|

Main Post Office, P.O. Box 751 |

www.asyousow.org |

Berkeley, CA 94704

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992 |

Notice of Exempt Solicitation Pursuant to Rule 14a-103

Name of the Registrant: Public Storage (PSA)

Name of persons relying on exemption: As You Sow

Address of persons relying on exemption: Main Post Office, P.O. Box 751, Berkeley, CA 94704

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated

under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule, but is made voluntarily

in the interest of public disclosure and consideration of these important issues.

Public Storage (PSA)

Vote Yes: Item #5 – Shareholder Proposal Regarding Greenhouse Gas Reduction Targets

Annual Meeting: May 2, 2023

CONTACT: Daniel Stewart | dstewart@asyousow.org

THE RESOLUTION

Shareholders request the Board

issue short and long-term Scope 1-3 greenhouse gas reduction targets aligned with the Paris Agreement’s 1.5°C goal requiring

Net zero emissions by 2050.

SUPPORTING STATEMENT: Proponents suggest, at management’s

discretion, that the targets:

| · | Take into consideration approaches used by advisory groups such as the Science

Based Targets initiative; |

| · | A timeline for setting a net zero by 2050 GHG reduction target, and 1.5°C

aligned interim targets; |

| · | An enterprise-wide climate transition plan to achieve 1.5°C

aligned emissions; and |

| · | Annual progress towards meeting its emissions reduction goals. |

SUMMARY

The window for limiting global warming to 1.5°C

is quickly narrowing,1 requiring immediate, sharp emissions reduction from all market sectors.2 Failure

to reach Net Zero emissions by 2050 is projected to have disastrous economic consequences,3 impacting companies and investor

portfolios. In response to this growing material risk, shareholders seek clear, consistent disclosures and science aligned greenhouse

gas reduction targets from the companies in which they invest.

_____________________________

1 https://www.ipcc.ch/2021/08/09/ar6-wg1-20210809-pr/

2

https://www.ipcc.ch/report/ar6/wg3/downloads/report/IPCC_AR6_WGIII_FullReport.pdf

3 https://www.nytimes.com/2021/04/22/climate/climate-change-economy.html

|

2023

Proxy Memo

Public

Storage | Set Net Zero Targets

|

The real estate industry will play a critical role in global decarbonization

efforts due to its significant value chain emissions – from use of power and natural gas in buildings, to embodied emissions in

construction materials and transportation – all significant sources of global emissions.

Public Storage is a global leader in self-storage facilities with thousands

of locations and over 170 million net rentable square feet of real estate.4 In its 2021 Annual Report, Public Storage states

that climate change poses both physical risk to its facilities and transition risk as society decarbonizes.5

Public Storage, however, has not set science-aligned greenhouse gas

reduction targets. It has set an emission reduction target of only 5% for its Scope 1 and 2 emissions by 20226 and has not

set targets for its value chain emissions. Without science-aligned emissions reduction targets, Public Storage lacks the foundation to

ensure that it is reducing its climate-related risk and it remains out of alignment with baseline investor expectations on climate risk

management. We urge a “Yes” vote on this proposal.

RATIONALE FOR A YES

VOTE

| 1. | Public Storage is exposed to disruptive risks associated with climate change. |

| 2. | Public Storage has provided insufficient emissions reduction targets to manage its climate risks. |

| 3. | Public Storage is failing to meet investor expectations and falling behind peers in setting net zero-aligned

targets for Scope 1-3 emissions. |

DISCUSSION

| 1. | Public Storage is exposed to disruptive risks associated with climate change. |

The global Paris goal

of achieving a net zero economy by 2050 will require mass decarbonization of the building sector, which is responsible for 30% of global

final energy consumption.7

With

170 million net square feet of rentable storage space operating under the Public Storage name, our Company is contributing to global climate

risk. It also faces substantial risks from a warming climate. According to its 2021 Annual Report, as global temperatures increase, Public

Storage properties may face increased destructive weather events such as floods, fires, and drought that could

cause damage to facilities and reduce demand for use of them.8

Beyond these physical

risks, Public Storage details how it faces growing governmental, political, and social pressure to address its climate impacts and reduce

its emissions. In the U.S., governments are developing greener building standards. For example, 100 cities in 11 states have developed

policies that require or encourage the switch to electric cooling and heating.9 As state and federal policymakers continue

to focus on climate legislation, Public Storage, with properties in 40 states, is likely to incur significant costs or other adverse impacts

on its business operations were it, or other entities in its value chain, required to install additional equipment, alter operations to

incorporate new technologies or processes, or reduce emissions to specific levels.

