Form 8-K - Current report

08 Februar 2024 - 10:20PM

Edgar (US Regulatory)

false

0001063761

0001063761

2024-02-08

2024-02-08

0001063761

us-gaap:CommonStockMember

2024-02-08

2024-02-08

0001063761

spg:SeriesJPreferredStockMember

2024-02-08

2024-02-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 8, 2024

SIMON

PROPERTY GROUP, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

001-14469 |

04-6268599 |

| (State

or other jurisdiction of |

(Commission

File Number) |

(IRS

Employer |

| incorporation) |

|

Identification

No.) |

225 West Washington Street

Indianapolis,

Indiana |

46204 |

| (Address

of principal executive offices) |

(Zip

Code) |

Registrant’s

telephone number, including area code: (317) 636-1600

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which

registered |

| Common

stock, $0.0001 par value |

|

SPG |

|

New York Stock Exchange |

| 83/8%

Series J Cumulative Redeemable Preferred Stock, $0.0001 par value |

|

SPGJ |

|

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§

230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth

company ¨

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ¨

On February 8, 2024, Simon Property Group, Inc.

(NYSE: SPG) issued a press release announcing that the Company’s Board of Directors authorized a new common stock repurchase program.

Under the new program, the Company may purchase up to $2.0 billion of its common stock over the next 24 months, as market conditions warrant.

The shares may be repurchased in the open market or in privately negotiated transactions, at prices that the Company deems appropriate

and subject to market conditions, applicable law and other factors deemed relevant in the Company’s sole discretion. The stock repurchase

program does not obligate the Company to repurchase any dollar amount or number of shares of common stock, and the program may be suspended

or discontinued at any time. This new $2.0 billion program replaces the previous program that had been scheduled to expire on May 16,

2024 of which approximately $1.7 billion was available.

A copy of the press release announcing the new

repurchase program is attached hereto as Exhibit 99.1, and is incorporated by reference and constitutes a part of this report.

| ITEM 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: February 8, 2024

| |

SIMON PROPERTY GROUP, INC. |

| |

|

| |

|

|

| |

|

By: |

/s/ Steven E. Fivel |

| |

|

|

Steven E. Fivel |

| |

|

|

Secretary and General Counsel |

Exhibit 99.1

| Contacts: |

|

|

| Tom Ward |

317-685-7330 Investors |

|

| Nicole Kennon |

704-804-1960 Media |

|

Simon®

Announces New $2.0 Billion

Common Stock Repurchase Program

INDIANAPOLIS, February 8, 2024 — Simon®,

a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations, today

announced that the Company’s Board of Directors authorized a new common stock repurchase program. Under the new program, the Company

may purchase up to $2.0 billion of its common stock over the next 24 months, as market conditions warrant. The shares may be repurchased

in the open market or in privately negotiated transactions, at prices that the Company deems appropriate and subject to market conditions,

applicable law and other factors deemed relevant in the Company’s sole discretion. The stock repurchase program does not obligate

the Company to repurchase any dollar amount or number of shares of common stock, and the program may be suspended or discontinued at

any time. This new $2.0 billion program replaces the previous program that had been scheduled to expire on May 16, 2024 of which

approximately $1.7 billion was available.

About Simon

Simon® is a real estate investment trust engaged

in the ownership of premier shopping, dining, entertainment and mixed-use destinations and an S&P 100 company (Simon Property Group,

NYSE: SPG). Our properties across North America, Europe and Asia provide community gathering places for millions of people every day

and generate billions in annual sales.

Forward-Looking Statements

Certain statements made in this press

release may be deemed "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995.

Although the Company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company

can give no assurance that its expectations will be attained, and it is possible that the Company's actual results may differ materially

from those indicated by these forward–looking statements due to a variety of risks, uncertainties and other factors. Such factors

include, but are not limited to: changes in economic and market conditions that may adversely affect the general retail environment,

including but not limited to those caused by inflation, recessionary pressures, wars, escalating geopolitical tensions as a result of

the war in Ukraine and the conflicts in the Middle East, and supply chain disruptions; the inability to renew leases and relet vacant

space at existing properties on favorable terms; the potential loss of anchor stores or major tenants; the inability to collect rent

due to the bankruptcy or insolvency of tenants or otherwise; an increase in vacant space at our properties; the potential for violence,

civil unrest, criminal activity or terrorist activities at our properties; natural disasters; the availability of comprehensive insurance

coverage; the intensely competitive market environment in the retail industry, including e-commerce; security breaches that could compromise

our information technology or infrastructure; reducing emissions of greenhouse gases; environmental liabilities; our international activities

subjecting us to risks that are different from or greater than those associated with our domestic operations, including changes in foreign

exchange rates; our continued ability to maintain our status as a REIT; changes in tax laws or regulations that result in adverse tax

consequences; risks associated with the acquisition, development, redevelopment, expansion, leasing and management of properties; the

inability to lease newly developed properties on favorable terms; the loss of key management personnel; uncertainties regarding the impact

of pandemics, epidemics or public health crises, and the associated governmental restrictions on our business, financial condition, results

of operations, cash flow and liquidity; changes in market rates of interest; the impact of our substantial indebtedness on our future

operations, including covenants in the governing agreements that impose restrictions on us that may affect our ability to operate freely;

any disruption in the financial markets that may adversely affect our ability to access capital for growth and satisfy our ongoing debt

service requirements; any change in our credit rating; risks relating to our joint venture properties, including guarantees of certain

joint venture indebtedness; and general risks related to real estate investments, including the illiquidity of real estate investments.

The Company discusses these and other risks and uncertainties under

the heading "Risk Factors" in its annual and quarterly periodic reports filed with the SEC. The Company may update that

discussion in subsequent other periodic reports, but except as required by law, the Company undertakes no duty or obligation to update

or revise these forward-looking statements, whether as a result of new information, future developments, or otherwise.

v3.24.0.1

Cover

|

Feb. 08, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 08, 2024

|

| Entity File Number |

001-14469

|

| Entity Registrant Name |

SIMON

PROPERTY GROUP, INC.

|

| Entity Central Index Key |

0001063761

|

| Entity Tax Identification Number |

04-6268599

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

225 West Washington Street

|

| Entity Address, City or Town |

Indianapolis

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46204

|

| City Area Code |

317

|

| Local Phone Number |

636-1600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common

stock, $0.0001 par value

|

| Trading Symbol |

SPG

|

| Security Exchange Name |

NYSE

|

| Series J Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

83/8%

Series J Cumulative Redeemable Preferred Stock, $0.0001 par value

|

| Trading Symbol |

SPGJ

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=spg_SeriesJPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

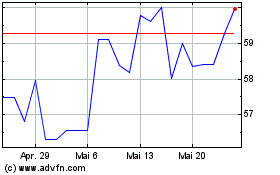

Simon Property (NYSE:SPG-J)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Simon Property (NYSE:SPG-J)

Historical Stock Chart

Von Jan 2024 bis Jan 2025