Tecnoglass,

Inc.

(NYSE: TGLS)

(“Tecnoglass” or the

“Company”),

a leading manufacturer

of architectural glass, windows, and associated aluminum products

serving the global residential and commercial end markets, today

reported financial results for the first quarter ended March 31,

2023.

José Manuel Daes, Chief Executive Officer of

Tecnoglass, commented, “Our strong momentum continued into 2023

with record first quarter results. We generated year-over-year

growth in all of our key operating metrics, resulting in record

first quarter revenues, gross profit, Adjusted EBITDA1, operating

cash flow and free cash flow. This performance further builds upon

our established track record of achieving strong financial

performance and returns for shareholders, derived from a multi-year

effort to fortify our architectural glass platform through sound

investments in strategic automation and capacity enhancements. Our

continued expanding backlog resulted in a third straight quarter of

approximately 60% year-over-year growth in multifamily/commercial

revenues. We were also particularly pleased with the continued

rapid growth of our single-family residential products. The shorter

cash cycle in our single-family residential business, along with

our prudent working capital management, also helped us generate our

13th consecutive quarter of strong cash flow. Achieving these

results amid a challenging macro-economic backdrop further

validates our growth strategy and our structural competitive

advantages. Overall, I am proud of the efforts of all of our team

members and as we look to the balance of the year, we believe we

have all of the tools in place to execute against our multi-faceted

growth strategy to further cement our position as an industry

leader in the architectural glass market.”

Christian Daes, Chief Operating Officer of

Tecnoglass, added, “We are thrilled to report an excellent start to

the year as demand for our single-family residential and

multifamily/commercial products remains strong. We are encouraged

by the solid levels of quoting and bidding activity in our markets,

with the accelerating growth in our backlog to a record $776

million at quarter-end, reflecting an increasing number of projects

in our commercial pipeline with visibility well into 2024. We are

encouraged to see the Architectural Billings Index (ABI), which

forecasts business conditions for the mid-to-high-rise end-market,

return to expansionary levels in March, which further validates

what we are seeing in our main markets. On all sides of our

business, our ability to timely deliver best-in-class products is

driving significant revenue growth and market share gains. We

remain focused on consistently improving within our

vertically-integrated operations as we continue to produce

innovative new products and geographic diversification.”

First Quarter

2023

Results

Total revenues for the first quarter of 2023

increased 50.6% to $202.6 million compared to $134.5 million in the

prior year quarter, driven by a significant increase in the

Company’s multifamily/commercial activity, strong growth in

single-family residential activity and market share gains.

Single-family residential revenues increased 40% year-over-year,

representing 41% of total revenues for the first quarter, helped by

market share gains and the continued positive demographic trends in

the Company’s main markets. Multifamily/commercial revenues

increased 59% year-over-year, attributable to the previously

mentioned increase in commercial construction projects which were

previously put on hold during the pandemic or moved into designing

and permitting stages in the last 18 months given the positive

demographic shifts in our main markets. Changes in foreign currency

exchange rates had an adverse impact of $1.2 million on both

Colombia revenues and total revenues in the quarter.

Gross profit for the first quarter of 2023

increased 78.6% to $107.8 million, representing a 53.2% gross

margin, compared to gross profit of $60.3 million, representing a

44.8% gross margin in the prior year quarter. The 830 basis point

improvement in gross margin mainly reflected operating leverage on

higher sales, favorable pricing dynamics and greater operating

efficiencies related to prior automation initiatives.

Selling, general and administrative expense

(“SG&A”) was $34.1 million for the first quarter of 2023

compared to $26.4 million in the prior year quarter, with the

increase attributable to higher shipping and commission expenses as

a result of a higher sales volume, as well as a higher provision

for bad debt expenses and incremental marketing costs associated

with the expansion of our new showrooms. As a percent of total

revenues, SG&A was 16.8% for the first quarter of 2023 compared

to 19.6% in the prior year quarter driven by better operating

leverage.

