise.

FOR FURTHER INFORMATION PLEASE CONTACT:

Aberdeen International Inc.

Mike McAllister

Manager, Investor Relations

+1 416-309-2134

info@aberdeeninternational.ca

Aberdeen International Inc.

David Stein

President and Chief Executive Officer

+1 416-861-5812

dstein@aberdeeninternational.ca

www.aberdeeninternational.ca

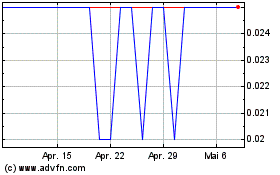

Aberdeen (TSX:AAB)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

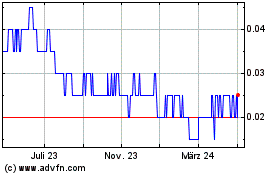

Aberdeen (TSX:AAB)

Historical Stock Chart

Von Mai 2023 bis Mai 2024