UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant

to Rule 13a-16 or 15d-16 Under the

Securities Exchange Act of 1934

October 24, 2023

Commission File Number: 001-32482

WHEATON PRECIOUS METALS CORP.

(Exact name of registrant as specified in its

charter)

Suite 3500 - 1021 West Hastings St.

Vancouver, British Columbia

V6E 0C3

(604) 684-9648

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

DOCUMENTS FILED AS PART OF THIS FORM 6-K

See the Exhibit Index to this Form 6-K.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

WHEATON PRECIOUS METALS CORP. |

|

| |

(Registrant) |

|

| |

|

|

|

| October 24,

2023 |

By: |

/s/

Curt Bernardi |

|

| |

|

Name: |

Curt

Bernardi |

|

| |

|

Title: |

Senior

Vice President, Legal |

|

| |

|

|

and

Corporate Secretary |

|

-2-

EXHIBIT INDEX

- 3 -

Exhibit 99.1

Wheaton Precious Metals Announces the Acquisition

of a New Silver Stream on the Mineral Park Mine

VANCOUVER, BC, Oct. 24, 2023 /CNW/ - Wheaton Precious

Metals™ Corp. ("Wheaton" or the "Company") is pleased to announce that its wholly-owned subsidiary, Wheaton

Precious Metals International Ltd. ("WPMI") has entered into a definitive Precious Metals Purchase Agreement (the "Silver

Stream") with Waterton Copper Corp., a subsidiary of Waterton Copper LP ("Waterton Copper") in respect to its 100% owned

Mineral Park Mine located in Arizona, USA (the "Project" or "Mineral Park").

"Wheaton is excited to bring Mineral Park back

into our portfolio given our long history with the mine, particularly given the work Waterton Copper has done to optimize the operation,"

said Randy Smallwood, Wheaton's President and Chief Executive Officer. "Our unique understanding of Mineral Park, and its potential,

positions us well to assist Waterton Copper in bringing the mine back into production in a sustainable manner. As global efforts to transition

to a low-carbon economy accelerate, critical metals, such as copper, that are produced responsibly within politically stable jurisdictions,

have never been more important.

"Waterton Copper is delighted to have Wheaton

Precious Metals' support," said Isser Elishis, Executive Chairman of Waterton Copper. "Waterton is investing approximately

$600 million to optimize Mineral Park including significant capital investments in new primary crushers, secondary and pebble crushing

circuits, and new higher-power SAG mills, which are expected to result in decades of operational excellence."

Transaction Details

(All values in US$ unless otherwise noted)

- Upfront Consideration: WPMI will pay Waterton Copper total

upfront cash consideration of $115 million (the "Deposit") in four payments during construction (three installments of $25 million

and a final installment of $40 million).

- Streamed Metal: Under the Silver Stream, WPMI will purchase

100% of the payable silver from the Project for the life of the mine. Payable silver is calculated using a fixed payable factor of 90%.

- Production Profile1: Attributable production

is forecast to average over 0.69 million ounces ("Moz") of silver per year for the first five years of production and over 0.74

Moz of silver per year for the life of mine, with construction to be completed by the end of Q1 2025. Mineral Park is forecast to have

a 12-year mine life, with the potential to expand the mine life to over 20 years.

- Production Payments: WPMI will make ongoing payments

for the silver ounces delivered equal to 18% of the spot price of silver ("Production Payment") until the uncredited deposit

is reduced to nil and 22% of the spot price of silver thereafter.

- Incremental Reserves and Resources1: The addition

of Mineral Park will increase Wheaton's total estimated Proven and Probable Mineral silver reserves by 14.6 Moz, Measured and Indicated

Mineral silver resources by 18.4 Moz and Inferred silver resources by 16.2 Moz.

- Other Considerations:

- The Silver Stream will include a customary completion test.

- WPMI will provide a secured debt facility of up to $25 million

once the full upfront consideration has been paid.

- WPMI has also obtained a right of first refusal on any future

precious metals streams, royalty, prepay or similar transactions.

