UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2024

Commission File Number: 001-32199

SFL Corporation Ltd.

--------------------------------------------------------------------------------

(Translation of registrant's name into English)

Par-la-Ville Place

14 Par-la-Ville Road

Hamilton, HM 08, Bermuda

--------------------------------------------------------------------------------

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached hereto is a copy of the press release of SFL Corporation Ltd. ("SFL" or the "Company"), dated February 14, 2024, announcing preliminary financial results for the quarter and full year ended December 31, 2023.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | SFL Corporation Ltd. | |

| | | | |

| Date: February 14, 2024 | By: | /s/ Ole B. Hjertaker | |

| Name: | Ole B. Hjertaker | |

| | Title: | SFL Management AS | |

| | | (Principal Executive Officer) | |

Preliminary Earnings Release

Q4 2023

SFL Corporation Ltd.

Preliminary Q4 2023 results and increased quarterly cash dividend to $0.26 per share

Hamilton, Bermuda, February 14, 2024. SFL Corporation Ltd. (“SFL” or the “Company”) today announced its preliminary financial results for the quarter and full year ended December 31, 2023.

Highlights

•80th consecutive quarterly dividend, increased to $0.26 per share

•Net profit of $31.4 million or $0.25 per share in the fourth quarter

•Received charter hire1 of $209.5 million in the quarter, including $3.4 million of profit share

•Adjusted EBITDA2 of $124.1 million from consolidated subsidiaries, plus $7.9 million adjusted EBITDA2 from 49.9% owned associated companies

•Delivery of Wolfsburg, our second LNG dual-fuel Car Carrier, on 10 year charter to Volkswagen

•Commencement of Hercules' drilling contract for Galp Energia in Namibia

•Subsequent to quarter end, our third LNG dual-fuel Car Carrier Odin Highway was delivered on 10 year contract to K Line

Ole B. Hjertaker, CEO of SFL Management AS, said in a comment:

«We are pleased to announce our 80th consecutive quarterly dividend as we celebrate our 20th anniversary. Over this period SFL has evolved from a vessel financing provider to a leading maritime infrastructure company with a fully integrated operational platform with a diversified modern fleet of vessels on time-charter to industry leading customers.

SFL has built up a high-quality operational platform, which has enabled us to secure repeat transactions with our key customers. And with all of our car carrier newbuildings delivered by the end of this quarter, we expect to continue increasing our charter revenues in 2024.

And we believe there is significant value embedded in our fleet beyond our current charter backlog, illustrated by the recent charter extensions for our car carriers SFL Composer and SFL Conductor at significantly higher charter rates than before. Owning modern high quality maritime assets in the next decade will be beneficial for SFL shareholders as we continue to build the company and our long term distribution capacity».

Quarterly Dividend

The Board of Directors has declared an increased quarterly cash dividend of $0.26 per share. The dividend will be paid on or around March 28, to shareholders of record as of March 15, and the ex-dividend date on the New York Stock Exchange will be March 14, 2024.

1 Charter hire represents the amounts billable in the period by the Company and its associates for chartering out vessels and rigs. This is mainly the contracted daily rate multiplied by the number of chargeable days plus any additional billable income, including profit share. Long term charter hire relates to contracts undertaken for a period greater than one year. Short term charter hire relates to contracts undertaken for a period less than one year, including voyage charters.

2 ‘Adjusted EBITDA’ is a non-U.S. GAAP measure. It represents cash receipts from operating activities before net interest and capital payments.

Results for the Quarter ended December 31, 2023

The Company reported total U.S. GAAP operating revenues on a consolidated basis of $209.6 million in the fourth quarter of 2023, compared to $204.9 million in the previous quarter. This figure is lower than the cash received as it excludes approximately $10.6 million of charter hire which is not classified as operating revenues pursuant to U.S. GAAP. This comprises of ‘repayment of investment in sales-type, direct financing leases and leaseback assets’ and gross charter hire from entities classified as ‘investment in associates’ for accounting purposes.

