UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

ZUORA, INC.

(Name of Issuer)

Class A Common Stock, par value $0.0001 per share

(Title of Class of Securities)

98983V106

(CUSIP Number)

Andrew J. Schader, Esq.

Silver Lake

55 Hudson

Yards

550 West 34th Street, 40th Floor

New York, NY 10001

(212) 981-5600

(Name, Address and Telephone Number of Person Authorized to Receive Notices and

Communications)

With copies to:

Kenneth Wallach, Esq.

Sunny Cheong, Esq.

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New

York, New York 10017

(212) 455-2000

March 24, 2022

(Date

of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section of the Exchange Act but shall be subject to all other provisions of the Exchange Act (however, see the Notes).

|

|

|

|

|

|

|

| 1. |

|

Names of

Reporting Persons. SLA Zurich Holdings, L.P. |

| 2. |

|

Check the Appropriate Box if a Member

of a Group (See Instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds (See Instructions)

OO |

| 5. |

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

12,500,000 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

12,500,000 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

12,500,000 |

| 12. |

|

Check if the Aggregate Amount in Row

(11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

|

Percent of Class Represented by Amount

in Row (11) 9.5% |

| 14. |

|

Type of Reporting Person (See

Instructions) PN |

2

|

|

|

|

|

|

|

| 1. |

|

Names of

Reporting Persons. SLA Zurich Aggregator, L.P. |

| 2. |

|

Check the Appropriate Box if a Member

of a Group (See Instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds (See Instructions)

OO |

| 5. |

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

7,500,000 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

7,500,000 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

7,500,000 |

| 12. |

|

Check if the Aggregate Amount in Row

(11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

|

Percent of Class Represented by Amount

in Row (11) 5.9% |

| 14. |

|

Type of Reporting Person (See

Instructions) PN |

3

CUSIP NO. 98983V106

|

|

|

|

|

|

|

| 1. |

|

Names of

Reporting Persons. SLA Zurich GP, L.L.C. |

| 2. |

|

Check the Appropriate Box if a Member

of a Group (See Instructions)

(a) ☐ (b) ☒ |

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds (See Instructions)

OO |

| 5. |

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

12,500,000 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

12,500,000 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

12,500,000 |

| 12. |

|

Check if the Aggregate Amount in Row

(11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

|

Percent of Class Represented by Amount

in Row (11) 9.5% |

| 14. |

|

Type of Reporting Person (See

Instructions) OO |

4

CUSIP NO. 98983V106

|

|

|

|

|

|

|

| 1. |

|

Names of

Reporting Persons. SL Alpine II Aggregator GP, L.L.C. |

| 2. |

|

Check the Appropriate Box if a Member

of a Group (See Instructions)

(a) ☐ (b) ☒ |

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds (See Instructions)

OO |

| 5. |

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

20,000,000 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

20,000,000 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

20,000,000 |

| 12. |

|

Check if the Aggregate Amount in Row

(11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

|

Percent of Class Represented by Amount

in Row (11) 14.4% |

| 14. |

|

Type of Reporting Person (See

Instructions) OO |

5

CUSIP NO. 98983V106

|

|

|

|

|

|

|

| 1. |

|

Names of

Reporting Persons. Silver Lake Alpine Associates II, L.P. |

| 2. |

|

Check the Appropriate Box if a Member

of a Group (See Instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds (See Instructions)

OO |

| 5. |

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

20,000,000 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

20,000,000 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

20,000,000 |

| 12. |

|

Check if the Aggregate Amount in Row

(11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

|

Percent of Class Represented by Amount

in Row (11) 14.4% |

| 14. |

|

Type of Reporting Person (See

Instructions) PN |

6

CUSIP NO. 98983V106

|

|

|

|

|

|

|

| 1. |

|

Names of

Reporting Persons. SLAA II (GP), L.L.C. |

| 2. |

|

Check the Appropriate Box if a Member

of a Group (See Instructions)