- Waterton Copper and Origin Mining Company, LLC (the direct owner

of Mineral Park, "Origin") will provide WPMI with corporate guarantees and certain other security over their assets.

- Waterton Copper is expected to comply in all material respects

with WPMI's Partner/Supplier Code of Conduct, which outlines Wheaton's expectations in regard to environmental, social and governance

("ESG") matters.

Financing the Transactions

As at June 30, 2023, the Company had approximately $829 million of cash on hand, which we believe when combined with the liquidity

provided by the available credit under the $2 billion revolving term loan and ongoing operating cash flows, positions the Company well

to fund the acquisition of the Silver Stream as well as all outstanding commitments and known contingencies and provides flexibility to

acquire additional accretive mineral stream interests.

About Wheaton Precious Metals

Wheaton is the world's premier precious metals streaming company with the highest-quality portfolio of long-life, low-cost assets.

Its business model offers investors commodity price leverage and exploration upside but with a much lower risk profile than a traditional

mining company. Wheaton delivers amongst the highest cash operating margins in the mining industry, allowing it to pay a competitive dividend

and continue to grow through accretive acquisitions. As a result, Wheaton has consistently outperformed gold and silver, as well as other

mining investments. Wheaton is committed to strong ESG practices and giving back to the communities where Wheaton and its mining partners

operate. Wheaton creates sustainable value through streaming for all of its stakeholders.

About Waterton Copper and Mineral Park

Owned and operated by Origin, a subsidiary of Waterton Copper LP, Mineral Park is a polymetallic mine located in north-west Arizona,

18 miles north of Kingsman. A copper-molybdenum-silver porphyry deposit with a long mining history, Mineral Park is currently under Phase

2 construction which is expected to be completed by the end of Q1 2025. Waterton Copper is fully funded and is investing approximately

$600 million to execute Phase 2 of its operating plan, which will bring the site to over one hundred million pounds of copper equivalent

annually and fully modernize the operation.

Attributable Silver Mineral Reserves and Mineral

Resources – Mineral Park Mine

| Category |

Tonnage

Mt |

Grade

Ag g/t |

Contained

Ag Moz |

|

Proven

Probable |

42.4

141.3 |

2.6

2.4 |

3.5

11.1 |

| P&P |

183.7 |

2.5 |

14.6 |

|

Measured

Indicated |

22.6

261.5 |

2.1

2.0 |

1.5

16.9 |

| M&I |

284.1 |

2.0 |

18.4 |

| Inferred |

341.2 |

1.5 |

16.2 |

| |

|

|

| Notes on Mineral Reserves & Mineral Resources: |

|

|

| 1. |

All Mineral Reserves and Mineral Resources have been estimated in accordance with the 2014 Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Standards for Mineral Resources and Mineral Reserves and National Instrument 43-101 – Standards for Disclosure for Mineral Projects ("NI 43-101"). |

|

|

| 2. |

Mineral Reserves and Mineral Resources are reported above in millions of metric tonnes ("Mt"), grams per metric tonne ("g/t") and millions of ounces ("Moz"). |

|

|

| 3. |

Qualified persons ("QPs"), as defined by the NI 43-101, for the technical information contained in this document (including the Mineral Reserve and Mineral Resource estimates) are: |

|

|

| |

a. Neil Burns, M.Sc., P.Geo. (Vice President, Technical Services); and |

|

| |

b. Ryan Ulansky, M.A.Sc., P.Eng. (Vice President, Engineering),

both employees of the Company (the "Company's QPs"). |

| 4. |

The Mineral Resources reported in the above tables are exclusive of Mineral Reserves. |

|

|

| 5. |

Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. |

|

|

| 6. |

Mineral Park Project Mineral Reserves are reported as of September 29, 2023 and Mineral Resources as of October 30, 2021. |

|

|

| 7. |

Mineral Park Mineral Reserves are reported above an NSR cut-off of $10.50 per tonne assuming $2.81 per pound copper, $14.25 per pound molybdenum and $16.13 per ounce silver. |

|

|

| 8. |

Mineral Park Mineral Resources are reported above a 0.15 percent copper equivalent cut-off assuming $3.45 per pound copper, $10.00 per pound molybdenum and $23.00 per ounce silver. |

