0001739566FALSE00017395662023-11-092023-11-090001739566dei:FormerAddressMember2023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 9, 2023

Utz Brands, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38686 | | 85-2751850 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

900 High Street

Hanover, PA 17331

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (717) 637-6644

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

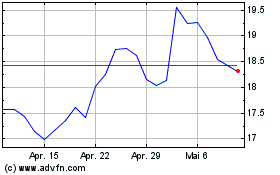

| Class A Common Stock, par value $0.0001 per share | | UTZ | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 9, 2023, Utz Brands, Inc. (the "Company") announced via press release the Company’s financial results for the second quarter ended October 1, 2023. A copy of the Company’s press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is hereby incorporated by reference into this Item 2.02. The information and exhibit contained in this Item 2.02 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 as amended (the “Exchange Act”), nor shall it be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure

The Company will hold a conference call and webcast on November 9, 2023 (see information in the press release under “News” of the Company’s website https://investors.utzsnacks.com). A copy of the slide materials to be discussed at the conference call and webcast is being furnished pursuant to Regulation FD as Exhibit 99.2 to this Current Report on Form 8-K and is hereby incorporated by reference into this Item 7.01. The information and exhibit contained in this Item 7.01 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, nor shall it be incorporated by reference into any filing under the Securities Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Utz Brands, Inc.

Dated: November 9, 2023

By: /s/ Ajay Kataria

Name: Ajay Kataria

Title: Executive Vice President, Chief Financial Officer

Utz Brands Reports Third Quarter 2023 Results

Hanover, PA –November 9, 2023 – Utz Brands, Inc. (NYSE: UTZ) (“Utz” or the “Company”), a leading U.S. manufacturer of branded salty snacks, today reported financial results for the Company’s third fiscal quarter ended October 1, 2023.

3Q’23 Summary:

•Net sales increased 2.5% year-over-year to $371.9 million

•Organic Net Sales increased 3.1% year-over-year

•Net income of $16.2 million vs. net income of $1.5 million in the year-ago period

•Adjusted EBITDA increased 9.2% year-over-year to $52.1 million

“We delivered solid results on both the top and bottom line in the third quarter, with strong growth of our Power Brands, particularly in our Expansion geographies. While Salty Snack category growth continues to normalize after several years of pricing actions, we also have seen some channel shifting due to a more value-conscious consumer. We will remain agile in this dynamic environment,” said Howard Friedman, Chief Executive Officer of Utz.

Friedman continued, “During the quarter we took aggressive actions to optimize our supply chain and portfolio for the future. These actions negatively impacted our second half volume greater than we anticipated, and coupled with the external environment, resulted in a near-term impact to our full-year net sales guidance. However, this stepped-up pace of supply chain and portfolio optimization has already delivered increased productivity and other costs savings, which has enabled us to maintain our full-year Adjusted EBITDA guidance. I believe we have now laid a strong foundation that well positions the Company for fiscal 2024 and beyond. We look forward to sharing more details on our accelerated value creation plans at our Investor Day in December.”

Third Quarter 2023 Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | 13-Weeks Ended |

| (in $millions, except per share amounts) | | October 1, 2023 | | October 2, 2022 | | % Change |

| | | | | | |

| Net Sales | | $ | 371.9 | | | $ | 362.8 | | | 2.5 | % |

| Organic Net Sales | | 374.2 | | | 362.8 | | | 3.1 | % |

| | | | | | |

| Gross Profit | | 119.3 | | | 118.3 | | | 0.8 | % |

| Gross Profit Margin | | 32.1 | % | | 32.6 | % | | (52) | bps |

| Adjusted Gross Profit | | 135.1 | | | 132.6 | | | 1.9 | % |

| Adjusted Gross Profit Margin | | 36.3 | % | | 36.5 | % | | (22) | bps |

| | | | | | |

| Net Income | | 16.2 | | | 1.5 | | | nm |

| Net Income Margin | | 4.4 | % | | 0.4 | % | | nm |

| Adjusted Net Income | | 24.6 | | | 22.5 | | | 9.5 | % |

| Adjusted EBITDA | | 52.1 | | | 47.7 | | | 9.2 | % |

| Adjusted EBITDA Margin | | 14.0 | % | | 13.1 | % | | 86 | bps |

Basic (Loss) Earnings Per Share(1) | | $ | 0.20 | | | $ | (0.01) | | | nm |

Adjusted Earnings Per Diluted Share(1) | | $ | 0.17 | | | $ | 0.16 | | | 9.2 | % |

(1) On an As-Converted Basis

See the description of the Non-GAAP financial measures used in this press release and reconciliations of such Non-GAAP measures to the most comparable GAAP measures in the tables that accompany this press release.

Third Quarter 2023 Results

Net sales in the quarter increased 2.5% to $371.9 million compared to $362.8 million in the third quarter of 2022. The increase in net sales was driven by Organic Net Sales growth of 3.1%, and this was partially offset by the Company’s continued shift to independent operators (“IOs”) and the resulting increase in sales discounts which the Company estimates impacted net sales growth by (0.6%).

Organic Net Sales growth was driven by the flow through of pricing actions that were taken in fiscal 2022 in response to inflationary pressures, which accounted for a 3.7% increase in net sales, partially offset by volume/mix declines of (0.6%). The volume performance in the quarter was driven by strong growth of the Company’s Power Brands while also benefiting from earlier than planned holiday shipments. In addition, volume performance was adversely impacted by supply chain transitions related to the Company’s network optimization initiatives, and its ongoing SKU rationalization program focused on reductions in private label and partner brands. The Company estimates this SKU rationalization program impacted volumes in the third quarter of 2023 by approximately (3.3%). Excluding the impact from SKU rationalization, the Company estimates that volume/mix would have increased 2.7% in the third quarter of 2023 versus the prior year period.

For the 13-week period ended October 1, 2023, the Company’s retail sales, as measured by Circana (formerly IRI) MULO-C, increased 3.2% versus the prior-year period and the Company’s Power Brands’ retail sales increased 5.1% versus the prior-year period(1). Power Brands’ retail sales growth versus the prior-year period was led by Utz®, On The Border®, Zapp’s®, and Boulder Canyon®. The Company’s Foundation Brands’ retail sales decreased (9.1%)(2) versus the prior year period.

(1) Circana (formerly IRI) Total US MULO-C, custom Utz Brands hierarchy, on a pro forma basis.

(2) Circana does not include certain Partner Brands and Private Label sales that are not assigned to Utz Brands.

Gross profit margin was 32.1% compared to 32.6% in the prior year period. Adjusted Gross Margin was 36.3% compared to 36.5% in the prior year period. The benefits from net price realization, productivity, and favorable sales mix more than offset cost inflation and supply chain investments, however the continued shift to IOs impacted Adjusted Gross Margins as expected by approximately 60 basis points, but with offsetting benefits in Selling, Distribution, and Administrative (“SD&A”) expense.

SD&A expenses increased 3.0% compared to the prior-year period. Adjusted SD&A Expense decreased (1.8)% compared to the prior year period primarily due to a reduction in selling costs from the shift to IO’s, lower administrative expenses, and productivity benefits. These factors were partially offset by continued investments in brand marketing, selling infrastructure and people, systems, and supply chain capabilities to support growth.

The Company reported net income of $16.2 million compared to net income of $1.5 million in the prior-year period. The increase in net income compared to the prior year was primarily due to a $16.0 million gain from the remeasurement of private placement warrant liability in the third quarter of 2023 versus a loss of $3.7 million in the prior year period. Partially offsetting this improvement was interest expense of $15.5 million in the current period compared to $11.6 million in the prior year period. The increase in interest expense is primarily attributable to higher interest rates, which impacted the portion of the Company’s floating rate debt, and the Company’s Real Estate Term Loan issued in October 2022.

Adjusted Net Income in the quarter increased 9.5% to $24.6 million compared to $22.5 million in the third quarter of 2022. Adjusted Earnings per Share increased 9.2% to $0.17 compared to $0.16 in the prior year period. Adjusted EBITDA increased 9.2% to $52.1 million, or 14.0% as a percentage of net sales, compared to Adjusted EBITDA of $47.7 million, or 13.1% as a percentage of net sales, in the prior year period.

Balance Sheet and Cash Flow Highlights

•As of October 1, 2023

◦Total liquidity of approximately $209.4 million, consisting of cash on hand of $60.1 million and $149.3 million available under the Company’s revolving credit facility.

◦Net debt of $875.9 million resulting in a Net Leverage Ratio of 4.8x based on trailing twelve months Normalized Adjusted EBITDA of $181.8 million.

