false000180883400018088342024-01-252024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 8-K

________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 25, 2024

(Exact name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

Georgia | | 1-39628 | | 85-2484385 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | | | | |

| 256 W. Data Drive | | Draper, | Utah | | 84020-2315 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (385) 351-1369

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.50 Par Value | | PRG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION

PROG Holdings, Inc. (the "Company") today provided an update to selected financial metrics included in its full-year 2023 outlook that was provided in its press release, dated October 25, 2023. Total revenues and diluted non-GAAP EPS are expected to meet or slightly exceed the high-end of the full-year 2023 outlook, while Adjusted EBITDA is expected to be within the provided range. In addition, the Company’s gross merchandise volume for the fourth quarter of 2023 was better than expected.

The information in this Item 2.02 of this Current Report on Form 8-K shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act"), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 (the "Securities Act").

ITEM 2.05. COSTS ASSOCIATED WITH EXIT OR DISPOSAL ACTIVITIES

As a continuation of cost reduction initiatives intended to drive efficiencies and right-size variable costs while minimizing the negative impact on growth-related initiatives, the Company today announced that it has taken several recent actions that are expected to result in annual pre-tax savings of approximately $15 million. These actions are expected to be substantially completed by the end of the first fiscal quarter of 2024.

In connection with these actions, the Company estimates that it will incur approximately $28 to $31 million of restructuring charges, substantially all of which are expected to be incurred by the end of the first fiscal quarter of 2024. These estimated charges consist primarily of $17 to $18 million in charges related to the termination of certain independent sales agent agreements, $5 to $6 million in charges related to severance payments and other termination benefits involving a reduction in our workforce, and $6 to $7 million in charges related to office space reduction and consolidation. In connection with the cost reduction initiatives, the Company expects that substantially all charges will be cash expenditures.

The estimated charges that the Company expects to incur are subject to a number of assumptions, and actual amounts may differ materially from such estimates. The Company may also incur additional charges not currently contemplated due to unanticipated events that may occur, including in connection with the implementation of the cost reduction initiatives.

ITEM 7.01. REGULATION FD DISCLOSURE

The information set forth in Item 2.02 of this Current Report on Form 8-K is incorporated herein by reference.

The Company issued a press release in connection with the continuation of its cost reduction initiatives described above, a copy of which is furnished as Exhibit 99.1 and is incorporated herein by reference. Additionally, a letter to the Company’s employees from Steve Michaels, the Company’s President and CEO, regarding the continuation of the Company’s cost reduction initiatives is furnished as Exhibit 99.2 and is incorporated herein by reference.

The information set forth in this Item 7.01 (including Exhibit 99.1 and Exhibit 99.2) of this Current Report on Form 8-K shall not be deemed "filed" for purposes of Section 18 of the Exchange Act, nor shall it be deemed incorporated by reference in any filing under the Securities Act.

Forward-Looking Statements

This Current Report on Form 8-K contains statements that constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended. All statements other than statements of historical fact made herein are forward-looking statements, including, without limitation, statements regarding the update to the Company’s full year 2023 outlook, the intended effects of the Company’s continuation of its cost reduction initiatives, the timing of completion of the Company’s continuation of its cost reduction initiatives and the Company’s estimates and expectations regarding the costs, charges and expenditures in connection with the continuation of its cost reduction initiatives. The Company has based these forward-looking statements on current expectations and assumptions regarding the cost reduction initiatives, which are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties include, but are not limited to, the risk of additional unexpected costs, charges and expenditures related to the continuation of the cost reduction initiatives, the risk that the Company will not achieve the anticipated pre-tax savings from the continuation of the cost reduction initiatives, the risk that the Company’s continuation of its cost reduction initiatives may negatively impact the Company’s revenue, business operations and reputation and other risks and uncertainties outside of our control. Additional risks and uncertainties that may cause actual results to differ materially include the risks and uncertainties listed in the Company’s filings with the Securities and Exchange Commission ("SEC"), including the Company’s most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on February 22, 2023 and the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2023, filed with the SEC on October 25, 2023. In providing forward-looking statements, the Company is not undertaking any duty or obligation to update these statements publicly as a result of new information, future events or otherwise, except as required by law.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits:

| | | | | |

Exhibit No. | Description |

| |

| |

| |

104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | PROG Holdings, Inc. |

| | By: | /s/ Brian Garner |

Date: | January 25, 2024 | | Brian Garner Chief Financial Officer |

PROG Holdings Announces Cost Savings Actions

SALT LAKE CITY, January 25, 2024 – PROG Holdings, Inc. (NYSE:PRG), the fintech holding company for Progressive Leasing, Vive Financial, Four Technologies, and Build, today announced several actions as a continuation of cost reduction initiatives expected to result in annual pre-tax savings for the Company.

