UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-22455

Cohen & Steers Select Preferred and Income Fund, Inc.

(Exact name of Registrant as specified

in charter)

1166 Avenue of the Americas, 30th Floor, New York, New York 10036

(Address of principal executive

offices) (Zip code)

Dana A. DeVivo

Cohen & Steers Capital Management, Inc.

1166 Avenue of the Americas, 30th Floor

New York, New York 10036

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212)

832-3232

Date of fiscal year end:

December 31

Date of reporting period: June 30,

2024

Item 1. Reports to Stockholders.

(a)

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

To Our Shareholders:

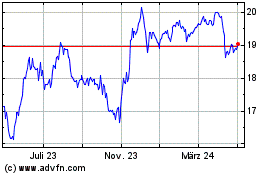

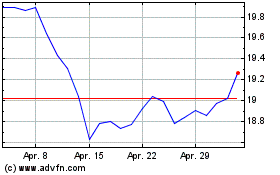

We would like to share with you our report for the six months ended June 30, 2024. The total returns for Cohen & Steers Select

Preferred and Income Fund, Inc. (the Fund) and its comparative benchmarks were:

|

|

|

|

|

| |

|

Six Months Ended

June 30, 2024 |

|

| Cohen & Steers Select Preferred and Income Fund at Net Asset Value(a) |

|

|

7.39 |

% |

| Cohen & Steers Select Preferred and Income Fund at Market Value(a) |

|

|

8.76 |

% |

| ICE BofA Fixed Rate Preferred Securities Index(b) |

|

|

4.38 |

% |

| Blended Benchmark—55% ICE BofA U.S. IG Institutional Capital Securities Index/20%

ICE BofA Core Fixed Rate Preferred Securities Index/25% Bloomberg Developed Market USD Contingent Capital Index(b) |

|

|

4.64 |

% |

| Bloomberg U.S. Aggregate Bond

Index(b) |

|

|

–0.71 |

% |

| ICE BofA U.S. All Capital Securities Index(b) |

|

|

5.06 |

% |

The performance data quoted represent past performance. Past performance is no guarantee of

future results. The investment return and the principal value of an investment will fluctuate and shares, if sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Performance results reflect the effects of leverage, resulting from borrowings under a credit agreement. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. The Fund’s returns assume the reinvestment

of all dividends and distributions at prices obtained under the Fund’s dividend reinvestment plan. Index performance does not reflect the deduction of any fees, taxes or expenses. An investor cannot invest directly in an index. Performance

figures for periods shorter than one year are not annualized.

The Fund expects to make regular monthly

distributions at a level rate (the Policy). Distributions paid by the Fund are subject to recharacterization for tax purposes and are taxable up to the amount of the Fund’s investment company taxable income and net realized gains. As a result

of the Policy, the Fund may pay distributions in excess of the Fund’s investment company taxable income and net realized gains. This excess would be a return of capital distributed from the Fund’s assets. Distributions of capital decrease

the Fund’s total assets and, therefore, could have the effect of increasing the Fund’s expense ratio. In addition, in order to make these distributions, the Fund may have to sell portfolio securities at a less than opportune time.

Market Review

The six months ended June 30, 2024 saw mixed results among fixed income categories. Economic growth in most major markets exceeded expectations, and progress on disinflation slowed. Bond yields rose as a result, and expectations on

the magnitude of central bank rate cuts were reduced. Some major central banks, including the European Central Bank and Bank of Canada, modestly cut rates in June, while the Federal Reserve signaled that its first rate reduction in this cycle was

likely to occur in the fourth quarter, at the earliest, and would be data-dependent.

| (a) |

As a closed-end investment company, the price of the Fund’s exchange-traded shares will be set

by market forces and can deviate from the net asset value (NAV) per share of the Fund. |

| (b) |

For benchmark descriptions, see page 4. |

1

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

In this environment, preferred securities

were the top-performing fixed income category, benefiting from high yields and a narrowing of credit spreads. High-yield bonds also had positive (though smaller) gains, while Treasury and intermediate- and longer-term investment-grade bonds

declined. Within the preferreds market, contingent capital securities (CoCos) and other over-the-counter (OTC) issues, which commonly feature rate-resetting structures, had the strongest returns due to their generally shorter durations compared to

the primarily fixed-rate perpetual securities available from exchange-traded preferreds.

Technical factors also played

a role in preferreds’ performance. New issuance in the first six months of 2024 rose sharply relative to recent years, but many of the deals have been to replace securities that were being redeemed. In the U.S., a large portion of the new

issuance was driven by a change in ratings agency methodology by Moody’s, which makes the issuance of hybrid securities more attractive for corporations as a tax-efficient strategy to obtain equity credit. This spurred utilities (and, to a

lesser degree, insurance companies) to issue OTC-traded hybrid securities. Bank refinancing activity was also strong. Taking advantage of current tight credit spreads, European banks tendered securities that are callable in the near term, while U.S.

banks refinanced or net redeemed higher-cost, floating-rate preferreds. Despite the robust year-to-date gross issuance activity, the size of the overall preferreds market has grown only modestly (while the exchange-traded $25 par market has

continued a trend of net redemptions).

Fund Performance

The portfolio had a positive total return in the period and outperformed its blended benchmark on both a market price and net asset

value basis.

The insurance sector underperformed most other preferred sectors despite solid underlying industry

fundamentals. Property & casualty companies continued to enjoy premium growth given the health of the economy, and life insurers benefited from higher bond yields. The sector’s underperformance stemmed partly from modest returns generated

by very high-quality Japan-based insurers. The Fund’s security selection and underweight allocation to insurance contributed to relative performance. Contributors included a pair of low-liquidity securities from an annuity provider that

rebounded after selling off last year. Having no investment in certain low-coupon securities from Japanese companies that trailed in the rally also contributed.

The banking sector continued to rebound from the well-publicized bank failures that occurred in the first quarter of 2023, with

concerns of contagion receding as fundamentals in the broader banking system remained healthy and resilient. CoCos from European banks were particularly strong amid new issues coming to market with attractive yields. The Fund’s selection in

U.S. bank issues contributed to relative performance. However, the positive effect of the U.S. bank selection was more than offset by unfavorable security selection in non-U.S. banks.

The utilities sector benefited from healthy financials and a positive growth outlook partly supported by expected long-term demand

for power for artificial intelligence applications. Performance in the sector was also boosted by investor demand for new deals that came to market priced with tighter resets. The Fund’s security selection in utilities preferreds aided relative

performance.

Security selection in the energy and pipeline sectors contributed to relative returns. The Fund held

overweight or out-of-benchmark investments in certain securities from companies that, in addition to rising energy prices, benefited from business transactions that were viewed positively from a credit perspective.

2

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

Impact of Leverage on Fund Performance

The Fund employs leverage as part of a yield-enhancement strategy. Leverage, which can increase total return in rising markets

(just as it can have the opposite effect in declining markets), contributed significantly to the Fund’s performance for the six months ended June 30, 2024.

Impact of Derivatives on Fund Performance

In connection with its use of leverage, the Fund pays interest on a portion of its borrowings based on a floating rate under the

terms of its credit agreement. To reduce the impact that an increase in interest rates could have on the performance of the Fund with respect to these borrowings, the Fund used interest rate swaps to exchange a portion of the floating rate for a

fixed rate. The Fund’s use of swaps contributed to the Fund’s total return for the six months ended June 30, 2024.

The Fund used total return swaps with the intention of managing credit risk. The total return swaps did not have a material impact on the Fund’s total return for the six months ended June 30, 2024.

The Fund used forward foreign currency exchange contracts for managing currency risk on certain Fund positions denominated in

foreign currencies. The currency forwards did not have a material impact on the Fund’s total return for the six months ended June 30, 2024.

Sincerely,

|

|

|

|

|

|

| ELAINE ZAHARIS-NIKAS

Portfolio Manager |

|

JERRY DOROST

Portfolio Manager |

The views and opinions in the preceding commentary are subject to change without notice and are

as of the date of the report. There is no guarantee that any market forecast set forth in the commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as

investment advice and is not intended to predict or depict performance of any investment.

Visit Cohen & Steers online at cohenandsteers.com

For more information about the Cohen & Steers family of mutual funds, visit cohenandsteers.com. Here you will

find fund net asset values, fund fact sheets and portfolio highlights, as well as educational resources and timely market updates.