Net income was $48.4 million, or $1.01 per

diluted share, in the first quarter of 2023 compared to net income

of $21.0 million, or $0.44 per diluted share, in the prior year

quarter, including a non-cash foreign exchange transaction loss of

$1.1 million in the first quarter of 2023 and a $2.9 million loss

in the first quarter of 2022. As previously disclosed, these

non-cash losses are related to the accounting re-measurement of

U.S. Dollar denominated assets and liabilities against the

Colombian Peso as functional currency.

Adjusted net income1 was $51.5

million, or $1.08 per diluted share, in the first quarter of 2023

compared to adjusted net income of $25.4 million, or $0.53 per

diluted share, in the prior year quarter. Adjusted net

income1, as reconciled in the table below,

excludes the impact of non-cash foreign exchange transaction gains

or losses and other non-core items, along with the tax impact of

adjustments at statutory rates, to better reflect core financial

performance.

Adjusted EBITDA1, as reconciled

in the table below, increased 89.3% to $85.8 million, or 42.4% of

total revenues, in the first quarter of 2023, compared to $45.4

million, or 33.7% of total revenues, in the prior year quarter. The

improvement was driven by higher sales and stronger gross and

operating margins. Adjusted EBITDA1 included a

$1.5 million contribution from the Company’s joint venture with

Saint-Gobain, compared to $0.8 million in the prior year

quarter.

Balance Sheet &

Liquidity

The Company ended the first quarter of 2023 with

total liquidity of approximately $300 million, including cash and

cash equivalents of $128.5 million and availability under its

committed revolving credit facilities of $170 million. Given the

Company’s continued growth in Adjusted EBITDA1 and strong cash

generation, debt leverage continues to trend lower and now stands

at 0.1 times net debt to LTM Adjusted EBITDA1, compared to 0.6

times in the prior year quarter.

Dividend

The Company declared a quarterly cash dividend

of $0.09 per share for the first quarter of 2023, representing a

20% increase from the previous dividend, which was paid on April

28, 2023 to shareholders of record as of the close of business on

March 31, 2023.

Full Year

2023 Outlook

Santiago Giraldo, Chief Financial Officer of

Tecnoglass, stated, “We are increasing our full year 2023 outlook

to reflect our strong start to 2023 and positive sales momentum

into the second quarter, reflected by record invoicing months in

March and April. We now expect full year 2023 revenues to grow

organically to a range of $810 million to $850 million

(approximately 16% growth at the midpoint of the range) and for

Adjusted EBITDA1 to increase to a range of $315 million to $335

million. This implies Adjusted EBITDA1 growth of approximately 23%

at the midpoint driven by stronger than originally anticipated

gross margins. The structural advantages provided by our vertically

integrated business model, as well as the investments we have made

in our production capabilities, put Tecnoglass firmly on track to

meet the strong demand anticipated in our updated outlook for the

full year 2023.”

Webcast and Conference Call

Management will host a webcast and conference

call on May 4, 2023 at 10:00 a.m. Eastern time (9:00 a.m. Bogota,

Colombia time) to review the Company’s results. The conference call

will be broadcast live over the Internet. Additionally, a slide

presentation will accompany the conference call. To listen to the

call and view the slides, please visit the Investor Relations

section of Tecnoglass' website at www.tecnoglass.com. Please go to

the website at least 15 minutes early to register, download and

install any necessary audio software. For those unable to access

the webcast, the conference call will be accessible by dialing

1-844-826-3035 (domestic) or 1-412-317-5195 (international). Upon

dialing in, please request to join the Tecnoglass First Quarter

2023 Earnings Conference Call.

If you are unable to listen live, a replay of

the webcast will be archived on the website. You may also access

the conference call playback by dialing 1-844-512-2921 (Domestic)

or 1-412-317-6671 (International) and entering passcode:

10177642.

About

Tecnoglass

Tecnoglass Inc. is a leading producer of

architectural glass, windows, and associated aluminum products

serving the multi-family, single-family and commercial end markets.