•For the 39-weeks ended October 1, 2023

◦Cash flow from operations was $49.1 million, which reflects strong working capital performance in the third quarter. This resulted in fiscal third quarter 2023 cash flow generation of $53.4 million vs $34.4 million in the prior year period.

◦Capital expenditures were $45.7 million, and dividend and distributions paid were $24.1 million.

Fiscal Year 2023 Outlook

The Company is today updating its previously-issued full-year fiscal 2023 financial outlook.

•The Company now expects total net sales growth of 2% to 3% (previously 3% to 5%) and Organic Net Sales growth of 3% to 4% (previously 4% to 6%), with the Company’s continued shift to IOs expected to impact total net sales growth by approximately (-1.0%). The revised range reflects the impact of our aggressive supply chain optimization actions and normalizing Salty Snack category growth with some channel shifting by consumers. Net sales growth is expected to be driven by net price realization, increased marketing and innovation, and continued distribution gains of the Company’s Power Brands, partially offset by the estimated impact of approximately (-3%) from the Company’s SKU rationalization program. Based on these assumptions, the Company now expects volume / mix to be modestly lower than fiscal 2022.

•The Company continues to expect Adjusted EBITDA growth of 8% to 11% driven by stronger operating performance led by the Company’s productivity programs, with continued investments in brand marketing, people, capabilities, and selling infrastructure.

The Company also expects:

•An effective tax rate (normalized GAAP basis tax expense, which excludes one-time items) in the range of 17% to 18% (previously 20% to 22%);

•Interest expense of approximately $55 million;

•Capital expenditures in the range of $50 to $55 million; and

•Net Leverage Ratio below 4.5x at year-end fiscal 2023.

With respect to projected fiscal 2023 Adjusted EBITDA, a quantitative reconciliation is not available without unreasonable efforts due to the high variability, complexity, and low visibility with respect to certain items which are excluded from Adjusted EBITDA. We expect the variability of these items to have a potentially unpredictable, and potentially significant, impact on our future financial results.

Conference Call and Webcast Presentation

The Company will host a conference call to discuss these results today at 8:30 a.m. Eastern Time. Please visit the “Events & Presentations” section of Utz’s Investor Relations website at https://investors.utzsnacks.com to access the live listen-

only webcast and presentation. Participants can also dial in over the phone by calling 1 (888) 510-2008. The Event Plus passcode is 1774171. The Company has also posted presentation slides and additional supplemental financial information, which are available now on Utz’s Investor Relations website.

A replay will be archived online and is also available telephonically approximately two hours after the call concludes through Thursday, November 16, 2023, by dialing 1-800-770-2030, and entering the Event Plus passcode 1774171.

About Utz Brands, Inc.

Utz Brands, Inc. (NYSE: UTZ) manufactures a diverse portfolio of savory snacks through popular brands including Utz®, On The Border® Chips & Dips, Golden Flake®, Zapp’s®, Good Health®, Boulder Canyon®, Hawaiian Brand®, and TORTIYAHS!®, among others.

After a century with strong family heritage, Utz continues to have a passion for exciting and delighting consumers with delicious snack foods made from top-quality ingredients. Utz’s products are distributed nationally through grocery, mass merchandisers, club, convenience, drug, and other channels. Based in Hanover, Pennsylvania, Utz has multiple manufacturing facilities located across the U.S. to serve our growing customer base. For more information, please visit www.utzsnacks.com or call 1‐800‐FOR‐SNAX.

Investors and others should note that Utz announces material financial information to its investors using its investor relations website (https://investors.utzsnacks.com/investors/default.aspx), U.S. Securities and Exchange Commission (the “Commission”) filings, press releases, public conference calls, and webcasts. Utz uses these channels, as well as social media, to communicate with our stockholders and the public about the Company, the Company’s products and other Company information. It is possible that the information that Utz posts on social media could be deemed to be material information. Therefore, Utz encourages investors, the media, and others interested in the Company to review the information posted on the social media channels listed on Utz’s investor relations website.

Investor Contact

Kevin Powers

Utz Brands, Inc.

kpowers@utzsnacks.com

Media Contact

Kevin Brick

Utz Brands, Inc.

kbrick@utzsnacks.com

Forward-Looking Statements

This press release includes certain statements made herein that are not historical facts but are “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. The forward-looking statements generally are accompanied by or include, without limitation, statements such as “will”, “expect”, “intends”, “goal” or other similar words, phrases or expressions. These forward-looking statements include future plans for the Company, the estimated or anticipated future results and benefits of the Company’s future plans and operations, the benefits of the Company’s productivity initiatives, the impact of the Company’s SKU rationalization program, the effects of the Company’s marketing and innovation initiatives, future capital structure, future opportunities for the Company, statements regarding the Company’s projected balance sheet and liabilities, including net leverage, and other statements that are not historical facts. These statements are based on the current expectations of the Company’s management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties and the Company’s business and actual results may differ materially. Factors that may cause such differences include, but are not limited to: the risk that the Company’s gross profit margins may be adversely impacted by a variety of factors, including variations in raw materials pricing, retail customer

requirements and mix, sales velocities and required promotional support; changes in consumers’ loyalty to the Company’s brands due to factors beyond the Company’s control; changes in demand for the Company’s products affected by changes in consumer preferences and tastes or if the Company is unable to innovate or market its products effectively; costs associated with building brand loyalty and interest in the Company’s products, which may be affected by actions by the Company’s competitors’ that result in the Company’s products not suitably differentiated from the products of their competitors; fluctuations in results of operations of the Company from quarter to quarter because of changes in promotional activities; the possibility that the Company may be adversely affected by other economic, business or competitive factors; the risk that recently completed business combinations and other acquisitions recently completed by the Company (collectively, the “Business Combinations”) disrupt plans and operations; the ability to recognize the anticipated benefits of such Business Combinations, which may be affected by, among other things, competition and the ability of the Company to grow and manage growth profitably and retain its key employees; the outcome of any legal proceedings that may be instituted against the Company following the consummation of such Business Combinations; changes in applicable law or regulations; costs related to the Business Combinations; the ability of the Company to maintain the listing of the Company’s Class A Common Stock on the New York Stock Exchange; the inability of the Company to develop and maintain effective internal controls; and other risks and uncertainties set forth in the section entitled “Risk Factors” and “Forward-Looking Statements” in the Company’s Annual Report on Form 10-K filed with the Commission, for the fiscal year ended January 1, 2023 and other reports filed by the Company with the Commission. In addition, forward-looking statements provide the Company’s expectations, plans or forecasts of future events and views as of the date of this communication. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this communication. The Company cautions investors not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based, except as otherwise required by law.

Non-GAAP Financial Measures:

Utz uses non-GAAP financial information and believes it is useful to investors as it provides additional information to facilitate comparisons of historical operating results, identify trends in our underlying operating results and provide additional insight and transparency on how we evaluate the business. We use non-GAAP financial measures to budget, make operating and strategic decisions, and evaluate our performance. These non-GAAP financial measures do not represent financial performance in accordance with generally accepted accounted principles in the United States (“GAAP”) and may exclude items that are significant in understanding and assessing financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that the presentation of these measures may not be comparable to similarly titled measures used by other companies.

Management believes that non-GAAP financial measures should be considered as supplements to the GAAP reported measures, should not be considered replacements for, or superior to, the GAAP measures and may not be comparable to similarly named measures used by other companies. We believe that these non-GAAP measures of financial results provide useful information to investors regarding certain financial and business trends relating to the financial condition and results of operations of the Company to date and that the presentation of non-GAAP financial measures is useful to investors in the evaluation of our operating performance compared to other companies in the salty snack industry, as similar measures are commonly used by the companies in this industry. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. The non-GAAP financial measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance.

Utz uses the following non-GAAP financial measures in its financial communications, and in the future could use others:

•Organic Net Sales

•Adjusted Gross Profit

•Adjusted Gross Profit as % of Net Sales (Adjusted Gross Profit Margin)

•Adjusted Selling, Distribution, and Administrative Expense

•Adjusted Selling, Distribution, and Administrative Expense as % of Net Sales

•Adjusted Net Income

•Adjusted Earnings Per Share

•EBITDA

•Adjusted EBITDA

•Adjusted EBITDA as % of Net Sales (Adjusted EBITDA Margin)

•Normalized Adjusted EBITDA

•Net Leverage Ratio

Organic Net Sales is defined as net sales excluding the impact of acquisitions and excluding the impact of IO route conversions.