(a) ☐ (b) ☒ |

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds (See Instructions)

OO |

| 5. |

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

20,000,000 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

20,000,000 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

20,000,000 |

| 12. |

|

Check if the Aggregate Amount in Row

(11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

|

Percent of Class Represented by Amount

in Row (11) 14.4% |

| 14. |

|

Type of Reporting Person (See

Instructions) OO |

7

CUSIP NO. 98983V106

|

|

|

|

|

|

|

| 1. |

|

Names of

Reporting Persons. Silver Lake Group, L.L.C. |

| 2. |

|

Check the Appropriate Box if a Member

of a Group (See Instructions)

(a) ☐ (b) ☒ |

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds (See Instructions)

OO |

| 5. |

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐ |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with: |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

20,000,000 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

20,000,000 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

20,000,000 |

| 12. |

|

Check if the Aggregate Amount in Row

(11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

|

Percent of Class Represented by Amount

in Row (11) 14.4% |

| 14. |

|

Type of Reporting Person (See

Instructions) OO |

8

| Item 1. |

Security and Issuer |

This Schedule 13D (the “Schedule 13D”) relates to the shares of Class A common stock, par value $0.0001 per share (the “Class A Common

Stock”), of Zuora, Inc., a Delaware corporation (the “Issuer”). The principal executive offices of the Issuer are located at 101 Redwood Shores Parkway, Redwood City, California 94065.

| Item 2. |

Identity and Background |

(a) and (f) This Schedule 13D is being filed jointly on behalf of the following persons (collectively, the “Reporting Persons”), each of which

is a Delaware entity:

1. SLA Zurich Holdings, L.P. (“SLA Zurich Holdings”),

2. SLA Zurich Aggregator, L.P. (“SLA Zurich Aggregator”),

3. SLA Zurich GP, L.L.C. (“SLA Zurich GP”),

4. SL Alpine II Aggregator GP, L.L.C. (“SLA Aggregator”),

5. Silver Lake Alpine Associates II, L.P. (“SLAA”),

6. SLAA II (GP), L.L.C. (“SLAA GP”),

7. Silver Lake Group, L.L.C. (“SLG” and, together with SLA Zurich Holdings, SLA Zurich Aggregator, SLA Zurich GP, SLA Aggregator,

SLAA and SLAA GP “Silver Lake”).

The Reporting Persons have entered into an agreement of joint filing, a copy of which is attached hereto as

Exhibit A.

(b) and (c) The general partner of SLA Zurich Holdings is SLA Zurich GP. SLA Aggregator is the sole member of SLA Zurich GP and the

general partner of SLA Zurich Aggregator. The general partner of SLA Aggregator is SLAA. The general partner of SLAA is SLAA GP. The managing member of SLAA GP is SLG. Certain information concerning the identity and background of each of the

managing members of SLG is set forth in Annex A attached hereto, which is incorporated herein by reference in response to this Item 2.

The principal

business of each of SLA Zurich Holdings and SLA Zurich Aggregator is to invest in securities. The principal business of SLA Zurich GP is to serve as the general partner of SLA Zurich Holdings. The principal business of SLA Aggregator is to serve as

sole member of SLA Zurich GP and the general partner of SLA Zurich Aggregator and to manage investments through other partnerships and limited liability companies. The principal business of SLAA is to serve as the general partner of SLA Aggregator

and to manage investments through other partnerships and limited liability companies. The principal business of SLAA GP is to serve as the general partner of SLAA. The principal business of SLG is to serve as the managing member of SLAA GP and to

manage investments through other partnerships and limited liability companies.

The principal office of each of the Reporting Persons is located at c/o

Silver Lake, 2775 Sand Hill Road, Suite 100, Menlo Park, California 94025.

