Inflation Has Consumers in a Recession State of Mind, Yet Optimism about Finances Hits Highest Level in Six Quarters

07 Juni 2023 - 2:00PM

Many consumers are in a financial conundrum. The latest TransUnion

(NYSE: TRU) Consumer Pulse study found that 44% of Americans

believe the U.S. economy is in a recession or will be by the end of

June. Three in four consumers (75%) believe a recession will occur

by the end of 2023. Despite these concerns, about six in 10

Americans (57%) reported optimism about their household finances

for the next 12 months – the highest level since the last quarter

of 2021.

What’s driving these conflicting notions? Inflation. About half

(46%) of consumers reported their income is not keeping up with

inflation for everyday goods such as groceries, gas, etc. That’s

understandable when one considers that inflation rose to 40-year

high levels in mid-2022 and, despite a gradual decline over the

past year, remains elevated at twice the rate it was prior to the

pandemic.

The Q2 2023 Consumer Pulse study is based on a survey of 3,000

American adults between April 25-May 9, 2023. For the sixth

consecutive quarter, consumers indicated that inflation is causing

them the most anxiety, with 79% reporting it as one of their top

three financial concerns. Recession (53%) and increased housing

prices on rent or mortgage (45%) were the next highest

concerns.

And while the Federal Reserve has increased interest rates 10

times since March 2022, rising interest rates (41%) only ranked as

the fourth greatest financial concern for consumers, though that

percentage did rise from 39% in Q1 2023 and 34% one year earlier in

Q2 2022.

Greatest Financial Concern by Generation

(Percent Ranked as Top 3 Concern)

|

Top Concerns |

Overall |

Gen Z |

Millennials |

Gen X |

Baby Boomers |

|

Inflation |

79 |

% |

68 |

% |

73 |

% |

82 |

% |

89 |

% |

|

Recession |

53 |

% |

45 |

% |

50 |

% |

56 |

% |

57 |

% |

|

Housing Prices (Rent or Mortgage) |

45 |

% |

53 |

% |

40 |

% |

35 |

% |

14 |

% |

|

Interest Rates |

41 |

% |

39 |

% |

43 |

% |

41 |

% |

40 |

% |

“We are living in uncharted territory from a consumer credit

perspective,” said Charlie Wise, senior vice president and head of

global research and consulting at TransUnion. “The combination of

rising interest rates and elevated inflation, while not uncommon

from a historical perspective, is an unfamiliar experience for many

consumers, especially those in the Gen Z and Millennial

generations. It’s also likely why a number of people are expressing

that they feel they are in a personal recession or soon will be in

one, with costs rising faster than their incomes. Conversely, a

majority of Americans are optimistic about their financial future.

The No. 1 reason: the unemployment rate remains near record low

levels. As long as the employment situation remains stable, most

employed individuals have the resources to weather inflation and

higher interest rates – at least in the near-term.”

Consumer Credit Health Down, But Not

Worrisome

As consumers send mixed messages about the economy, TransUnion’s

proprietary gauge on consumer credit health trends – the Credit

Industry Indicator (CII) – posits a slight decline occurring in the

credit markets. The CII decreased to 110 in Q1 2023, down from 113

the previous quarter and 116 one year earlier, though the overall

level indicates that credit markets remain relatively healthy.

The CII is a quarterly measure of depersonalized and aggregated

consumer credit health trends that summarizes movements in credit

demand, credit supply, consumer credit behaviors, and credit

performance metrics over time into a single indicator.

Lower levels for the CII generally indicate a decline in the

overall health of the consumer credit market. However, the

fluctuations in the metric are low, especially compared to larger

swings observed during recent crises, such as the onset of the

pandemic when the CII dropped from 113 in Q1 2020 to 55 in Q2

2020.

“The CII has been weighed down recently by cooling credit demand

and a drop in supply by lenders. Yet, the declines we have observed

are not concerning, and levels indicate the consumer credit market

remains on solid footing,” added Wise.

Optimism Highest Among Younger Generations

Part of the reason concern levels are not high: consumers’

optimism about their household finances in the next 12 months is

high. Gen Z (73%) and Millennials (69%) are most optimistic about

their finances, especially compared to Gen X (51%) and Baby Boomers

(41%).

More than half of Americans (51%) expect their income to rise in

the next 12 months compared to 41% in Q1, led by Millennials and

Gen Z. These generations expect their income to rise in the next

year, 68% and 66%, respectively, compared to 46% for Gen X and 27%

for Baby Boomers.

“A foundation for weathering a challenging macro environment,

where costs of everyday items are up and interest rates are rising,

is to be gainfully employed,” concluded Wise. “Employed consumers

are far better able to make payments on debts they may have and to

spend on both discretionary and non-discretionary items, both vital

for the health of the U.S. economy. While the employment situation

has remained strong for quite a while, it will be one of the

metrics we follow most closely in coming months to gauge the future

outlook for the U.S. consumer.”

For more information about the Consumer Pulse study, please

click here.

About TransUnion (NYSE:TRU)

TransUnion is a global information and insights company with

over 12,000 associates operating in more than 30 countries. We make

trust possible by ensuring each person is reliably represented in

the marketplace. We do this with a Tru™ picture of each person: an

actionable view of consumers, stewarded with care. Through our

acquisitions and technology investments we have developed

innovative solutions that extend beyond our strong foundation in

core credit into areas such as marketing, fraud, risk and advanced

analytics. As a result, consumers and businesses can transact with

confidence and achieve great things. We call this Information for

Good®—and it leads to economic opportunity, great experiences and

personal empowerment for millions of people around the

world.

http://www.transunion.com/business

|

Contact |

Dave

BlumbergTransUnion |

| Email |

david.blumberg@transunion.com |

| Telephone |

312-972-6646 |

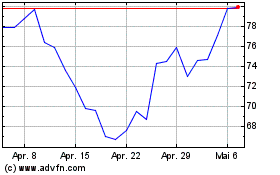

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Apr 2023 bis Apr 2024