Under U.S. GAAP, mobilization revenue and costs for the drilling rig Hercules are deferred and recorded over the contract duration. The rig was mobilizing to Namibia in the first part of the fourth quarter, and we expect to record additional mobilization contribution, after expenses, of approximately $3.6 million in the first quarter in addition to ordinary operating revenue under the contract.

The net result in the fourth quarter was also impacted by non-recurring or non-cash items including net negative mark-to-market effects from derivatives of $5.1 million, negative mark-to-market effects from equity investments of $1.4 million and an increase of $0.3 million in credit loss provisions.

Reported net income pursuant to U.S. GAAP for the quarter was $31.4 million, or $0.25 per share.

Business Update

As of December 31, 2023, and adjusted for subsequent transactions, the estimated fixed rate charter backlog3 from the Company’s fleet of 73 wholly or partly owned vessels and newbuildings under construction was approximately $3.2 billion with a weighted remaining charter term of 5.7 years.

Some of the charters include purchase options which, if exercised, may reduce the fixed rate charter backlog and the average remaining charter term, but will increase capital available for new investments. Additionally, several charters include a profit-sharing feature that may improve SFL’s operating results.

The majority of our vessels are employed on time charter contracts where SFL is responsible for technical, operational, and commercial management. In addition, some vessels are employed on bareboat charters where the Company’s customers are responsible for these services.

Container

SFL has a container fleet of 36 vessels. The container fleet generated approximately $91.8 million in gross charter hire in the quarter, including $3.4 million in profit share from fuel savings.

During the quarter, Maersk exercised an extension option for the 9,500 teu vessel Maersk Sarat until mid-2025, adding approximately $13 million to our charter backlog. The option rate is higher than the previous charter rate and we continue the profit share arrangement relating to fuel savings.

Car carrier

SFL has a car carrier fleet of seven vessels, of which two were under construction at quarter end. The car carrier fleet generated approximately $22.1 million of charter hire in the quarter.

3 Fixed rate backlog as of December 31, 2023 includes fully owned vessels, rigs and 100% of four partially owned 19,000 teu container vessels, which SFL also manages. It also includes subsequent transactions. The backlog excludes charterers’ extension options and purchase options (if applicable).

In November, the Company took delivery of the Wolfsburg, the second of our four LNG dual-fuel Car Carriers newbuilds. Following an interim charter from Asia to Europe for an Asia based operator, the vessel has now commenced its ten-year time-charter to Volkswagen Group.

The vessels SFL Conductor and SFL Composer will continue their charters to Volkswagen Group for another three years with Volkswagen holding the option to extend the period for another two years.

Subsequent to quarter end, the Company took delivery of our third LNG dual-fuel Car Carrier Odin Highway, on 10 year charter to K Line.

Tanker

SFL has a fleet of 13 crude oil and product tankers. The vessels generated approximately $29.8 million in gross charter hire during the quarter. All of SFL’s tanker vessels are employed on long term time-charters.

Dry Bulk

The Company has 15 dry bulk carriers of which eight were employed on long term charters in the quarter. SFL generated approximately $21.0 million in gross charter hire from the dry bulk vessels.

Seven dry bulk vessels, comprising of five supramax and two kamsarmax bulkers, were employed in the spot and short term charter market in the quarter and earned approximately $7.3 million in net charter hire, compared to approximately $6.2 million in the previous quarter.

Offshore

SFL owns two harsh environment drilling rigs, the large jack-up rig Linus and the semi-submersible ultra-deepwater rig Hercules. During the fourth quarter, the rigs generated approximately $44.9 million in contract revenues, compared to approximately $64.1 million in the third quarter.

Linus is under a long-term contract with ConocoPhillips on the Greater Ekofisk Area in Norway until 2028. During the quarter, revenues were $19.0 million compared to $16.6 million in the previous quarter. The rig is scheduled to undergo its 10 year special periodic survey (“SPS”) in Q2 2024, with an estimated net capital expenditure of approximately $30 million and we expect the rig to be off hire for approximately five weeks.

Hercules completed a drilling contract with ExxonMobil in Canada in September and commenced a contract with Galp Energia in Namibia in mid-November after a short stay in Las Palmas for preparations.