(d) and (e) None of the Reporting Persons nor, to the best knowledge of

the Reporting Persons, any of the persons listed on Annex A attached hereto has, during the past five years, been convicted of any criminal proceeding (excluding traffic violations or similar misdemeanors), nor been a party to a civil proceeding of

a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state

securities laws or finding any violation with respect to such laws.

| Item 3. |

Source and Amount of Funds or Other Consideration |

The information set forth in or incorporated by reference in Item 6 of this Schedule 13D is incorporated by reference in its entirety into this Item 3.

10

On March 2, 2022, the Issuer entered into an Investment Agreement (as amended, the “Investment

Agreement”) with an affiliate of SLAA. Pursuant to the Investment Agreement, on March 24, 2022 (the “Closing Date”), SLA Zurich Holdings purchased from the Issuer $250,000,000 aggregate principal amount of convertible senior PIK

toggle notes due 2029 (each a “Note”, collectively the “Notes”) for an aggregate purchase price of $242,000,000 and agreed to purchase an additional $150,000,000 of Notes in a subsequent closing on or before 18 months of the

Closing Date in accordance with the terms of the Investment Agreement.

In addition, as a condition of the Investment Agreement, the Issuer issued to SLA

Zurich Aggregator warrants (the “Warrants”) to acquire up to 7,500,000 shares of Class A Common Stock, exercisable for a period of seven years from the Closing Date, and of which (i) up to 2,500,000 warrants shall be exercisable

at $20.00 per share, (ii) up to 2,500,000 warrants shall be exercisable at $22.00 per share and (iii) up to 2,500,000 warrants shall be exercisable at $24.00 per share, subject to adjustment pursuant to the terms thereof.

The funds required for the purchase were provided through equity contributions from equity holders of SLA Zurich Holdings.

| Item 4. |

Purpose of the Transaction |

The information set forth in or incorporated by reference in Item 3 and Item 6 of this Schedule 13D is incorporated by reference in its entirety into this Item

4.

Each of the Reporting Persons acquired the Notes and Warrants for investment purposes. Pursuant to the Investment Agreement, Silver Lake has the right

to nominate one director to the board of directors of the Issuer. Mr. Joseph Osnoss, Managing Partner of Silver Lake, will serve as a Class III member of the board of directors of the Issuer in connection with the closing of the

transaction. Directors affiliated with Silver Lake will be entitled to earn director compensation pursuant to the Issuer’s standard director compensation arrangements, which compensation may be held for the benefit of Silver Lake and/or certain

of their affiliates or certain of the funds they manage. Silver Lake will also have the right to designate one non-voting Board observer who shall be entitled to attend Board meetings.

Although the Reporting Persons do not currently have any specific plan or proposal to convert the Notes, sell the Notes or the Class A Common Stock

issuable upon conversion thereof, except as described herein, each Reporting Person, consistent with its investment purpose and subject to the agreements described in Item 6 below, at any time and from time to time may acquire additional shares of

Class A Common Stock or securities convertible, exchangeable or exercisable for or into shares of Class A Common Stock or dispose of any or all of the Notes or the shares of Class A Common Stock issuable upon conversion thereof

(including, without limitation, distributing some or all of such shares of Class A Common Stock to such Reporting Person’s members, partners, stockholders or beneficiaries, as applicable, transferring Notes or shares of Class A Common

Stock to affiliated transferees, or the entry into a total return swap, asset swap or repurchase transaction in connection with a permitted financing, in each case in accordance with the agreements described in Item 6 below), depending upon an

ongoing evaluation of its investment in the Notes and/or Class A Common Stock, the price and availability of the Issuer’s securities, the Issuer’s business and the Issuer’s prospects, applicable legal restrictions, prevailing

market conditions, other investment opportunities, tax considerations, liquidity requirements of such Reporting Person and/or other investment considerations. Subject to the terms of the Investment Agreement (described in Item 6 below), the

Reporting Persons may request or demand a registration statement be filed by the Issuer and be made available and effective so that they may, if they later decide, deliver to the Issuer take-down notices in connection therewith or otherwise to sell

Notes, Warrants and/or shares of Class A Common Stock utilizing such registration statement.