Adjusted Gross Profit represents Gross Profit excluding Depreciation and Amortization expense, a non-cash item. In addition, Adjusted Gross Profit excludes the impact of costs that fall within the categories of non-cash adjustments and non-recurring items such as those related to stock-based compensation, hedging and purchase commitments adjustments, asset impairments, acquisition, and integration costs, business transformation initiatives, and financing-related costs. Adjusted Gross Profit is one of the key performance indicators that our management uses to evaluate operating performance. We also report Adjusted Gross Profit as a percentage of Net Sales as an additional measure for investors to evaluate our Adjusted Gross Profit margins on Net Sales.

Adjusted Selling, Distribution, and Administrative Expense is defined as all Selling, Distribution, and Administrative expense excluding Depreciation and Amortization expense, a non- cash item. In addition, Adjusted Selling, Distribution, and Administrative Expenses exclude the impact of costs that fall within the categories of non-cash adjustments and non-recurring items such as those related to stock-based compensation, hedging and purchase commitments adjustments, asset impairments, acquisition and integration costs, business transformation initiatives, and financing-related costs. We also report Adjusted Selling, Distribution, and Administrative Expense as a percentage of Net Sales as an additional measure for investors to evaluate our Adjusted Selling, Distribution, and Administrative margin on Net Sales.

Adjusted Net Income is defined as Net Income excluding the additional Depreciation and Amortization expense, a non-cash item, related to the Business Combination with Collier Creek Holdings and the acquisitions of Kennedy Endeavors, Kitchen Cooked, Inventure, Golden Flake, Truco Enterprises, R.W. Garcia and Festida. In addition, Adjusted Net Income is also adjusted to exclude deferred financing fees, interest income, and expense relating to IO loans and certain non-cash items, such as those related to stock-based compensation, hedging, and purchase commitments adjustments, asset impairments, acquisition and integration costs, business transformation initiatives, remeasurement of warrant liabilities and financing-related costs. Lastly, Adjusted Net Income normalizes the income tax provision to account for the above-mentioned adjustments.

Adjusted Earnings Per Share is defined as Adjusted Net Income (as defined, herein) divided by the weighted average shares outstanding for each period on a fully diluted basis, assuming the Private Placement Warrants are net settled and the Shares of Class V Common Stock held by Continuing Members is converted to Class A Common Stock.

EBITDA is defined as Net Income before Interest, Income Taxes, and Depreciation and Amortization.

Adjusted EBITDA is defined as EBITDA further adjusted to exclude certain non-cash items, such as stock-based compensation, hedging and purchase commitments adjustments, and asset impairments; acquisition and integration costs; business transformation initiatives; and financing-related costs. Adjusted EBITDA is one of the key performance indicators we use in evaluating our operating performance and in making financial, operating, and planning decisions.

We believe Adjusted EBITDA is useful to the users of this release and financial information contained in the release in the evaluation of Utz’s operating performance compared to other companies in the salty snack industry, as similar measures are commonly used by companies in this industry. We have historically reported an Adjusted EBITDA metric to investors and banks for covenant compliance. We also provide in this release, Adjusted EBITDA as a percentage of Net Sales, as an additional measure for readers to evaluate our Adjusted EBITDA margins on Net Sales.

Normalized Adjusted EBITDA is defined as Adjusted EBITDA after giving effect to pre-acquisition Adjusted EBITDA of the Festida Foods and R.W. Garcia acquisitions, and the buyout of Clem and J&D Snacks.

Net Leverage Ratio is defined as Normalized Adjusted EBITDA divided by Net Debt. Net Debt is defined as Gross Debt less Cash and Cash Equivalents.

Management believes that the non-GAAP financial measures are meaningful to investors because they increase transparency and assist investors to understand and analyze our ongoing operational performance. The financial measures are shown as supplemental disclosures in this release because they are widely used by the investment community for analysis and comparative evaluation. They also provide additional metrics to evaluate the Company’s operations and, when considered with both the GAAP results and the reconciliation to the most comparable GAAP measures, provide a more complete understanding of the Company’s business than could be obtained absent this disclosure. The non-GAAP measures are not and should not be considered an alternative to the most comparable GAAP measures or any other figure calculated in accordance with GAAP, or as an indicator of operating performance. The Company’s calculation of the non-GAAP financial measures may differ from methods used by other companies. Management believes that the non-GAAP measures are important to have an understanding of the Company’s overall operating results in the periods presented. The non-GAAP financial measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. As new events or circumstances arise, these definitions could change. When the definitions change, we will provide the updated definitions and present the related non-GAAP historical results on a comparable basis.

Utz Brands, Inc.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

For the thirteen weeks ended October 1, 2023 and October 2, 2022

(In thousands, except share information)

(Unaudited)

| | | | | | | | | | | |

| (in thousands) | Thirteen weeks ended October 1, 2023 | | Thirteen weeks ended October 2, 2022 |

| Net sales | $ | 371,852 | | | $ | 362,818 | |

| Cost of goods sold | 252,583 | | | 244,545 | |

| Gross profit | 119,269 | | | 118,273 | |

| | | |

| Selling, distribution, and administrative expenses | | | |

| Selling and distribution | 70,973 | | | 69,263 | |

| Administrative | 34,531 | | | 33,182 | |

| Total selling, distribution, and administrative expenses | 105,504 | | | 102,445 | |

| | | |

| Loss on sale of assets, net | (8,488) | | | (823) | |

| | | |

| Income from operations | 5,277 | | | 15,005 | |

| | | |

| Other income (expense) | | | |

| Interest expense | (15,537) | | | (11,648) | |

| Other income | 392 | | | 205 | |

| Gain (loss) on remeasurement of warrant liability | 15,984 | | | (3,672) | |

| Other income (expense), net | 839 | | | (15,115) | |

| | | |

| Income (loss) before taxes | 6,116 | | | (110) | |

| Income tax benefit | (10,099) | | | (1,595) | |

| Net income | 16,215 | | | 1,485 | |

| | | |

| Net income attributable to noncontrolling interest | (222) | | | (2,373) | |

| Net income (loss) attributable to controlling interest | $ | 15,993 | | | $ | (888) | |

| | | |

Earnings per Class A Common stock: (in dollars) | | | |

| Basic | $ | 0.20 | | | $ | (0.01) | |

| Diluted | $ | 0.19 | | | $ | (0.01) | |

| Weighted-average shares of Class A Common stock outstanding | | | |

| Basic | 81,141,417 | | | 80,812,835 | |

| Diluted | 83,444,275 | | | 80,812,835 | |

| | | |

| Net income | $ | 16,215 | | | $ | 1,485 | |

| Other comprehensive income: | | | |

| Change in fair value of interest rate swap | 4,047 | | | 19,655 | |

| Comprehensive income | 20,262 | | | 21,140 | |

| Net comprehensive (income) loss attributable to noncontrolling interest | (1,932) | | | (10,696) | |

| Net comprehensive income attributable to controlling interest | $ | 18,330 | | | $ | 10,444 | |

Utz Brands, Inc.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

For the thirty-nine weeks ended October 1, 2023 and October 2, 2022

(In thousands, except share information)

(Unaudited)

| | | | | | | | | | | |

| (in thousands) | Thirty-nine weeks ended October 1, 2023 | | Thirty-nine weeks ended October 2, 2022 |

| Net sales | $ | 1,086,138 | | | $ | 1,053,732 | |

| Cost of goods sold | 744,980 | | | 720,123 | |

| Gross profit | 341,158 | | | 333,609 | |

| | | |

| Selling, distribution, and administrative expenses | | | |

| Selling and distribution | 202,888 | | | 226,169 | |

| Administrative | 123,155 | | | 110,549 | |

| Total selling, distribution, and administrative expenses | 326,043 | | | 336,718 | |

| | | |

| (Loss) gain on sale of assets, net | (9,275) | | | 919 | |

| | | |

| Income (loss) from operations | 5,840 | | | (2,190) | |

| | | |

| Other (expense) income | | | |

| Interest expense | (44,934) | | | (31,478) | |

| Other income | 2,279 | | | 80 | |

| Gain on remeasurement of warrant liability | 16,560 | | | 4,032 | |

| Other expense, net | (26,095) | | | (27,366) | |

| | | |

| Loss before taxes | (20,255) | | | (29,556) | |

| Income tax benefit | (13,435) | | | (1,688) | |

| Net loss | (6,820) | | | (27,868) | |

| | | |

| Net loss attributable to noncontrolling interest | 9,562 | | | 12,589 | |

| Net income (loss) attributable to controlling interest | $ | 2,742 | | | $ | (15,279) | |

| | | |

Income (loss) per Class A Common stock: (in dollars) | | | |

| Basic | $ | 0.03 | | | $ | (0.19) | |

| Diluted | $ | 0.03 | | | $ | (0.19) | |

| Weighted-average shares of Class A Common stock outstanding | | | |

| Basic | 81,060,961 | | | 79,852,137 | |

| Diluted | 83,567,756 | | | 79,852,137 | |

| | | |

| Net loss | $ | (6,820) | | | $ | (27,868) | |

| Other comprehensive income: | | | |

| Change in fair value of interest rate swap | 3,294 | | | 50,475 | |

| Comprehensive (loss) income | (3,526) | | | 22,607 | |

| Net comprehensive loss (income) attributable to noncontrolling interest | 8,173 | | | (8,981) | |

| Net comprehensive income (loss) attributable to controlling interest | $ | 4,647 | | | $ | 13,626 | |

Utz Brands, Inc.