Our website also provides comprehensive information about Cohen & Steers, including our

most recent press releases, profiles of our senior investment professionals and their investment approach to each asset class. The Cohen & Steers family of mutual funds specializes in liquid real assets, including real estate securities, listed

infrastructure and natural resource equities, as well as preferred securities and other income solutions.

3

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

Performance Review (Unaudited)

Average Annual Total Returns—For Periods Ended June 30, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

|

Since Inception(a) |

|

|

Fund at NAV |

|

|

18.49 |

% |

|

|

3.75 |

% |

|

|

5.60 |

% |

|

|

7.77 |

% |

|

Fund at Market Value |

|

|

17.89 |

% |

|

|

0.96 |

% |

|

|

5.64 |

% |

|

|

6.93 |

% |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The

investment return will vary and the principal value of an investment will fluctuate and shares, if sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance

results reflect the effect of leverage from utilization of borrowings under a credit agreement. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. The Fund’s returns assume the reinvestment of all

dividends and distributions at prices obtained under the Fund’s dividend reinvestment plan. The performance table does not reflect the deduction of brokerage commissions or taxes that a shareholder would pay on Fund distributions or the sale of

Fund shares.

| (a) |

Commencement of investment operations was November 24, 2010. |

Benchmark Descriptions

The ICE

BofA Fixed Rate Preferred Securities Index tracks the performance of fixed-rate U.S. dollar-denominated preferred securities issued in the U.S. domestic market. The ICE BofA U.S. IG Institutional Capital Securities Index tracks the performance of

U.S. dollar-denominated investment-grade hybrid capital corporate and preferred securities publicly issued in the U.S. domestic market. The ICE BofA Core Fixed Rate Preferred Securities Index tracks the performance of fixed-rate U.S.

dollar-denominated preferred securities issued in the U.S. domestic market, excluding $1,000 par securities. The Bloomberg Developed Market USD Contingent Capital Index includes hybrid capital securities in developed markets with explicit equity

conversion or write down loss absorption mechanisms that are based on an issuer’s regulatory capital ratio or other explicit solvency-based triggers. The Bloomberg U.S. Aggregate Bond Index is a broad-market measure of the U.S.

dollar-denominated investment-grade fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset backed securities, and commercial mortgage-backed securities. The ICE

BofA U.S. All Capital Securities Index tracks the performance of fixed rate, U.S. dollar-denominated hybrid corporate and preferred securities publicly issued in the U.S. domestic market. Benchmark returns are shown for comparative purposes only and

may not be representative of the Fund’s portfolio.

4

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

Our Leverage Strategy

(Unaudited)

Our current leverage strategy utilizes borrowings up to the maximum

permitted by the Investment Company Act of 1940 to provide additional capital for the Fund, with an objective of increasing net income available for shareholders. As of June 30, 2024, leverage represented 34% of the Fund’s managed assets.

Through a combination of variable rate financing and interest rate swaps, the Fund has locked in

interest rates on a significant portion of this additional capital through 2027 (where we effectively reduce our variable rate obligation and lock in our fixed rate obligation over various terms). Locking in a significant portion of our leveraging

costs is designed to protect the dividend-paying ability of the Fund. The use of leverage increases the volatility of the Fund’s NAV in both up and down markets. However, we believe that locking in portions of the Fund’s leveraging costs

for the various terms partially protects the Fund’s expenses from an increase in short-term interest rates.

Leverage Facts(a)(b)

|

|

|

| Leverage (as a % of managed assets) |

|

34% |

| % Variable Rate Financing |

|

16% |

| Variable Rate |

|

6.0% |

| % Fixed Rate

Financing(c) |

|

84% |

| Weighted Average Rate on Fixed Financing |

|

1.5% |

| Weighted Average Term on Fixed Financing |

|

2.3 years |

The Fund seeks to enhance its dividend yield through leverage. The use of leverage

is a speculative technique and there are special risks and costs associated with leverage. The NAV of the Fund’s shares may be reduced by the issuance and ongoing costs of leverage. So long as the Fund is able to invest in securities that

produce an investment yield that is greater than the total cost of leverage, the leverage strategy will produce higher current net investment income for shareholders. On the other hand, to the extent that the total cost of leverage exceeds the

incremental income gained from employing such leverage, shareholders would realize lower net investment income. In addition to the impact on net income, the use of leverage will have an effect of magnifying capital appreciation or depreciation for

shareholders. Specifically, in an up market, leverage will typically generate greater capital appreciation than if the Fund were not employing leverage. Conversely, in down markets, the use of leverage will generally result in greater capital

depreciation than if the Fund had been unlevered. To the extent that the Fund is required or elects to reduce its leverage, the Fund may need to liquidate investments, including under adverse economic conditions which may result in capital losses

potentially reducing returns to shareholders. There can be no assurance that a leveraging strategy will be successful during any period in which it is employed.

| (a) |

Data as of June 30, 2024. Information is subject to change. |

| (b) |

See Note 7 in Notes to Financial Statements. |

| (c) |

Represents fixed payer interest rate swap contracts on variable rate borrowing.

|

5

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

June 30, 2024

Top Ten Holdings(a)

(Unaudited)

|

|

|

|

|

|

|

|

|

| Security |

|

Value |

|

|

% of

Managed

Assets |

|

|

|

|

| JPMorgan Chase & Co., 6.875%, Series NN |

|

$ |

4,594,945 |

|

|

|

1.2 |

|

| HSBC Holdings PLC, 6.00% (United Kingdom) |

|

|

4,453,253 |

|

|

|

1.2 |

|

| Goldman Sachs Group, Inc., 7.50%, Series X |

|

|

4,432,672 |

|

|

|

1.2 |

|

| Citigroup Capital III, 7.625%, due 12/1/36 |

|

|

4,317,299 |

|

|

|

1.1 |

|

| Wells Fargo & Co., 3.90%, Series BB |

|

|

3,873,293 |

|

|

|

1.0 |

|

| Charles Schwab Corp., 4.00%, Series I |

|

|

3,432,015 |

|

|

|

0.9 |

|

| NextEra Energy Capital Holdings, Inc., 6.75%, due 6/15/54 |

|

|

3,412,872 |

|

|

|

0.9 |

|

| Toronto-Dominion Bank, 8.125%, due 10/31/82 (Canada) |

|

|

3,324,358 |

|

|

|

0.9 |

|

| UBS Group AG, 9.25% to 11/13/28 (Switzerland) |

|

|

3,235,209 |

|

|

|

0.8 |

|

| UBS Group AG, 9.25% to 11/13/33 (Switzerland) |

|

|

3,142,698 |

|

|

|

0.8 |

|

| (a) |

Top ten holdings (excluding short-term investments and derivative instruments) are determined on

the basis of the value of individual securities held. The Fund may also hold positions in other securities issued by the companies listed above. See the Schedule of Investments for additional details on such other positions.

|

Sector Breakdown(b)

(Based on Managed Assets)

(Unaudited)