Tecnoglass is the second largest glass fabricator serving the U.S.

and the #1 architectural glass transformation company in Latin

America. Located in Barranquilla, Colombia, the Company’s 4.1

million square foot, vertically-integrated and state-of-the-art

manufacturing complex provides efficient access to over 1,000

global customers, with the U.S. accounting for more than 90% of

revenues. Tecnoglass' tailored, high-end products are found on some

of the world's most distinctive properties, including One Thousand

Museum (Miami), Paramount (Miami), Salesforce Tower (San

Francisco), Via 57 West (NY), Hub50House (Boston), Aeropuerto

Internacional El Dorado (Bogotá), One Plaza (Medellín), Pabellon de

Cristal (Barranquilla). For more information, please visit

www.tecnoglass.com or view our corporate video at

https://vimeo.com/134429998.

Forward Looking Statements

This press release includes certain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, including statements

regarding future financial performance, future growth and future

acquisitions. These statements are based on Tecnoglass’ current

expectations or beliefs and are subject to uncertainty and changes

in circumstances. Actual results may vary materially from those

expressed or implied by the statements herein due to changes in

economic, business, competitive and/or regulatory factors, and

other risks and uncertainties affecting the operation of

Tecnoglass’ business. These risks, uncertainties and contingencies

are indicated from time to time in Tecnoglass’ filings with the

Securities and Exchange Commission. The information set forth

herein should be read in light of such risks. Further, investors

should keep in mind that Tecnoglass’ financial results in any

particular period may not be indicative of future results.

Tecnoglass is under no obligation to, and expressly disclaims any

obligation to, update or alter its forward-looking statements,

whether as a result of new information, future events and changes

in assumptions or otherwise, except as required by law.

1 Adjusted net income (loss) and Adjusted EBITDA in both periods

are reconciled in the table below.

Investor Relations:Santiago Giraldo CFO

305-503-9062 investorrelations@tecnoglass.com

Tecnoglass Inc. and

SubsidiariesConsolidated Balance Sheets

(In thousands, except share and per share

data)

|

|

|

March

31, |

|

|

|

|

|

|

|

2023(Unaudited) |

|

|

December 31, 2022 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

128,538 |

|

|

$ |

103,671 |

|

| Investments |

|

|

2,140 |

|

|

|

2,049 |

|

| Trade accounts receivable, net |

|

|

167,137 |

|

|

|

158,397 |

|

| Due from related parties |

|

|

772 |

|

|

|

1,447 |

|

| Inventories |

|

|

143,057 |

|

|

|

124,997 |

|

| Contract assets – current portion |

|

|

18,982 |

|

|

|

12,610 |

|

| Other current assets |

|

|

40,364 |

|

|

|

28,963 |

|

| Total current assets |

|

$ |

500,990 |

|

|

$ |

432,134 |

|

| Long-term assets: |

|

|

|

|

|

|

|

|

| Property, plant and equipment, net |

|

$ |

223,554 |

|

|

$ |

202,865 |

|

| Deferred income taxes |

|

|

155 |

|

|

|

558 |

|

| Contract assets – non-current |

|

|

4,415 |

|

|

|

8,875 |

|

| Long-term trade accounts receivable |

|

|

- |

|

|

|

1,225 |

|

| Intangible assets |

|

|

2,614 |

|

|

|

2,706 |

|

| Goodwill |

|

|

23,561 |

|

|

|

23,561 |

|

| Long-term investments |

|

|

60,433 |

|

|

|

57,839 |

|

| Other long-term assets |

|

|

3,735 |

|

|

|

4,545 |

|

| Total long-term assets |

|

|

318,467 |

|

|

|

302,174 |

|

| Total assets |

|

$ |

819,457 |

|

|

$ |

734,308 |

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Short-term debt and current portion of long-term debt |