_____________________________

4 https://www.publicstorage.com/our-story

5 https://s1.q4cdn.com/588671402/files/doc_financials/2021/ar/Public-Storage-Annual-Report-2021-vF.pdf,

p.11

6 https://s1.q4cdn.com/588671402/files/doc_downloads/Sustainable-Moving-Supplies/07/Public-Storage-Sustainability-Report-2022-vF.pdf,

p.10

7 https://www.iea.org/reports/buildings.

8 https://s1.q4cdn.com/588671402/files/doc_financials/2021/ar/Public-Storage-Annual-Report-2021-vF.pdf,

p.11

9 https://buildingdecarb.org/zeb-ordinances.

|

2023

Proxy Memo

Public

Storage | Set Net Zero Targets

|

It is in Public Storage’s

best interest to proactively comply with global climate policy momentum and align internal processes, as well as its capital allocation

decisions, to a business model that will succeed in a net zero economy. Committing to targets and working on a transition plan aligned

with the Paris Agreement now will reduce the risk of hasty, ineffective, and costly decarbonization compliance in the future.

| 2. | Public Storage has provided insufficient emissions reduction targets to manage its climate risks. |

Proponent has been engaging with Public

Storage on climate for over two years. Proponent recognizes and supports Public Storage’s improving climate related actions, such

as its short-term goals to reduce energy consumption and operational carbon emissions, and its decision to measure and disclose its Scope

3 emissions. However, Public Storage fails in setting net zero-aligned short- and long-term targets that cover its full range of Scope

1, 2, and 3 emissions. Setting Paris-aligned 1.5°C goals ensures investors that Public

Storage’s actions are aligned with the rate and pace of global decarbonization. Setting net zero goals ensures that its progress

is planned across time, that 1.5°C related investments and actions are being made timely

and across all material value chain emissions sources, and ensures that its value chain partners are similarly proactively addressing

climate risk and setting 1.5°C aligned targets. Additionally, by setting net zero goals,

Public Storage can plan for adequate progress against peers and send a strong signal to investors that Public Storage is positioning itself

for success in a transitioning economy.

| 3. | Public Storage is failing to meet investor expectations

and falling behind peers in setting net zero-aligned targets for Scope 1-3 emissions. |

Shareholders

are increasingly concerned about material climate risk to both their companies and their portfolios and seek clear and consistent disclosures

and robust science-aligned target setting from their issuers. Currently, more than $130 trillion of assets under management is committed

to achieve 1.5°C.10 The Climate Action 100+ initiative, a coalition of 700 investors with over $68 trillion in assets,

outlines metrics of climate accountability in its Net Zero Company Benchmark, including: 1) a net zero goal; 2) short, medium, and long

term GHG reduction targets aligned with the Paris Agreement; and 3) a transition action plan, among other measures. The CA100+ supports

reducing company emissions at the rate necessary to achieve Paris goals and avoiding risks associated with the transition to net zero.11

The Science Based Targets initiative (SBTi) is widely considered the global gold standard of science-aligned target setting. Across the

market, over 1,463 companies have joined the Science-Based Targets initiative’s Business Ambition for 1.5°C campaign, committing

to set net zero emission reduction targets in line with a 1.5°C future. As Paris-aligned goals and transition plans become the norm,

Public Storage risks becoming a laggard if it does not set 1.5oC aligned goals across its full range of operational and value

chain emissions. In contrast to Public Storage, 51 North American companies in the real estate

sector have committed to establish valid GHG targets through the Science Based Targets initiative.12

_____________________________

10 https://www.gfanzero.com/press/amount-of-finance-committed-to-achieving-1-5c-now-at-scale-needed-to-deliver-the-transition/

11 https://www.climateaction100.org/progress/net-zero-company-benchmark/

12 https://sciencebasedtargets.org/companies-taking-action

|

2023

Proxy Memo

Public

Storage | Set Net Zero Targets

|

Currently, Public Storage’s lack of short- and long-term net zero targets do not align with the expectations of the CA100+ Benchmark

or SBTi’s Net Zero Standard. Investors are concerned that Public Storage’s inability to meet the standards of these science-aligned

organizations will put the Company at risk in an industry that is being redefined by climate change.

By calculating its full value chain emissions and setting 1.5°C

aligned emission reduction targets, Public Storage can provide investors with assurance that management is adequately addressing concerns

about growing climate risks.