|

|

| 9. |

The Silver Stream provides that Waterton Copper will deliver silver equal to 100% of the payable silver production for the life of the mine. |

|

|

Neil Burns, P.Geo., Vice President, Technical Services for Wheaton Precious Metals and Ryan Ulansky, P.Eng., Vice President, Engineering,

are a "qualified person" as such term is defined under National Instrument 43-101, and have reviewed and approved the technical

information disclosed in this news release (specifically Mr. Burns has reviewed mineral resource estimates and Mr. Ulansky has reviewed

the mineral reserve estimates).

| ____________________________________________ |

| 1) Please refer to the Attributable Mineral Reserves & Mineral Resources table in this news release for full disclosure of reserves and resources associated with Mineral Park including accompanying footnotes. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking

statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information"

within the meaning of applicable Canadian securities legislation concerning the business, operations and financial performance of Wheaton

and, in some instances, the business, mining operations and performance of Wheaton's Precious Metals Purchase Agreement ("PMPA")

counterparties. Forward-looking statements, which are all statements other than statements of historical fact, include, but are not limited

to, statements with respect to payment by WPMI of $115 million to Waterton Copper and the satisfaction of each party's obligations in

accordance with the Silver Stream, the receipt by Wheaton of silver production in respect of the Project, the future price of commodities,

the estimation of future production from Mining Operations (including in the estimation of production, mill throughput, grades, recoveries

and exploration potential), the estimation of mineral reserves and mineral resources (including the estimation of reserve conversion rates)

and the realization of such estimations, the commencement, timing and achievement of construction, expansion or improvement projects by

Wheaton's PMPA counterparties at mineral stream interests owned by Wheaton (the "Mining Operations"), the payment of upfront

cash consideration to counterparties under PMPAs, the satisfaction of each party's obligations in accordance with PMPAs and royalty arrangements

and the receipt by the Company of precious metals and cobalt production in respect of the applicable Mining Operations under PMPAs or

other payments under royalty arrangements, the ability of Wheaton's PMPA counterparties to comply with the terms of a PMPA (including

as a result of the business, mining operations and performance of Wheaton's PMPA counterparties) and the potential impacts of such on

Wheaton, future payments by the Company in accordance with PMPAs, the costs of future production, the estimation of produced but not yet

delivered ounces, the impact of epidemics (including the COVID-19 virus pandemic), including the potential heightening of other risks,

future sales of common shares under the ATM program, continued listing of the Company's common shares, any statements as to future dividends,

the ability to fund outstanding commitments and the ability to continue to acquire accretive PMPAs, including any acceleration of payments,

projected increases to Wheaton's production and cash flow profile, projected changes to Wheaton's production mix, the ability of Wheaton's

PMPA counterparties to comply with the terms of any other obligations under agreements with the Company, the ability to sell precious

metals and cobalt production, confidence in the Company's business structure, the Company's assessment of taxes payable and the impact

of the CRA Settlement, possible domestic audits for taxation years subsequent to 2016 and international audits, the Company's assessment

of the impact of any tax reassessments, the Company's intention to file future tax returns in a manner consistent with the CRA Settlement,

the Company's climate change and environmental commitments, and assessments of the impact and resolution of various legal and tax matters,

including but not limited to audits. Generally, these forward-looking statements can be identified by the use of forward-looking terminology

such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled",

"estimates", "forecasts", "projects", "intends", "anticipates" or "does not anticipate",

or "believes", "potential", or variations of such words and phrases or statements that certain actions, events or

results "may", "could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of Wheaton to be materially different from those expressed or implied by

such forward-looking statements, including but not limited to risks relating to the satisfaction of each party's obligations in accordance

with the terms of the Silver Stream, risks associated with fluctuations in the price of commodities (including Wheaton's ability to sell

its precious metals or cobalt production at acceptable prices or at all), risks related to the Mining Operations (including fluctuations

in the price of the primary or other commodities mined at such operations, regulatory, political and other risks of the jurisdictions

in which the Mining Operations are located, actual results of mining, risks associated with the exploration, development, operating, expansion

and improvement of the Mining Operations, environmental and economic risks of the Mining Operations, and changes in project parameters

as plans continue to be refined), the absence of control over the Mining Operations and having to rely on the accuracy of the public disclosure

and other information Wheaton receives from the Mining Operations, uncertainty in the estimation of production from Mining Operations,

uncertainty in the accuracy of mineral reserve and mineral resource estimation, risks of significant impacts on Wheaton or the Mining