In their capacity as significant stockholders of the

Issuer, the Reporting Persons may take an active role in working with the Issuer’s management and the board of directors on operational, financial and strategic initiatives and may engage in communications with one or more other stockholders or

other securityholders of the Issuer as well. Each of the Reporting Persons, in its capacity as a shareholder of the Issuer, may discuss ideas that, if effected, may relate to or result in any of the matters listed in Items 4(a)-(j) of Schedule 13D.

Other than as described above, none of the Reporting Persons nor, to the knowledge of each Reporting Person, any individuals listed in Annex A attached

hereto, currently has any plans or proposals that relate to, or would result in, any of the matters listed in Items 4(a) through (j) of Schedule 13D, although the Reporting Persons may, at any time and from time to time, review or reconsider

their position, change their purpose and/or formulate plans or proposals with respect thereto. As a result of these activities, one or more of the Reporting Persons may suggest or take a position with respect to potential changes in the operations,

management, or capital structure of the Issuer as a means of enhancing shareholder value. Such suggestions or positions may include one or more plans or proposals that relate to or would result in any of the actions described in Items 4(a) through

(j) of Schedule 13D.

11

| Item 5. |

Interest in Securities of the Issuer |

The information contained in rows 7, 8, 9, 10, 11 and 13 on each of the cover pages of this Schedule 13D and the information set forth or incorporated in Items

2, 3 and 6 of this Schedule 13D is incorporated by reference in its entirety into this Item 5.

(a) – (b) By virtue of the relationships among the

Reporting Persons described herein, the Reporting Persons may be deemed to constitute a group within the meaning of Section 13(d)(5) of the rules and regulations promulgated by the Securities and Exchange Commission (the “Commission”)

pursuant to the Securities Exchange Act of 1934 (the “Exchange Act”). As such, pursuant to Rule 13d-3 under the Exchange Act, the Reporting Persons may be deemed to beneficially own an aggregate of

20,000,000 shares of Class A Common Stock of the Issuer, which includes 12,500,000 shares of Class A Common Stock which would be received upon conversion of Notes held by SLA Zurich Holdings and 7,500,000 shares of Class A Common

Stock which would be received upon exercise of the Warrants held by SLA Zurich Aggregator, representing in the aggregate approximately 14.4% of the issued and outstanding shares of Class A Common Stock of the Issuer, as calculated pursuant to

Rule 13d-3 under the Securities Exchange Act of 1934, as amended. The beneficial ownership information provided herein does not include an additional 7,500,000 shares of Class A Common Stock underlying

the additional Notes to be purchased by the Reporting Persons pursuant to the terms and conditions set forth in the Investment Agreement, as described further in Item 6 below.

The percentages of beneficial ownership in this Schedule 13D assume (i) the conversion by the Reporting Persons of $250,000,000 in aggregate principal

amount of Notes into 12,500,000 shares of Class A Common Stock based on the current Conversion Rate (as defined below) and (ii) the exercise of Warrants into 7,500,000 shares of Class A Common Stock, and are based on 119,029,895

shares of Class A Common Stock outstanding as of February 28, 2022, as provided by the Issuer in the Investment Agreement. As further described in Item 6 below, pursuant to the Indenture (defined below), the Issuer may elect to pay

interest on the Notes in kind at a rate of 5.50% per annum, payable quarterly, and as a result, the number of shares of Class A Common Stock into which the Notes may be converted may increase over time.

Information with respect to the beneficial ownership of Class A Common Stock by the individuals listed in Annex A is set forth in Annex A attached hereto

and incorporated herein by reference in response to this Item 5.

(c) Except as set forth in Item 3 to this Schedule 13D, none of the Reporting Persons

have effected any transaction in the Issuer’s Class A Common Stock during the past 60 days.

(d) No one other than the Reporting Persons has the

right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, any of the securities of the Issuer reported on this Schedule 13D.

(e) Not applicable.