CONSOLIDATED BALANCE SHEETS

October 1, 2023 and January 1, 2023

(In thousands)

| | | | | | | | | | | |

| | As of

October 1, 2023 | | As of January 1, 2023 |

| | (Unaudited) | | |

| ASSETS | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 60,094 | | | $ | 72,930 | |

| Accounts receivable, less allowance of $2,638 and $1,815, respectively | 132,038 | | | 136,985 | |

| Inventories | 116,674 | | | 118,006 | |

| Prepaid expenses and other assets | 44,196 | | | 34,991 | |

| Current portion of notes receivable | 5,553 | | | 9,274 | |

| Total current assets | 358,555 | | | 372,186 | |

| Non-current Assets | | | |

| Property, plant and equipment, net | 329,846 | | | 345,198 | |

| Goodwill | 915,295 | | | 915,295 | |

| Intangible assets, net | 1,070,691 | | | 1,099,565 | |

| Non-current portion of notes receivable | 13,246 | | | 12,794 | |

| Other assets | 109,267 | | | 95,328 | |

| Total non-current assets | 2,438,345 | | | 2,468,180 | |

| Total assets | $ | 2,796,900 | | | $ | 2,840,366 | |

| LIABILITIES AND EQUITY | | | |

| Current Liabilities | | | |

| Current portion of term debt | $ | 20,649 | | | $ | 18,472 | |

| Current portion of other notes payable | 8,317 | | | 12,589 | |

| Accounts payable | 135,931 | | | 114,360 | |

| Accrued expenses and other | 62,714 | | | 92,012 | |

| Total current liabilities | 227,611 | | | 237,433 | |

| Non-current portion of term debt and revolving credit facility | 895,172 | | | 893,335 | |

| Non-current portion of other notes payable | 19,496 | | | 20,339 | |

| Non-current accrued expenses and other | 75,551 | | | 67,269 | |

| Non-current warrant liability | 28,944 | | | 45,504 | |

| Deferred tax liability | 114,059 | | | 124,802 | |

| Total non-current liabilities | 1,133,222 | | | 1,151,249 | |

| Total liabilities | 1,360,833 | | | 1,388,682 | |

| Commitments and Contingencies | | | |

| Equity | | | |

| Shares of Class A Common Stock, $0.0001 par value; 1,000,000,000 shares authorized; 81,141,417 and 80,882,334 shares issued and outstanding as of October 1, 2023 and January 1, 2023, respectively | 8 | | | 8 | |

| Shares of Class V Common Stock, $0.0001 par value; 61,249,000 shares authorized; 59,349,000 shares issued and outstanding as of October 1, 2023 and January 1, 2023 | 6 | | | 6 | |

| Additional paid-in capital | 938,898 | | | 926,919 | |

| Accumulated deficit | (265,743) | | | (254,564) | |

| Accumulated other comprehensive income | 32,682 | | | 30,777 | |

| Total stockholders' equity | 705,851 | | | 703,146 | |

| Noncontrolling interest | 730,216 | | | 748,538 | |

| Total equity | 1,436,067 | | | 1,451,684 | |

| Total liabilities and equity | $ | 2,796,900 | | | $ | 2,840,366 | |

Utz Brands, Inc.

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the thirty-nine weeks ended October 1, 2023 and October 2, 2022

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| Thirty-nine weeks ended October 1, 2023 | | Thirty-nine weeks ended October 2, 2022 |

| Cash flows from operating activities | | | |

| Net loss | $ | (6,820) | | | $ | (27,868) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Impairment and other charges | 9,548 | | | 4,678 | |

| Depreciation and amortization | 60,114 | | | 66,345 | |

| Gain on remeasurement of warrant liability | (16,560) | | | (4,032) | |

| Loss (gain) on sale of assets | 9,275 | | | (919) | |

| Share-based compensation | 11,808 | | | 7,579 | |

| Deferred taxes | (10,743) | | | (1,315) | |

| Deferred financing costs | 1,084 | | | 1,047 | |

| Changes in assets and liabilities: | | | |

| Accounts receivable, net | 4,947 | | | (12,628) | |

| Inventories | 644 | | | (27,866) | |

| Prepaid expenses and other assets | (20,183) | | | (18,308) | |

| Accounts payable and accrued expenses and other | 6,016 | | | 21,358 | |

| Net cash provided by operating activities | 49,130 | | | 8,071 | |

| Cash flows from investing activities | | | |

| Acquisitions, net of cash acquired | — | | | (75) | |

| Purchases of property and equipment | (45,707) | | | (68,708) | |

| | | |

| Proceeds from sale of property and equipment | 8,794 | | | 4,100 | |

| Proceeds from sale of routes | 21,683 | | | 16,819 | |

| Proceeds from the sale of IO notes | 4,094 | | | 5,017 | |

| Proceeds from insurance claims for capital investments | — | | | 3,935 | |

| Notes receivable, net | (26,369) | | | (14,028) | |

| Net cash used in investing activities | (37,505) | | | (52,940) | |

| Cash flows from financing activities | | | |

| Line of credit borrowings, net | 20,324 | | | 40,390 | |

| Borrowings on term debt and notes payable | 4,273 | | | 33,969 | |

| Repayments on term debt and notes payable | (23,744) | | | (20,692) | |

| Payment of debt issuance cost | (655) | | | (1,471) | |

| Payments of tax withholding requirements for employee stock awards | (589) | | | (6,217) | |

| | | |

| Proceeds from issuance of shares | — | | | 28,000 | |

| Dividends | (13,921) | | | (12,793) | |

| Distribution to noncontrolling interest | (10,149) | | | (6,410) | |

| Net cash (used in) provided by financing activities | (24,461) | | | 54,776 | |

| Net (decrease) increase in cash and cash equivalents | (12,836) | | | 9,907 | |

| Cash and cash equivalents at beginning of period | 72,930 | | | 41,898 | |

| Cash and cash equivalents at end of period | $ | 60,094 | | | $ | 51,805 | |

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures

Net Sales and Organic Net Sales

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 13-Weeks Ended | | | | 39-Weeks Ended | | |

| (dollars in millions) | | October 1, 2023 | | October 2, 2022 | | Change | | October 1, 2023 | | October 2, 2022 | | Change |

| Net Sales as Reported | | $ | 371.9 | | | $ | 362.8 | | | 2.5 | % | | $ | 1,086.1 | | | $ | 1,053.7 | | | 3.1 | % |

| Impact of Acquisitions | | — | | | — | | | | | — | | | — | | | |

| Impact of IO Conversions | | 2.3 | | | — | | | | | 7.6 | | | — | | | |

| Organic Net Sales | | $ | 374.2 | | | $ | 362.8 | | | 3.1 | % | | $ | 1,093.7 | | | $ | 1,053.7 | | | 3.8 | % |

(1) Organic Net Sales excludes the Impact of Acquisitions and the Impact of IO Conversions that took place after Q2 2022.