Operations as a result of an epidemic (including the COVID-19 virus pandemic), the ability of each party to satisfy their obligations

in accordance with the terms of the PMPAs, the estimation of future production from Mining Operations, Wheaton's interpretation of, compliance

with or application of, tax laws and regulations or accounting policies and rules being found to be incorrect, any challenge or reassessment

by the CRA of the Company's tax filings being successful and the potential negative impact to the Company's previous and future tax filings,

assessing the impact of the CRA Settlement (including whether there will be any material change in the Company's facts or change in law

or jurisprudence), potential implementation of a 15% global minimum tax, counterparty credit and liquidity, mine operator concentration,

indebtedness and guarantees, hedging, competition, claims and legal proceedings against Wheaton or the Mining Operations, security over

underlying assets, governmental regulations, international operations of Wheaton and the Mining Operations, exploration, development,

operations, expansions and improvements at the Mining Operations, environmental regulations, climate change, Wheaton and the Mining Operations

ability to obtain and maintain necessary licenses, permits, approvals and rulings, Wheaton and the Mining Operations ability to comply

with applicable laws, regulations and permitting requirements, lack of suitable supplies, infrastructure and employees to support the

Mining Operations, inability to replace and expand mineral reserves, including anticipated timing of the commencement of production by

certain Mining Operations (including increases in production, estimated grades and recoveries), uncertainties of title and indigenous

rights with respect to the Mining Operations, environmental, social and governance matters, Wheaton and the Mining Operations ability

to obtain adequate financing, the Mining Operations ability to complete permitting, construction, development and expansion, global financial

conditions, Wheaton's acquisition strategy and other risks discussed in the section entitled "Description of the Business –

Risk Factors" in Wheaton's Annual Information Form available on SEDAR+ at www.sedarplus.ca and Wheaton's Form 40-F for the year

ended December 31, 2022 on file with the U.S. Securities and Exchange Commission on EDGAR (the "Disclosure"). Forward-looking

statements are based on assumptions management currently believes to be reasonable, including (without limitation): the payment of $115

million to Waterton Copper and the satisfaction of each party's obligations in accordance with the terms of the Silver Stream, that there

will be no material adverse change in the market price of commodities, that the Mining Operations will continue to operate and the mining

projects will be completed in accordance with public statements and achieve their stated production estimates, that the mineral reserves

and mineral resource estimates from Mining Operations (including reserve conversion rates) are accurate, that each party will satisfy

their obligations in accordance with the PMPAs, that Wheaton will continue to be able to fund or obtain funding for outstanding commitments,

that Wheaton will be able to source and obtain accretive PMPAs, that neither Wheaton nor the Mining Operations will suffer significant

impacts as a result of an epidemic (including the COVID-19 virus pandemic), that any outbreak or threat of an outbreak of a virus or other

contagions or epidemic disease will be adequately responded to locally, nationally, regionally and internationally, without such response

requiring any prolonged closure of the Mining Operations or having other material adverse effects on the Company and counterparties to

its PMPAs, that the trading of the Company's common shares will not be adversely affected by the differences in liquidity, settlement

and clearing systems as a result of multiple listings of the Common Shares on the LSE, the TSX and the NYSE, that the trading of the Company's

common shares will not be suspended, and that the net proceeds of sales of common shares, if any, will be used as anticipated, that expectations

regarding the resolution of legal and tax matters will be achieved (including ongoing CRA audits involving the Company), that Wheaton

has properly considered the interpretation and application of Canadian tax law to its structure and operations, that Wheaton has filed

its tax returns and paid applicable taxes in compliance with Canadian tax law, that Wheaton's application of the CRA Settlement is accurate