During the quarter, revenues from Hercules were $25.9 million compared to $47.5 million in the previous quarter. The reduction in contract revenue for the Hercules relates to fewer contract days in the quarter as the rig spent about half the quarter in mobilization mode.

Financing, Capital Expenditure and Corporate Matters

As of December 31, 2023, SFL had approximately $165 million of cash and cash equivalents and the Company also had unencumbered vessels with a combined market value of more than $100 million.

At the end of the fourth quarter, SFL had two newbuild LNG dual-fuel car carriers under construction with approximately $77 million of remaining capital commitments. The vessels are fully funded by individual JOLCO financing arrangements and the combined net cash proceeds upon delivery from the yard is estimated to approximately $45 million.

The Company’s Board of Directors authorized the repurchase of up to an aggregate of $100 million of the Company's common shares, which is valid until June 30, 2024. In 2023 the Company repurchased an aggregate of approximately 1.1 million shares at an average price of approximately $9.27 per share, which leaves around $90 million remaining available under the program. The Company is not obligated under the terms of the program to repurchase any of its common shares and the program may be suspended or reinstated at any time at the Company's discretion and without further notice.

Strategy and Outlook

SFL’s business model is to own and acquire modern maritime assets in combination with long term charters to high quality companies in multiple end markets. Owning a diversified portfolio of vessels on long term charters provide high earnings visibility, lower residual value risk and lower concentration risk to an individual shipping market or specific customer. It further enables the Company to continuously reinvest in new assets and pay attractive dividends.

Since early 2020, we estimate that newbuild yard prices for standard vessels have increased by 30-40% due to inflationary pressure in international commodity prices and labor markets. This, combined with increased focus on premium vessel operations and fuel efficiency, could have profound implications for future shipping rates and the value of the vessels after the existing charter periods. We therefore believe that owning modern high quality maritime assets in the next decade will be beneficial for SFL shareholders.

Corporate and other matters

In January 2024, the Company issued 43,708 new shares to an officer in settlement of options issued in 2019 pursuant to the Company’s incentive program. In February 2024, SFL awarded 440,000 new options to employees, officers, and directors pursuant to the Company’s incentive program.

Accounting Items

Under accounting principles generally accepted in the United States of America (“U.S. GAAP”), long term lease financing arrangements for some of the Company’s container vessels require the Company to report seven of these vessels as ‘Vessels and equipment under finance lease, net’ with the corresponding lease debt reported as ‘finance lease liability’, short and long term.

Additionally, another nine container vessels were reported as ‘Investment in sales-type, direct financing leases and leaseback assets’ in the Company’s consolidated accounts at quarter end.

Under U.S. GAAP, the partly owned affiliates owning four container vessels were accounted for as ‘investment in associates’ applying the equity method. As a result of the accounting treatment, operating revenues, operating expenses and net interest expenses in these affiliates were not included in SFL’s consolidated income statement. Instead, the net contribution from these affiliates were recognized as a combination of ‘Interest income from associates’ and ‘Results in associates’.

In SFL’s consolidated balance sheet, the total investment the Company has in assets held in such equity method investees is a combination of ‘Investment in associates’ and ‘Amount due from related parties – Long term’ as a substantial part of the investments initially undertaken in these associated companies were funded by intercompany loans provided by SFL.

In accordance with the Expected Credit Loss model for assets classified as financial assets under U.S. GAAP, a calculation of a credit loss provision is carried out each quarter on SFL’s direct financing lease receivables, amongst other assets, based on historical experience, current conditions and reasonable supportable forecasts, and recorded on the balance sheet with the corresponding change in the provision being recorded on the income statement. At the end of the quarter, the Company and affiliates accounted for as associates, carried a total credit loss provision of approximately $3.1 million.

Revenue and costs associated with drilling contracts are recorded in accordance with Accounting Standards Codification (“ASC”) 606 Revenue from Contracts with Customers, which specifies that mobilization and demobilization fees (if applicable) and associated mobilization costs are to be recorded over the days spent drilling during the contracts.