| (b) |

Excludes derivative instruments. |

6

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS

June 30, 2024 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Shares |

|

|

Value |

|

| PREFERRED

SECURITIES—EXCHANGE-TRADED |

|

|

24.9% |

|

|

|

|

|

|

|

|

|

| BANKING |

|

|

8.4% |

|

|

|

|

|

| Bank of America Corp., 4.125%, Series PP(a)(b) |

|

|

|

34,350 |

|

|

$ |

632,383 |

|

| Bank of America Corp., 4.25%, Series QQ(a)(b) |

|

|

|

59,099 |

|

|

|

1,101,014 |

|

| Bank of America Corp., 4.375%, Series NN(a)(b) |

|

|

|

32,349 |

|

|

|

637,599 |

|

| Bank of America Corp., 5.00%, Series LL(a)(b) |

|

|

|

11,932 |

|

|

|

261,907 |

|

| Bank of America Corp., 5.375%, Series KK(a)(b) |

|

|

|

55,770 |

|

|

|

1,294,422 |

|

| Bank of America Corp., 5.875%, Series HH(a)(b) |

|

|

|

35,622 |

|

|

|

890,550 |

|

| Federal Agricultural Mortgage Corp., 4.875%, Series G(b) |

|

|

|

27,286 |

|

|

|

530,985 |

|

| JPMorgan Chase & Co., 4.20%, Series MM(a)(b) |

|

|

|

15,599 |

|

|

|

297,785 |

|

| JPMorgan Chase & Co., 4.55%, Series JJ(a)(b) |

|

|

|

19,453 |

|

|

|

402,483 |

|

| JPMorgan Chase & Co., 4.625%, Series LL(a)(b) |

|

|

|

32,103 |

|

|

|

672,237 |

|

| JPMorgan Chase & Co., 5.75%, Series DD(a)(b) |

|

|

|

58,472 |

|

|

|

1,455,953 |

|

| M&T Bank Corp., 7.50%, Series J(a)(b) |

|

|

|

87,200 |

|

|

|

2,250,632 |

|

| Morgan Stanley, 5.85%, Series K(a)(b) |

|

|

|

35,291 |

|

|

|

876,628 |

|

| Morgan Stanley, 6.375%, Series I(a)(b) |

|

|

|

66,456 |

|

|

|

1,664,723 |

|

| Morgan Stanley, 6.50%, Series P(a)(b) |

|

|

|

14,598 |

|

|

|

381,008 |

|

| Regions Financial Corp., 5.70% to 5/15/29, Series C(a)(b)(c) |

|

|

|

35,091 |

|

|

|

805,338 |

|

| Texas Capital Bancshares, Inc., 5.75%, Series B(a)(b) |

|

|

|

5,234 |

|

|

|

98,975 |

|

| Truist Financial Corp., 4.75%, Series R(a)(b) |

|

|

|

20,152 |

|

|

|

400,017 |

|

| U.S. Bancorp, 4.00%, Series

M(a)(b) |

|

|

|

50,675 |

|

|

|

883,265 |

|

| U.S. Bancorp, 5.50%, Series

K(a)(b) |

|

|

|

22,605 |

|

|

|

523,532 |

|

| Wells Fargo & Co., 4.25%, Series DD(a)(b) |

|

|

|

44,544 |

|

|

|

836,091 |

|

| Wells Fargo & Co., 4.375%, Series CC(a)(b) |

|

|

|

39,874 |

|

|

|

767,973 |

|

| Wells Fargo & Co., 4.70%, Series AA(a)(b) |

|

|

|

52,257 |

|

|

|

1,061,340 |

|

| Wells Fargo & Co., 4.75%, Series Z(a)(b) |

|

|

|

82,253 |

|

|

|

1,678,784 |

|

| Wells Fargo & Co., 5.625%, Series Y(a)(b) |

|

|

|

37,197 |

|

|

|

872,642 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21,278,266 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSUMER DISCRETIONARY

PRODUCTS |

|

|

0.2% |

|

|

|

|

|

| Ford Motor Co., Senior Debt, 6.20%, due 6/1/59(a) |

|

|

|

636 |

|

|

|

15,226 |

|

| Ford Motor Co., Senior Debt, 6.50%, due 8/15/62(a) |

|

|

|

22,478 |

|

|

|

561,950 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

577,176 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIAL SERVICES |

|

|

1.2% |

|

|

|

|

|

|

|

|

|

| Affiliated Managers Group, Inc., 5.875%, due 3/30/59(a) |

|

|

|

3,021 |

|

|

|

67,459 |

|

| Affiliated Managers Group, Inc., 6.75%, due 3/30/64(a) |

|

|

|

30,867 |

|

|

|

786,491 |

|

| Apollo Global Management, Inc., 7.625% to 9/15/28, due 9/15/53(a)(c) |

|

|

|

25,894 |

|

|

|

683,602 |

|

See accompanying notes to financial statements.

7

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2024 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Shares |

|

|

Value |

|

| Carlyle Finance LLC, 4.625%, due 5/15/61(a) |

|

|

|

14,586 |

|

|

$

|

265,465 |

|

| TPG Operating Group II LP, 6.95%, due 3/15/64(a) |

|

|

|

46,366 |

|

|

|

1,203,661 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,006,678 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INDUSTRIAL SERVICES |

|

|

1.1% |

|

|

|

|

|

|

|

|

|

| WESCO International, Inc., 10.625% to 6/22/25, Series A(b)(c) |

|

|

|

104,030 |

|

|

|

2,697,498 |

|

|

|

|

|

|

|

|

|

|

|

| INSURANCE |

|

|

7.2% |

|

|

|

|

|

|

|

|

|

| AEGON Funding Co. LLC, 5.10%, due 12/15/49 (Netherlands)(a) |

|

|

|

48,866 |

|

|

|

1,014,947 |

|

| Allstate Corp., 7.375%, Series J(a)(b) |

|

|

|

19,747 |

|

|

|

527,640 |

|

| Arch Capital Group Ltd., 4.55%, Series G(a)(b) |

|

|

|

64,738 |

|

|

|

1,246,207 |

|

| Arch Capital Group Ltd., 5.45%, Series F(a)(b) |

|

|

|

34,097 |

|

|

|

763,773 |

|

| Athene Holding Ltd., 4.875%, Series D(a)(b) |

|

|

|

70,627 |

|

|

|

1,329,906 |

|

| Athene Holding Ltd., 5.625%, Series B(a)(b) |

|

|

|

18,464 |

|

|

|

397,530 |

|

| Athene Holding Ltd., 6.35% to 6/30/29, Series A(a)(b)(c) |

|

|

|

43,898 |

|

|

|

1,058,820 |

|

| Athene Holding Ltd., 6.375% to 6/30/25, Series C(a)(b)(c) |

|

|

|

6,735 |

|

|

|

169,385 |

|

| Athene Holding Ltd., 7.25% to 3/30/29, due 3/30/64(a)(c) |

|

|

|

53,523 |

|

|

|

1,359,484 |

|

| Athene Holding Ltd., 7.75% to 12/30/27, Series E(a)(b)(c) |

|

|

|

44,265 |

|

|

|

1,142,037 |

|

| Axis Capital Holdings Ltd., 5.50%, Series E(a)(b) |

|

|

|

29,013 |

|

|

|

612,755 |

|

| Brighthouse Financial, Inc., 5.375%, Series C(a)(b) |

|

|

|

29,307 |

|

|

|

566,211 |

|

| Enstar Group Ltd., 7.00% to 9/1/28, Series D(a)(b)(c) |

|

|

|

54,631 |

|

|

|

1,368,507 |

|

| Equitable Holdings, Inc., 4.30%, Series C(a)(b) |

|

|

|

24,923 |

|

|

|

450,359 |

|

| Equitable Holdings, Inc., 5.25%, Series A(a)(b) |

|

|

|

34,139 |

|

|

|

742,523 |

|

| F&G Annuities & Life, Inc., Senior Debt, 7.95%,

due 12/15/53(a) |

|

|

|

50,050 |

|

|

|

1,297,296 |

|

| Lincoln National Corp., 9.00%, Series D(a)(b) |

|

|

|

40,216 |

|

|

|

1,124,037 |

|

| MetLife, Inc., 4.75%, Series F(a)(b) |

|

|

|

11,301 |

|

|

|

229,749 |

|

| MetLife, Inc., 5.625%, Series E(a)(b) |

|

|

|

66,230 |

|

|

|

1,617,999 |

|

| Reinsurance Group of America, Inc., 7.125% to 10/15/27, due 10/15/52(a)(c) |

|

|

|

13,226 |

|

|

|

345,463 |

|

| RenaissanceRe Holdings Ltd., 4.20%, Series G (Bermuda)(b) |

|

|

|

34,699 |

|

|

|

611,396 |

|

| W R Berkley Corp., 4.125%, due 3/30/61(a) |

|

|

|

14,253 |

|

|

|

249,570 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18,225,594 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PIPELINES |

|

|

0.2% |

|

|

|

|

|

|

|

|

|

| TC Energy Corp., 3.351% to 11/30/25, Series 11 (Canada)(a)(b)(c) |

|

|

|

26,957 |

|

|

|

377,739 |

|

|

|

|

|

|

|

|

|

|

|

| REAL ESTATE |

|

|

1.4% |

|

|

|

|

|

|

|

|

|

| CTO Realty Growth, Inc., 6.375%, Series A(b) |

|

|

|

21,968 |

|

|

|

442,216 |

|

| Public Storage, 4.10%, Series S(a)(b) |

|

|

|

30,000 |

|

|

|

544,200 |

|

See accompanying notes to financial statements.