(including the Company's assessment that there will be no material change in the Company's facts or change in law or jurisprudence), and

such other assumptions and factors as set out in the Disclosure. There can be no assurance that forward-looking statements will prove

to be accurate and even if events or results described in the forward-looking statements are realized or substantially realized, there

can be no assurance that they will have the expected consequences to, or effects on, Wheaton. Readers should not place undue reliance

on forward-looking statements and are cautioned that actual outcomes may vary. The forward-looking statements included herein are for

the purpose of providing readers with information to assist them in understanding Wheaton's expected financial and operational performance

and may not be appropriate for other purposes. Any forward-looking statement speaks only as of the date on which it is made, reflects

Wheaton's management's current beliefs based on current information and will not be updated except in accordance with applicable securities

laws. Although Wheaton has attempted to identify important factors that could cause actual results, level of activity, performance or

achievements to differ materially from those contained in forward-looking statements, there may be other factors that cause results, level

of activity, performance or achievements not to be as anticipated, estimated or intended.

Cautionary Language Regarding Reserves And Resources

For further information on Mineral Reserves and Mineral

Resources and on Wheaton more generally, readers should refer to Wheaton's Annual Information Form for the year ended December 31, 2022,

which was filed on March 31, 2023 and other continuous disclosure documents filed by Wheaton since January 1, 2023, available on SEDAR

at www.sedar.com. Wheaton's Mineral Reserves and Mineral Resources are subject to the qualifications and notes set forth therein. Mineral

Resources which are not Mineral Reserves do not have demonstrated economic viability. Numbers have been rounded as required by reporting

guidelines and may result in apparent summation differences.

Cautionary Note to United States Investors Concerning

Estimates of Measured, Indicated and Inferred Resources: The information contained herein has been prepared in accordance with the

requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The Company

reports information regarding mineral properties, mineralization and estimates of mineral reserves and mineral resources in accordance

with Canadian reporting requirements which are governed by, and utilize definitions required by, Canadian National Instrument 43-101 –

Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum (the

"CIM") – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the

"CIM Standards"). These definitions differ from the definitions adopted by the United States Securities and Exchange Commission

("SEC") under the United States Securities Act of 1933, as amended (the "Securities Act") which are applicable to

U.S. companies. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven

mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources"

and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates

under the standards adopted by the SEC. Information contained herein that describes Wheaton's mineral deposits may not be comparable to

similar information made public by U.S. companies subject to reporting and disclosure requirements under the United States federal securities

laws and the rules and regulations thereunder. United States investors are urged to consider closely the disclosure in Wheaton's Form

40-F, a copy of which may be obtained from Wheaton or from https://www.sec.gov/edgar.shtml.

View original content:https://www.prnewswire.com/news-releases/wheaton-precious-metals-announces-the-acquisition-of-a-new-silver-stream-on-the-mineral-park-mine-301966519.html

SOURCE Wheaton Precious Metals Corp.

View original content: http://www.newswire.ca/en/releases/archive/October2023/24/c2186.html

%CIK: 0001323404

For further information: Wheaton Precious Metals: Investor Contact:

Emma Murray, Vice President, Investor Relations, Tel: 1-844-288-9878, Email: info@wheatonpm.com; Media Contact: Simona Antolak, Vice President,

Communications & Corporate Affairs, Tel: 604-639-9870, Email: simona.antolak@wheatonpm.com; Waterton Copper: Paul Nielson, P. Eng,

Head of Development Portfolio, Principal, Tel: 1-647-289-8246, Email: pnielson@watertonglobal.com

CO: Wheaton Precious Metals Corp.

CNW 18:14e 24-OCT-23

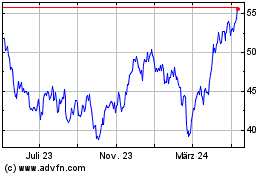

Wheaton Precious Metals (NYSE:WPM)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Wheaton Precious Metals (NYSE:WPM)

Historical Stock Chart

Von Jan 2024 bis Jan 2025