Non-U.S. GAAP Financial Measures

In this press release the Company present additional information and measures in a way it believes will be most meaningful and useful to investors, analysts and others who use the Company’s financial information to evaluate its current and expected future cash flows. Some of the measurements the Company use are considered non-U.S. GAAP financial measures under SEC rules and regulations. In this release, SFL presents Adjusted EBITDA which is a non-U.S. GAAP financial measure as defined in SEC Regulation G. The Company believes that this non-U.S. GAAP financial measure, which may be defined and calculated differently by other companies, better explains and enhances the understanding of its business. However, this measure should not be viewed as a substitute for measures determined in accordance with U.S. GAAP.

Adjusted EBITDA is a cash measure for the Company representing the net cash received from operating activities before net interest and capital payments. It is the equivalent of charter hires billable less cash operating expenses. See Appendix 1.

Cautionary Statement Regarding Forward Looking Statements

This press release may contain forward looking statements. These statements are based upon various assumptions, many of which are based, in turn, upon further assumptions, including SFL management’s examination of historical operating trends, data contained in the Company’s records and other data available from third parties. Although SFL believes that these assumptions were reasonable when made, because assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond its control, SFL cannot give assurance that it will achieve or accomplish these expectations, beliefs or intentions.

Important factors that, in the Company’s view, could cause actual results to differ materially from those discussed in the forward looking statements include the strength of world economies, fluctuations in currencies and interest rates, general market conditions in the seaborne transportation industry, which is cyclical and volatile, including fluctuations in charter hire rates and vessel values, changes in demand in the markets in which the Company operates, including shifts in consumer demand from oil towards other energy sources or changes to trade patterns for refined oil products, changes in market demand in countries which import commodities and finished goods and changes in the amount and location of the production of those commodities and finished goods, technological innovation in the sectors in which we operate and quality and efficiency requirements from customers, increased inspection procedures and more restrictive import and export controls, changes in the Company’s operating expenses, including bunker prices, dry-docking and insurance costs, performance of the Company’s charterers and other counterparties with whom the Company deals, the impact of any restructuring of the counterparties with whom the Company deals, timely delivery of vessels under construction within the contracted price, governmental laws and regulations, including environmental regulations, that add to our costs or the costs of our customers, potential liability from pending or future litigation, potential disruption of shipping

routes due to accidents, political instability, terrorist attacks, piracy or international hostilities, the length and severity of the ongoing coronavirus outbreak and governmental responses thereto and the impact on the demand for commercial seaborne transportation, drilling rigs and the condition of the financial markets, and other important factors described from time to time in the reports filed by the Company with the United States Securities and Exchange Commission. SFL disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

February 14, 2024

The Board of Directors

SFL Corporation Ltd.

Hamilton, Bermuda

Questions may be directed to SFL Management AS:

Aksel C. Olesen, Chief Financial Officer: +47 23114036

André Reppen, Chief Treasurer and Senior Vice President: +47 23114055

Marius Furuly, Vice President - IR : +47 23114016

For more information about SFL, please visit its website: www.sflcorp.com

SFL CORPORATION LTD.

FOURTH QUARTER 2023 REPORT (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | |

| INCOME STATEMENT | Three months ended | | Full year | |

| (in thousands of $ | Dec 31, | | Sep 30, | | 2023 | |

| except per share data) | 2023 | | 2023 | | (audited) | |

| Charter revenues: operating leases and rig revenue contracts | 205,268 | | | 200,781 | | | 732,932 | | |

Charter revenues: sales-type, direct financing and leaseback assets (excluding charter hire treated as Repayments)(1) | 916 | | | 1,467 | | | 6,192 | | |

| Profit share income | 3,389 | | | 2,638 | | | 13,162 | | |

| Total operating revenues | 209,573 | | | 204,886 | | | 752,286 | | |

| Gain on sale of assets and termination of charters | — | | | 2,194 | | | 18,670 | | |

| | | | | | |

| | | | | | |

| Vessel and rig operating expenses | (76,381) | | | (82,858) | | | (293,756) | | |