12

| Item 6. |

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer

|

The information set forth or incorporated in Item 3 and Item 4 is incorporated by reference in its entirety into this Item 6.

Investment Agreement

On March 2, 2022, the

Issuer entered into an Investment Agreement with an affiliate of SLAA pursuant to which, on the Closing Date, SLA Zurich Holdings purchased $250,000,000 aggregate principal amount of the Notes and the Warrants were issued to SLA Zurich Aggregator .

The Investment Agreement provides SLA Zurich Holdings will purchase an additional $150,000,000 aggregate principal amount of the Notes on or before the 18 month anniversary of the Closing Date, subject to the terms and conditions set forth in the

Investment Agreement.

Board Representation

As long

as SLG or its affiliates beneficially own shares of Class A Common Stock (assuming conversion of the Notes and exercise of the Warrants) representing at least 4% of the outstanding shares of Class A Common Stock and Class B

common stock of the Issuer (calculated assuming conversion of the Notes and exercise of the Warrants), Silver Lake will maintain the right to nominate one individual for election to the Board of Directors of the Issuer (the “Board”), who

will be a managing director, officer, advisor or employee of SLG or certain of its affiliates. Silver Lake’s initial nominee will be Joseph Osnoss. Such right to nominate a director of the Issuer will terminate upon the Issuer’s entry into

a definitive agreement providing for the merger of the Issuer into any other person constituting a change in control. For so long as Silver Lake has a right to nominate a director, as described above, it will also have the right to designate one

board observer to attend meeting of the Board and any committee thereof.

Standstill Obligations

Silver Lake is subject to a standstill provision until the later of (i) the date that is six months following such time as Silver Lake no longer has a

representative or a right to have a representative on the Board and (ii) the three year anniversary of the Closing Date (the “Standstill Period”). During the Standstill Period, Silver Lake will not, among other things and subject to

specified exceptions (a) acquire any securities of the Issuer if, immediately after such acquisition, Silver Lake, together with certain of its affiliates, would beneficially own more than 19.9% of the then outstanding Class A Common Stock

(assuming conversion of the Notes and exercise of the Warrants) of the Issuer, excluding any shares purchased pursuant to its participation rights described below; (b) participate in any solicitation of proxies; or (c) form, join or

participate in any group (as defined in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended) with any persons other than Silver Lake’s affiliates with respect to any securities of the Issuer. The Standstill Period will

terminate early upon the effective date of a change of control of the Issuer or 90 days after such date that Silver Lake and certain of its affiliates cease to beneficially own any Notes or shares of the Issuer’s Class A Common Stock

(other than as may have been issued to directors for compensation purposes).

Transfer Restrictions

For a period of 18 months from the Closing Date, or earlier upon a change of control of the Issuer, Silver Lake will be restricted from converting the Notes or

exercising the Warrants or transferring or entering into an agreement that transfers the economic consequences of ownership of the Notes, Warrants or the shares of Class A Common Stock to be issued upon conversion of the Notes or exercise of

the Warrants, respectively. These restrictions shall not apply to, among other exceptions, transfers to certain affiliates and transfers or pledges of the Notes, Warrants or the shares of Class A Common Stock to be issued upon conversion of the

Notes or exercise of the Warrants, respectively, or the satisfaction of obligations related to pledged Notes or Warrants, in each case in connection with one or more bona fide margin loans.

13

Participation Rights

Silver Lake has the option to purchase up to 50% of any equity securities, or instruments convertible into or exchangeable for any equity securities, in any

proposed offerings by the Issuer until the earlier of (i) the first anniversary of the Closing Date or (ii) such time as Silver Lake no longer has a representative and no longer has rights to have a representative, on the Board. Silver

Lake’s option does not apply to equity securities or instruments convertible into or exchangeable for any equity securities issued in connection with, among other things, certain acquisitions, underwritten public offerings, strategic

partnerships or commercial arrangements, or equity compensation plans.