8

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2024 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Shares |

|

|

Value |

|

| Public Storage, 4.70%, Series J(a)(b) |

|

|

|

38,024 |

|

|

$

|

784,435 |

|

| Public Storage, 4.75%, Series K(a)(b) |

|

|

|

22,122 |

|

|

|

469,650 |

|

| Regency Centers Corp., 5.875%, Series B(b) |

|

|

|

60,000 |

|

|

|

1,305,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,545,501 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TELECOMMUNICATIONS |

|

|

1.9% |

|

|

|

|

|

|

|

|

|

| AT&T, Inc., 4.75%, Series C(a)(b) |

|

|

|

48,527 |

|

|

|

978,304 |

|

| AT&T, Inc., 5.00%, Series A(a)(b) |

|

|

|

48,300 |

|

|

|

1,018,164 |

|

| AT&T, Inc., Senior Debt, 5.35%, due 11/1/66(a) |

|

|

|

36,835 |

|

|

|

849,047 |

|

| AT&T, Inc., Senior Debt, 5.625%, due 8/1/67(a) |

|

|

|

24,500 |

|

|

|

586,040 |

|

| Telephone & Data Systems, Inc., 6.00%, Series VV(a)(b) |

|

|

|

11,937 |

|

|

|

213,792 |

|

| U.S. Cellular Corp., Senior Debt, 5.50%, due 3/1/70(a) |

|

|

|

10,084 |

|

|

|

205,209 |

|

| U.S. Cellular Corp., Senior Debt, 5.50%, due 6/1/70(a) |

|

|

|

17,286 |

|

|

|

349,350 |

|

| U.S. Cellular Corp., Senior Debt, 6.25%, due 9/1/69(a) |

|

|

|

26,813 |

|

|

|

599,271 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,799,177 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| UTILITIES |

|

|

3.3% |

|

|

|

|

|

|

|

|

|

| Algonquin Power & Utilities Corp., 6.20% to 10/1/24,

due

7/1/79, Series 19-A (Canada)(a)(c) |

|

|

|

22,887 |

|

|

|

576,295 |

|

| Brookfield BRP Holdings Canada, Inc., 4.625% (Canada)(a)(b) |

|

|

|

25,091 |

|

|

|

388,659 |

|

| Brookfield BRP Holdings Canada, Inc., 4.875% (Canada)(a)(b) |

|

|

|

34,274 |

|

|

|

562,436 |

|

| Brookfield Infrastructure Finance ULC, 5.00%,

due 5/24/81 (Canada)(a) |

|

|

|

47,325 |

|

|

|

835,286 |

|

| Brookfield Infrastructure Partners LP, 5.125%,

Series 13 (Canada)(a)(b) |

|

|

|

42,166 |

|

|

|

782,601 |

|

| CMS Energy Corp., 5.625%, due 3/15/78(a) |

|

|

|

39,996 |

|

|

|

963,504 |

|

| SCE Trust VII, 7.50%, Series M (TruPS)(a)(b) |

|

|

|

98,818 |

|

|

|

2,586,067 |

|

| SCE Trust VIII, 6.95%, Series N(a)(b) |

|

|

|

55,163 |

|

|

|

1,419,896 |

|

| Sempra, 5.75%, due

7/1/79(a) |

|

|

|

14,706 |

|

|

|

343,385 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,458,129 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL PREFERRED

SECURITIES—EXCHANGE-TRADED

(Identified cost—$63,378,476) |

|

|

|

|

|

|

|

62,965,758 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount* |

|

|

|

|

| PREFERRED SECURITIES—OVER-THE-COUNTER |

|

|

122.2% |

|

|

|

|

|

|

|

|

|

| BANKING |

|

|

73.8% |

|

|

|

|

|

| Abanca Corp. Bancaria SA, 6.00% to 1/20/26 (Spain)(b)(c)(d)(e) |

|

|

EUR |

800,000 |

|

|

|

839,703 |

|

See accompanying notes to financial statements.

9

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2024 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount* |

|

|

Value |

|

| Abanca Corp. Bancaria SA, 10.625% to 7/14/28 (Spain)(b)(c)(d)(e) |

|

EUR |

400,000 |

|

|

$

|

477,173 |

|

| ABN AMRO Bank NV, 6.875% to 9/22/31 (Netherlands)(b)(c)(d)(e) |

|

EUR |

1,000,000 |

|

|

|

1,085,929 |

|

| AIB Group PLC, 7.125% to 10/30/29 (Ireland)(b)(c)(d)(e) |

|

EUR |

1,400,000 |

|

|

|

1,501,475 |

|

| Banco Bilbao Vizcaya Argentaria SA, 6.125% to 11/16/27 (Spain)(a)(b)(c)(d) |

|

|

600,000 |

|

|

|

553,516 |

|

| Banco Bilbao Vizcaya Argentaria SA, 6.875% to 12/13/30 (Spain)(b)(c)(d)(e) |

|

EUR |

1,000,000 |

|

|

|

1,059,050 |

|

| Banco Bilbao Vizcaya Argentaria SA, 9.375% to 3/19/29 (Spain)(b)(c)(d) |

|

|

1,500,000 |

|

|

|

1,600,224 |

|

| Banco de Sabadell SA, 5.75% to 3/15/26 (Spain)(b)(c)(d)(e) |

|

EUR |

800,000 |

|

|

|

838,145 |

|

| Banco de Sabadell SA, 9.375% to 7/18/28 (Spain)(b)(c)(d)(e) |

|

EUR |

1,600,000 |

|

|

|

1,891,483 |

|

| Banco Santander SA, 7.00% to 11/20/29 (Spain)(b)(c)(d)(e) |

|

EUR |

1,200,000 |

|

|

|

1,291,566 |

|

| Banco Santander SA, 9.625% to 11/21/28 (Spain)(b)(c)(d) |

|

|

1,200,000 |

|

|

|

1,288,271 |

|

| Banco Santander SA, 9.625% to 5/21/33 (Spain)(b)(c)(d) |

|

|

2,800,000 |

|

|

|

3,110,814 |

|

| Bank of America Corp., 4.375% to 1/27/27, Series RR(a)(b)(c) |

|

|

1,574,000 |

|

|

|

1,492,519 |

|

| Bank of America Corp., 5.875% to 3/15/28, Series FF(a)(b)(c) |

|

|

1,235,000 |

|

|

|

1,229,771 |

|

| Bank of America Corp., 6.10% to 3/17/25, Series AA(a)(b)(c) |

|

|

675,000 |

|

|

|

674,720 |

|

| Bank of America Corp., 6.125% to 4/27/27, Series TT(a)(b)(c) |

|

|

1,215,000 |

|

|

|

1,224,575 |

|

| Bank of America Corp., 6.25% to 9/5/24, Series X(a)(b)(c) |

|

|

305,000 |

|

|

|

304,497 |

|

| Bank of America Corp., 6.30% to 3/10/26, Series DD(a)(b)(c) |

|

|

662,000 |

|

|

|

665,872 |

|

| Bank of Nova Scotia, 8.00% to 1/27/29, due 1/27/84 (Canada)(a)(c) |

|

|

1,000,000 |

|

|

|

1,035,169 |

|

| Bank of Nova Scotia, 8.625% to 10/27/27, due 10/27/82 (Canada)(a)(c) |

|

|

1,600,000 |

|

|

|

1,680,219 |

|

| Barclays Bank PLC, 6.278% to 12/15/34, Series 1 (United Kingdom)(b)(c) |

|

|

880,000 |

|

|

|

864,712 |

|

| Barclays PLC, 6.125% to 12/15/25 (United Kingdom)(b)(c)(d) |

|

|

600,000 |

|

|

|

588,745 |

|

See accompanying notes to financial statements.