| Administrative expenses | (3,793) | | | (3,325) | | | (15,565) | | |

| Depreciation | (56,390) | | | (55,513) | | | (214,062) | | |

| Vessel impairment charge | — | | | — | | | (7,389) | | |

| Total operating expenses | (136,564) | | | (141,696) | | | (530,772) | | |

| | | | | | |

| Operating income | 73,009 | | | 65,384 | | | 240,184 | | |

| | | | | | |

| Results in associates | 693 | | | 704 | | | 2,848 | | |

| Interest income from associates | 1,150 | | | 1,150 | | | 4,563 | | |

| Interest income, other | 2,230 | | | 1,954 | | | 9,073 | | |

| Interest expense | (40,236) | | | (40,107) | | | (159,279) | | |

| Amortization of deferred charges | (2,044) | | | (2,069) | | | (7,731) | | |

| Interest and valuation gain/(loss) on non-designated derivatives | (3,867) | | | 3,452 | | | (3,109) | | |

| Gain/(loss) on investments in debt and equity securities | (1,394) | | | 274 | | | (1,912) | | |

| Other financial items | 2,861 | | | 852 | | | 2,623 | | |

| Taxes | (1,034) | | | (2,289) | | | (3,323) | | |

| Net income | 31,368 | | | 29,305 | | | 83,937 | | |

| | | | | | |

| Basic earnings per share ($) | 0.25 | | | 0.23 | | | 0.67 | | |

| | | | | | |

Weighted average number of shares(2) | 125,701,236 | | | 125,763,481 | | | 126,248,912 | | |

Common shares outstanding(2) | 125,701,236 | | | 125,701,236 | | | 125,701,236 | | |

(1) ‘Charter revenues: sales-type, direct financing and leaseback assets’ are reported net of charter hire classified as ‘Repayment of Investment in sales-type, direct financing & leaseback assets’ under US GAAP, which for the three months ended December 31, 2023 was $2.8 million (three months ended September 30, 2023: $3.3 million; full year 2023: $13.9 million).

(2) The weighted average number of shares and the number of common shares outstanding excludes approximately 11.8 million shares issued by SFL as part of share lending arrangements and 1.1 million shares held by SFL as treasury stock. The shares are owned by SFL, thus they are excluded in the calculation of earnings per share.

SFL CORPORATION LTD.

FOURTH QUARTER 2023 REPORT (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | |

| BALANCE SHEET | Dec 31, | | Sep 30, | | Dec 31, 2022 | |

| (in thousands of $) | 2023 | | 2023 | | (audited) | |

| ASSETS | | | | | | |

| Short term | | | | | | |

Cash and cash equivalents(1) | 165,492 | | | 118,028 | | | 188,362 | | |

| | | | | | |

| Investment in marketable securities | 5,104 | | | 6,222 | | | 7,283 | | |

| Amount due from related parties | 3,532 | | | 3,986 | | | 4,392 | | |

| Investment in sales-type, direct financing & leaseback assets, current portion | 20,640 | | | 21,423 | | | 15,432 | | |

| Other current assets | 103,291 | | | 79,363 | | | 81,513 | | |

| | | | | | |

| Long term | | | | | | |

| Vessels, rigs and equipment, net | 2,654,733 | | | 2,623,925 | | | 2,646,389 | | |

| Vessels and equipment under finance lease, net | 573,454 | | | 583,866 | | | 614,763 | | |

| Capital improvements, newbuildings and vessel deposits | 86,058 | | | 99,222 | | | 97,860 | | |

| Investment in sales-type, direct financing & leaseback assets, long term | 35,099 | | | 37,098 | | | 103,591 | | |

