Earnings Preview: McGraw-Hill - Analyst Blog

31 Oktober 2012 - 11:20AM

Zacks

The McGraw-Hill Companies

Inc. (MHP) – a publisher and a provider of financial

information and media services – is slated to release its financial

results for the third quarter of fiscal 2012 on Friday, November 2,

2012.

Earlier, the results were scheduled to release on October 31, 2012;

however, it has been postponed to Friday, November 2, 2012, owing

to bad weather conditions arising from Hurricane Sandy.

The current Zacks Consensus Estimate for earnings is $1.30 per

share, ranging between a low of $1.28 and a high of $1.35 per

share. The current estimate reflects a 7.4% increase from $1.21 per

share reported in the prior-year period. Revenue, as per Zacks

Consensus Estimate for the quarter, is valued at $1,989

million.

We believe the company’s focus on

growth and value plan along with the acquisition made by the

company recently have aided the earnings estimate to move up, which

is expected to continue in the upcoming quarters.

In the last reported quarter, McGraw-Hill acquired Credit Market

Analysis Limited (CMA) from CME Group Inc. (CME),

which is an independent data provider in the over-the-counter

markets. The acquisition strengthens S&P Capital IQ’s position

in the market compared to its peers.

Synopsis of the Last Quarter

McGraw-Hill’s second-quarter 2012 adjusted earnings increased 25%

to 85 cents a share and also surpassed the Zacks Consensus Estimate

of 76 cents. However, including one-time items, earnings increased

11% year over year.

The company stated that the strong

performance of S&P Indices/ S&P Capital IQ and Commodities

& Commercial boosted the quarterly profits.

McGraw-Hill’s total revenue inched

down 1% year over year to $1,547 million and came below the Zacks

Consensus Estimate of $1,587 million.

(For full report on earnings study: McGraw-Hill Beats on Bottom

Line)

Agreement of Estimate Revisions

For the to-be-reported quarter, 2 out of 6 analysts raised their

earnings estimates while none lowered the same over the past 30

days. During the last 7 days none of the analysts changed their

estimates.

Moreover, for fiscal 2012, a similar trend was noticed over the

last 7 as well as 30 days, with 2 out of 8 analysts revising their

estimates up and none lowering the same over the same time

frame.

Magnitude of estimate Revisions

For the upcoming quarter, the Zacks Consensus Estimate moved up by

a penny to $1.30 per share over the last 30 days, whereas in the

past 7 days it remained unchanged.

For fiscal 2012, the Zacks Consensus Estimate increased by 5 cents

to $3.40 per share in the last 30 days, whereas no changes were

seen over the last 7 days.

Mixed Earnings Surprise History

With respect to earnings surprise, McGraw-Hill has beaten the Zacks

Consensus Estimate in three out of the last four quarters, whereas

it missed the estimate in one quarter. The company has topped the

Zacks Consensus Estimate by an average of 6.2% in the trailing four

quarters.

Neutral on McGraw-Hill

With an aim to boost the shareholders’ value, McGraw-Hill announced

extensive growth and value measures, including the separation of

the company into two independent companies, McGraw-Hill Financial

and McGraw-Hill Education. McGraw-Hill expects to complete the

split-up by the end of fiscal 2012.

Further, the company added that it will focus on abridging costs by

$100 million to ensure that higher costs would not be an impediment

in margin expansion at both Financial and Education.

However, the company’s results could be negatively impacted by

lower volume of debt securities issued in the capital markets.

Financial distress of the recent kind could either dent investor’s

demand for debt securities or make issuers reluctant to issue such

securities. In addition, increase in interest rates or credit

spreads, may adversely affect the general level of debt

issuance.

Due to the factors mentioned above, we currently maintain our long

term ‘Neutral’ recommendation on the stock. McGraw-Hill, which

competes with Pearson plc (PSO), holds a Zacks #2

Rank, translating it into short-term Buy rating on the stock based

on positive earnings surprise in the last three successive

quarters.

CME GROUP INC (CME): Free Stock Analysis Report

MCGRAW-HILL COS (MHP): Free Stock Analysis Report

PEARSON PLC-ADR (PSO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

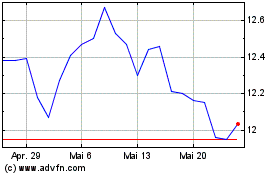

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024