10

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2024 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount* |

|

|

Value |

|

| Barclays PLC, 8.00% to 3/15/29 (United Kingdom)(b)(c)(d) |

|

|

1,400,000 |

|

|

$

|

1,424,976 |

|

| Barclays PLC, 8.875% to 9/15/27 (United Kingdom)(b)(c)(d)(e) |

|

GBP |

600,000 |

|

|

|

778,173 |

|

| Barclays PLC, 9.25% to 9/15/28 (United Kingdom)(b)(c)(d) |

|

GBP |

600,000 |

|

|

|

787,566 |

|

| Barclays PLC, 9.625% to 12/15/29 (United Kingdom)(b)(c)(d) |

|

|

2,400,000 |

|

|

|

2,607,821 |

|

| BNP Paribas SA, 4.50% to 2/25/30 (France)(b)(c)(d)(f) |

|

|

1,400,000 |

|

|

|

1,114,434 |

|

| BNP Paribas SA, 4.625% to 1/12/27 (France)(b)(c)(d)(f) |

|

|

2,800,000 |

|

|

|

2,526,929 |

|

| BNP Paribas SA, 4.625% to 2/25/31 (France)(b)(c)(d)(f) |

|

|

2,275,000 |

|

|

|

1,827,448 |

|

| BNP Paribas SA, 7.00% to 8/16/28 (France)(a)(b)(c)(d)(f) |

|

|

565,000 |

|

|

|

557,938 |

|

| BNP Paribas SA, 7.375% to 8/19/25 (France)(b)(c)(d)(f) |

|

|

1,000,000 |

|

|

|

1,000,005 |

|

| BNP Paribas SA, 7.375% to 6/11/30 (France)(b)(c)(d)(e) |

|

EUR |

400,000 |

|

|

|

446,052 |

|

| BNP Paribas SA, 7.75% to 8/16/29 (France)(b)(c)(d)(f) |

|

|

2,000,000 |

|

|

|

2,022,030 |

|

| BNP Paribas SA, 8.50% to 8/14/28 (France)(b)(c)(d)(f) |

|

|

3,000,000 |

|

|

|

3,080,148 |

|

| BNP Paribas SA, 9.25% to 11/17/27 (France)(b)(c)(d)(f) |

|

|

1,600,000 |

|

|

|

1,700,538 |

|

| CaixaBank SA, 7.50% to 1/16/30 (Spain)(b)(c)(d)(e) |

|

EUR |

600,000 |

|

|

|

669,076 |

|

| CaixaBank SA, 8.25% to 3/13/29 (Spain)(b)(c)(d)(e) |

|

EUR |

1,400,000 |

|

|

|

1,595,565 |

|

| Charles Schwab Corp., 4.00% to 6/1/26, Series I(a)(b)(c) |

|

|

3,653,000 |

|

|

|

3,432,015 |

|

| Charles Schwab Corp., 4.00% to 12/1/30,

Series H(a)(b)(c) |

|

|

3,668,000 |

|

|

|

3,137,108 |

|

| Charles Schwab Corp., 5.00% to 6/1/27, Series K(a)(b)(c) |

|

|

652,000 |

|

|

|

628,008 |

|

| Citigroup Capital III, 7.625%, due 12/1/36 (TruPS) |

|

|

4,115,000 |

|

|

|

4,317,299 |

|

| Citigroup, Inc., 3.875% to 2/18/26, Series X(b)(c) |

|

|

2,343,000 |

|

|

|

2,223,290 |

|

| Citigroup, Inc., 5.95% to 5/15/25, Series P(b)(c) |

|

|

1,305,000 |

|

|

|

1,298,104 |

|

| Citigroup, Inc., 6.25% to 8/15/26, Series T(b)(c) |

|

|

636,000 |

|

|

|

637,146 |

|

| Citigroup, Inc., 7.625% to 11/15/28, Series AA(b)(c) |

|

|

1,828,000 |

|

|

|

1,907,847 |

|

| CoBank ACB, 6.25% to 10/1/26, Series I(a)(b)(c) |

|

|

2,534,000 |

|

|

|

2,515,213 |

|

| CoBank ACB, 6.45% to 10/1/27, Series K(a)(b)(c) |

|

|

1,370,000 |

|

|

|

1,354,673 |

|

| Commerzbank AG, 7.875% to 10/9/31, Series EMTN (Germany)(b)(c)(d)(e) |

|

EUR |

600,000 |

|

|

|

641,748 |

|

| Cooperatieve Rabobank UA, 3.25% to 12/29/26 (Netherlands)(a)(b)(c)(d)(e) |

|

EUR |

600,000 |

|

|

|

593,841 |

|

| Cooperatieve Rabobank UA, 4.875% to 6/29/29 (Netherlands)(a)(b)(c)(d)(e) |

|

EUR |

1,000,000 |

|

|

|

1,004,688 |

|

| Coventry Building Society, 8.75% to 6/11/29

(United Kingdom)(b)(c)(d)(e) |

|

GBP |

800,000 |

|

|

|

1,019,400 |

|

See accompanying notes to financial statements.

11

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2024 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount* |

|

|

Value |

|

| Credit Agricole SA, 4.75% to 3/23/29 (France)(a)(b)(c)(d)(f) |

|

|

2,000,000 |

|

|

$

|

1,744,182 |

|

| Credit Agricole SA, 6.50% to 9/23/29, Series EMTN (France)(a)(b)(c)(d)(e) |

|

EUR |

800,000 |

|

|

|

858,354 |

|

| Credit Agricole SA, 7.25% to 9/23/28, Series EMTN (France)(a)(b)(c)(d)(e) |

|

EUR |

300,000 |

|

|

|

332,036 |

|

| Credit Agricole SA, 8.125% to 12/23/25 (France)(a)(b)(c)(d)(f) |

|

|

650,000 |

|

|

|

660,493 |

|

| Credit Suisse Group AG, 6.375%, Claim (Switzerland)(b)(d)(f)(g)(h)(i) |

|

|

3,000,000 |

|

|

|

270,000 |

|

| Deutsche Bank AG, 6.00% to 10/30/25, Series 2020 (Germany)(b)(c)(d) |

|

|

400,000 |

|

|

|

380,616 |

|

| Deutsche Bank AG, 8.125% to 10/30/29 (Germany)(b)(c)(d)(e) |

|

EUR |

1,600,000 |

|

|

|

1,726,758 |

|

| Deutsche Bank AG, 10.00% to 12/1/27 (Germany)(b)(c)(d)(e) |

|

EUR |

1,000,000 |

|

|

|

1,153,307 |

|

| Erste Group Bank AG, 7.00% to 4/15/31 (Austria)(a)(b)(c)(d)(e) |

|

EUR |

1,000,000 |

|

|

|

1,053,548 |

|

| Farm Credit Bank of Texas, 5.70% to 9/15/25, Series 4(b)(c)(f) |

|

|

1,441,000 |

|

|

|

1,421,202 |

|

| Farm Credit Bank of Texas, 7.75% to 6/15/29(b)(c) |

|

|

839,000 |

|

|

|

851,621 |

|

| Farm Credit Bank of Texas, 9.596% (3 Month USD Term SOFR + 4.01%)(b)(f)(j) |

|

|

9,779 |

† |

|

|

982,790 |

|

| First Horizon Bank, 6.409% (3 Month USD Term SOFR + 1.112%, Floor 3.75%)(a)(b)(f)(j) |

|

|

1,537 |

† |

|

|

1,029,790 |

|

| Goldman Sachs Capital I, 6.345%, due 2/15/34 (TruPS) |

|

|

750,000 |

|

|

|

774,753 |

|

| Goldman Sachs Group, Inc., 3.65% to 8/10/26, Series U(b)(c) |

|

|

1,287,000 |

|

|

|

1,199,994 |

|

| Goldman Sachs Group, Inc., 7.50% to 5/10/29, Series X(b)(c) |

|

|

4,300,000 |

|

|

|

4,432,672 |

|

| HSBC Capital Funding Dollar 1 LP, 10.176% to 6/30/30, Series 2 (United

Kingdom)(b)(c)(f) |

|

|

1,067,000 |

|

|

|

1,293,764 |

|

| HSBC Holdings PLC, 4.00% to 3/9/26 (United Kingdom)(a)(b)(c)(d) |

|

|

1,800,000 |

|

|

|

1,690,310 |

|

| HSBC Holdings PLC, 4.60% to 12/17/30 (United Kingdom)(a)(b)(c)(d) |

|

|

3,400,000 |

|

|

|

2,922,499 |

|

| HSBC Holdings PLC, 6.00% to 5/22/27 (United Kingdom)(a)(b)(c)(d) |

|

|

4,600,000 |

|

|

|

4,453,253 |

|

| HSBC Holdings PLC, 6.50%, due 9/15/37 (United Kingdom)(a) |

|

|

902,000 |

|

|

|

935,838 |

|

See accompanying notes to financial statements.