Registration Rights

Silver Lake is also entitled to certain registration rights in respect of the Notes, Warrants, the shares of Class A Common Stock issuable upon conversion

of the Notes or exercise of the Warrants and other shares of Class A Common Stock purchased by it after the effective date of the Investment Agreement while it or its affiliates hold other registerable securities; provided, that such

registration rights will cease upon the earliest of (a) when such securities have been disposed of pursuant to an effective registration statement or in compliance with Rule 144, (b) upon the later of the date (i) in the case of such

securities held by Silver Lake, no Silver Lake designee is on the Board and (ii) the holder thereof beneficially owns less than (x) one percent of the outstanding shares of Class A Common Stock as of such time and such securities are

freely transferable under Rule 144 (and, in the case of the Notes, such securities may be represented by an Unrestricted Global Security (as defined in the Indenture) when sold) and (y) $25,000,000 in aggregate principal amount of Notes (subject to

certain exceptions), or (c) when such securities cease to be outstanding.

Subject to qualifying therefor, the Issuer will file an automatic shelf

registration statement on Form S-3 and use reasonable efforts to keep such registration statement to be continuously effective until the earliest of (i) the date on which all registrable

securities covered by the Issuer’s registration statement have been sold pursuant to the Investment Agreement and (ii) there otherwise cease to be any registerable securities. If a holder of registerable securities notifies the Issuer of

its intent to sell at least $25,000,000 of registrable securities pursuant to the Issuer’s registration statement, the Issuer is obligated, among other things, to amend or supplement the registration statement as necessary to enable the sale of

such securities in an underwritten offering. However, the Issuer is not required to amend, supplement or file a registration statement during any Blackout Period (as defined in the Investment Agreement). The Issuer may not call a Blackout Period

more than twice in any period of 12 consecutive months and the aggregate length of Blackout Periods in any period of 12 consecutive months may not exceed 90 days.

The Issuer will bear the expenses incurred in connection with a registration pursuant to the Investment Agreement, and each holder of registrable securities

participating in an offering will bear the expenses relating to applicable underwriting discounts and commissions, agency fees, brokers’ commissions and transfer taxes, if any, and similar charges.

Indenture

The Issuer issued $250,000,000

aggregate principal amount of Notes pursuant to an Indenture (the “Indenture”), dated as of March 24, 2022, by and between the Issuer and U.S. Bank National Association, as trustee. The Notes bear interest at a rate of 3.95% per

annum, payable quarterly in cash, provided that the Issuer may elect to pay interest in kind at 5.50% per annum, payable quarterly. The Notes will mature on March 31, 2029, subject to earlier conversion or repurchase. Under the terms of the

Indenture, at the option of a holder of the Notes, the Notes are convertible into shares of Class A Common Stock of the Issuer. The initial conversion rate of the Notes is 50.0000 shares of Class A Common Stock (the “Conversion

Rate”) per $1,000 principal amount of the Notes, which rate is subject to certain anti-dilution adjustments. The Conversion Rate is equivalent to an initial conversion price of approximately $20.00 per share of Class A Common Stock.

Holders of the Notes may require that the Issuer repurchase all or part of the principal amount of the Notes at a purchase price equal to the principal amount plus the total sum of all remaining scheduled interest payments through the remainder of

the term of the Notes upon the occurrence of a Fundamental Change (as defined in the Indenture). In addition, upon the occurrence of a Make-Whole Fundamental Change (as defined in the Indenture), the Issuer may be required to increase the Conversion

Rate for the Notes converted in connection with such a Make-Whole Fundamental Change. On and after the fifth anniversary of the Closing Date, the holders of the Notes may require that the Issuer repurchase all or part of the principal amount of the

Notes at a purchase price equal to the principal amount plus accrued interest through the date of repurchase. The Issuer has no right to redeem the Notes prior to maturity. The Indenture includes a restrictive covenant that, subject to specified

exceptions and parameters, limits the ability of the Issuer and its subsidiaries to incur additional debt, including secured debt, and includes customary events of default, which may result in the acceleration of the maturity of the Notes under the

Indenture.