|

$ |

819 |

|

|

$ |

504 |

|

| Trade accounts payable and accrued expenses |

|

|

86,629 |

|

|

|

90,186 |

|

| Due to related parties |

|

|

5,491 |

|

|

|

5,323 |

|

| Dividends payable |

|

|

4,334 |

|

|

|

3,622 |

|

| Contract liability – current portion |

|

|

58,591 |

|

|

|

49,601 |

|

| Other current liabilities |

|

|

88,394 |

|

|

|

60,566 |

|

| Total current liabilities |

|

$ |

244,258 |

|

|

$ |

209,802 |

|

| Long-term liabilities: |

|

|

|

|

|

|

|

|

| Deferred income taxes |

|

$ |

5,732 |

|

|

$ |

5,190 |

|

| Contract liability – non-current |

|

|

11 |

|

|

|

11 |

|

| Long-term debt |

|

|

169,076 |

|

|

|

168,980 |

|

| Total long-term liabilities |

|

|

174,819 |

|

|

|

174,181 |

|

| Total liabilities |

|

$ |

419,077 |

|

|

$ |

383,983 |

|

| SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Preferred shares, $0.0001 par value, 1,000,000 shares

authorized, 0 shares issued and outstanding at March 31, 2023 and

December 31, 2022, respectively |

|

$ |

- |

|

|

$ |

- |

|

| Ordinary shares, $0.0001 par value, 100,000,000 shares

authorized, 47,674,773 and 47,674,773 shares issued and outstanding

at March 31, 2023 and December 31, 2022, respectively |

|

|

5 |

|

|

|

5 |

|

| Legal Reserves |

|

|

1,458 |

|

|

|

1,458 |

|

| Additional paid-in capital |

|

|

219,290 |

|

|

|

219,290 |

|

| Retained earnings |

|

|

278,198 |

|

|

|

234,254 |

|

| Accumulated other comprehensive loss |

|

|

(100,213 |

) |

|

|

(106,187 |

) |

| Shareholders’ equity attributable to controlling

interest |

|

|

398,738 |

|

|

|

348,820 |

|

| Shareholders’ equity attributable to non-controlling

interest |

|

|

1,642 |

|

|

|

1,505 |

|

| Total shareholders’ equity |

|

|

400,380 |

|

|

|

350,325 |

|

| Total liabilities and shareholders’ equity |

|

$ |

819,457 |

|

|

$ |

734,308 |

|

Tecnoglass Inc. and

SubsidiariesConsolidated Statements of Operations

and Comprehensive Income (In thousands,

except share and per share

data)(Unaudited)