Investment in associates(2) | 16,473 | | | 16,517 | | | 16,547 | | |

Amount due from related parties, long term(2) | 45,000 | | | 45,000 | | | 45,000 | | |

| Other long term assets | 22,513 | | | 36,958 | | 40,198 | |

| | | | | | |

| Total assets | 3,731,389 | | | 3,671,608 | | | 3,861,330 | | |

| | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | |

| Short term | | | | | | |

| Short term and current portion of long term interest bearing debt | 432,918 | | | 384,730 | | | 921,270 | | |

| Amount due to related parties | 2,890 | | | 1,098 | | | 1,936 | | |

| Finance lease liability, current portion | 419,341 | | | 210,301 | | | 53,655 | | |

| Other current liabilities | 114,046 | | 116,254 | | 79,750 | |

| | | | | | |

| Long term | | | | | | |

| Long term interest bearing debt, net of deferred charges | 1,713,828 | | | 1,681,730 | | | 1,279,786 | | |

| Finance lease liability, long term | — | | | 222,662 | | | 419,341 | | |

| | | | | | |

| Other long term liabilities | 8,969 | | | 12,020 | | | 14,361 | | |

| | | | | | |

| Stockholders’ equity | 1,039,397 | | 1,042,813 | | 1,091,231 | |

| | | | | | |

| Total liabilities and stockholders’ equity | 3,731,389 | | 3,671,608 | | 3,861,330 | |

(1) Not including cash held by affiliates accounted for as ‘Investment in associates’.

(2) One of our affiliates was accounted for as ‘Investment in associates’ at quarter end. Our investment is a combination of equity classified as ‘Investment in associates’ and any loans from the Company to the affiliate included within ‘Amount due from related parties, long term’.

SFL CORPORATION LTD.

FOURTH QUARTER 2023 REPORT (UNAUDITED)

| | | | | | | | | | | | | | | | | |

| STATEMENT OF CASHFLOWS | Three months ended | | Full year |

| (in thousands of $) | Dec 31, | | Sep 30, | | 2023 |

| 2023 | | 2023 | | (unaudited) |

| | | | | |

| OPERATING ACTIVITIES | | | | | |

| Net income | 31,368 | | | 29,305 | | | 83,937 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | |

| Depreciation and amortization | 58,083 | | | 57,231 | | | 220,365 | |

| Vessel impairment charge | — | | | — | | | 7,389 | |

| Adjustment of derivatives to fair value recognised in net income | 5,109 | | | (2,306) | | | 8,374 | |

| (Gain)/Loss on investments in debt and equity securities | 1,394 | | | (274) | | | 1,912 | |

| Results in associates | (693) | | | (704) | | | (2,848) | |

| Gain on sale of assets and termination of charters | — | | | (2,194) | | | (18,670) | |

| Repayment of investment in sales-type, direct financing & leaseback assets | 2,786 | | | 3,348 | | | 13,906 | |

| Other, net | 118 | | | 124 | | | 2,553 | |

| Change in operating assets and liabilities | (17,245) | | | (53,323) | | | 26,171 | |

| Net cash provided by operating activities | 80,920 | | | 31,207 | | | 343,089 | |

| | | | | |

| INVESTING ACTIVITIES | | | | | |

| | | | | |

| | | | | |

| | | | | |

| Purchase of vessels, capital improvements, newbuildings and deposits | (63,621) | | | (65,616) | | | (264,418) | |

| | | | | |

| Proceeds from sale of vessels and termination of charters | — | | | 51,989 | | | 156,200 | |

| | | | | |

| Cash received from associates | 736 | | | 727 | | | 2,919 | |

| Other assets / investments | 2,655 | | | 4,780 | | | 1,405 | |

| Net cash used in investing activities | (60,230) | | | (8,120) | | | (103,894) | |

| | | | | |

| FINANCING ACTIVITIES | | | | | |

| | | | | |

| Repayments of finance lease liability | (13,621) | | | (13,464) | | | (53,654) | |

| Proceeds from long and short term debt | 133,131 | | | 91,267 | | | 944,585 | |

| Repayment of long and short term debt | (60,836) | | | (99,391) | | | (781,122) | |

| Repurchase of Company bonds | — | | | (38,067) | | | (205,848) | |

| | | | | |

| Expenses paid in connection with securing finance | (201) | | | (500) | | | (12,448) | |

| | | | | |

| Principal settlements of cross currency swaps, net | — | | | (10,600) | | | (20,412) | |

| Cash paid for share repurchase | — | | | (5,339) | | | (10,174) | |

| Cash dividends paid | (31,699) | | | (30,431) | | | (122,992) | |

| Net cash provided by/ (used in) financing activities | 26,774 | | | (106,525) | | | (262,065) | |

| | | | | |

| Net increase/ (decrease) in cash and cash equivalents | 47,464 | | | (83,438) | | | (22,870) | |

| Cash and cash equivalents at beginning of period | 118,028 | | | 201,466 | | | 188,362 | |

| Cash and cash equivalents at end of period | 165,492 | | | 118,028 | | | 165,492 | |

