UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2023

Commission File No. 001-39224

TFI INTERNATIONAL INC.

(Translation of registrant’s name into English)

8801 Trans-Canada Highway, Suite 500

Saint-Laurent, Québec

H4S 1Z6 Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

|

|

|

|

|

|

EXHIBIT NUMBER |

|

EXHIBIT DESCRIPTION |

|

|

99.1 |

|

Press Release |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TFI International Inc. |

|

|

|

|

Date: December 22, 2023 |

|

|

|

By: |

|

/s/ Josiane M. Langlois |

|

|

|

|

|

|

Name: Josiane M. Langlois |

|

|

|

|

|

|

Title: Vice-President, Legal Affairs & Corporate Secretary |

Exhibit 99.1

For Immediate Release

TFI International Agrees to Acquire Daseke

for $8.30 in Cash per Common Share

Montreal, Quebec, December 22, 2023 – TFI International Inc. (NYSE and TSX: TFII), a North American leader in the transportation and logistics industry, today announced it has agreed to acquire Daseke, Inc. (“Daseke”, NASDAQ: DSKE), one of the leading flatbed and specialized transportation and logistics companies in North America, for $8.30 in cash per common share. The transaction is subject to customary closing conditions, including regulatory approvals, and is expected to close during the second quarter of 2024. Management expects the transaction to be EPS-neutral to TFI International in 2024, and accretive by at least $0.50 per share in 2025 based on current market conditions.

Daseke’s operations include approximately 4,900 tractors, 11,000 flatbed and specialized trailers, and one million square feet of industrial warehousing space, offering comprehensive transportation and logistics solutions for major shippers. After the merger, Daseke will continue to operate its portfolio of brands as part of TFI’s Truckload segment. On a pro forma basis, the Truckload segment is expected to generate approximately US $3.6 billion in annual total revenue, operate one of the largest comprehensive truckload businesses in Canada, and be one of the largest participants in the less-commoditized specialized equipment truckload marketplace in the United States. Over the medium term, TFI expects to evaluate the potential benefits of separating into two distinct public companies – one comprising the Truckload segment, and one comprising the LTL, P&C, and Logistics segments.

“This attractive acquisition is highly complementary to our existing operations and scales our Truckload segment into a leading North American truckload transportation and logistics business. Daseke’s deep expertise in servicing a broad portfolio of specialized and industrial end markets such as high-security cargo, agriculture, manufacturing, and construction, is critical given the relative strength of specialized market dynamics today. We extend a warm welcome to the Daseke team,” stated Alain Bédard, Chairman, President and Chief Executive Officer of TFI International. “This acquisition also advances our strategic consideration of creating a unique opportunity for shareholders to separately invest in a specialized truckload business and in an LTL, P&C and Logistics business. Our immediate focus will be on improving Daseke’s financial results, with the strategic consideration to follow and be ongoing.”

ABOUT THE TRANSACTION

The merger agreement has been unanimously approved by the Boards of Directors of TFI International and Daseke. The transaction is subject to approval of holders of a majority of the outstanding shares of Daseke common stock and other customary closing conditions, including regulatory approval. The closing is not conditioned on financing.

The total enterprise value of the transaction is approximately $1.1 billion, including the merger consideration for the common stock, retirement of Daseke’s outstanding preferred stock, payoff or assumption of outstanding debt, net of cash, and estimated transaction fees and expenses. TFI International expects to fund the transaction using cash balances and available financing sources and expects to seek to retain in place certain of Daseke’s existing equipment financing arrangements.

ADVISOR

Scudder Law Firm, P.C., L.L.O., Lincoln, Nebraska, served as TFI International’s legal advisor in connection with the transaction.

ABOUT TFI INTERNATIONAL

TFI International Inc. is a North American leader in the transportation and logistics industry, operating across the United States and Canada through its subsidiaries. TFI International creates value for shareholders by identifying strategic acquisitions and managing a growing network of wholly owned operating subsidiaries. Under the TFI International umbrella, companies benefit from financial and operational resources to build their businesses and increase their efficiency. TFI International companies service the following segments:

TFI International Inc. is publicly traded on the New York Stock Exchange and the Toronto Stock Exchange under the symbol TFII. For more information, visit www.tfiintl.com.

For further information:

Alain Bédard

Chairman, President and CEO

TFI International Inc.

647-729-4079

abedard@tfiintl.com

Additional Information about the Transaction and Where to Find It

This communication is being made in respect of the proposed acquisition by TFI International of Daseke. A meeting of the stockholders of Daseke will be held to seek stockholder approval in connection with the proposed acquisition. Daseke will file with the Securities and Exchange Commission (“SEC”) a proxy statement and other relevant documents in connection with the proposed transaction. The definitive proxy statement will be sent or given to the stockholders of Daseke and will contain important information about the proposed transaction and related matters. INVESTORS AND STOCKHOLDERS OF DASEKE SHOULD READ THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT DASEKE, TFI INTERNATIONAL, AND THE TRANSACTION. Investors may obtain a free copy of these materials (when they are available) and other documents filed by Daseke with the SEC at the SEC’s website at www.sec.gov, at Daseke’s website at www.investor.daseke.com or by sending a written request to the Daseke’s Investor Relations department at investors@daseke.com.

Participants in the Solicitation

Daseke and certain of its directors, executive officers and other employees may be deemed to be participants in soliciting proxies from its stockholders in connection with the transaction. Information regarding the persons who may, under the rules of the SEC, be considered to be participants in the solicitation of Daseke’s stockholders in connection with the transaction will be set forth in Daseke’s definitive proxy statement for its stockholder meeting. Additional information regarding these individuals and any direct or indirect interests they may have in the transaction will be set forth in the definitive proxy statement when it is filed with the SEC in connection with the transaction.