Gross Profit and Adjusted Gross Profit

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 13-Weeks Ended | | 39-Weeks Ended |

| (dollars in millions) | | October 1, 2023 | | October 2, 2022 | | October 1, 2023 | | October 2, 2022 |

| Gross Profit | | $ | 119.3 | | | $ | 118.3 | | | $ | 341.2 | | | $ | 333.6 | |

| Depreciation and Amortization | | 8.3 | | | 10.3 | | | 25.9 | | | 31.8 | |

| Non-Cash, Non-recurring adjustments | | 7.5 | | | 4.0 | | | 15.9 | | | 8.9 | |

| Adjusted Gross Profit | | $ | 135.1 | | | $ | 132.6 | | | $ | 383.0 | | | $ | 374.3 | |

| Adjusted Gross Profit as a % of Net Sales | | 36.3 | % | | 36.5 | % | | 35.3 | % | | 35.5 | % |

Adjusted Selling, Distribution, and Administrative Expense

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 13-Weeks Ended | | 39-Weeks Ended |

| (dollars in millions) | | October 1, 2023 | | October 2, 2022 | | October 1, 2023 | | October 2, 2022 |

| Selling, Distribution, and Administrative Expense | | $ | 105.5 | | | $ | 102.4 | | | $ | 326.0 | | | $ | 336.7 | |

| Depreciation and Amortization in SD&A Expense | | (11.4) | | (11.5) | | (34.2) | | (34.5) |

| Non-Cash, and/or Non-recurring Adjustments | | (11.1) | | (6.4) | | (46.6) | | (54.6) |

| Adjusted Selling, Distribution, and Administrative Expense | | $ | 83.0 | | $ | 84.5 | | $ | 245.2 | | $ | 247.6 |

| Adjusted SD&A Expense as a % of Net Sales | | 22.3 | % | | 23.3 | % | | 22.6 | % | | 23.5 | % |

Adjusted Net Income

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 13-Weeks Ended | | 39-Weeks Ended |

| (dollars in millions, except per share data) | | October 1, 2023 | | October 2, 2022 | | October 1, 2023 | | October 2, 2022 |

| Net Income (Loss) | | $ | 16.2 | | | $ | 1.5 | | | $ | (6.8) | | | $ | (27.9) | |

| Income Tax (Benefit) Expense | | (10.1) | | | (1.6) | | | (13.4) | | | (1.7) | |

| Income (Loss) Before Taxes | | 6.1 | | | (0.1) | | | (20.2) | | | (29.6) | |

| Deferred Financing Fees | | 0.6 | | | 0.3 | | | 1.1 | | | 1.0 | |

| Acquisition Step-Up Depreciation and Amortization | | 12.0 | | | 13.2 | | | 35.6 | | | 39.6 | |

| Certain Non-Cash Adjustments | | 24.5 | | | 0.9 | | | 42.2 | | | 9.2 | |

| Acquisition and Integration | | 1.3 | | | 4.8 | | | 8.7 | | | 40.8 | |

| Business and Transformation Initiatives | | 1.4 | | | 5.4 | | | 19.9 | | | 13.3 | |

| Financing-Related Costs | | 0.1 | | | — | | | 0.2 | | | 0.2 | |

| (Gain) Loss on Remeasurement of Warrant Liability | | (16.0) | | | 3.7 | | | (16.6) | | | (4.0) | |

| Other Non-Cash and/or Non-Recurring Adjustments | | 23.9 | | | 28.3 | | | 91.1 | | | 100.1 | |

| Adjusted Earnings before Taxes | | 30.0 | | | 28.2 | | | 70.9 | | | 70.5 | |

| Taxes on Earnings as Reported | | 10.1 | | | 1.6 | | | 13.4 | | | 1.7 | |

Income Tax Adjustments(1) | | (15.5) | | | (7.3) | | | (25.9) | | | (16.0) | |

| Adjusted Taxes on Earnings | | (5.4) | | | (5.7) | | | (12.5) | | | (14.3) | |

| Adjusted Net Income | | $ | 24.6 | | | $ | 22.5 | | | $ | 58.4 | | | $ | 56.2 | |

| | | | | | | | |

| Average Weighted Basic Shares Outstanding on an As-Converted Basis | | 140.5 | | | 140.2 | | | 140.4 | | | 139.2 | |

| Fully Diluted Shares on an As-Converted Basis | | 142.8 | | | 142.5 | | | 142.9 | | | 141.1 | |

| Adjusted Earnings Per Share | | $ | 0.17 | | | $ | 0.16 | | | $ | 0.41 | | | $ | 0.40 | |

(1) Income Tax Adjustment calculated as (Loss) Income before taxes plus (i) Acquisition, Step-Up Depreciation and Amortization and (ii) Other Non-Cash and/or Non-Recurring Adjustments, multiplied by a normalized GAAP effective tax rate, minus the actual tax provision recorded in the Consolidated Statement of Operations and Comprehensive Loss. The normalized GAAP effective tax rate excludes one-time items such as the impact of tax rate changes on deferred taxes and changes in valuation allowances.

Depreciation & Amortization

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 13-Weeks Ended | | 39-Weeks Ended |

| (dollars in millions) | | October 1, 2023 | | October 2, 2022 | | October 1, 2023 | | October 2, 2022 |

| Core D&A - Non-Acquisition-related included in Gross Profit | | $ | 5.4 | | | $ | 6.2 | | | $ | 17.5 | | | $ | 19.5 | |

| Step-Up D&A - Transaction-related included in Gross Profit | | 2.9 | | | 4.1 | | | 8.4 | | | 12.3 | |

| Depreciation & Amortization - included in Gross Profit | | 8.3 | | | 10.3 | | | 25.9 | | | 31.8 | |

| | | | | | | | |

| Core D&A - Non-Acquisition-related included in SD&A Expense | | 2.3 | | 2.4 | | 7 | | 7.2 |

| Step-Up D&A - Transaction-related included in SD&A Expense | | 9.1 | | | 9.1 | | | 27.2 | | | 27.3 | |

| Depreciation & Amortization - included in SD&A Expense | | 11.4 | | | 11.5 | | | 34.2 | | | 34.5 | |

| | | | | | | | |

| Depreciation & Amortization - Total | | $ | 19.7 | | | $ | 21.8 | | | $ | 60.1 | | | $ | 66.3 | |

| | | | | | | | |

| Core Depreciation and Amortization | | $ | 7.7 | | | $ | 8.6 | | | $ | 24.5 | | | $ | 26.7 | |

| Step-Up Depreciation and Amortization | | 12.0 | | 13.2 | | 35.6 | | 39.6 |

| Total Depreciation and Amortization | | $ | 19.7 | | | $ | 21.8 | | | $ | 60.1 | | | $ | 66.3 | |

EBITDA and Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 13-Weeks Ended | | 39-Weeks Ended |

| (dollars in millions) | | October 1, 2023 | | October 2, 2022 | | October 1, 2023 | | October 2, 2022 |

| Net Income (Loss) | | $ | 16.2 | | | $ | 1.5 | | | $ | (6.8) | | | $ | (27.9) | |

| Plus non-GAAP adjustments: | | | | | | | | |

| Income Tax (Benefit) Expense | | (10.1) | | | (1.6) | | | (13.4) | | | (1.7) | |

| Depreciation and Amortization | | 19.7 | | | 21.8 | | | 60.1 | | | 66.3 | |

| Interest Expense, Net | | 15.5 | | | 11.6 | | | 44.9 | | | 31.5 | |

| Interest Income from IO loans(1) | | (0.5) | | | (0.4) | | | (1.4) | | | (1.3) | |

| EBITDA | | 40.8 | | | 32.9 | | | 83.4 | | | 66.9 | |

| Certain Non-Cash Adjustments(2) | | 24.5 | | | 0.9 | | | 42.2 | | | 9.2 | |

| Acquisition and Integration(3) | | 1.3 | | | 4.8 | | | 8.7 | | | 40.8 | |

| Business Transformation Initiatives(4) | | 1.4 | | | 5.4 | | | 19.9 | | | 13.3 | |

| Financing-Related Costs(5) | | 0.1 | | | — | | | 0.2 | | | 0.2 | |

| (Gain) loss on Remeasurement of Warrant Liabilities(6) | | (16.0) | | | 3.7 | | | (16.6) | | | (4.0) | |

| Adjusted EBITDA | | $ | 52.1 | | | $ | 47.7 | | | $ | 137.8 | | | $ | 126.4 | |

| | | | | | | | |

| Net income (loss) as a % of Net Sales | | 4.4 | % | | 0.4 | % | | (0.6) | % | | (2.6) | % |

| Adjusted EBITDA as a % of Net Sales | | 14.0 | % | | 13.1 | % | | 12.7 | % | | 12.0 | % |

(1)Interest Income from IO loans refers to Interest Income that we earn from IO notes receivable that have resulted from our initiatives to transition from RSP distribution to IO distribution (“Business Transformation Initiatives”). There is a notes payable recorded that mirrors most of the IO notes receivable, and the interest expense associated with the notes payable is part of the Interest Expense, Net adjustment.

(2)Certain Non-Cash Adjustments are comprised primarily of the following:

Incentive programs – The Company incurred $3.7 million and $1.9 million of share-based compensation expense, that was awarded to associates and directors, and compensation expense associated with the employee stock purchase plan for the thirteen weeks ended October 1, 2023 and October 2, 2022, respectively. The Company incurred $11.8 million and $6.7 million of share-based compensation, that was awarded to associates and directors, and compensation expense associated with the employee stock purchase plan for the thirty-nine weeks ended October 1, 2023 and October 2, 2022, respectively.