| |

|

Three months

ended |

|

| |

|

March 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Operating revenues: |

|

|

|

|

|

|

|

|

| External customers |

|

$ |

202,306 |

|

|

$ |

134,022 |

|

| Related parties |

|

|

333 |

|

|

|

526 |

|

|

Total operating revenues |

|

|

202,639 |

|

|

|

134,548 |

|

| Cost of sales |

|

|

(94,884 |

) |

|

|

(74,215 |

) |

| Gross profit |

|

|

107,755 |

|

|

|

60,333 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

| Selling expense |

|

|

(16,320 |

) |

|

|

(13,368 |

) |

| General and administrative expense |

|

|

(17,755 |

) |

|

|

(12,999 |

) |

| Total operating expenses |

|

|

(34,075 |

) |

|

|

(26,367 |

) |

| Operating income |

|

|

73,680 |

|

|

|

33,966 |

|

| Non-operating income, net |

|

|

1,287 |

|

|

|

342 |

|

| Equity method income |

|

|

1,449 |

|

|

|

1,580 |

|

| Foreign currency transactions losses |

|

|

(1,100 |

) |

|

|

(2,909 |

) |

| Interest expense and deferred cost of financing |

|

|

(2,273 |

) |

|

|

(1,468 |

) |

| Income before taxes |

|

|

73,043 |

|

|

|

31,511 |

|

| Income tax provision |

|

|

(24,671 |

) |

|

|

(10,558 |

) |

| Net income |

|

$ |

48,372 |

|

|

$ |

20,953 |

|

| Income attributable to non-controlling interest |

|

|

(137 |

) |

|

|

(100 |

) |

| Income attributable to parent |

|

$ |

48,235 |

|

|

$ |

20,853 |

|

| Comprehensive income: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

48,372 |

|

|

$ |

20,953 |

|

| Foreign currency translation adjustments |

|

|

7,811 |

|

|

|

13,635 |

|

| Change in fair value of derivative contracts |

|

|

(1,837 |

) |

|

|

2,622 |

|

| Total comprehensive income (loss) |

|

$ |

54,346 |

|

|

$ |

37,210 |

|

| Comprehensive income attributable to non-controlling

interest |

|

|

(137 |

) |

|

|

(100 |

) |

| Total comprehensive income (loss) attributable to

parent |

|

$ |

54,209 |

|

|

$ |

37,110 |

|

| Basic income per share |

|

$ |

1.01 |

|

|

$ |

0.44 |

|

| Diluted income per share |

|

$ |

1.01 |

|

|

$ |

0.44 |

|

| Basic weighted average common shares outstanding |

|

|

47,674,773 |

|

|

|

47,674,773 |

|

| Diluted weighted average common shares outstanding |

|

|

47,674,773 |

|

|

|

47,674,773 |

|

Tecnoglass Inc. and

SubsidiariesConsolidated Statements of Cash

Flows (In

thousands)(Unaudited)

| |

|

Three months ended March 31, |

|

| |

|

2023 |

|

|

2022 |

|

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

48,372 |

|

|

$ |

20,953 |

|

| Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

| Allowance for credit losses |

|

|

914 |

|

|

|

414 |

|

| Depreciation and amortization |

|

|

4,767 |

|

|

|

5,251 |

|

| Deferred income taxes |

|

|

156 |

|

|

|

(1,568 |

) |

| Equity method income |

|

|

(1,449 |

) |

|

|

(1,580 |

) |

| Realized gain on derivative instruments |

|

|

(1,951 |

) |

|

|

- |

|

| Deferred cost of financing |

|

|

312 |

|

|

|

363 |

|

| Other non-cash adjustments |

|

|

(16 |

) |

|

|

5 |

|

| Unrealized currency translation losses |

|

|

410 |

|

|

|

3,205 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Trade accounts receivable |