Forward Looking Statements

This communication contains “forward-looking statements,” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 that provides a safe harbor for forward-looking statements, including statements relating to the completion of the transaction, all statements that do not relate solely to historical or current facts, and expectations, intentions or strategies regarding the future. These forward-looking statements are generally denoted by the use of words such as “anticipate,” “believe,” “expect,” “intend,” “aim,” “target,” “plan,” “continue,” “estimate,” “project,” “may,” “will,” “should,” “could,” “would,” “predict,” “potential,” “ongoing,” “goal,” “can,” “seek,” “designed,” “likely,” “foresee,” “forecast,” “project,” “hope,” “strategy,” “objective,” “mission,” “continue,” “outlook,” “potential,” “feel,” and similar expressions. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Statements in this announcement that are forward looking may include, but are not limited to, statements regarding the benefits of the proposed transaction with Daseke and the associated integration plans, expected synergies and revenue opportunities, expected branding, anticipated future operating performance and results of TFI

International, including statements regarding anticipated earnings, margins, and cash flows, anticipated future liquidity, anticipated availability of future resources, financial or otherwise, anticipated growth opportunities, anticipated fleet size, the availability of the transaction consideration, the expected management of Daseke following the transaction, the expected timing of the closing of the proposed transaction and other transactions contemplated by the proposed transaction, and the strategic consideration of separating the Truckload segment of TFI International into a separate publicly traded entity. By their nature, all forward-looking statements are not guarantees of future performance or results and are subject to risks and uncertainties that are difficult to predict and/or quantify. Such risks and uncertainties include, but are not limited to: the occurrence of any event, change or other circumstance that could give rise to the right of TFI International or Daseke or both of them to terminate the proposed transaction, including circumstances requiring Daseke to pay TFI International a termination fee pursuant to the transaction agreement; the failure to obtain applicable regulatory or Daseke stockholder approval in a timely manner or otherwise; the risk that the transaction may not close in the anticipated timeframe or at all due to one or more of the other closing conditions to the transaction not being satisfied or waived; the risk that there may be unexpected costs, charges or expenses resulting from the proposed transaction; risks related to the ability of TFI International to successfully integrate the businesses and achieve the expected synergies and operating efficiencies within the expected timeframes or at all and the possibility that such integration may be more difficult, time consuming or costly than expected; risks that the proposed transaction disrupts TFI International’s or Daseke’s current plans and operations; the risk that certain restrictions during the pendency of the proposed transaction may impact TFI International’s or Daseke’s ability to pursue certain business opportunities or strategic transactions; risks related to disruption of each company’s management’s time and attention from ongoing business operations due to the proposed transaction; risks associated with continued and sufficient availability of capital and financing; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of TFI International’s and/or Daseke’s common stock or operating results; the risk that the proposed transaction and its announcement could have an adverse effect on the ability of TFI International and Daseke to retain and hire key personnel, to retain customers and to maintain relationships with each of their respective business partners, suppliers and customers and on their respective operating results and businesses generally; the risk of litigation that could be instituted against the parties to the agreement or their respective directors, affiliated persons or officers and/or regulatory actions related to the proposed transaction, including the effects of any outcomes related thereto; risks related to the considerations of, and if approved execution of, the separation of TFI International’s Truckload segment into a separate publicly traded company; risks related to changes in accounting standards or tax rates, laws or regulations; risks related to unpredictable and severe or catastrophic events, including but not limited to acts of terrorism, war or hostilities (including effects of the conflict in Ukraine), cyber-attacks, or the impact of the COVID-19 pandemic or any other pandemic, epidemic or outbreak of an infectious disease in the United States or worldwide on TFI International’s or Daseke’s business, financial condition and results of operations, as well as the response thereto by each company; and other business effects, including the effects of industry, market, economic (including the effect of inflation), political or regulatory conditions. Also, TFI International’s and Daseke’s actual results may differ materially from those contemplated by the forward-looking statements for a number of additional reasons as described in TFI International’s and Daseke’s respective SEC filings, including those set forth in the Risk Factors section and under any “Forward-Looking Statements” or similar heading in TFI International’s or Daseke’s respective reports filed with the SEC.

You are cautioned not to place undue reliance on TFI International’s or Daseke’s forward-looking statements. TFI International’s or Daseke’s respective forward-looking statements are and will be based upon each company’s management’s then-current views and assumptions regarding TFI International’s proposed transaction with Daseke, future events and operating performance, and are applicable only as of the dates of such statements. Neither TFI International nor Daseke assumes any duty to update or revise forward-looking statements, whether as a result of new information, future events, uncertainties or otherwise.

If the proposed transaction is consummated, Daseke’s stockholders will cease to have any equity interest in Daseke and will have no right to participate in its earnings and future growth.

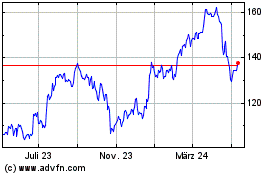

TFI (NYSE:TFII)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

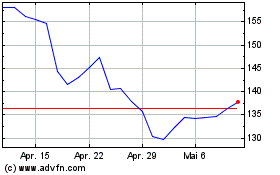

TFI (NYSE:TFII)

Historical Stock Chart

Von Dez 2023 bis Dez 2024