Asset Impairments and Write-Offs — For the thirteen weeks ended October 1, 2023, the Company recorded an adjustment for a non-cash loss on sale of $13.7 million related to fixed assets for the sale of the Bluffton, Indiana plant along with the transfer of $4.7 million from Business Transformation Initiatives in note (4) below related to the termination of a contract that was settled with the sale. During the thirteen and thirty-nine weeks ended October 1, 2023, the Company recorded impairments and non-cash loss on sale totaling $0.1 million and $23.3 million, respectively. During the thirty-nine weeks ended October 2, 2022, the Company recorded an impairment of $2.0 million related to the termination of a distribution agreements.

Purchase Commitments and Other Adjustments – We have purchase commitments and options for specific quantities at fixed prices for certain of our products’ key ingredients. To facilitate comparisons of our underlying operating results, this adjustment was made to remove the volatility of purchase commitments and options related unrealized gains and losses. The adjustment related to Purchase Commitment and Other non-cash adjustment (gains) losses were $1.4 million and $(1.0) million for the thirteen weeks ended October 1, 2023 and October 2, 2022, respectively. The thirty-nine weeks ended October 1, 2023 and October 2, 2022 also included $1.4 million and $0.5 million of unrealized purchase commitment losses, respectively. Additionally, we recorded $0.9 million for the amortization of cloud-based computing assets for the thirteen and thirty-nine weeks ended, October 1, 2023.

(3)Adjustment for Acquisition and Integration Costs – This is comprised of consulting, transaction services, and legal fees incurred for acquisitions and certain potential acquisitions, in addition to expenses associated with integrating recent acquisitions. Such expenses were $1.2 million and $9.5 million for the thirteen and thirty-nine weeks ended October 1, 2023, respectively, as well as $0.1 million of expense and $0.8 million of income for the change of the Tax Receivable Agreement Liability associated with the Business Combination for the thirteen and thirty-nine weeks ended October 1, 2023, respectively. Charges related to the buyout of multiple distributors, which was accounted for as a contract termination resulted in expense of $23.0 million for the thirty-nine week period ended October 2, 2022. Additionally, other acquisitions and integration cost of $4.8 million and $16.8 million were recorded for the thirteen and thirty-nine weeks ended October 2, 2022, respectively, also included are adjustment of $1.0 million of expense for the increase of the Tax Receivable Agreement Liability associated with the Business Combination for the thirty-nine week period ended October 2, 2022.

(4)Business Transformation Initiatives Adjustment – This adjustment is related to consultancy, professional, legal, closure and other expenses incurred for specific initiatives and structural changes to the business that do not reflect the cost of normal business operations. In addition, gains and losses realized from the sale of distribution rights to IOs and the subsequent disposal of trucks, severance costs associated with the elimination of RSP positions, and Enterprise Resource Planning transition costs, fall into this category. The Company incurred such costs of $6.1 million and $5.4 million for the thirteen weeks ended October 1, 2023 and October 2, 2022, respectively, and $24.6 million and $13.3 million for the thirty-nine weeks ended October 1, 2023 and October 2, 2022, respectively, which included the closure of our Gramercy, Louisiana and Birmingham, Alabama plants along with various other supply chain, commercial and administrative initiatives. Additionally, as noted above, the costs for the thirteen and thirty-nine weeks ended October 1, 2023 also includes a transfer of expense of $(4.7) million related to a contract termination that was not settled in cash. During 2023, we completed the closure of our Gramercy, Louisiana and Birmingham, Alabama manufacturing plants along with the sale of our Bluffton, IN manufacturing plant.

(5)Financing-Related Costs – These costs include adjustments for various items related to raising debt and equity capital or debt extinguishment costs.

(6)Gains and losses related to the changes in the remeasurement of warrant liabilities are not expected to be settled in cash, and when exercised would result in a cash inflow to the Company with the Warrants converting to Class A Common Stock with the liability being extinguished and the fair value of the Warrants at the time of exercise being recorded as an increase to equity.

Normalized Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | FY 2022 | | | | | FY 2023 | | |

| (dollars in millions) | | Q1 | | Q2 | | Q3 | | Q4 | | FY 2022 | | | Q1 | | Q2 | | Q3 | | Trailing 52-weeks |

| Adjusted EBITDA | | $ | 36.5 | | | $ | 42.2 | | | $ | 47.7 | | | $ | 44.1 | | | $ | 170.5 | | | | $ | 40.4 | | | $ | 45.2 | | | $ | 52.1 | | | $ | 181.8 | |

Pre-Acquisition Adjusted EBITDA(1) | | 0.2 | | | — | | | — | | | — | | | 0.2 | | | | — | | | — | | | — | | | — | |

| Normalized Adjusted EBITDA | | $ | 36.7 | | | $ | 42.2 | | | $ | 47.7 | | | $ | 44.1 | | | $ | 170.7 | | | | $ | 40.4 | | | $ | 45.2 | | | $ | 52.1 | | | $ | 181.8 | |

(1) Pre-Acquisition Adjusted EBITDA - This adjustment represents the Adjusted EBITDA of acquired companies, prior to the acquisition date, as well as from the buyout date of Clem and J&D Snacks.

Net Debt and Leverage Ratio

| | | | | | | | |

| (dollars in millions) | | As of October 1, 2023 |

| Term Loan | | $ | 773.3 | |

| Real Estate Loan | | 81.0 | |

| ABL Facility | | 20.4 | |

Capital Leases(1) | | 61.1 | |

| Deferred Purchase Price | | 0.2 | |

Gross Debt(2) | | 936.0 |

| Cash and Cash Equivalents | | 60.1 | |

| Total Net Debt | | $ | 875.9 | |

| | |

| Last 52-Weeks Normalized Adjusted EBITDA | | $ | 181.8 | |

| | |

Net Leverage Ratio(3) | | 4.8x |

(1) Capital Leases include equipment term loans and excludes the impact of step-up accounting.

(2) Excludes amounts related to guarantees on IO loans which are collateralized by routes. We have the ability to recover substantially all of the outstanding loan value in the event of a default scenario, which historically has been uncommon.

(3) Based on Normalized Adjusted EBITDA of $181.8 million.

Utz Brands, Inc. T H I R D Q U A R T E R 2 0 2 3 E A R N I N G S P R E S E N T A T I O N N O V E M B E R 9 , 2 0 2 3

UTZ BRANDS, INC. Q3 2023 Earnings Presentation 2 Disclaimer Forward-Looking Statements Certain statements made herein are not historical facts but are “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. The forward-looking statements generally are accompanied by or include, without limitation, statements such as “will”, “expect”, “intends”, “goal” or other similar words, phrases or expressions. These forward-looking statements include the expected effects from the COVID-19 pandemic, future plans for the Utz Brands, Inc. (“the Company”), the estimated or anticipated future results and benefits of the Company’s future plans and operations, the benefits of the Company’s productivity initiatives, the impact of the Company’s SKU rationalization program, the effects of the Company’s marketing and innovation initiatives, the benefits of the Company's network optimization efforts, future capital structure, future opportunities for the Company, the effects of inflation or supply chain disruptions, statements regarding the Company’s project balance sheet and liabilities, including net leverage, and other statements that are not historical facts. These statements are based on the current expectations of the Company’s management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties and the Company’s business and actual results may differ materially. Factors that may cause such differences include, but are not limited to: the risk that the Company’s gross profit margins may be adversely impacted by a variety of factors, including variations in raw materials pricing, retail customer requirements and mix, sales velocities and required promotional support; changes in consumers’ loyalty to the Company’s brands due to factors beyond the Company’s control; changes in demand for the Company’s products affected by changes in consumer preferences and tastes or if the Company is unable to innovate or market its products effectively; costs associated with building brand loyalty and interest in the Company’s products, which may be affected by actions by the Company’s competitors’ that result in the Company’s products not suitably differentiated from the products of their competitors; fluctuations in results of operations of the Company from quarter to quarter because of changes in promotional activities; the possibility that the Company may be adversely affected by other economic, business or competitive factors; the risk that the Company may not recognize the anticipated benefits of recently completed business combinations and other acquisitions recently completed by the Company (collectively, the “Business Combinations”), which may be affected by, among other things, competition and the ability of the Company to grow and manage growth profitably and retain its key employees; the ability of the Company to close planned acquisitions; changes in applicable law or regulations; costs related to the Business Combinations and other planned acquisitions; the inability of the Company to maintain the listing of the Company’s Class A Common Stock on the New York Stock Exchange; the inability of the Company to develop and maintain effective internal controls; and other risks and uncertainties set forth in the section entitled “Risk Factors” and “Forward-Looking Statements” in the Company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “Commission”) for the fiscal year ended January 1, 2023, and other reports filed by the Company with the Commission. In addition, forward-looking statements provide the Company’s expectations, plans or forecasts of future events and views as of the date of this communication. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this communication. The Company cautions investors not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based, except as otherwise required by law. Industry Information Unless otherwise indicated, information contained in this presentation or made orally during this presentation concerning the Company’s industry, competitive position and the markets in which it operates is based on information from independent and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from the Company’s internal research, and are based on assumptions made by the Company upon reviewing such data, and the Company’s experience in, and knowledge of, such industry and markets, which the Company believes to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which the Company operates, and the Company’s future performance are necessarily subject to uncertainty and risk due to a variety of factors, which could cause results to differ materially from those expressed in the estimates made by the independent parties and by the Company. Non-GAAP Financial Measures This presentation includes certain financial measures not presented in accordance with generally accepted accounting principles in the United States (“GAAP”) including, but not limited to, Organic Net Sales, Adjusted Gross Profit, Adjusted SD&A, EBITDA, Adjusted EBITDA, Normalized Adjusted EBITDA, Adjusted Net Income, and Adjusted Earnings Per Share, and certain ratios and other metrics derived therefrom. These non-GAAP financial measures do not represent financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that the presentation of these measures may not be comparable to similarly-titled measures used by other companies. Reconciliations of these non-GAAP measures to the most directly comparable GAAP measures are set forth in the appendix to this presentation. We believe (i) these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the financial condition and results of operations of the Company to date; and (ii) that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in comparing financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. The non-GAAP financial measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance.