12

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2024 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount* |

|

|

Value |

|

| HSBC Holdings PLC, 6.50%, due 9/15/37 (United Kingdom)(a) |

|

|

300,000 |

|

|

$

|

307,432 |

|

| HSBC Holdings PLC, 6.50% to 3/23/28 (United Kingdom)(a)(b)(c)(d) |

|

|

1,600,000 |

|

|

|

1,579,132 |

|

| HSBC Holdings PLC, 8.00% to 3/7/28 (United Kingdom)(a)(b)(c)(d) |

|

|

2,400,000 |

|

|

|

2,526,600 |

|

| Huntington Bancshares, Inc., 4.45% to 10/15/27, Series G(b)(c) |

|

|

779,000 |

|

|

|

711,107 |

|

| Huntington Bancshares, Inc., 5.625% to 7/15/30, Series F(b)(c) |

|

|

926,000 |

|

|

|

889,719 |

|

| ING Groep NV, 4.25% to 5/16/31, Series NC10 (Netherlands)(b)(c)(d) |

|

|

600,000 |

|

|

|

468,550 |

|

| ING Groep NV, 4.875% to 5/16/29 (Netherlands)(a)(b)(c)(d)(e) |

|

|

2,200,000 |

|

|

|

1,916,716 |

|

| ING Groep NV, 5.75% to 11/16/26 (Netherlands)(b)(c)(d) |

|

|

2,400,000 |

|

|

|

2,309,088 |

|

| ING Groep NV, 7.50% to 5/16/28 (Netherlands)(a)(b)(c)(d)(e) |

|

|

800,000 |

|

|

|

800,062 |

|

| ING Groep NV, 8.00% to 5/16/30 (Netherlands)(a)(b)(c)(d)(e) |

|

|

1,200,000 |

|

|

|

1,225,230 |

|

| Intesa Sanpaolo SpA, 5.875% to 9/1/31, Series EMTN (Italy)(b)(c)(d)(e) |

|

EUR |

400,000 |

|

|

|

409,906 |

|

| Intesa Sanpaolo SpA, 6.375% to 3/30/28 (Italy)(b)(c)(d)(e) |

|

EUR |

400,000 |

|

|

|

419,009 |

|

| Intesa Sanpaolo SpA, 7.00% to 5/20/32 (Italy)(b)(c)(d)(e) |

|

EUR |

1,000,000 |

|

|

|

1,064,257 |

|

| Intesa Sanpaolo SpA, 7.70% to 9/17/25 (Italy)(b)(c)(d)(f) |

|

|

800,000 |

|

|

|

799,938 |

|

| Intesa Sanpaolo SpA, 9.125% to 9/7/29 (Italy)(b)(c)(d)(e) |

|

EUR |

1,800,000 |

|

|

|

2,132,398 |

|

| JPMorgan Chase & Co., 6.875% to 6/1/29, Series NN(a)(b)(c) |

|

|

4,438,000 |

|

|

|

4,594,945 |

|

| Lloyds Banking Group PLC, 7.50% to 9/27/25 (United Kingdom)(b)(c)(d) |

|

|

2,200,000 |

|

|

|

2,204,705 |

|

| Lloyds Banking Group PLC, 8.50% to 9/27/27 (United Kingdom)(b)(c)(d) |

|

GBP |

800,000 |

|

|

|

1,035,929 |

|

| M&T Bank Corp., 3.50% to 9/1/26, Series I(b)(c) |

|

|

178,000 |

|

|

|

148,986 |

|

| Nationwide Building Society, 5.75% to 6/20/27 (United Kingdom)(b)(c)(d)(e) |

|

GBP |

600,000 |

|

|

|

714,527 |

|

| NatWest Group PLC, 5.125% to 5/12/27 (United Kingdom)(b)(c)(d) |

|

GBP |

1,000,000 |

|

|

|

1,175,612 |

|

| NatWest Group PLC, 6.00% to 12/29/25 (United Kingdom)(b)(c)(d) |

|

|

1,100,000 |

|

|

|

1,078,810 |

|

| NatWest Group PLC, 8.00% to 8/10/25 (United Kingdom)(b)(c)(d) |

|

|

800,000 |

|

|

|

806,008 |

|

See accompanying notes to financial statements.

13

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2024 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount* |

|

|

Value |

|

| Nordea Bank Abp, 6.625% to 3/26/26 (Finland)(a)(b)(c)(d)(f) |

|

|

1,600,000 |

|

|

$

|

1,591,851 |

|

| PNC Financial Services Group, Inc., 3.40% to 9/15/26, Series T(a)(b)(c) |

|

|

1,283,000 |

|

|

|

1,154,276 |

|

| PNC Financial Services Group, Inc., 6.00% to 5/15/27, Series U(a)(b)(c) |

|

|

1,381,000 |

|

|

|

1,367,255 |

|

| PNC Financial Services Group, Inc., 6.20% to 9/15/27, Series V(a)(b)(c) |

|

|

1,976,000 |

|

|

|

1,973,252 |

|

| PNC Financial Services Group, Inc., 6.25% to 3/15/30, Series W(a)(b)(c) |

|

|

2,191,000 |

|

|

|

2,140,542 |

|

| Regions Financial Corp., 5.75% to 6/15/25, Series D(b)(c) |

|

|

529,000 |

|

|

|

521,039 |

|

| Skandinaviska Enskilda Banken AB, 6.875% to 6/30/27 (Sweden)(a)(b)(c)(d)(e) |

|

|

200,000 |

|

|

|

198,000 |

|

| Societe Generale SA, 5.375% to 11/18/30 (France)(b)(c)(d)(f) |

|

|

1,600,000 |

|

|

|

1,293,050 |

|

| Societe Generale SA, 6.75% to 4/6/28 (France)(b)(c)(d)(f) |

|

|

2,360,000 |

|

|

|

2,116,521 |

|

| Societe Generale SA, 9.375% to 11/22/27 (France)(b)(c)(d)(f) |

|

|

2,800,000 |

|

|

|

2,838,094 |

|

| Societe Generale SA, 10.00% to 11/14/28 (France)(b)(c)(d)(f) |

|

|

2,800,000 |

|

|

|

2,911,983 |

|

| Standard Chartered PLC, 4.30% to 8/19/28 (United Kingdom)(b)(c)(d)(f) |

|

|

800,000 |

|

|

|

669,633 |

|

| Standard Chartered PLC, 4.75% to 1/14/31 (United Kingdom)(b)(c)(d)(f) |

|

|

1,200,000 |

|

|

|

992,364 |

|

| Standard Chartered PLC, 7.75% to 8/15/27 (United Kingdom)(b)(c)(d)(f) |

|

|

600,000 |

|

|

|

607,321 |

|

| Standard Chartered PLC, 7.875% to 3/8/30 (United Kingdom)(b)(c)(d)(f) |

|

|

1,200,000 |

|

|

|

1,205,168 |

|

| State Street Corp., 6.70% to 3/15/29, Series I(b)(c) |

|

|

2,014,000 |

|

|

|

2,031,040 |

|

| Stichting AK Rabobank Certificaten, 6.50% (Netherlands)(b)(e) |

|

EUR |

1,103,150 |

|

|

|

1,284,882 |

|

| Swedbank AB, 7.625% to 3/17/28 (Sweden)(b)(c)(d)(e) |

|

|

200,000 |

|

|

|

199,625 |

|

| Swedbank AB, 7.75% to 3/17/30 (Sweden)(b)(c)(d)(e) |

|

|

1,200,000 |

|

|

|

1,200,870 |

|

| Toronto-Dominion Bank, 8.125% to 10/31/27,

due 10/31/82 (Canada)(a)(c) |

|

|

3,200,000 |

|

|

|

3,324,358 |

|

| Truist Financial Corp., 4.95% to 9/1/25, Series P(a)(b)(c) |

|

|

537,000 |

|

|

|

527,348 |

|

| Truist Financial Corp., 5.10% to 3/1/30, Series Q(a)(b)(c) |

|

|

1,450,000 |

|

|

|

1,361,330 |

|

| Truist Financial Corp., 5.125% to 12/15/27, Series M(a)(b)(c) |

|

|

872,000 |

|

|

|

828,217 |

|

See accompanying notes to financial statements.