These additional actions, which include a reduction in workforce, the termination of certain independent sales agent agreements, and office space consolidation, are intended to drive efficiencies within the Company’s cost structure while enabling it to remain committed to funding growth-related initiatives.

The Company believes that these actions, which are expected to be substantially completed during the first quarter of 2024, will result in annualized pre-tax savings of approximately $15 million.

“While our GMV in the fourth quarter of 2023 was better than expected, our overall lease portfolio size was down entering 2024 and we must continue to actively manage our business to best position us for future success,” said PROG Holdings President and CEO Steve Michaels. “Decisions impacting our employees are never easy, however our company is stronger because of their contributions, and I am incredibly proud of what we have achieved together.”

The Company is also providing an update to select financial metrics from the outlook provided in its Q3 2023 earnings release. Total revenues and diluted non-GAAP EPS are expected to meet or slightly exceed the high-end of the full-year 2023 outlook, while Adjusted EBITDA is expected to be within the provided range. In addition, the Company's gross merchandise volume for the fourth quarter of 2023 was better than expected.

PROG Holdings will discuss these actions and provide additional updates on its business during its fourth quarter earnings call on Wednesday, February 21, 2024, which can be accessed via the Company’s Investor Relations website,

https://investor.progholdings.com/.

About PROG Holdings, Inc.

PROG Holdings, Inc. (NYSE:PRG) is a fintech holding company headquartered in Salt Lake City, UT, that provides transparent and competitive payment options to consumers. The Company owns Progressive Leasing, a leading provider of e-commerce, app-based, and in-store point-of-sale lease-to-own solutions, Vive Financial, an omnichannel provider of second-look revolving credit products, Four Technologies, a provider of Buy Now, Pay Later payment options through its platform, Four, and Build, provider of personal credit building products. More information on PROG Holdings and its companies can be found at https://investor.progholdings.com/.

Forward Looking Statements:

This press release contains statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended. All statements other than statements of historical fact made herein are forward-looking statements, including, without limitation, statements regarding the update to the Company’s full year 2023 outlook, the intended effects of the Company’s continuation of its cost reduction initiatives, the timing of completion of the Company’s continuation of its cost reduction initiatives, and the Company’s estimates and expectations regarding the amount of annualized pre-tax savings associated with those initiatives. The Company has based these forward-looking statements on current expectations and assumptions regarding the cost reduction initiatives, which are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties include, but are not limited to, the risk of additional unexpected costs, charges and expenditures related to the continuation of the cost reduction initiatives, the risk that the Company will not achieve the anticipated pre-tax savings from the continuation of the cost reduction initiatives, the risk that the Company’s continuation of its cost reduction initiatives may negatively impact the Company’s revenue, business operations and reputation and other risks and uncertainties outside of our control. Additional risks and uncertainties that may cause actual results to differ materially include the risks and uncertainties listed in the Company’s filings with the Securities and Exchange Commission (“SEC”), including the Company’s most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on February 22, 2023 and the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2023, filed with the SEC on October 25, 2023. In providing forward-looking statements, the Company is not undertaking any duty or obligation to update these statements publicly as a result of new information, future events or otherwise, except as required by law.

Investor Contact

John A. Baugh, CFA

VP, Investor Relations

john.baugh@progleasing.com

Media Contact

Mark Delcorps

Director, Corporate Communications

media@progholdings.com

PROG Nation,

We have made significant strides strengthening our business while successfully managing our portfolio during turbulent economic times, and these achievements are primarily due to the collective contributions from all of you.