|

|

(8,644 |

) |

|

|

6,099 |

|

| Inventories |

|

|

(13,048 |

) |

|

|

(13,452 |

) |

| Prepaid expenses |

|

|

(864 |

) |

|

|

507 |

|

| Other assets |

|

|

(14,338 |

) |

|

|

(1,841 |

) |

| Trade accounts payable and accrued expenses |

|

|

(9,681 |

) |

|

|

(5,551 |

) |

| Taxes payable |

|

|

25,488 |

|

|

|

11,591 |

|

| Labor liabilities |

|

|

(447 |

) |

|

|

(331 |

) |

| Other liabilities |

|

|

(7 |

) |

|

|

(1,196 |

) |

| Contract assets and liabilities |

|

|

12,425 |

|

|

|

1,965 |

|

| Related parties |

|

|

664 |

|

|

|

2,301 |

|

| CASH PROVIDED BY OPERATING ACTIVITIES |

|

$ |

43,063 |

|

|

$ |

27,135 |

|

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

| Purchase of investments |

|

|

(134 |

) |

|

|

(1,136 |

) |

| Acquisition of property and equipment |

|

|

(15,554 |

) |

|

|

(9,258 |

) |

| CASH USED IN INVESTING ACTIVITIES |

|

$ |

(15,688 |

) |

|

$ |

(10,394 |

) |

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

| Cash dividend |

|

|

(3,579 |

) |

|

|

(3,099 |

) |

| Proceeds from debt |

|

|

292 |

|

|

|

93 |

|

| Repayments of debt |

|

|

- |

|

|

|

(15,312 |

) |

| CASH USED IN FINANCING ACTIVITIES |

|

$ |

(3,287 |

) |

|

$ |

(18,318 |

) |

| |

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash and cash

equivalents |

|

$ |

778 |

|

|

$ |

997 |

|

| |

|

|

|

|

|

|

|

|

| NET INCREASE IN CASH |

|

|

24,866 |

|

|

|

(580 |

) |

| CASH - Beginning of period |

|

|

103,672 |

|

|

|

85,011 |

|

| CASH - End of period |

|

$ |

128,538 |

|

|

$ |

84,431 |

|

| |

|

|

|

|

|

|

|

|

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION |

|

|

|

|

|

|

|

|

| Cash paid during the period for: |

|

|

|

|

|

|

|

|

| Interest |

|

$ |

2,717 |

|

|

$ |

1,139 |

|

| Income Tax |

|

$ |

26,342 |

|

|

$ |

2,927 |

|

| |

|

|

|

|

|

|

|

|

| NON-CASH INVESTING AND FINANCING ACTIVITES: |

|

|

|

|

|

|

|

|

| Assets acquired under credit or debt |

|

$ |

4,790 |

|

|

$ |

2,678 |

|

Revenues by

Region(Amounts in

thousands)(Unaudited)

| |

Three months ended |

|

Twelve months ended |

|

|

March 31, |

|

March 31, |

|

2023 |

|

2022 |

|

% Change |

|

2023 |

|

2022 |

|

% Change |

| Revenues by

Region |

|

|

|

|

|

|

|

|

|

|

|

| United States |

194,840 |

|

126,984 |

|

53.4 |

% |

|

756,222 |

|

482,504 |

|

56.7 |

% |

| Colombia |

5,740 |

|

4,025 |

|

42.6 |

% |

|

17,715 |

|

22,735 |

|

-22.1 |

% |

| Other Countries |

2,058 |

|

3,539 |

|

(41.9 |

%) |

|

10,724 |

|

14,539 |

|

(26.2 |

%) |

| Total Revenues by

Region |

202,639 |

|

134,548 |

|

50.6 |

% |

|

784,661 |

|

519,778 |

|

51.0 |

% |

Reconciliation of Non-GAAP Performance

Measures to GAAP Performance

Measures(In

thousands)(Unaudited)

The Company believes that total revenues with

foreign currency held neutral non-GAAP performance measures, which

management uses in managing and evaluating the Company's business,

may provide users of the Company's financial information with

additional meaningful bases for comparing the Company's current

results and results in a prior period, as these measures reflect

factors that are unique to one period relative to the comparable

period. However, these non‑GAAP performance measures should be

viewed in addition to, and not as an alternative for, the Company's

reported results under accounting principles generally accepted in

the United States.

| |

Three months ended |

|

Twelve months ended |

|

|

March 31, |

|

March 31, |

|

2023 |

|

|

2022 |

|

% Change |

|

2023 |

|

|

2022 |

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenues with

Foreign Currency Held Neutral |

203,881 |

|

|

134,548 |

|

51.5 |

% |

|

787,584 |

|

|

519,778 |

|

51.5 |

% |

| Impact of changes in foreign

currency |

(1,242 |

) |

|

- |

|

|

|

(2,923 |

) |

|

- |

|

|

| Total Revenues,

As Reported |

202,639 |

|

|

134,548 |

|

50.6 |

% |

|

784,661 |

|

|

519,778 |

|

51.0 |

% |

Currency impacts on total revenues for the

current quarter have been derived by translating current quarter

revenues at the prevailing average foreign currency rates during

the prior year quarter, as applicable.

Reconciliation of Adjusted EBITDA and

Adjusted net

(loss) income to

net (loss)

income(In thousands, except share

and per share

data)(Unaudited)

Adjusted EBITDA and adjusted net (loss) income

are not measures of financial performance under generally accepted

accounting principles (“GAAP”). Management believes Adjusted EBITDA

and adjusted net (loss) income, in addition to operating profit,

net (loss) income and other GAAP measures, is useful to investors

to evaluate the Company’s results because it excludes certain items

that are not directly related to the Company’s core operating

performance. Investors should recognize that Adjusted EBITDA and

adjusted net (loss) income might not be comparable to

similarly-titled measures of other companies. These measures should

be considered in addition to, and not as a substitute for or

superior to, any measure of performance prepared in accordance with

GAAP.

Reconciliations of the non-GAAP measures used in

this press release are included in the tables attached to this

press release, to the extent available without unreasonable effort.