14

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2024 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount* |

|

|

Value |

|

| UBS Group AG, 4.375% to 2/10/31 (Switzerland)(b)(c)(d)(f) |

|

|

|

1,800,000 |

|

|

$

|

1,464,397 |

|

| UBS Group AG, 4.875% to 2/12/27 (Switzerland)(b)(c)(d)(f) |

|

|

|

3,200,000 |

|

|

|

2,938,632 |

|

| UBS Group AG, 5.125% to 7/29/26 (Switzerland)(b)(c)(d)(e) |

|

|

|

400,000 |

|

|

|

381,815 |

|

| UBS Group AG, 6.875% to 8/7/25 (Switzerland)(a)(b)(c)(d)(e) |

|

|

|

1,000,000 |

|

|

|

993,627 |

|

| UBS Group AG, 9.25% to 11/13/28 (Switzerland)(b)(c)(d)(f) |

|

|

|

3,000,000 |

|

|

|

3,235,209 |

|

| UBS Group AG, 9.25% to 11/13/33 (Switzerland)(b)(c)(d)(f) |

|

|

|

2,800,000 |

|

|

|

3,142,698 |

|

| U.S. Bancorp, 3.70% to 1/15/27, Series N(a)(b)(c) |

|

|

|

377,000 |

|

|

|

341,928 |

|

| U.S. Bancorp, 5.30% to 4/15/27, Series J(a)(b)(c) |

|

|

|

1,000,000 |

|

|

|

972,199 |

|

| Virgin Money U.K. PLC, 8.25% to 6/17/27 (United Kingdom)(b)(c)(d)(e) |

|

|

GBP |

800,000 |

|

|

|

1,017,600 |

|

| Wells Fargo & Co., 3.90% to 3/15/26, Series BB(b)(c) |

|

|

|

4,045,000 |

|

|

|

3,873,293 |

|

| Wells Fargo & Co., 5.875% to 6/15/25, Series U(b)(c) |

|

|

|

724,000 |

|

|

|

722,502 |

|

| Wells Fargo & Co., 5.95%, due 12/15/36 |

|

|

|

1,027,000 |

|

|

|

1,024,860 |

|

| Wells Fargo & Co., 7.625% to 9/15/28(b)(c) |

|

|

|

2,160,000 |

|

|

|

2,305,595 |

|

| Wells Fargo & Co., 7.95%, due 11/15/29, Series B |

|

|

|

249,000 |

|

|

|

276,328 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

186,662,375 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ENERGY |

|

|

1.1% |

|

|

|

|

|

|

|

|

|

| BP Capital Markets PLC, 4.375% to 6/22/25(a)(b)(c) |

|

|

|

384,000 |

|

|

|

377,412 |

|

| BP Capital Markets PLC, 4.875% to 3/22/30(a)(b)(c) |

|

|

|

953,000 |

|

|

|

901,430 |

|

| BP Capital Markets PLC, 6.45% to 12/1/33(a)(b)(c) |

|

|

|

1,425,000 |

|

|

|

1,467,370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,746,212 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIAL SERVICES |

|

|

1.6% |

|

|

|

|

|

|

|

|

|

| American Express Co., 3.55% to 9/15/26, Series D(b)(c) |

|

|

|

1,833,000 |

|

|

|

1,713,305 |

|

| Apollo Management Holdings LP, 4.95% to 12/17/24, due 1/14/50(a)(c)(f) |

|

|

|

878,000 |

|

|

|

862,146 |

|

| ARES Finance Co. III LLC, 4.125% to 6/30/26, due 6/30/51(a)(c)(f) |

|

|

|

1,075,000 |

|

|

|

1,004,151 |

|

| Discover Financial Services, 6.125% to 6/23/25, Series D(b)(c) |

|

|

|

463,000 |

|

|

|

459,191 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,038,793 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INSURANCE |

|

|

16.0% |

|

|

|

|

|

|

|

|

|

| Aegon Ltd., 5.50% to 4/11/28, due 4/11/48 (Netherlands)(a)(c) |

|

|

|

600,000 |

|

|

|

579,992 |

|

| Aegon Ltd., 5.625% to 4/15/29 (Netherlands)(b)(c)(d)(e) |

|

|

EUR |

1,200,000 |

|

|

|

1,244,971 |

|

See accompanying notes to financial statements.

15

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2024 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount* |

|

|

Value |

|

| Allianz SE, 3.50% to 11/17/25 (Germany)(a)(b)(c)(d)(f) |

|

|

2,200,000 |

|

|

$

|

2,054,565 |

|

| Assurant, Inc., 7.00% to 3/27/28, due 3/27/48(c) |

|

|

1,555,000 |

|

|

|

1,562,320 |

|

| AXA SA, 6.375% to 7/16/33, Series EMTN (France)(a)(b)(c)(d)(e) |

|

EUR |

400,000 |

|

|

|

438,933 |

|

| AXA SA, 8.60%, due 12/15/30 (France)(a) |

|

|

525,000 |

|

|

|

618,373 |

|

| AXIS Specialty Finance LLC, 4.90% to 1/15/30, due 1/15/40(a)(c) |

|

|

545,000 |

|

|

|

499,771 |

|

| Corebridge Financial, Inc., 6.875% to 9/15/27, due 12/15/52(a)(c) |

|

|

1,740,000 |

|

|

|

1,756,937 |

|

| Enstar Finance LLC, 5.50% to 1/15/27, due 1/15/42(a)(c) |

|

|

1,390,000 |

|

|

|

1,344,754 |

|

| Enstar Finance LLC, 5.75% to 9/1/25, due 9/1/40(a)(c) |

|

|

1,770,000 |

|

|

|

1,735,358 |

|

| Equitable Holdings, Inc., 4.95% to 9/15/25, Series B(a)(b)(c) |

|

|

900,000 |

|

|

|

888,237 |

|

| Global Atlantic Fin Co., 4.70% to 7/15/26, due 10/15/51(c)(f) |

|

|

1,613,000 |

|

|

|

1,498,600 |

|

| Global Atlantic Fin Co., 7.95% to 7/15/29, due 10/15/54(c)(f) |

|

|

1,430,000 |

|

|

|

1,441,032 |

|

| Hartford Financial Services Group, Inc., 7.709% (3 Month USD Term SOFR +

2.387%), due 2/12/47, Series ICON(a)(f)(j) |

|

|

1,400,000 |

|

|

|

1,247,965 |

|

| ILFC E-Capital Trust I, 7.159% (3

Month USD Term SOFR + 1.812%), due 12/21/65 (TruPS)(f)(j) |

|

|

693,000 |

|

|

|

566,371 |

|

| Lancashire Holdings Ltd., 5.625% to 3/18/31, due 9/18/41 (United Kingdom)(a)(c)(e) |

|

|

1,000,000 |

|

|

|

906,567 |

|

| Liberty Mutual Group, Inc., 4.125% to 9/15/26, due 12/15/51(c)(f) |

|

|

1,150,000 |

|

|

|

1,077,447 |

|

| Lincoln National Corp., 9.25% to 12/1/27, Series C(b)(c) |

|

|

1,103,000 |

|

|

|

1,191,776 |

|

| Markel Group, Inc., 6.00% to 6/1/25(b)(c) |

|

|

690,000 |

|

|

|

686,079 |

|

| MetLife Capital Trust IV, 7.875%, due 12/15/37 (TruPS)(a)(f) |

|

|

2,678,000 |

|

|

|

2,875,109 |

|

| MetLife, Inc., 9.25%, due 4/8/38(a)(f) |

|

|

2,309,000 |

|

|

|

2,676,958 |

|

| Nippon Life Insurance Co., 5.95% to 4/16/34, due 4/16/54 (Japan)(a)(c)(f) |

|

|

900,000 |

|

|

|

887,888 |

|

| Phoenix Group Holdings PLC, 5.625% to 1/29/25 (United Kingdom)(b)(c)(d)(e) |

|

|

200,000 |

|

|

|

198,171 |

|

| Phoenix Group Holdings PLC, 8.50% to 12/12/29 (United Kingdom)(b)(c)(d)(e) |

|

|

400,000 |

|

|

|

394,256 |

|

| Prudential Financial, Inc., 6.00% to 6/1/32, due 9/1/52(a)(c) |

|

|

1,312,000 |

|

|

|

1,297,281 |

|

| Prudential Financial, Inc., 6.50% to 12/15/33, due 3/15/54(a)(c) |

|

|

1,820,000 |

|

|

|

1,841,809 |

|

| Prudential Financial, Inc., 6.75% to 12/1/32, due 3/1/53(a)(c) |

|

|

990,000 |

|

|

|

1,014,688 |

|

See accompanying notes to financial statements.