ASSOCIATED COMPANIES ACCOUNTED FOR AS INVESTMENT IN ASSOCIATES

FOURTH QUARTER 2023 (UNAUDITED)

Condensed income statement data for the three months ended December 31, 2023

| | | | | | | | |

| River Box | |

| (in thousands of $) | Holding Inc | |

| Ownership share presented | 49.9% | |

| | |

Charter revenues - direct financing leases (net of charter hire treated as Repayment of investment in direct financing leases) (1) | 4,538 | | |

| | |

Interest expense, related party (2) | (574) | | |

| Interest expense, other | (3,305) | | |

Other items (3) | 34 | | |

Net income (4) | 693 | | |

(1) Charter revenues – direct financing leases’ are reported net of charter hire classified as ‘Repayment of investment in direct financing leases’ under US GAAP, which for the three months ended December 31, 2023 was $3.3 million.

(2) ‘Interest expense, related party’ from this affiliate is included in the Company’s consolidated income statement as ‘Interest income from associates’. For the three months ended December 31, 2023, the Company recorded approximately $1.2 million from this associate. In the above table, the Company's 49.9% share of River Box Holding’s income statement is shown.

(3) ‘Net income from this affiliate appears in the Company’s consolidated income statement as ‘Results in associates’.

Condensed balance sheet data as of December 31, 2023

| | | | | | | | |

| River Box | |

| (in thousands of $) | Holding Inc (1) | |

| Ownership share presented | 49.9% | |

| Cash and cash equivalents | 2,544 | | |

| Investment in direct financing leases including current portion | 234,643 | | |

| | |

| Total assets | 237,187 | | |

| | |

| | |

| Short term and long term portions of lease liability | 197,141 | | |

| Other current liabilities | 1,118 | | |

| | |

Long term loans from shareholders, net (2) | 22,455 | | |

| | |

Stockholder's equity (3) | 16,473 | | |

| | |

| Total liabilities and stockholder's equity | 237,187 | | |

| | |

| | |

(1) The numbers represent the Company's relative share of 49.9% in River Box Holding Inc.

(2) The Company has a $45.0 million loan to River Box included within ‘Amount due from related parties, long term’. In the above table, the Company's 49.9% share of River Box Holding’s balance sheet is shown.

(3) ‘Stockholder’s equity’ from affiliates appears in the Company’s consolidated balance sheet as ‘Investment in associates’.

APPENDIX 1: RECONCILIATION OF ADJUSTED EBITDA

FOURTH QUARTER 2023 (UNAUDITED)

| | | | | | | | | | | | |

| Adjusted EBITDA | Three months ended | |

| Dec 31, 2023 | |

| (in thousands of $) | Company (excluding associates) | | 49.9% owned associates | |

| | | | |

| Net cash provided by operating activities | 80,920 | | 4,485 | |

| Non cash movements in other assets and liabilities | 7,590 | | (510) | |

| Interest related to Non- Designated Derivatives | (1,242) | | — | |

| Interest expense | 40,236 | | 3,305 | |

| Interest income, other | (2,230) | | — | |

| Interest (income)/expense from associates | (1,150) | | 574 | |

| | | | |

Adjusted EBITDA (1) | 124,124 | | 7,854 | |

(1)‘Adjusted EBITDA’ is a non-U.S. GAAP measure. It represents cash receipts from operating activities before net interest and capital payments.

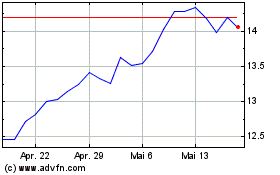

SFL (NYSE:SFL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

SFL (NYSE:SFL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024