Because GAAP financial measures on a forward-looking basis are not

accessible, and reconciling information is not available without

unreasonable effort, we have not provided reconciliations for

forward-looking non-GAAP measures.

A reconciliation of Adjusted net (loss) income

and Adjusted EBITDA to the most directly comparable GAAP measure in

accordance with SEC Regulation G follows, with amounts in

thousands:

| |

|

Three months

ended |

|

| |

|

Mar 31, |

|

| |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

| Net (loss) income |

|

|

48,372 |

|

|

|

20,953 |

|

|

Less: Income (loss) attributable to non-controlling interest |

|

|

(137 |

) |

|

|

(100 |

) |

| (Loss) Income attributable to parent |

|

|

48,235 |

|

|

|

20,853 |

|

|

Foreign currency transactions losses (gains) |

|

|

1,100 |

|

|

|

2,909 |

|

|

Non Recurring expenses (non-recurring profesional fees, capital

market fees, provision for bad debt, other non-core ítems) |

|

|

3,275 |

|

|

|

3,487 |

|

|

Joint Venture VA (Saint Gobain) adjustments |

|

|

435 |

|

|

|

36 |

|

|

Tax impact of adjustments at statutory rate |

|

|

(1,539 |

) |

|

|

(1,930 |

) |

| Adjusted net (loss) income |

|

|

51,506 |

|

|

|

25,355 |

|

| |

|

|

|

|

|

|

|

|

|

Basic income (loss) per share |

|

|

1.01 |

|

|

|

0.44 |

|

|

Diluted income (loss) per share |

|

|

1.01 |

|

|

|

0.44 |

|

| |

|

|

|

|

|

|

|

|

|

Diluted Adjusted net income (loss) per share |

|

|

1.08 |

|

|

|

0.53 |

|

| |

|

|

|

|

|

|

|

|

| Diluted Weighted Average Common Shares Outstanding in

thousands |

|

|

47,675 |

|

|

|

47,675 |

|

|

Basic weighted average common shares outstanding in thousands |

|

|

47,675 |

|

|

|

47,675 |

|

|

Diluted weighted average common shares outstanding in

thousands |

|

|

47,675 |

|

|

|

47,675 |

|

| |

|

|

|

|

|

|

|

|

| |

|

Three months

ended |

|

| |

|

Mar 31, |

|

| |

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

| Net (loss) income |

|

|

48,372 |

|

|

|

20,953 |

|

|

Less: Income (loss) attributable to non-controlling interest |

|

|

(137 |

) |

|

|

(100 |

) |

| (Loss) Income attributable to parent |

|

|

48,235 |

|

|

|

20,853 |

|

|

Interest expense and deferred cost of financing |

|

|

2,273 |

|

|

|

1,468 |

|

|

Income tax (benefit) provision |

|

|

24,671 |

|

|

|

10,558 |

|

|

Depreciation & amortization |

|

|

4,767 |

|

|

|

5,251 |

|

|

Foreign currency transactions losses (gains) |

|

|

1,100 |

|

|

|

2,909 |

|

|

Non Recurring expenses (non-recurring profesional fees, capital

market fees, provision for bad debt, other non-core ítems) |

|

|

3,275 |

|

|

|

3,487 |

|

|

Joint Venture VA (Saint Gobain) EBITDA adjustments |

|

|

1,515 |

|

|

|

825 |

|

|

Adjusted EBITDA |

|

|

85,836 |

|

|

|

45,351 |

|

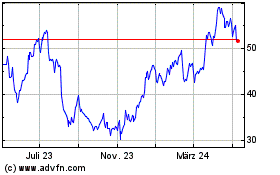

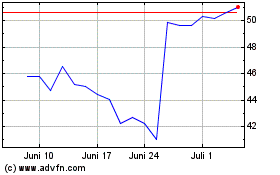

Tecnoglass (NYSE:TGLS)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Tecnoglass (NYSE:TGLS)

Historical Stock Chart

Von Mai 2023 bis Mai 2024