16

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2024 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount* |

|

|

Value |

|

| QBE Insurance Group Ltd., 5.875% to 5/12/25 (Australia)(a)(b)(c)(f) |

|

|

|

1,800,000 |

|

|

$

|

1,786,021 |

|

| Rothesay Life PLC, 4.875% to 4/13/27, Series NC6 (United Kingdom)(b)(c)(d)(e) |

|

|

|

400,000 |

|

|

|

353,757 |

|

| Rothesay Life PLC, 7.00% to 6/11/29, due 9/11/34 (United Kingdom)(a)(c)(e) |

|

|

|

800,000 |

|

|

|

802,092 |

|

| SBL Holdings, Inc., 6.50% to 11/13/26(b)(c)(f) |

|

|

|

1,370,000 |

|

|

|

1,110,310 |

|

| SBL Holdings, Inc., 7.00% to 5/13/25(b)(c)(f) |

|

|

|

1,216,000 |

|

|

|

1,061,972 |

|

| Sumitomo Life Insurance Co., 5.875% to 1/18/34 (Japan)(a)(b)(c)(f) |

|

|

|

2,000,000 |

|

|

|

1,952,126 |

|

| Zurich Finance Ireland Designated Activity Co., 3.00% to 1/19/31, due

4/19/51, Series EMTN (Switzerland)(a)(c)(e) |

|

|

|

966,000 |

|

|

|

796,346 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40,388,832 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PIPELINES |

|

|

10.8% |

|

|

|

|

|

|

|

|

|

| Enbridge, Inc., 5.50% to 7/15/27, due 7/15/77, Series 2017-A (Canada)(c) |

|

|

|

275,000 |

|

|

|

259,558 |

|

| Enbridge, Inc., 5.75% to 4/15/30, due 7/15/80, Series 20-A (Canada)(c) |

|

|

|

1,365,000 |

|

|

|

1,290,174 |

|

| Enbridge, Inc., 6.00% to 1/15/27, due 1/15/77, Series 16-A (Canada)(c) |

|

|

|

1,724,000 |

|

|

|

1,677,374 |

|

| Enbridge, Inc., 6.25% to 3/1/28, due 3/1/78 (Canada)(c) |

|

|

|

1,970,000 |

|

|

|

1,892,447 |

|

| Enbridge, Inc., 7.20% to 3/27/34, due 6/27/54 (Canada)(a)(c) |

|

|

|

1,340,000 |

|

|

|

1,351,417 |

|

| Enbridge, Inc., 7.375% to 10/15/27, due 1/15/83 (Canada)(c) |

|

|

|

698,000 |

|

|

|

700,425 |

|

| Enbridge, Inc., 7.375% to 12/15/29, due 3/15/55 (Canada)(a)(c) |

|

|

|

690,000 |

|

|

|

693,105 |

|

| Enbridge, Inc., 7.625% to 10/15/32, due 1/15/83 (Canada)(c) |

|

|

|

2,152,000 |

|

|

|

2,205,230 |

|

| Enbridge, Inc., 8.25% to 10/15/28, due 1/15/84, Series NC5 (Canada)(c) |

|

|

|

1,868,000 |

|

|

|

1,950,962 |

|

| Enbridge, Inc., 8.50% to 10/15/33, due 1/15/84 (Canada)(c) |

|

|

|

2,815,000 |

|

|

|

3,041,698 |

|

| Energy Transfer LP, 6.50% to 11/15/26, Series H(b)(c) |

|

|

|

1,250,000 |

|

|

|

1,236,063 |

|

| Energy Transfer LP, 6.625% to 2/15/28, Series B(b)(c) |

|

|

|

124,000 |

|

|

|

120,798 |

|

| Energy Transfer LP, 7.125% to 5/15/30, Series G(b)(c) |

|

|

|

1,873,000 |

|

|

|

1,859,964 |

|

| Energy Transfer LP, 8.00% to 2/15/29, due 5/15/54(c) |

|

|

|

480,000 |

|

|

|

502,376 |

|

| Enterprise Products Operating LLC, 8.574% (3 Month USD Term SOFR +

3.248%), due 8/16/77, Series D(a)(j) |

|

|

|

986,000 |

|

|

|

982,639 |

|

| Transcanada Trust, 5.50% to 9/15/29, due 9/15/79 (Canada)(c) |

|

|

|

2,817,000 |

|

|

|

2,595,807 |

|

| Transcanada Trust, 5.60% to 12/7/31, due 3/7/82 (Canada)(c) |

|

|

|

2,065,000 |

|

|

|

1,874,636 |

|

| Transcanada Trust, 5.875% to 8/15/26, due 8/15/76, Series 16-A (Canada)(c) |

|

|

|

3,172,000 |

|

|

|

3,112,385 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27,347,058 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to financial statements.

17

COHEN

& STEERS SELECT PREFERRED

AND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2024 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount* |

|

|

Value |

|

| REAL ESTATE |

|

|

1.9% |

|

|

|

|

|

|

|

|

|

| Scentre Group Trust 2, 4.75% to 6/24/26, due 9/24/80 (Australia)(a)(c)(f) |

|

|

|

2,189,000 |

|

|

$

|

2,115,469 |

|

| Scentre Group Trust 2, 5.125% to 6/24/30, due 9/24/80 (Australia)(a)(c)(f) |

|

|

|

1,200,000 |

|

|

|

1,118,464 |

|

| Unibail-Rodamco-Westfield SE, 7.25% to 7/3/28 (France)(b)(c)(e) |

|

|

EUR |

1,400,000 |

|

|

|

1,578,021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,811,954 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| RETAIL &

WHOLESALE—STAPLES |

|

|

0.7% |

|

|

|

|

|

|

|

|

|

| Land O’ Lakes, Inc., 7.00%(b)(f) |

|

|

|

1,100,000 |

|

|

|

863,500 |

|

| Land O’ Lakes, Inc., 7.25%(b)(f) |

|

|

|

1,190,000 |

|

|

|

969,850 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,833,350 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TELECOMMUNICATIONS |

|

|

0.3% |

|

|

|

|

|

|

|

|

|

| Telefonica Europe BV, 6.135% to 2/3/30 (Spain)(b)(c)(e) |

|

|

EUR |

700,000 |

|

|

|

786,917 |

|

|

|

|

|

|

|

|

|

|

|

| UTILITIES |

|

|

16.0% |

|

|

|

|

|

|

|

|

|

| AES Corp., 7.60% to 10/15/29, due 1/15/55(c) |

|

|

|

1,883,000 |

|

|

|

1,907,281 |

|

| Algonquin Power & Utilities Corp., 4.75% to 1/18/27,

due 1/18/82 (Canada)(c) |

|

|

|

2,524,000 |

|

|

|

2,310,802 |

|

| American Electric Power Co., Inc., 3.875% to 11/15/26, due 2/15/62(c) |

|

|

|

1,481,000 |

|

|

|

1,364,227 |

|

| American Electric Power Co., Inc., 6.95% to 9/15/34, due 12/15/54(c) |

|

|

|

1,780,000 |

|

|

|

1,775,178 |

|

| American Electric Power Co., Inc., 7.05% to 9/15/29, due 12/15/54(c) |

|

|

|

1,798,000 |

|

|

|

1,794,582 |

|

| CMS Energy Corp., 4.75% to 3/1/30, due 6/1/50(c) |

|

|

|

992,000 |

|

|

|

909,597 |

|

| Dominion Energy, Inc., 4.35% to 1/15/27, Series C(b)(c) |

|

|

|

2,525,000 |

|

|

|

2,381,866 |

|

| Dominion Energy, Inc., 6.875% to 11/3/29, due 2/1/55, Series A(a)(c) |

|

|

|

1,181,000 |

|

|

|

1,206,050 |

|

| Dominion Energy, Inc., 7.00% to 3/3/34, due 6/1/54, Series B(a)(c) |

|

|

|

2,295,000 |

|

|

|

2,393,602 |

|

| Edison International, 5.375% to 3/15/26, Series A(b)(c) |

|