However, we are not immune to the continued macroeconomic headwinds currently being faced by our customers and retail partners. In response, we have conducted a thorough analysis of our business and taken a number of steps to reduce costs and enhance operational efficiency.

To ensure we have the best organizational structure in place for the challenges ahead, I, with input from our executive team, have made the difficult decision to reduce our team size across the company while transitioning to a global workforce strategy in key areas. We believe that this will align our resources to achieve our strategic growth initiatives more efficiently.

Today’s actions are not being taken lightly, so I want to provide some context around them.

If your position has been included in this workforce reduction, the People Team will send an invitation before 9 AM (MT) scheduling a Zoom conversation by the end of today with one of your leaders and a People Team representative. Details about each employee’s individual arrangements will be discussed in these meetings.

The last day of employment for many of those impacted will be Friday, January 26. However, a number of employees, primarily from our Technology department, will be provided with a working notice and their last day of employment will extend beyond this week.

Conversations with impacted employees have been designed to offer information and resources specific to individual circumstances, and the following separation package will be offered to all impacted employees:

•A one-time, non-capped severance package that includes a minimum of four weeks of base salary plus additional pay for each full year of service.

•Payment for all accrued and unused PTO.

•Continued Employee Assistance Program access, including counselling and support for employees and families for three months following the last day worked.

•A lump-sum subsidy for the employer-paid portion of COBRA for employees on PROG’s medical, dental, or vision plans.

•Outplacement services and career support from Lee Hecht Harrison, an industry-leading talent solutions provider, alongside dedicated support from our Talent Acquisition Team.

The People Team will be offering informational support webinars for both individuals who are leaving PROG and employees who are staying with PROG after notifications are made, and we encourage you to take advantage of these resources. Additionally, and out of an abundance of caution, I want to remind all employees of our Information Protection Policy during this difficult time so that no one unintentionally violates their obligations.

For those of you leaving PROG, thank you for your hard work and contributions. I am truly grateful for the time we've spent working together and wish you success in your future endeavors. We are a stronger company because of your contributions to serving our customers, and I remain incredibly proud of what we have achieved together.

For the team that will remain at PROG, I know this decision will bring a period of change, and I thank you in advance for your continued support as we navigate the transition. Please know we did everything possible to extend the utmost respect and compassion to those employees impacted, and that we believe the actions we have taken will offer the balance we need to continue our progress towards our goals.

Moving Ahead

As part of this plan, we are transitioning a portion of our team, primarily in Technology, to a global workforce strategy. We expect this will help improve our technological speed to market, enhance our access to new capabilities and skills, strengthen business continuity, and increase our agility, scalability, and capacity for resources to be deployed across the organization. I invite you all to collectively contribute to the bright future that lies ahead by continuing to “innovate and simplify,” a value that remains core to PROG’s approach.

As we move forward, our focus remains on the adaptability and grit that has defined PROG from the beginning. Your dedication, talent, and hard work have always been the driving force behind our success, and I look forward to continuing to offer millions of consumers access to the tools and support they need for financial empowerment.

The opportunity in front of us is greater than ever, but so is our need to act with urgency to seize it. I’m committed to doing everything in my power to best position us for the future and unlock our full potential. With your continued support, I have no doubt that we will get it done.

Sincerely,

Steve

v3.23.4

Cover Page

|

Jan. 25, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 25, 2024

|

| Entity Registrant Name |

PROG HOLDINGS, INC.

|

| Entity Central Index Key |

0001808834

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

GA

|

| Entity File Number |

1-39628

|

| Entity Tax Identification Number |

85-2484385

|

| Entity Address, Address Line One |

256 W. Data Drive

|

| Entity Address, City or Town |

Draper,

|

| Entity Address, State or Province |

UT

|

| Entity Address, Postal Zip Code |

84020-2315

|

| City Area Code |

385

|

| Local Phone Number |

351-1369

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.50 Par Value

|

| Trading Symbol |

PRG

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

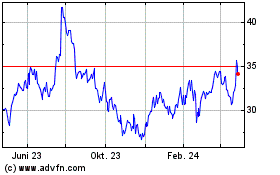

PROG (NYSE:PRG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

PROG (NYSE:PRG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024