Business Overview H O W A R D F R I E D M A N C H I E F E X E C U T I V E O F F I C E R UTZ BRANDS, INC. Q3 2023 Earnings Presentation

UTZ BRANDS, INC. Q3 2023 Earnings Presentation 4 Third Quarter Key Takeaways Organic Net Sales growth of 3.1% on top of 12.6% growth in the prior year quarter Aggressive actions to optimize supply chain and product portfolio impacted volume greater than anticipated but helped deliver year- over year Adjusted EBITDA margin expansion of ~90bps Power Brands’ retail sales growth of 5%(1) led by Boulder Canyon®, On The Border®, Zapp’s®, and Utz® potato chips (1) Retail sales are Circana Total US MULO-C, custom Utz Brands hierarchy, 13-weeks ended 10/1/2023; % YoY Growth compared to the comparable period in the prior year on a pro forma basis. Revising FY’23 Net Sales Outlook and reaffirming Adjusted EBITDA outlook of 8% to 11% growth

UTZ BRANDS, INC. 5 ▪ On target to deliver FY’23 productivity savings of 4% ▪ Reducing manufacturing plants from 17 to 13 ▪ Continued insourcing of co-manufactured volume ▪ Reduced SKU count by 30% over the last two-years ▪ Enhanced procurement capabilities ▪ Outsourced transportation private fleet Aggressive Actions to Optimize Supply Chain and Product Portfolio Q3 2023 Earnings Presentation (4 plants to 3 plants) Carlisle St. plant to be closed in 1Q’24 Utz Manufacturing Plant Network Plants remaining Plants being sold or closed

Summary of Third Quarter 2023 Results 35.8 % 36.5 % Net Sales (in Millions) Adj. EBITDA (in Millions) Note: Organic Net Sales, Adjusted Gross Profit, Adjusted Gross Margin, Adjusted EBITDA Margin and Adjusted EBITDA, are Non-GAAP financial measures. See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. UTZ BRANDS, INC. Q3 2023 Earnings Presentation 6 $47.7 $52.1 3Q’22 3Q’23 +9% $362.8 $371.9 3Q’22 3Q’23 +3% 14.0%13.1% Adj. EBITDA Margin ▪ Organic Net Sales growth led by Power Brands ▪ Third consecutive quarter of Adjusted EBITDA margin year-over-year expansion Adjusted EBITDA Margin YoY Change (as % of Net Sales) +90bps 3Q’22 4Q’22 1Q’23 2Q’23 3Q’23 +40bps +80bps -10bps-120bps

UTZ BRANDS, INC. Q3 2023 Earnings Presentation 7 Third Quarter Retail Sales Overview Source: Retail sales are Circana Total US MULO-C, custom Utz Brands hierarchy, 13-weeks ended 10/1/2023; % YoY growth compared to the comparable period in the prior year on a pro forma basis. $54.3 $49.4 $364.1 $382.6 3Q’22 3Q’23 $418.4 $432.0 +3.2% Utz Retail Sales Year-over-Year Growth (in Millions) ▪ Power Brand momentum led by Utz® Potato Chips, On The Border®, Zapp’s®, and Boulder Canyon® ▪ Foundation Brands primarily impacted by supply chain transitions and SKU rationalization Utz Power Brands +5% YoY Growth Utz Foundation Brands (9%) YoY Decline 3Q’23 Retail Sales Growth Key Drivers ▪ Lapping sales growth of 22% in the prior year ▪ 25% Potato Chip sales growth in Expansion geographies ▪ Growth across all major channels ▪ Distribution gains in the Food channel in Core geographies ▪ Continued flavored pretzel distribution and velocity gains ▪ Potato chip growth impacted by C-store distribution ▪ 70% sales growth in Grocery channel led by distribution gains ▪ Sales growth in Core geographies doubled vs. the prior year +1% +19% +12% +49%

UTZ BRANDS, INC. Q3 2023 Earnings Presentation 8 Consumption Volume Trends are Improving Utz & Salty Snack Category Retail Volume Quarterly Trends vs. the Prior-Year Period -0.5% -7.3% -6.6% -0.5% -9.0% -8.6% -0.9% -2.2% -1.2% -1.0% -0.9% 0.5% Total Salty Snacks Power Brands 13-weeks ended 1/1/23 4/2/23 7/2/23 10/1/23 Source: Retail sale are Circana Total US MULO-C, custom Utz Brands hierarchy; % YoY growth compared to the comparable period in the prior year on a pro forma basis. ▪ Lapped significant prior year growth in the first half of 2022 ▪ Power Brands’ volume growing faster than the category in 3Q’23

3Q’23 Retail Sales by Sub-Category Total Sub-Category Sub-Category Retail Sales Year-over-Year Growth (13-Weeks Ended 10/1/23) Source: Retail sale are Circana Total US MULO-C, custom Utz Brands hierarchy, 13-weeks ended 10/1/2023; % YoY growth compared to the comparable period in the prior year on a pro forma basis. (1) Based on Salty Snacks and Dips MULO+C Total US IRI data for 52-weeks ended 10/1/2023. Pro forma for acquisitions. UTZ BRANDS, INC. Q3 2023 Earnings Presentation 9 6.5% 3.4% 7.7% 15.4% 7.1% 5.6% 5.6% -5.4% -2.1% -9.4% -0.8% -2.5% -3.9% 1.8% Potato Chips Tortilla Chips Pretzels Cheese Snacks Salsa Queso Pork Rinds ▪ Delivering growth across our three largest sub-categories ▪ Cheese impacted by lapping Mass channel promotional features; Pork performance is being addressed 40% 19% 12% 8% 6% 4% 11% Potato Chips Tortilla Chips Pretzels Cheese Dips Pork Other Retail Sales Breakdown(1) By Product Type Lapping Utz Salsa and Queso prior year growth of 22% and 65%, respectively

▪ Core performance due to lapping Utz® brand prior year growth of 20% and Foundation Brand declines ▪ Expansion share gains led by Power Brands with strong distribution gains 3Q’23 Retail Sales by Geography Source: Retail sales are IRI Total US MULO-C, custom Utz Brands hierarchy, 13-weeks ended 10/1/2023; % YoY Growth compared to the comparable period in the prior year on a pro forma basis. Geographic Retail Sales Year-over-Year Growth (13-Weeks Ended 10/1/23) Total Salty Snacks Power Brands UTZ BRANDS, INC. Q3 2023 Earnings Presentation 10 5.5% 1.6% 3.0% 6.0% 5.8% 8.4% CORE EXPANSION

UTZ BRANDS, INC. Q3 2023 Earnings Presentation Financial Performance A J A Y K A T A R I A C H I E F F I N A N C I A L O F F I C E R

