Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

09 Februar 2024 - 1:52PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of

1934

For the month of February

2024

Commission File Number

1-14732

COMPANHIA SIDERÚRGICA

NACIONAL

(Exact name of registrant

as specified in its charter)

National Steel Company

(Translation of registrant’s

name into English)

Av. Brigadeiro Faria Lima

3400, 20th Floor

São Paulo, SP, Brazil

04538-132

(Address of principal executive

office)

Indicate by check mark whether

the registrant files or will file annual reports

under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F

_______

Indicate by

check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

Announcement of CSN Resources S.A.’s Pricing

of US$200.0 Million of 8.875% Notes Due 2030

São Paulo, February 8, 2024 – Companhia Siderúrgica

Nacional (“CSN”) (NYSE: SID) announces that its Luxembourg finance subsidiary, CSN Resources S.A., priced a re-tap

offering of US$200.0 million in aggregate principal amount of 8.875% senior notes due 2030 (the “Notes”), guaranteed

by CSN, offered pursuant to exemptions from registration under Rule 144A and Regulation S under the U.S. Securities Act of 1933, as amended

(the “Securities Act”). The Notes were offered as a further issuance of and will be consolidated and form a single

fungible series with CSN Resources S.A.’s 8.875% notes due 2030 issued in an aggregate principal amount of US$500.0 million on December

5, 2023. The total aggregate principal amount of notes of this series that will be outstanding following this re-tap offering will be

US$700.0 million. Closing is expected to occur on February 13, 2024.

CSN expects to use the net proceeds from the offering for debt repayment

and general corporate purposes.

When issued, the Notes will not have been registered under the Securities

Act or state securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from the

registration requirements of the Securities Act and applicable state securities laws. This press release does not constitute an offer

to sell or the solicitation of an offer to buy the Notes or any other securities and shall not constitute an offer, solicitation or sale

in any jurisdiction in which, or to any person to whom, such an offer, solicitation or sale is unlawful. Any offers of the Notes will

be made only by means of a private offering memorandum.

This press release may contain forward-looking statements within the meaning

of Section 27A of the Securities Act and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Forward-looking information

involves important risks and uncertainties that could significantly affect anticipated results in the future, and, accordingly, such results

may differ from those expressed in any forward-looking statements.

COMPANHIA SIDERÚRGICA

NACIONAL

Marcelo Cunha Ribeiro

Chief Financial and Investor

Relations Officer

SIGNATURES

Pursuant to the requirements

of the U.S. Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

|

|

| February 8, 2024 |

Companhia Siderúrgica Nacional |

| |

By:

|

/s/ Benjamin Steinbruch

Benjamin Steinbruch |

| |

|

Title: |

Chief Executive Officer |

| |

| |

By:

|

/s/ Marcelo Cunha Ribeiro

Marcelo Cunha Ribeiro |

| |

Title: |

Chief Financial and Investor Relations Officer |

| |

|

|

|

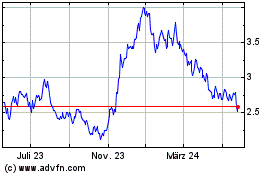

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

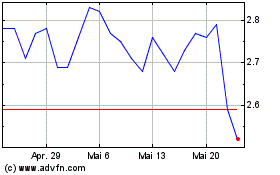

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

Von Nov 2023 bis Nov 2024