14

Warrants

On the Closing Date, the Issuer issued SLA Zurich Aggregator Warrants to purchase up to 7,500,000 shares of Class A Common Stock, exercisable for a period

of approximately seven years from the Closing Date, and of which, subject to the terms set forth in the Warrants, (i) 2,500,000 Warrants are exercisable at $20.00 per share, (ii) 2,500,000 Warrants are exercisable at $22.00 per share, and (iii)

2,500,000 Warrants are exercisable at $24.00 per share, subject to adjustment pursuant to the terms thereof. Upon the occurrence of a Make-Whole Fundamental Change (as defined in the Warrants), the Issuer may be required to increase the number of

shares issuable upon exercise of the Warrants, and to adjust the exercise price for the Warrants, in accordance with the Warrants.

The foregoing

descriptions of the Indenture, Investment Agreement and Warrants are each qualified in their entirety by reference to the Indenture, Investment Agreement and Loan Agreement which are filed as Exhibits B, C and D, respectively, to this Schedule 13D

and incorporated by reference herein.

Margin Loan Facility

SLA Zurich Holdings and certain of its affiliates has entered into a Margin Loan and Security Agreement dated as of March 21, 2022 (as amended from time

to time, the “Loan Agreement”) with the lenders party thereto (each, a “Lender” and collectively, the “Lenders”) and JPMorgan Chase, N.A., as administrative agent (the “Administrative Agent”).

Pursuant to the Loan Agreement, the obligations of SLA Zurich Holdings and other affiliated borrowers thereunder are secured by, among other assets held by

such affiliated borrowers, a pledge of Notes owned by SLA Zurich Holdings. As of March 24, 2022, SLA Zurich Holdings has pledged an aggregate principal amount of $250,000,000 of Notes (the “Pledged Notes”).

The loans under the Loan Agreement mature on or about March 21, 2025, subject to any mutually agreed extension. Upon the occurrence of certain events

that are customary for these type of loans, the Lenders may exercise their rights to require SLA Zurich Holdings and the other affiliated borrowers to pre-pay the loan proceeds or post additional

collateral, and the Lenders may exercise their rights to foreclose on, and dispose of, the Pledged Notes and other collateral, in each case, in accordance with the Loan Agreement and related documentation.

Non-Employee Director Compensation

Directors affiliated with Silver Lake are entitled to earn director compensation pursuant to the Issuer’s standard director compensation arrangements,

which compensation is held for the benefit of Silver Lake and/or certain of their affiliates or certain of the funds they manage. Mr. Joseph Osnoss, a Managing Partner at SLG, was appointed as a member of the Board of the Issuer and has been

awarded 26,024 restricted stock units, which will vest annually in three equal installments on the anniversary of the grant date, provided that Mr. Osnoss continues as a director through each such date. The beneficial ownership numbers reported

herein do not include any shares of Class A Common Stock and restricted stock units awarded to Mr. Osnoss as director compensation and the Reporting Persons disclaim beneficial ownership over such securities.

| Item 7. |

Material to Be Filed as Exhibits |

| A. |

Agreement of Joint Filing by and among the Reporting Persons |

| B. |

Indenture, dated March 24, 2022, between the Issuer and U.S. Bank National Association (incorporated by

reference to Exhibit 10.2 to the Issuer’s Form 8-K filed on March 25, 2022) |

| C. |

Investment Agreement, dated as of March 2, 2022, between the Issuer and Silver Lake |

| |

Alpine |

II, L.P. (incorporated by reference to Exhibit 10.1 to the Issuer’s Form

8-K filed on March 2, 2022) |

| D. |

Warrant (incorporated by reference to Exhibit 10.3 to the Issuer’s Form

8-K filed on March 25, 2022) |

15

Signatures

After reasonable inquiry and to the best of its knowledge and belief, the undersigned certify that the information set forth in this statement is true,

complete and correct.