UTZ BRANDS, INC. Q3 2023 Earnings Presentation 12 Third Quarter Financial Results Summary Note: Organic Net Sales, Adjusted SD&A, Adjusted Gross Profit, Adjusted EBITDA, Adjusted Net Income and Adjusted EPS are Non-GAAP financial measures. See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. 3Q’23 3Q’22 YoY Change In $ millions, except per share amounts 13-weeks ended October 1, 2023 13-weeks Ended October 2, 2022 Net Sales 371.9 362.8 +2.5% Organic Net Sales 374.2 362.8 +3.1% Adj. Gross Profit 135.1 132.6 +1.9% % of net sales 36.3% 36.5% (22 bps) Adj. SD&A Expense 83.0 84.5 (1.8%) % of net sales 22.3% 23.3% +97 bps Adj. EBITDA 52.1 47.7 +9.2% % of net sales 14.0% 13.1% +87 bps Adj. Net Income 24.6 22.5 +9.5% Adj. EPS $0.17 $0.16 +9.2% ▪ Organic Net Sales growth of +3.1% – +3.7% price realization partially offset by (0.6%) volume/mix – +2.7% volume/mix excluding SKU rationalization of (3.3%) – Benefit from earlier than planned holiday shipments ▪ Adjusted Gross Margin decline of (22 bps) – Estimate IO conversions adversely impacted Adjusted Gross Margin by approximately (60 bps) ▪ Adjusted SD&A Expense leverage of 97bps – Reduction in selling costs from the shift to IO’s, lower administrative expenses, and productivity savings ▪ Adjusted EPS growth of 9.2% – Higher Adj. EBITDA and favorable tax rate partially offset by higher interest expense

UTZ BRANDS, INC. Q3 2023 Earnings Presentation 13 ▪ Total net sales growth of +2.5% and Organic Net Sales growth of +3.1% ▪ Supply chain and product portfolio optimization actions impacted volume greater than anticipated ▪ Volume/mix growth of +2.7% excluding the estimated impact from SKU rationalization of approximately (3.3%) ▪ Impact from conversion of company-owned direct store delivery (“DSD”) routes to IOs of (0.6%) with conversion nearly complete 3Q’23 Net Sales Bridge 3Q’23 Net Sales YoY Growth Decomposition (1) SKU rationalization based on Utz estimates. (2) Estimated impact due to conversion of employee-serviced DSD routes to independent operator-serviced routes. -3.3% 3Q’23 Organic Net Sales Growth Volume/Mix ex-SKU Rationalization 3Q’23 Total Net Sales Growth Price 2.7% SKU Rationalization -0.6% IO Conversions 3.7% 3.1% 2.5% (1) Note: Organic Net Sales is a Non-GAAP financial measure. Note: See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. (2)

3Q’23 Adjusted EBITDA Margin Decomposition UTZ BRANDS, INC. Q3 2023 Earnings Presentation 14 ▪ Net price realization from 2022 actions to counter inflation ▪ Volume/mix flat with favorable mix primarily due to SKU rationalization offset by lower volume ▪ Benefits from productivity ▪ Lower administrative and selling expenses more than offset by increased investments to support growth ▪ Continued commodity and labor inflation 3Q’23 Adjusted EBITDA Margin Bridge (1) Represents savings realized during Q3 2023 as a % of prior year net sales. (2) Excludes Distribution Expense. 3Q’22 3.7% Price 0.0% Vol/Mix 2.8% Productivity Savings -0.4% Selling & Admin Exp -5.3% Inflation 3Q’23 13.1% 14.0% (2) Note: Adjusted EBITDA Margin is a Non-GAAP financial measure. See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. (1)

UTZ BRANDS, INC. Q3 2023 Earnings Presentation 15 Cash Flow and Balance Sheet Highlights Note: See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. (1) Includes $10.1M of Distributions to Non-controlling Interest. (2) Includes Term Loan, ABL Facility and Capital Leases. Capital Leases include equipment term loans and excludes the impact of step-up accounting. (3) Net Leverage Ratio is a Non-GAAP financial measure and is based on Normalized Adjusted EBITDA of $181.8M. As of January 1, 2023 Cash Flow Highlights 39-Weeks Ended October 1, 2023 Net Cash From Operations $49.1M Capital Expenditures $45.7M Dividends and Distributions Paid(1) $24.1M Balance Sheet Highlights As October 1, 2023 Cash and Cash Equivalents $60.1M Gross Debt(2) $936.0M Net Debt $875.9M Net Leverage Ratio(3) 4.8x

UTZ BRANDS, INC. Strong Liquidity and No Significant Debt Maturities Until 2028 Debt Maturities Schedule (in $M as of 10/1/23(2)) ▪ ~70% of total long-term debt fixed at ~4.7% via interest rate swaps, which are significantly favorable to the market ▪ Liquidity of ~$209M with ABL availability of ~$149M as of October 1, 2023 ▪ Covenant-light debt structure with no financial maintenance covenants on Term Loan B and ABL covenant only triggered if borrowing capacity is less than $13M ▪ Utz is focused on de-leveraging – 3Q’23 Net Leverage ratio of 4.8x based on LTM Normalized Adjusted EBITDA of $181.8M(1) – FY’23 year-end leverage target of below 4.5x – Long-term target of 3x – 4x 20 500 273 81 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 ABL Term Loan B (fixed) Term Loan B (floating) Real Estate Term Loan (fixed) 773 225 16Q3 2023 Earnings Presentation 1) Net Leverage Ratio is a Non-GAAP financial measure. See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. NLR based on LTM Adjusted EBITDA. 2) Maturities represent Term Loan B, Real Estate Loan and ABL, and excludes equipment loans of $50.4M, finance leases of $10.7M, and deferred financing fees of $9.2M.

UTZ BRANDS, INC. Updating Fiscal 2023 Outlook Note: See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. (1) Normalized GAAP basis tax expense, which excludes one-time items. Fiscal 2023 Growth versus Fiscal 2022 Actual Results Net Sales +2% to 3% Total growth (previously +3% to 5%) +3% to 4% Organic growth (previously +4% to 6%) ▪ Organic Net Sales growth led by price, and volume/mix modestly lower vs fiscal 2022 primarily due to SKU rationalization impact of (~300 bps) ▪ Sales growth supported by increased marketing and innovation, and continued distribution gains ▪ Estimated IO route conversion negative impact of (~1%) on total net sales growth and expect conversion to be substantially complete in 2H’23 Adjusted EBITDA +8% to 11% growth (unchanged) ▪ Gross input cost inflation of high-single-digits ▪ Adj. EBITDA margin expansion through SD&A expense leverage primarily driven by strong productivity savings and other cost savings, with continued investments in brand marketing, people, selling infrastructure, and supply chain capabilities Additional Assumptions: ▪ Effective normalized tax rate of between 17% to 18% (previously 20% to 22%)(1) ▪ Net interest expense of approximately $55M ▪ Capital expenditures of between $50M to $55M ▪ Net leverage below 4.5x at year-end fiscal 2023 Q3 2023 Earnings Presentation 17 ▪ Adjusting our Net Sales outlook to reflect supply chain transition impacts and consumer trends ▪ Reaffirming Adjusted EBITDA guidance due to stepped up pace of productivity and other cost savings

UTZ BRANDS, INC. 18 Well-Positioned for Fiscal 2024 and Beyond Advantaged Power Brand portfolio with significant geographic expansion opportunity in attractive Salty Snack category Aggressive supply chain and portfolio optimization actions enabling margin expansion Capabilities enhanced with investments in people, process and technology Balance sheet deleveraging to enable financial flexibility Q3 2023 Earnings Presentation

Appendix UTZ BRANDS, INC. Q3 2023 Earnings Presentation

UTZ BRANDS, INC. 20 Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures Q3 2023 Earnings Presentation See footnotes in Utz’s 3Q’23 earnings press release dated November 9, 2023.

UTZ BRANDS, INC. 21 Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures Q3 2023 Earnings Presentation See footnotes in Utz’s 3Q’23 earnings press release dated November 9, 2023.

UTZ BRANDS, INC. 22 Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures Q3 2023 Earnings Presentation See footnotes in Utz’s 3Q’23 earnings press release dated November 9, 2023.

UTZ BRANDS, INC. 23 Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures Q3 2023 Earnings Presentation See footnotes in Utz’s 3Q’23 earnings press release dated November 9, 2023.

UTZ BRANDS, INC. 24 Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures Q3 2023 Earnings Presentation See footnotes in Utz’s 3Q’23 earnings press release dated November 9, 2023.

25 Utz Geographic Classifications FL NM DE MD TX OK KS NE SD ND MT WY CO UT ID AZ NV WA CA OR KY ME NY PA VT NH MA RI CT WV INIL NC TN SC ALMS AR LA MO IA MN WI NJ GA DC VA OH MI AK HI Core Expansion UTZ BRANDS, INC. Q3 2023 Earnings Presentation

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |