falseFY20230000109177falsefalsefalsefalse00001091772022-10-012023-09-300000109177spb:SbRhHoldingsLlcMember2022-10-012023-09-3000001091772023-04-02iso4217:USD00001091772023-12-31xbrli:shares

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

| | | | | |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended September 30, 2023

OR

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to ___________

| | | | | | | | | | | | | | |

| Commission File No. | | Name of Registrant, State of Incorporation,

Address of Principal Offices, and Telephone No. | | IRS Employer Identification No. |

| 1-4219 | | Spectrum Brands Holdings, Inc. | | 74-1339132 |

(a Delaware corporation)

3001 Deming Way, Middleton, WI 53562

(608) 275-3340

www.spectrumbrands.com

| | | | | | | | | | | | | | |

| 333-192634-03 | | SB/RH Holdings, LLC | | 27-2812840 |

(a Delaware limited liability company)

3001 Deming Way, Middleton, WI 53562

(608) 275-3340

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Registrant | | Title of each class | | Name of each exchange on which registered |

| Spectrum Brands Holdings, Inc. | | Common Stock, Par Value $0.01 | | New York Stock Exchange |

| SB/RH Holdings, LLC | | None | | None |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrants are well-known seasoned issuers, as defined in Rule 405 of the Securities Act.

| | | | | | | | | | | | | | | | | |

| Spectrum Brands Holdings, Inc. | Yes | ☒ | No | ☐ | |

| SB/RH Holdings, LLC | Yes | ☐ | No | ☒ | |

Indicate by check mark if the registrants are not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| | | | | | | | | | | | | | | | | |

| Spectrum Brands Holdings, Inc. | Yes | ☐ | No | ☒ | |

| SB/RH Holdings, LLC | Yes | ☐ | No | ☒ | |

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| | | | | | | | | | | | | | | | | |

| Spectrum Brands Holdings, Inc. | Yes | ☒ | No | ☐ | |

| SB/RH Holdings, LLC | Yes | ☒ | No | ☐ | |

Indicate by check mark whether the registrants have submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

| | | | | | | | | | | | | | | | | |

| Spectrum Brands Holdings, Inc. | Yes | ☒ | No | ☐ | |

| SB/RH Holdings, LLC | Yes | ☒ | No | ☐ | |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

| | | | | | | | | | | | | | | | | |

| Spectrum Brands Holdings, Inc. | | ☐ | | | |

| SB/RH Holdings, LLC | | ☐ | | | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company in Rule 12b-2 of the Exchange Act.:

| | | | | | | | | | | | | | | | | |

Registrant | Large Accelerated Filer | Accelerated Filer | Non-accelerated Filer | Smaller Reporting Company | Emerging Growth Company |

| Spectrum Brands Holdings, Inc. | X | | | | |

| SB/RH Holdings, LLC | | | X | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| | | | | |

| Spectrum Brands Holdings, Inc. | ☐ |

| SB/RH Holdings, LLC | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| | | | | | | | | | | | | | | | | |

| Spectrum Brands Holdings, Inc. | Yes | ☐ | No | ☒ | |

| SB/RH Holdings, LLC | Yes | ☐ | No | ☒ | |

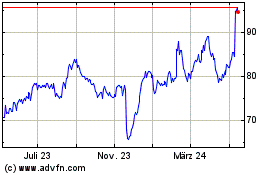

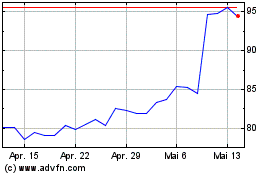

The aggregate market value of the voting stock held by non-affiliates of Spectrum Brands Holdings, Inc. was approximately $2,624 million based upon the closing price on the last business day of the registrant's most recently completed second fiscal quarter (April 2, 2023). For the sole purposes of making this calculation, term “non-affiliate” has been interpreted to exclude directors and executive officers and other affiliates of the registrant. Exclusion of shares held by any person should not be construed as a conclusion by the registrant, or an admission by any such person, or that such person is an “affiliate” of the Company, as defined by applicable securities law.

As of December 31, 2023, there were outstanding 30,840,406 shares of Spectrum Brands Holdings, Inc.’s Common Stock, par value $0.01 per share.

| | | | | | | | |

Auditor Name: KPMG, LLP | Auditor Location: Milwaukee, Wisconsin | Auditor Firm ID: 185 |

SB/RH Holdings, LLC meets the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and has therefore omitted the information otherwise called for by Items 10 to 13 of Form 10-K as allowed under General Instruction I(2)(c).

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| |

| | |

| ITEM 10. | | |

| ITEM 11. | | |

| ITEM 12. | | |

| ITEM 13. | | |

| | |

| ITEM 15. | | |

| |

| |

EXPLANATORY NOTE

Spectrum Brands Holdings, Inc. and SB/RH Holdings, LLC are filing this Amendment No. 1 (this “Form 10-K/A”) to their Annual Report on Form 10-K for the fiscal year ended September 30, 2023 (“Fiscal 2023”) that was filed with the Securities and Exchange Commission (“SEC”) on November 21, 2023 (the “Original Form 10-K”) for the sole purpose of including certain of the information required by Part III of Form 10-K. As required by Rule 12b-15, in connection with this Form 10-K/A, the Company’s Principal Executive Officer and Principal Financial Officer are providing Rule 13a-14(a) certifications included herein.

Except as explicitly set forth herein, this Form 10-K/A does not purport to modify or update the disclosures in, or exhibits to, the Original Form 10-K or to update the Original Form 10-K to reflect events occurring after the date of such filing.

PART III

Except as otherwise specified, all references herein to the “Company,” “Spectrum Brands,” “we,” “us” or “our” refer to Spectrum Brands Holdings, Inc. and “Fiscal” refers to the fiscal year ended September 30 of each applicable year.

| | | | | |

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Our Board of Directors

In accordance with our Third Restated By-Laws (our “By-Laws”) and our Amended and Restated Certificate of Incorporation (our “Charter”), our Board currently consists of seven members that are currently divided into three classes (designated as Class I, Class II and Class III, respectively). In August 2021, at our annual stockholders’ meeting, our stockholders approved an amendment to our Charter to declassify our Board. We are two-thirds of the way completed in the declassification process, which we expect to complete at our 2024 annual stockholders meeting. Pursuant to such charter amendment (i) our current Class I directors stood for election at our 2022 annual meeting and have stood, and will continue to stand, for election for one-year terms thereafter, (ii) our current Class II directors stood for election at our 2023 annual meeting and will stand for election for one-year terms thereafter, (iii) our current Class III directors will stand for election at our 2024 annual meeting and will stand for election for one-year terms thereafter and (iv) beginning in 2024, all directors will stand for election for one-year terms at the 2024 annual meeting.

Our Nominating and Corporate Governance Committee (“NCG Committee”) considers and chooses nominees for our Board with the primary goal of presenting a diverse and well-qualified slate of candidates who will serve the interests of our Company and our shareholders, taking into account the attributes of each candidate’s professional skill set and credentials, as well as gender, age, ethnicity and personal background. In evaluating nominees, our NCG Committee reviews each candidate’s background and assesses each candidate’s independence, skills, experience and expertise based upon a number of factors. We seek directors with the highest professional and personal ethics, integrity and character who have experience at the governance and policy-making level in their respective fields. Our NCG Committee reviews the professional background of each candidate to determine whether each candidate has the appropriate experience and ability to effectively make important decisions as a member on our Board. Our NCG Committee also determines whether a candidate’s skills and experience complement and enhance the collective skills and experience of our existing Board members.

Director Skills and Experiences

Our directors collectively represent a robust and diverse set of skills and experience, which we believe positions our Board and its committees well to effectively oversee the execution of our business strategy and to advance the interests of the Company and its stakeholders. The following table summarizes some of the key categories of skills and experience of our current directors:

| | | | | | | | | | | | | | | | | | | | | | | |

| Directors |

| Skills & Experience | Sherianne James | Leslie L. Campbell | Joan Chow | Hugh R. Rovit | Gautam Patel | David M. Maura | Terry L. Polistina |

| Accounting/Auditing | | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Business Operations | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Consumer Products | ✓ | ✓ | ✓ | ✓ | | ✓ | ✓ |

| Corporate Governance | ✓ | | ✓ | ✓ | ✓ | ✓ | ✓ |

| Corporate Strategy & Business Development | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Ethics/Corporate Social Responsibility | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Executive Leadership & Management | ✓ | ✓ | ✓ | ✓ | | ✓ | ✓ |

| Finance/Capital Management & Allocation | | ✓ | | ✓ | ✓ | ✓ | ✓ |

| Human Resources & Compensation | | | ✓ | ✓ | ✓ | ✓ | ✓ |

| International Business Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Marketing/Sales or Brand Management | ✓ | ✓ | ✓ | ✓ | | ✓ | ✓ |

| Mergers & Acquisitions | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Public Company Board Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Public Company Executive Experience | ✓ | | ✓ | ✓ | | ✓ | ✓ |

Director Diversity as Group

As discussed in more detail below, we have developed a Board Diversity Policy, setting out the basic principles for promoting the appropriate balance of skills, experience and diversity of perspectives necessary to enhance the effectiveness of the Board and to maintain the highest standards of corporate governance. Pursuant to this policy, the selection of Board candidates is based on a range of perspectives with reference to the Company’s business model and specific needs, including, but not limited to, talents, skills and expertise, industry experience, professional experience, gender, age, race, language, cultural background, educational background and other similar characteristics.

As outlined further below, we are proud to have the benefit of a skilled and multifaceted Board, the majority of which is composed of female and diverse background members. We are committed to ensuring that female and minority candidates are among the pool of individuals from which new Board nominees are selected. We have steadily advanced this objective by appointing to our Board a number of candidates, all of whom are from a diverse background. As discussed further on page 9 of this report, we have taken a number of significant strategic transactions and reduced the business holdings of our Company from six down to three and further intend on reducing our business holdings down to two to become a pure play Global Pet Care and Home & Garden company. Alongside these business reductions, we have reduced the size of our employee base and our senior executive team. We also reduced the size of our Board from nine to seven directors, six of which are independent, instead of filling the vacancies. We intend to promote female representation on our Board should we experience any vacancies or once we re-examine the composition of our Board following the transition of the Company to a pure play Global Pet Care and Home & Garden company.

Racial/National Origin Diversity

Gender Diversity

Director Diversity by Individual

| | | | | | | | | | | | | | | | | |

| Name | Age | Gender | Asian / South Asian | Black / African American | White / Caucasian |

| Sherianne James | 55 | F | | ✓ | |

| Leslie L. Campbell | 63 | M | | ✓ | |

| Joan Chow | 63 | F | ✓ | | |

| Hugh R. Rovit | 63 | M | | | ✓ |

| Gautam Patel | 51 | M | ✓ | | |

| David M. Maura | 51 | M | | | ✓ |

| Terry L. Polistina | 60 | M | | | ✓ |

Board & Committee Composition

The names of our seven current directors and their respective classes and ages. Board tenures and committee memberships are each set forth in the following table:

| | | | | | | | | | | | | | | | | | | | |

| | | | Committee Membership 3 |

| Name | Class1 | Age | Tenure2 | A | C | NCG |

Sherianne James Independent Director | I | 55 | 2018 | | ○ | ● |

Leslie L. Campbell Independent Director | I | 63 | 2021 | ○ | | |

Joan Chow Independent Director | I | 63 | 2021 | ○ | | |

Hugh R. Rovit Independent Director | II | 63 | 2018 | ○ | | ○ |

Gautam Patel Independent Director | II | 51 | 2020 | ● | ○ | |

David M. Maura Executive Chairman | III | 51 | 2018 | | | |

Terry L. Polistina Lead Independent Director | III | 60 | 2018 | | ● | ○ |

1.The term of our Class I, Class II and Class III directors expires at our 2024 annual shareholders meeting; thereafter, the term of all directors will expire annually.

2.Tenure represents service on the Board of the Company following the merger on July 13, 2018 of HRG Group, Inc. (now known as Spectrum Brands Holdings, Inc.) with its majority owned subsidiary, Spectrum Brands Legacy, Inc. (formerly known as "HRG Group", Spectrum Brands Holdings, Inc.)("SPB Legacy").

3.Committee membership: A = Audit Committee; C = Compensation Committee; NCG = NCG Committee; * indicates committee Chair; ○ indicates committee member.

Director Biographies

Set forth below are biographies for each of our directors, accompanied by descriptions of some of their key skills and experiences. The absence of any given category of key skills or experiences from the list preceding a director’s biography does not necessarily signify a lack of qualification in any such category.

Class I Directors

| | | | | |

| Sherianne James | Class I Director |

Independent Director since: October 2018

Age: 55

Race/Ethnicity: African American

Gender: Female

Assignments/Committees:

• NCG Committee (Chair)

• Compensation Committee

| Sherianne James was appointed to our Board in October 2018. Ms. James has served as Chief Marketing Officer of Essilor of America since August 2017 and SVP of Customer Engagement since March 2020, and previously was Vice President, Consumer Marketing for the company since July 2016. From February 2011 to July 2016, she held positions of increasing responsibility in marketing and operations for Transitions Optical, a division of Essilor of America, culminating in her role as Vice President of Transitions Optical from April 2014 to July 2016.

From July 2005 through December 2010, Ms. James was Senior Marketing Manager for Russell Hobbs/Applica. She previously held a number of key project manager, research manager and brand manager positions with Kraft Foods, Inc. and, later, Kraft/Nabisco Foods from June 1995 to June 2005. Ms. James earned a B.S. degree in chemical engineering from the University of Florida in 1994 and an MBA from Northwestern University’s Kellogg Graduate School of Management in 2002. Ms. James currently serves as Chair of our NCG Committee and is a member of our Compensation Committee. See table on page 4 for Ms. James’ key skills and experiences. |

| | | | | |

| Leslie L. Campbell | Class I Director |

Independent Director since: April 2021

Age: 63

Race/Ethnicity: African American

Gender: Male

Assignments/Committees:

• Audit Committee

| Leslie L. Campbell was appointed to our Board in April 2021. Since 2015, Mr. Campbell has been the owner and Chief Executive Officer of Campbell & Associates LLC, a product development and engineering company. From 2013 to 2015, he served as Executive Vice President at AAMP Global, a vehicle technology company where he was responsible for engineering, research and development, new product development and operations. From 2002 to 2013, Mr. Campbell served in various senior roles of increasing responsibility in the engineering department for Applica Consumer Products, including serving the last six years of his tenure as Vice President of Engineering Quality and Regulatory where he was responsible for the design and development of new products and the maintenance of existing core product lines. From 1999 to 2002, Mr. Campbell served as Chief Engineer for B/E Aerospace where he was responsible for the design and development of galley products for commercial airlines. From 1995 to 1999, Mr. Campbell served as a Senior Research Engineer for Baker Hughes. From 1990 to 1995, he served as Senior Engineer at the Johnson Space Center (NASA) and from 1989 to 1990 he was a Senior Engineer at General Electric - Aerospace Division. Mr. Campbell received an undergraduate degree in engineering from the University of Florida. Mr. Campbell currently serves as a member of our Audit Committee. See table on page 4 for Mr. Campbell’s key skills and experiences. |

| | | | | |

| Joan Chow | Class I Director |

Independent Director since: April 2021

Age: 63

Race/Ethnicity: Asian

Gender: Female

Assignments/Committees:

• Audit Committee

| Joan Chow was appointed to our Board in April 2021. From February 2016 until October 2021, Ms. Chow served as Chief Marketing Officer of the Greater Chicago Food Depository. From 2007 to August 2015, Ms. Chow was the Executive Vice President and Chief Marketing Officer at ConAgra Foods, Inc. ConAgra Foods, now known as Conagra Brands, is one of North America’s leading packaged food companies. Prior to joining ConAgra in 2007, Ms. Chow was employed for nine years with Sears Holdings Corporation in various marketing positions of increasing responsibility, having served as Senior Vice President/Chief Marketing Officer of Sears Retail immediately prior to taking the position with ConAgra. Prior to that, she served in executive positions with Information Resources Inc. and Johnson & Johnson Consumer Products, Inc. Ms. Chow is a director at Energy Recovery, Inc., where she is on the Audit Committee and chairs the Compensation Committee, and is a director at High Liner Foods, where she is on the Audit Committee. She has previously served as Chair of the Compensation Committee and a member of the Governance Committee at Welbilt Inc., and as a director of The Manitowoc Company, RC2 Corporation and Feeding America. Ms. Chow has an M.B.A. from the Wharton School of the University of Pennsylvania and a B.A. with distinction from Cornell University. Ms. Chow currently serves as a member of our Audit Committee. See table on page 4 for Ms. Chow’s key skills and experiences. |

Class II Directors

| | | | | |

| Hugh R. Rovit | Class II Director |

Independent Director since: July 2018

Age: 63

Race/Ethnicity: Caucasian

Gender: Male

Assignments/Committees:

• Audit Committee

• NCG Committee

| Hugh R. Rovit was appointed to our Board in July 2018. From June 2010 until July 2018, Mr. Rovit served as one of the directors of Spectrum Legacy. Prior to that time, he served as a director of SBI from August 2009 to June 2010. Mr. Rovit is currently board advisor to MISSION, a global leader in cooling and heat-relief solutions after having served as Chief Executive Officer from May 2022 to September 2023. Mr. Rovit previously served as Chief Executive Officer of S’well, Inc., a global manufacturer and marketer of reusable stainless-steel bottles and accessories from February 2020 until its sale to a strategic competitor in March 2022. Prior to that, Mr. Rovit served as Chief Executive Officer of Ellery Homestyles, a leading supplier of branded and private label home fashion products to major retailers, offering curtains, bedding, throws and specialty products, from May 2013 until its sale in September 2018 to a strategic competitor. Previously, Mr. Rovit served as Chief Executive Officer of Sure Fit Inc., a marketer and distributor of home furnishing products from 2006 until its sale to a strategic competitor in December 2012 and was a Principal at turnaround management firm Masson & Company from 2001 through 2005. Previously, Mr. Rovit held the positions of Chief Financial Officer of Best Manufacturing, Inc., a manufacturer and distributor of institutional service apparel and textiles, from 1998 through 2001 and Chief Financial Officer of Royce Hosiery Mills, Inc., a manufacturer and distributor of men’s and women’s hosiery, from 1991 through 1998. Mr. Rovit is also a director of GSC Technologies, Inc. and previously served as a director of PlayPower, Inc., Nellson Nutraceuticals, Inc., Kid Brands Inc., Atkins Nutritional, Inc., Oneida, Ltd., Cosmetic Essence, Inc., Xpress Retail and Twin Star International. Mr. Rovit received his B.A. degree from Dartmouth College and has an MBA from Harvard Business School. Mr. Rovit is a member of our Audit Committee and NCG Committee. See table on page 4 for Mr. Rovit’s key skills and experiences. |

| | | | | |

| Gautam Patel | Class II Director |

Independent Director since: October 2020

Age: 51

Race/Ethnicity: Asian

Gender: Male

Assignments/Committees:

• Audit Committee (Chair)

• Compensation Committee

| Gautam Patel was appointed to our Board in October 2020. Mr. Patel has served as Managing Director of Tarsadia Investments, a private investment firm based in Newport Beach, California, since 2012. In that role, Mr. Patel has led a team of investment professionals to identify, evaluate and execute principal control equity investments across sectors including life sciences, financial services and technology. Prior to joining Tarsadia, Mr. Patel served as Managing Director at Lazard from 2008 to 2012, where he led financial and strategic advisory efforts in sectors including transportation and logistics, private equity and healthcare. Prior to that, Mr. Patel served in a variety of advisory roles at Lazard from 1999 to 2008, including restructuring, bankruptcy and corporate reorganization assignments in 2001 and 2008. From 1994 to 1997, Mr. Patel was an Analyst at Donaldson, Lufkin & Jenrette, where he worked on mergers and acquisitions as well as high-yield and equity financings. Mr. Patel is currently a Board Member of Amneal Pharmaceuticals (NYSE: AMRX) Mr. Patel is currently a Board Member of Amneal Pharmaceuticals (NYSE: AMRX). Mr. Patel also serves on the board of Casita Maria Center for Arts and Education, a New York-based nonprofit organization which aims to empower children through arts-based education. Mr. Patel received a B.A. from Claremont McKenna College, a B.S. from Harvey Mudd College, an MSc from the London School of Economics and an MBA from the University of Chicago. Mr. Patel currently serves as Chair of our Audit Committee and as a member of our Compensation Committee. See table on page 4 for Mr. Patel’s key skills and experiences. |

Class III Directors

| | | | | |

| Terry L. Polistina | Class III Director |

Independent Director since: July 2018

Age: 60

Race/Ethnicity: Caucasian

Gender: Male

Assignments/Committees:

• Lead Independent Director • Compensation Committee (Chair) • NCG Committee | Terry L. Polistina was appointed to our Board in July 2018. From June 2010 until July 2018, Mr. Polistina served as one of the directors of SPB Legacy. Since July 2018, Mr. Polistina has also served as the Lead Independent Director of the Board. Prior to that, he served as a director of SBI from August 2009 to June 2010. Mr. Polistina served as the President, Small Appliances of SPB Legacy beginning in June 2010 and became President - Global Appliances of SPB Legacy in October 2010 until September 2013. Prior to that, Mr. Polistina served as the Chief Executive Officer and President of Russell Hobbs from 2007 until 2010. Mr. Polistina served as Chief Operating Officer at Applica from 2006 to 2007 and Chief Financial Officer from 2001 to 2007, at which time Applica combined with Russell Hobbs. Mr. Polistina previously served as a director of privately held Entic, Inc. Mr. Polistina received an undergraduate degree in finance from the University of Florida and holds an MBA from the University of Miami. Mr. Polistina is the Chair of our Compensation Committee, is a member of our NCG Committee and serves as the Lead Independent Director of the Board. See table on page 4 for Mr. Polistina’s key skills and experiences. |

See “Our Executive Officers”below for certain information regarding David M. Maura, our Class III Director and our only director-employee.

Our Executive Officers

Our executive officers serve at the discretion of our Board. Our Board selected each of our executive officers because their background provides each executive with the experience and skill set geared toward helping us succeed in our business strategy. Our management team is composed of experienced executives from diverse backgrounds who focus on the performance of our Company to drive long-term outcomes. We are proud to have the benefit of individuals with diverse backgrounds on our executive team, and we are committed to promoting candidates from a diverse backgrounds as we select new executive officers.

Included in the discussion below is information regarding our executive officers who do not serve as directors of our Company.

David M. Maura

Chief Executive Officer and Chairman of the Board of Directors (July 2018 to Present)

Age: 51

Race/Ethnicity: Caucasian

Gender: Male

__________________________________________________________________________________________________________________________

David M. Maura was appointed our Executive Chairman and our Chief Executive Officer in July 2018. Previously, he had served as the Executive Chairman, effective as of January 2016, and as Chief Executive Officer, effective as of April 2018, of SPB Legacy. Prior to such appointment, Mr. Maura served as non-executive Chairman of the board of directors of SPB Legacy since July 2011 and served as interim Chairman and as one of the directors of SPB Legacy since June 2010. Mr. Maura was a Managing Director and the Executive Vice President of Investments at HRG Group, Inc. (now known as Spectrum Brands Holdings, Inc.) from October 2011 until November 2016 and had been a member of HRG Group’s board of directors from May 2011 until December 2017. Mr. Maura previously served as a Vice President and Director of Investments of Harbinger Capital Partners LLC from 2006 until 2012. Prior to joining Harbinger Capital in 2006, Mr. Maura was a Managing Director and Senior Research Analyst at First Albany Capital, Inc., where he focused on distressed debt and special situations, primarily in the consumer products and retail sectors. Prior to First Albany, Mr. Maura was a Director and Senior High Yield Research Analyst in Global High Yield Research at Merrill Lynch & Co. Previously, Mr. Maura was a Vice President and Senior Analyst in the High Yield Group at Wachovia Securities, where he covered various consumer product, service and retail companies. Mr. Maura began his career at ZPR Investment Management as a Financial Analyst.

Mr. Maura served as Chairman, President and Chief Executive Officer of Mosaic Acquisition Corp. (“Mosaic”) from October 2017 to January 2020, and served as outside director of Vivint Smart Home, Inc. (Mosaic’s successor) from January 2020 until March 2020. He previously served on the boards of directors of Ferrous Resources, Ltd., Russell Hobbs and Applica. Mr. Maura received a B.S. degree in business administration from Stetson University and is a CFA charter holder. See table on page 4 for Mr. Maura’s key skills and experiences.

Jeremy W. Smeltser

__________________________________________________________________________________________________________________________

Executive Vice President, Chief Financial Officer (November 2019 to Present)

Age: 49

Race/Ethnicity: Caucasian

Gender: Male

__________________________________________________________________________________________________________________________

Jeremy W. Smeltser was appointed our Executive Vice President on October 1, 2019 and was appointed our Chief Financial Officer on November 17, 2019. He previously served as Vice President and Chief Financial Officer of SPX Flow, Inc. (“SPX Flow”). Prior to his role at SPX Flow, he served as Vice President and Chief Financial Officer of SPX Corporation, where he served in various roles, including as Vice President and Chief Financial Officer, Flow Technology and became an officer of SPX Corporation in April 2009. Mr. Smeltser joined SPX Corporation in 2002 from Ernst & Young LLP, where he was an audit manager in Tampa, Florida. Prior to that, he held various positions with Arthur Andersen LLP in Tampa, Florida and Chicago, Illinois, focused primarily on assurance services for global manufacturing clients. Mr. Smeltser earned a B.S. degree in accounting from Northern Illinois University.

Ehsan Zargar

__________________________________________________________________________________________________________________________

Executive Vice President, General Counsel & Corporate Secretary (October 2018 to Present)

Age: 46

Race/Ethnicity: Asian (Middle Eastern)

Gender: Male

__________________________________________________________________________________________________________________________

Ehsan Zargar was appointed our Executive Vice President, General Counsel and Corporate Secretary on October 1, 2018. Mr. Zargar is responsible for the Company’s legal, environmental, social and governance, health and safety, insurance and real estate functions. In addition, Mr. Zargar takes a leading role in negotiating and implementing the Company’s M&A, capital markets and other strategic activities. Previously, Mr. Zargar also led the Company’s executive compensation program. From June 2011 until July 2018, Mr. Zargar held a number of increasingly senior positions with HRG Group, a publicly-listed acquisition company, including serving as its Executive Vice President and Chief Operating Officer from January 2017 until July 2018, as its General Counsel since April 2015 and as Corporate Secretary since February 2012. During his time at HRG Group, Mr. Zargar took a leading role in setting, negotiating and implementing HRG Group’s M&A, capital markets and other strategic activities. Mr. Zargar has extensive experience serving on private and public boards and committees of portfolio companies, including setting and overseeing senior management compensation programs. From August 2017 until July 2018, Mr. Zargar served as a director of SPB Legacy. From November 2006 to June 2011, Mr. Zargar worked in the New York office of Paul, Weiss, Rifkind, Wharton & Garrison LLP. Previously, Mr. Zargar practiced law at another major law firm focusing on general corporate matters. Mr. Zargar received a law degree from Faculty of Law at the University of Toronto and a B.A. from the University of Toronto.

Corporate Governance

Our corporate governance practices have evolved alongside our overall holding structure and business strategy. As disclosed in our prior filings, prior to July 13, 2018, our Company was called HRG Group and was engaged in a completely different business. HRG Group was a permanent acquisition vehicle that held, bought and sold interests in a number of different businesses, including, among others, a majority interest in an insurance business by the name of Fidelity & Guaranty, complete ownership of a reinsurance business by the name of Front Street, complete ownership of an oil and gas business by the name of Compass and a majority ownership of our legacy company, which was also called “Spectrum Brands Holdings, Inc.” (“SPB Legacy"). In 2016, HRG Group proceeded to wind-down its operations by disposing of all of its business holdings, and by 2018 its only remaining interest was its majority ownership in SPB Legacy. On July 13, 2018, HRG Group completed a merger with SPB Legacy. Following the completion of the merger (the “HRG Merger”), (i) HRG Group continued on as the surviving public company and changed its name to “Spectrum Brands Holdings, Inc.” and (ii) SPB Legacy became a wholly owned subsidiary of our Company and ceased being a separate public company.

Following the HRG Merger, we reviewed the overall strategy of the Company and decided to streamline our business holdings and focus on our core areas of expertise. In connection with that we took the following actions to reduce our business holdings.

•In January 2019, we sold our Global Battery and Lighting business for $2 billion, prior to purchase price and other adjustments;

•In January 2019, we sold of our Global Auto Care business for $1.2 billion, consisting of $938.7 million in cash proceeds and $242.1 million in stock of the purchaser;

•In June 2023, we sold our Hardware and Home improvement business for $4.3 billion, prior to purchase price and other adjustments; and

•In 2023, we set a strategic goal of becoming a faster growing, higher margin Company by separating or disposing of our Home and Personal Care business and transitioning our remaining Company to a pure play Global Pet Care and Home & Garden company.

Following the completion of these strategic actions, we have reduced the business holdings of our Company from six down to three and, as discussed above, further intend on reducing our business holdings down to two to become a pure play Global Pet Care and Home & Garden company, which is intended to continue to be bolstered in size and footprint through continued organic growth and future acquisitions. Alongside these reductions, we have also reduced the size of our employee base and our senior executive team. We also reduced the size of our Board from nine to seven directors, six of which are independent, instead of filling the vacancies. We intend to promote female representation on our Board should we experience any vacancies or once we re-examine the composition of our Board following the transition of the Company to a pure play Global Pet Care and Home & Garden company.

While completing the transformative strategic, operational and personnel changes discussed above, we significantly modified the corporate governance and compensation practices of the Company. Prior to the HRG Merger, the Company was a “controlled company” and a majority-owned subsidiary of HRG Group. Following the HRG Merger, the Company evolved into a widely-held public company and we determined that its corporate governance and compensation practices should be updated to reflect its position as a widely-held company and should come in line with corporate governance and compensation best practices. For a discussion of some of our corporate governance changes following the HRG Merger, see remainder of this report.

The following table provides an overview of our corporate governance practices:

| | | | | |

| Our Practices |

| |

✓ Diverse Board and executive team

✓ Majority voting and a director resignation policy

✓ Stock ownership guidelines

✓ Anti-hedging policy

✓ Board Diversity Policy

✓ Global Environmental, Social and Governance Policy

✓ Global Energy and Greenhouse Gas Policy

✓ Environmental Policy

✓ Human Rights Policy | ✓ Independent lead director

✓ Majority of the Board composed of independent directors

✓ All committees composed entirely of independent directors

✓ Board declassifying process two-thirds (2/3) of the way completed

✓ Related person transactions policy

✓ Anti-pledging policy

✓ Robust clawback policy

✓ All members of the Audit Committee are financial experts

✓ All members of our Compensation Committee are independent |

Board Structure

Lead Independent Director

Mr. Polistina was appointed to our Board, and as our Lead Independent Director in July 2018. In his capacity as our Lead Independent Director, Mr. Polistina:

| | | | | |

| • | Presides at all meetings of the Board at which the Chairman of the Board is not present. |

| • | Presides at all executive sessions of the independent members of the Board and has the authority to call meetings of the independent members of the Board. |

| • | Serves as liaison between the management and the independent members of the Board and provides our Chief Executive Officer (“CEO”) and other members of management with feedback from executive sessions of the independent members of the Board. |

| • | Reviews and approves the information to be provided to the Board. |

| • | Reviews and approves meeting agendas and coordinates with management to develop such agendas. |

| • | Approves meeting schedules to assure there is sufficient time for discussion of all agenda items. |

| • | If requested by major shareholders, ensures that he is available for consultation and direct communication. |

| • | Interviews, along with the Chair of our NGC Committee, Board and senior management candidates and makes recommendations with respect to Board candidates and hiring of senior management. |

| • | Consults with other members of our Compensation Committee with respect to the performance review of our CEO and other member of our senior management team. |

| • | Performs such other functions and responsibilities as requested by the Board from time to time. |

Mr. Maura serves as our Executive Chairman and our CEO. Given Mr. Maura’s broad experience in mergers and acquisitions, the consumer products and retail sectors and finance and investments, our Board believes that it is in the best interest of the Company for Mr. Maura to concurrently serve as our Executive Chairman and CEO.

Director Independence

In accordance with the New York Stock Exchange Listed Company Manual (the “NYSE Rules”) and our Corporate Governance Guidelines, a majority of our Board is required to be composed of independent directors. All of our directors, except for David Maura (our Chairman and CEO), qualify as independent directors. More specifically, our Board has affirmatively determined that none of the following directors has a material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company): Leslie L. Campbell, Joan Chow, Sherianne James, Terry L. Polistina, Hugh R. Rovit and Gautam Patel. Our Board has adopted the definition of “independent director” set forth under Section 303A.02 of the NYSE Rules to assist it in making determinations of independence. Our Board has determined that the directors referred to above currently meet these standards and qualify as independent.

Meetings of Independent Directors

The Company generally holds executive sessions at each Board and committee meeting. In his capacity as our Lead Independent Director, Mr. Polistina presides over executive sessions of the entire Board, and the Chair of each committee presides over the executive sessions of that committee.

Committees Established by Our Board of Directors

Our Board has designated three principal standing committees: our Audit Committee, our Compensation Committee and our NCG Committee, each of which has a written charter addressing each such committee’s purpose and responsibilities and include such duties that the Board may designate, from time to time. Our Board, directly or through one or more of its committees, provides oversight on our management’s efforts to promote corporate social responsibility and sustainability, including efforts to advance initiatives regarding the environment, diversity, equity and inclusion, human rights, labor, health and safety and other matters. Each such committee is composed entirely of independent directors.

Audit Committee

Our Audit Committee has been established in accordance with Section 303A.06 of the NYSE Rules and Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for the purpose of overseeing the Company’s accounting and financial reporting processes and audits of our financial statements. Our Audit Committee is responsible for monitoring (i) the integrity of our financial statements, (ii) our independent registered public accounting firm’s qualifications and independence, (iii) the performance of our internal audit function and independent auditors and (iv) our compliance with legal and regulatory requirements. The responsibilities and authority of our Audit Committee are described in further detail in the Charter of the Audit Committee, as adopted by our Board in July 2018, a copy of which is available at our website www.spectrumbrands.com under “Investor Relations-Corporate Governance Documents.”

The current members of our Audit Committee are Gautam Patel (Chair), Joan Chow, Leslie L. Campbell and Hugh R. Rovit. Our Board has determined that all members of our Audit Committee qualify as “audit committee financial experts” as defined in the rules promulgated by the SEC in furtherance of Section 407 of the Sarbanes-Oxley Act of 2002. Our Board has determined that all members of our Audit Committee qualify as independent, as such term is defined in Section 303A.02 of the NYSE Rules, Section 10A(m)(3)(B) of the Exchange Act and Exchange Act Rule 10A-3(b).

Compensation Committee

Our Compensation Committee is responsible for (i) overseeing our compensation and employee benefits plans and practices, including our executive compensation plans and our incentive compensation and equity-based plans, (ii) evaluating and approving the performance of our Executive Chairman and CEO and other executive officers in light of those goals and objectives and (iii) reviewing and discussing with management our compensation discussion and analysis disclosure and compensation committee reports in order to comply with our public reporting requirements. The responsibilities and authority of our Compensation Committee are described in further detail in the Charter of the Compensation Committee, as adopted by our Board in November 2020, a copy of which is available at our website www.spectrumbrands.com under “Investor Relations-Corporate Governance Documents.”

The current members of our Compensation Committee are Terry L. Polistina (Chair), Sherianne James and Gautam Patel. Our Board has determined that all members of our Compensation Committee qualify as independent, as such term is defined in Section 303A.02 of the NYSE Rules.

NCG Committee

Our NCG Committee is responsible for (i) identifying and recommending to our Board individuals qualified to serve as our directors and on our committees of our Board, (ii) advising our Board with respect to board composition, procedures and committees, (iii) developing and recommending to our Board a set of corporate governance principles applicable to the Company and (iv) overseeing the evaluation process of our Board, the committees of the Board, the individual directors and our Executive Chairman and CEO. The responsibilities and authority of our NCG Committee are described in further detail in the Charter of the NCG Committee, as adopted by our Board in July 2018, a copy of which is available at our website www.spectrumbrands.com under “Investor Relations-Corporate Governance Documents.”

The current members of our NCG Committee are Sherianne James (Chair), Terry L. Polistina and Hugh R. Rovit. Our Board has determined that all members of our NCG Committee qualify as independent, as such term is defined in Section 303A.02 of the NYSE Rules.

Board and Committee Activities

During Fiscal 2023, our Board held five meetings and acted by unanimous written consent on four occasions. Our Audit Committee held four meetings during Fiscal 2023. Our Compensation Committee held seven meetings during Fiscal 2023. Our NCG Committee held five meetings during Fiscal 2023.

During Fiscal 2023, all of our directors attended 100% of the meetings of the Board and committees on which they served.

Our Practices and Policies

Since 2018, we have created and updated our practices and policies to incorporate new regulatory requirements and industry best practices. These practices and policies, which are set forth immediately below, guide our corporate governance and ethical practices To ensure our practices and policies are compliant, we regularly review and, if appropriate, update them with the assistance and guidance of experienced internal and external legal counsel.

Corporate Governance Guidelines and Code of Ethics and Business Conduct

Our Board has adopted our Corporate Governance Guidelines to assist it in the exercise of its responsibilities. These guidelines reflect our Board’s commitment to monitor the effectiveness of policy and decision-making, both at our Board and management level, with a view to enhancing stockholder value over the long term. Our Corporate Governance Guidelines address, among other things, our Board and Board committee composition and responsibilities, director qualifications standards and selection and evaluation of our CEO. In addition, pursuant to these guidelines, our Board has formalized a process by which our directors are assessed annually by our NCG Committee. The assessment includes a peer review process and evaluates the Board as a whole, the committees of the Board and the individual directors. In carrying out this assessment, we may retain an external evaluator to assist our Board and NCG Committee at least every three years. Our Board has adopted a Code of Business Conduct and Ethics Policy for directors, officers and employees and a Code of Ethics for the Principal Executive and Senior Financial Officers to provide guidance to our CEO, Chief Financial Officer (“CFO”), principal accounting officer or controller and our business segment chief financial officers or persons performing similar functions.

Majority Voting and Director Resignation Policy

During Fiscal 2019, our Board adopted a majority voting policy for the election of directors. Pursuant to this policy, which applies in the case of uncontested director elections, a director must be elected by a majority of the votes cast with respect to the election of such director. For purposes of this policy, a “majority of the votes cast” means that the number of shares voted “for” a director must exceed the number of shares voted “against” that director and abstentions and broker non-votes are not counted as “votes cast.”

The policy also provides that in the event that an incumbent director nominee receives a greater number of votes “against” than votes “for” their election, they must (within five business days following the final certification of the related election results) offer to tender their written resignation from the Board to the NCG Committee. The NCG Committee will review such offer of resignation and will consider such factors and circumstances as it may deem relevant, and, within 90 days following the final certification of the election results, will make a recommendation to the Board concerning the acceptance or rejection of such tendered offer of resignation. The policy requires the decision of the Board to be promptly publicly disclosed.

Board Diversity Policy

In October 2020, our Board adopted a Board Diversity Policy. The purpose of this policy is to set out the basic principles to be followed to ensure that the Board has the appropriate balance of skills, experience and diversity of perspectives necessary to enhance the effectiveness of the Board and to maintain the highest standards of corporate governance. Pursuant to this policy, selection of Board candidates will be based on a range of perspectives with reference to the Company’s business model and specific needs, including, but not limited to, talents, skills and expertise, industry experience, professional experience, gender, age, race, language, cultural background, educational background and other similar characteristics.

Anti-Hedging Policy

The Company believes it is improper and inappropriate for our directors, officers, employees and certain of their family members (each, a “Subject Person”) to engage in hedging, short-term or speculative transactions involving the Company’s securities. Our anti-hedging policy, which we further strengthened during Fiscal 2019, applies to all Subject Persons. The Company prohibits Subject Persons from engaging in (i) derivative, speculative, hedging or monetization transactions in Company securities (including, but not limited to, any trading on derivatives (such as swaps, forwards and/or futures) of Company securities that allow a stockholder to lock in the value of Company securities in exchange for all or part of the potential upside appreciation in the value of such stock), (ii) short sales (i.e., selling stock the Subject Person does not own and borrowing shares to make delivery) or (iii) buying or selling puts, calls, options or other derivatives in respect of Company securities.

Anti-Pledging Policy

In addition, the Company believes it is improper and inappropriate for any Subject Person to engage in pledging transactions involving the Company’s securities. During Fiscal 2019, we adopted a robust anti-pledging policy, which prohibits Subject Persons from pledging or encumbering Company securities as collateral for a loan or other indebtedness. This prohibition includes, but is not limited to, holding such shares in a margin account as collateral for a margin loan or borrowing against Company securities on margin. Any pledges (and any modifications or replacements of such pledges) that existed prior to the adoption of our policy are exempted (unless otherwise prohibited by applicable law or Company policy) and modification or replacement of any such pre-existing pledge may be made so long as such modification or replacement does not result in additional shares being pledged.

Securities Trading Policy

Our Company believes that it is appropriate to monitor and prohibit certain trading in the securities of our Company. Accordingly, trading of the Company’s securities by directors, executive officers and certain other employees who are so designated by the office of the Company’s General Counsel is subject to trading period limitations or must be conducted in accordance with a previously established trading plan that meets SEC requirements. At all times, including during approved trading periods, directors, executive officers and certain other employees notified by the office of the Company’s General Counsel are required to obtain preclearance from the Company’s General Counsel or its designee prior to entering into any transactions in Company securities, unless those transactions occur in accordance with a previously established trading plan that meets SEC requirements.

Transactions subject to our securities trading policy include, among others, purchases and sales of Company stock, bonds, options, puts and calls, derivative securities based on securities of the Company, gifts of Company securities, contributions of Company securities to a trust, sales of Company stock acquired upon the exercise of stock options, broker-assisted cashless exercises of stock options, market sales to raise cash to fund the exercise of stock options and trades in Company’s stock made under an employee benefit plan.

Stock Ownership Guidelines

Our Board believes that our directors, named executive officers and certain other Company officers and employees should own and hold Company common stock to further align their interests with the interests of stockholders and promote the Company’s commitment to sound corporate governance. To memorialize this commitment, effective January 29, 2013, our Board, upon the recommendation of our Compensation Committee, established stock ownership and retention guidelines (the “SOG”) applicable to the Company’s directors, NEOs and all other officers of the Company and its subsidiaries with a level of Vice President or above (such officers and our NEOs, our “Covered Officers”). Effective January 1, 2020, the Company improved and enhanced the SOG to further align it with best practices by: (i) increasing our directors’ and Covered Officers’ retention requirement from 25% to 50% of their net after-tax shares received under awards granted until they reach their required stock ownership under the SOG; and (ii) extending the applicable time period for our directors and Covered Officers to achieve the minimum ownership requirements to five years from the date of eligibility or promotion. Even when the required stock ownership is obtained, all NEOs are subject to an additional stock retention requirement requiring them to retain at least 50% of their net after-tax shares of Company stock received under awards for one year after the date of vesting.

Under the updated SOG, our directors are expected to achieve stock ownership with a value of at least five times their annual cash retainer. In addition, our Covered Officers are expected to achieve the levels of stock ownership indicated below (which equal a dollar value of stock based on a multiple of the Covered Officer’s base salary).

| | | | | | | | |

| Position | $ Value of Stock to be Retained (Multiple of Base Salary or Cash Retainer) | Years to Achieve |

| Board Members | 5x Cash Retainer | 5 years |

| Executive Chairman and CEO | 5x Base Salary | 5 years |

| Chief Operating Officer, CFO, General Counsel and Presidents of our Business Units | 3x Base Salary | 5 years |

| Senior Vice Presidents | 2x Base Salary | 5 years |

| Vice Presidents | 1x Base Salary | 5 years |

The stock ownership levels attained by a director or a Covered Officer are based on shares directly owned by the director or Covered Officer, whether through earned and vested restricted stock units (“RSU”) or performance stock units (“PSU”) or restricted stock grants or open market purchases. Unvested time-based restricted stock and unvested time-based RSUs count toward the ownership goals, but unvested non-time based restricted shares, unvested PSUs and stock options do not count toward the ownership goals. On a quarterly basis, our Compensation Committee reviews the progress of our directors and Covered Officers in meeting these guidelines. In some circumstances, failure to meet the guidelines by a director or a Covered Officer could result in additional retention requirements or other actions by our Compensation Committee.

Compensation Clawback Policy

We have adopted a Compensation Clawback Policy (the “Clawback Policy”), as amended in November 2023 as required by Section 954 of the Dodd-Frank Act and Rule 10D-1of the Exchange Act (collectively, “Dodd-Frank”),which was recently amended as required by Section 954 of the Dodd-Frank Act, Rule 10D-1 of the Securities Exchange Act of 1934 and the stock listing rules promulgated in connection with the same (collectively, the “Section 10D Rules”), setting forth the conditions under which applicable incentive compensation provided to our executive officers may be subject to forfeiture, disgorgement, recoupment or diminution (“clawback”). The Clawback Policy provides that our Board or our Compensation Committee shall require the clawback or adjustment of incentive-based compensation to the Company in the following circumstances:

| | | | | |

• | As required by Section 304 of the Sarbanes Oxley Act of 2002, which generally provides that if the Company is required to prepare an accounting restatement due to material noncompliance as a result of misconduct with financial reporting requirements under the securities laws, then the CEO and CFO must reimburse the Company for any incentive-based compensation or equity compensation and profits from the sale of the Company’s securities during the 12-month period following initial publication of the financial statements that had been restated; |

• | As required by Dodd-Frank, which generally requires that, in the event the Company is required to prepare an accounting restatement due to its material noncompliance with financial reporting requirements under the securities laws, the Company shall recover from any of its current or former executive officers who received incentive compensation during the three-year period preceding the date on which the Company is required to prepare a restatement based on the erroneous financial reporting, any amount that exceeds what would have been paid to the executive officer after giving effect to the restatement, subject to limited exceptions permitted under Dodd-Frank; and |

• | As required by any other applicable law, regulation or regulatory requirement. |

Additionally, under our Compensation Clawback Policy, our Board or Compensation Committee in their discretion may require that any executive officer who has been awarded incentive-based compensation shall forfeit, disgorge, return or adjust such compensation in the following circumstances:

| | | | | |

• | If the Company suffers significant financial loss, reputational damage or similar adverse impact as a result of actions taken or decisions made by the executive officer in circumstances constituting illegal or intentionally wrongful conduct or gross negligence; or |

• | If the executive officer is awarded or is paid out under any incentive compensation plan of the Company on the basis of a material misstatement of financial calculations or information or if events coming to light after the award disclose a material misstatement which would have significantly reduced the amount of the award or payout if known at the time of the award or payout. |

The awards and incentive compensation subject to clawback under this policy include vested and unvested equity awards, shares acquired upon vesting or lapse of restrictions, short- and long-term incentive bonuses and similar compensation, discretionary bonuses, any other awards or compensation under the Company’s equity plans and any other incentive compensation plan of the Company. Any clawback under this policy may, in the discretion of our Board or Compensation Committee (or otherwise as required by Dodd-Frank), be effectuated through the reduction, forfeiture or cancellation of awards, the return of paid-out cash or exercised or released shares, adjustments to future incentive compensation opportunities or in such other manner as our Board and Compensation Committee determine to be appropriate, except as otherwise required by law. The Company will not indemnify or provide insurance to cover any repayment of incentive compensation in accordance with the Clawback Policy.

In addition, under the Company’s equity plans, any equity award granted (including those granted to our NEOs) may be cancelled by our Compensation Committee in its sole discretion, except as prohibited by applicable law, if the participant, without the consent of the Company, while employed by or providing services to the Company or any affiliate or after termination of such employment or service, violates a non-competition, non-solicitation or non-disclosure covenant or agreement or otherwise engages in activity that is in conflict with or is adverse to the interests of the Company or any affiliate, including fraud or conduct contributing to any financial restatements or irregularities engaged in, as determined by our Compensation Committee in its sole discretion. Our Compensation Committee may also provide in any award agreement that the participant will forfeit any gain realized on the vesting or exercise of such award and must repay the gain to the Company, in each case except as prohibited by applicable law, if (i) the participant engages in any activity referred to in the preceding sentence or (ii) the amount of any such gain is in excess of what the participant should have received under the terms of the award for any reason (including without limitation by reason of a financial restatement, mistake in calculations or other administrative error). Additionally, awards are subject to clawback, forfeiture or similar requirements to the extent required by applicable law (including without limitation Section 304 of the Sarbanes-Oxley Act and Section 954 of the Dodd-Frank Act). Equity awards issued have included these provisions.

Risk Oversight

The Company’s risk assessment and management function is led by the Company’s senior management, which is responsible for day-to-day management of the Company’s risk profile, with oversight from our Board and its committees. Central to our Board’s oversight function is our Audit Committee. In accordance with our Audit Committee Charter, our Audit Committee is responsible for the oversight of the financial reporting process and internal controls. In this capacity, our Audit Committee is responsible for reviewing and evaluating guidelines and policies governing the process by which senior management of the Company and the relevant departments of the Company, including the internal audit department, assess and manage the Company’s exposure to risk, as well as the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures.

The Company has implemented an annual formalized risk assessment process. In accordance with this process, a governance risk and compliance group of certain members of senior management has the responsibility to identify, assess and oversee the management of risk for the Company. This group obtains input from other members of management and subject matter experts as needed. Management uses the collective input received to measure the potential likelihood and impact of key risks and to determine the adequacy of the Company’s risk management strategy. Periodically, representatives of this committee report to our Audit Committee on its activities and the Company’s risk exposure.

In addition, the Company maintains an information security program that supports the security, confidentiality, integrity and availability of our information technology systems. In connection with such program, the Board is briefed by management on information security matters and employees receive information security awareness training. In the past three years, we have not experienced an information security breach and we maintain an appropriate information security risk insurance policy.

Cybersecurity

We understand the importance of preserving trust and protecting personal information, trade secrets and confidential and proprietary information. To assist us, we have a cybersecurity governance framework in place, which is designed to protect information and information systems from unauthorized access, use, disclosure, disruption, modification or destruction. The program is built upon a foundation of advanced security technology, overseen by an experienced and trained team with knowledge of cybersecurity best practices. Our cybersecurity program consists of controls designed to identify, protect against, detect, respond to and recover from information and cybersecurity incidents.

Highlights of our cybersecurity program include:

•A cybersecurity team consisting of experienced and knowledgeable employees that interface with consultants and vendors.

•Appropriate plans designed to provide a framework for handling high-severity security incidents and facilities coordination across multiple parts of the Company;

•Differentiated layers of controls, including embedding security into our technology investments;

•Investments into threat intelligence and monitoring;

•Cybersecurity testing for both training and threat detection purposes; and

•Annual cybersecurity awareness trainings.

In response to the recent SEC cybersecurity disclosure rule, we have updated our cybersecurity program to incorporate the rule’s requirements to report any potential material cybersecurity incidents to our Board and, if deemed to be material, as appropriate or required, disclose such a material incident via a Form 8-K within four (4) business days of determining the occurrence of such a cybersecurity incident.

Environmental, Social and Governance Matters

We are committed to further enhancing our environmental, social and governance (“ESG”) efforts and recognize the impact our business has on our communities and the world. We believe in making a positive difference in the communities in which we live and work and strive to discharge our corporate social responsibilities from a global perspective and throughout every aspect of our operations, consistent with our focus on creating value for all of our stakeholders over the long term. Our decisions regarding business strategy, operations and resource allocation are guided by this purpose and are rooted in our core values. Our Board recognizes the negative effect that poor environmental practices and human capital management may have on us and our returns. Accordingly, our Board considers and balances the impact on the environment, people and the communities of which we are a part in deciding how to operate our business. Our Board receives periodic reports regarding our risk exposure and risk mitigation efforts in these areas.

We are committed to operating our business with all stakeholders in mind and with a view toward long-term sustainability and value creation, even as our business and society face a variety of existing and emerging challenges. We leverage our expertise, along with external partners, to help address these challenges. While our corporate social responsibility commitments address many areas, we focus on five key priorities: (i) product and content safety; (ii) environmental sustainability; (iii) human rights and ethical sourcing; (iv) employee safety and well-being; and (v) diversity and inclusion.

| | | | | |

| • | ESG Highlights – As part of our ESG efforts, we are proud of the investment we have made in our internal resources and the experienced and reputable outside advisors we have engaged to assist us in identifying and evaluating ESG trends, issues and opportunities that are available to our Company. Consistent with our Company-wide mission statement “To Make Living Better at Home,” we identified our ESG vision statement to be “Committing to a process of continuous improvement for the benefit of our consumers, customers, employees, investors and the planet by integrating ESG into everything we do.” Our Board has adopted, among other things, (i) an Environmental Policy, which sets forth our commitment to the health and safety of our employees and protection of the environment across our global operations; (ii) a Human Rights Policy, which sets forth our commitment to respect and promote human rights, including the protection of minority groups’ rights and women’s rights, in furtherance of the guidance set forth in, among others, the Universal Declaration of Human Rights, UN Guiding Principles on Business and Human Rights, the International Labor Organizations Declaration on Fundamental Principles and Rights at Work and the Organization for Economic Cooperation and Development for Multinational Enterprises; (iii) a Global Energy and Greenhouse Gas (GHG) Policy, which sets forth our commitment to the protection of the environment, preservation of natural resources and the effective management and reduction of energy and GHGs by, among other things, identifying opportunities for purchasing direct, renewable energy in key markets and requiring energy considerations when making investments for major renovations and new capital equipment and major construction; and (iv) a Global Environmental, Social and Governance Policy, which sets forth our commitment to ESG. Additionally, we have published our March 2023 Corporate Sustainability Report, which describes a number of our ESG efforts over the past several years. To learn more about our ESG efforts and successes, please visit our website at www.spectrumbrands.com under “Investor Relations.” |

| • | Product & Content Safety - Product safety is essential to upholding our consumers’ trust and expectations, and we embed quality and safety processes into our production processes and the products we deliver. This includes embracing our responsibility to create safe, high-quality products and marketing them responsibly. This also includes our global product safety training program, which enhances our commitment to product safety and further empowers our employees to maintain the safety of our products and report any product safety concerns. |

| • | Employee Wellness and Talent Development – We encourage our employees to “Speak Up,” “Be Accountable,” “Take Action,” and “Grow Talent,” and to promote innovation, trust, accountability and collaboration. The result is a work environment that encourages the well-being of our employees holistically: mind and body. We are also committed to developing our future leaders at every level. Our talent processes start with understanding what current and future talent is needed to deliver business goals, followed by a talent review process to assist managers with evaluating talent. Learning and development is a critical part of creating our culture of high performance, innovation and inclusion. We believe in transparency, accountability and inclusion, and performance and development plans to promote managers and employees have conversations about career aspirations, mobility, developmental goals and interests, inclusion and the work environment. |

| • | Employee Health and Safety – We are committed to the environmental health and safety (“EHS”) of our employees. We continuously strive to maintain our strong safety performance as we continue to operate our business around the globe. Our EHS training program tailored to anticipated job duties and is designed to promote a workforce that is engaged and empowered to report health and safety concerns, a management team who supports and invests in employee safety and the leadership of our skilled and experienced EHS team. The EHS team hosts regular meetings to share information and discuss best practices across plants and site training to our employees to promote compliance with applicable safety standards and regulations. Workplace incidents or near misses are reviewed carefully to identify and remediate applicable root causes. |

| • | Environmental Sustainability – We are passionate about protecting our planet and conserving natural resources for future generations, including pursuing innovative ways to reduce our environmental impacts across our businesses. We drive our strategic environmental blueprint across our organization with the intention of reducing the environmental impacts of our products, minimizing the environmental footprint of our operations and processes and encouraging our employees and partners to embrace and promote environmental responsibility. We are proud of our efforts to further promote environmentally sustainable practices and have aligned our objectives against three industry frameworks, which will be used to help identify future goals for our environmental sustainability efforts: (i) Sustainability Accounting Standards Board (“SASB”); (ii) Global Reporting Initiative (“GRI”); and (iii) Climate Disclosure Project (“CDP”). We monitor our performance across several environmental sustainability ratings and rankings. Highlights from Fiscal 2023 include: •For the first time, gathering “Scope 3” emissions data for our greenhouse gas emissions disclosure; •Initiating numerous energy conservation projects, a main contributor in decreasing our carbon footprint; •Reducing waste, water, and energy usage compared to the prior year; •Increasing the percentage of post-consumer recycled (“PCR”) materials in our product packaging; •Achieving Giga-Guru status for the 6th straight year; •Continuing to outperform our industry competitors that participate in the Sustainability Insight System (THESIS) environmental and social disclosure program; •Placing in the top half of our industry peers on the social and environmental factors in Institutional Shareholder Service’s ESG Rankings; •Achieving a CDP score that places us in the top 40% of all companies that participate in the CDP report; and •Publishing our March 2023 Corporate Sustainability Report. |

| • | Human Rights & Ethical Sourcing – Treating people with fairness, dignity and respect and operating ethically in our supply chain are part of our core values. We demonstrate these deep beliefs in the way we treat our employees and in the expectations and requirements we have of those with whom we do business. We work with our third-party factories and licensees to ensure all products are manufactured in safe and healthy environments and the human rights of workers in our supply chain are being respected. To these ends, we review all suppliers who provide materials, products or services to Spectrum Brands and expect them to abide by our Supplier Code of Conduct, uphold our Code of Business Conduct and Ethics and comply with our Human Rights Policy and Conflict Minerals Policy. |

| | | | | |

| • | Diversity, Equity & Inclusion – We take a holistic approach to diversity, equity and inclusion (“DEI”). We believe that supporting equality and promoting inclusion across our business and society makes the world a better place for all. We know that the more inclusive we are as a company, the stronger our business will be. We support the personal and professional growth of our diverse worker base, with a goal of positively impacting their lives and well-being. |

| Our DEI framework is designed to drive meaningful, long-term progress both within and beyond our own workplace and focuses on several key pillars, including: 1.Business – Develop a holistic business strategy that strengthens our relationships with diverse customers, suppliers, vendors, brokers, consultants, advisors, and business partners. 2.Brands and Products – Build authentic and inclusive brands and products that appeal to all communities, consumers, and employees. 3.Culture – Promote a Company culture that embraces the principle of DEI. 4.Employees – Foster a workplace that respects, values and recognizes everyone and strives to remove systemic barriers to achieve inclusion and advancement that drives company success. 5.Community – Dedicate resources and efforts to promote charitable organizations or initiatives that combat racism, promote equity, and are committed to the advancement of underrepresented communities. To further these efforts, we engaged a third-party consultant who provided counsel, training and cultural development actions and ideas to help us make progress on our plan to make our workplace and communities even more inclusive. We also have a U.S. Diversity, Equity and Inclusion Advisory Council (the “DEI Council”), comprised of employees with diverse backgrounds and perspectives who advocate and advise on ways to advance the DEI dialogue and drive meaningful cultural change at the company. In furtherance of these efforts, we have implemented leadership training for our senior leaders across the Company on the topic of authentic diversity and leadership. This training focused on leaders having the confidence and ability to bring their authentic selves and those of their reports into the workplace and fostering inclusive and welcoming workplace relationships all of which is intended to contribute to a thriving DEI space for all. We continue to focus on communications that feature diverse voices across our Company and provide information on topics important to our employee population, such as mental health, different holiday celebrations, gender pronouns and diverse and female leadership. We believe that the well-being of our employees is central to our success and especially important for those in communications that have faced unique challenges in the last few years. We will continue our DEI efforts to make progress on enhancing our Company and to attract and retain diverse talent that can help us achieve our business goals and better serve our stakeholders. |

| • | Diverse Workforce Representation – We believe that tone at the top is paramount in setting the culture of our Company. We are proud that our Board is comprised of over a majority of diverse Directors. Consistent with those efforts, we strive to obtain more representation across all levels of our Company, and we are taking efforts to enhance recruitment, hiring and promotion practices to attract, develop and retain a diverse workforce across our entire organization. |