Dated: March 28, 2022

|

|

|

| SLA Zurich Holdings, L.P. |

| By: |

|

SLA Zurich GP, L.L.C., its general partner |

|

|

| By: |

|

/s/ Andrew J. Schader |

|

|

Name: Andrew J. Schader |

|

|

Title: Managing Director |

|

|

|

| SLA Zurich Aggregator, L.P. |

| By: |

|

SL Alpine II Aggregator GP, L.L.C., its general partner |

| By: |

|

Silver Lake Alpine Associates II, L.P., its managing member |

| By: |

|

SLAA II (GP), L.L.C., its general partner |

| By: |

|

Silver Lake Group, L.L.C., its managing member |

|

|

| By: |

|

/s/ Andrew J. Schader |

|

|

Name: Andrew J. Schader |

|

|

Title: Managing Director and General Counsel |

|

|

|

| SLA Zurich GP, L.L.C. |

|

|

| By: |

|

/s/ Andrew J. Schader |

|

|

Name: Andrew J. Schader |

|

|

Title: Managing Director |

|

|

|

| SL Alpine II Aggregator GP, L.L.C. |

| By: |

|

Silver Lake Alpine Associates II, L.P., its managing member |

| By: |

|

SLAA II (GP), L.L.C., its general partner |

| By: |

|

Silver Lake Group, L.L.C., its managing member |

|

|

| By: |

|

/s/ Andrew J. Schader |

|

|

Name: Andrew J. Schader |

|

|

Title: Managing Director and General Counsel |

|

|

|

| Silver Lake Alpine Associates II, L.P. |

| By: |

|

SLAA II (GP), L.L.C., its general partner |

| By: |

|

Silver Lake Group, L.L.C., its managing member |

|

|

| By: |

|

/s/ Andrew J. Schader |

|

|

Name: Andrew J. Schader |

|

|

Title: Managing Director and General Counsel |

|

|

|

| SLAA II (GP), L.L.C. |

| By: |

|

Silver Lake Group, L.L.C., its managing member |

|

|

| By: |

|

/s/ Andrew J. Schader |

|

|

Name: Andrew J. Schader |

|

|

Title: Managing Director and General Counsel |

|

|

|

| Silver Lake Group, L.L.C. |

|

|

| By: |

|

/s/ Andrew J. Schader |

|

|

Name: Andrew J. Schader |

|

|

Title: Managing Director and General Counsel |

Annex A

The following sets forth the name and principal occupation of each of the managing members of Silver Lake Group, L.L.C., each of whom is a citizen of the

United States.

|

|

|

|

|

| Name |

|

Business Address |

|

Principal Occupation |

| Egon Durban |

|

c/o Silver Lake

2775 Sand Hill Road, Suite 100

Menlo Park, California 94025 |

|

Co-CEO and Managing Member of Silver Lake Group, L.L.C. |

| Kenneth Hao |

|

c/o Silver Lake

2775 Sand Hill Road, Suite 100

Menlo Park, California 94025 |

|

Chairman and Managing Member of Silver Lake Group, L.L.C. |

| Gregory Mondre |

|

c/o Silver Lake

2775 Sand Hill Road, Suite 100

Menlo Park, California 94025 |

|

Co-CEO and Managing Member of Silver Lake Group, L.L.C. |

| Joseph Osnoss |

|

c/o Silver Lake

55 Hudson Yards

550 West 34th Street, 40th Floor

New York, NY 10001 |

|

Managing Partner and Managing Member of Silver Lake Group, L.L.C. |

None of the persons listed above beneficially owns any Class A Common Stock of the Issuer or has engaged in any

transactions in Class A Common Stock in the previous 60 days.

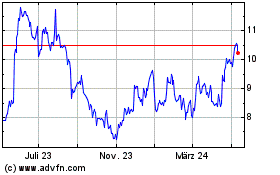

Zuora (NYSE:ZUO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Zuora (NYSE:ZUO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024