RESPONSE TO PUBLIC

STORAGE BOARD OF DIRECTORS’ STATEMENT IN OPPOSITION

Public Storage touts its efforts to reduce its Scope 1 and 2 emissions

such as committing to installing solar at over 1,000 properties by 2025, doubling the number of Green Building certified facilities to

approximately 140 by the end of 2024, and completing over 2,500 LED lighting conversions. While good first steps, Public Storage has thousands

of facilities and no overarching GHG reduction goal beyond its current 2022 goal of 5% reduction in its Scope 1 and 2 GHG emissions. It

does not appear Public Storage’s actions are sufficiently ambitious to reduce its full range of operational and value chain emissions

in line with global net zero by 2050 goals.

Proponents have been in discussions with Public Storage for several

years on the topic of taking responsibility for its full range of GHG emissions. By setting and working to achieve net zero goals, Public

Storage can contribute to reducing its own, and its suppliers’ emissions, with the goal of avoiding the most catastrophic climate

impacts. The Board claims that the Proposal includes a one-size-fits-all approach, but global GHG reduction goals can only be achieved

by collective 1.5oC-aligned action across every industry sector. Such goals will drive down energy needs, which will allow

energy companies to decarbonize, it will drive innovation, allowing low carbon technology to spread.

Thousands of other companies have made

commitments to address their contribution to climate risk by aligning with net zero emissions and have begun to inform investors about

their transition plans. While Public Storage pushes back on the requested timeline for setting net zero goals (12 months for Scopes 1-2

and 24 months for Scope 3), these timelines are typically sufficient to commit to science-aligned targets. For example, the Science Based

Targets initiative affords 24 months to companies to develop targets after a commitment. To protect the global economy from the impacts

of climate change and protect investor value, limiting global warming to 1.5oC requires every

company, regardless of industry or emissions intensity, to set net zero targets.

Public Storage suggests that it should wait for the final SEC climate

disclosure rule before it acts. Yet, shareholders continue to ask for full emission disclosure and for the setting of net zero targets

to address climate-related risk regardless of the outcome of the proposed SEC rule. The SEC itself states that the rule is reflective

of shareholder’s current need for disclosures related to climate action. Waiting for the Rule impedes investors from obtaining the

information necessary to understand which companies are taking net zero aligned actions and which are falling behind the global energy

transition. Delay also prevents investors from knowing which companies face a range of risks and lost opportunities and which companies

are proactive and timely in addressing their value chain emissions. Investors are asking not for minimum regulatory compliance but best

practice in science-aligned climate performance.

|

2023

Proxy Memo

Public

Storage | Set Net Zero Targets

|

Thus, this shareholder request to set science-aligned targets is by

no means unique, unnecessary, or prescriptive but rather, basic, and fundamental. Once set, management has the freedom and authority to

decide when and by what means it will reach its 1.5°C targets, as long as they are

science aligned. By delaying a decision to set targets, the Company is sacrificing the critical time it needs to complete foundational

steps and orient towards a net zero future.

CONCLUSION

By failing to set net zero targets,

Public Storage misaligns with benchmarks underpinned by climate science, lacks goalposts to develop a clear roadmap to reduce emissions

across its full value chain, and cannot, therefore, be considered to be on track to meet net zero emissions. We urge a “Yes”

vote on this resolution.

Vote “Yes” on this Shareholder Proposal 5

--

For questions, please contact Daniel Stewart, As You Sow,

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE,

U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION

OF AUTHORITY TO VOTE YOUR PROXY. THE COST OF DISSEMINATING THE FOREGOING INFORMATION TO SHAREHOLDERS IS BEING BORNE ENTIRELY BY ONE OR

MORE OF THE CO-FILERS. PROXY CARDS WILL NOT BE ACCEPTED BY ANY CO-FILER. PLEASE DO NOT SEND YOUR PROXY TO ANY CO-FILER. TO VOTE YOUR PROXY,

PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

5

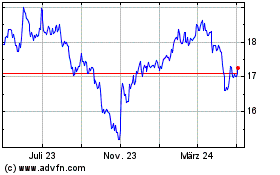

Public Storage (NYSE:PSA-O)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

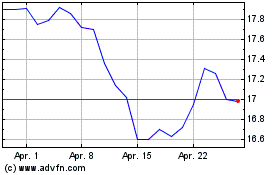

Public Storage (NYSE:PSA-O)

Historical Stock Chart

Von Apr 2023 bis Apr 2024