Reaffirms 2013 Annual

Guidance

Service Launches in Mexico

Planet Payment, Inc. (Nasdaq:PLPM) (LSE:PPT), a leading provider of

international payment and transaction processing and multi-currency

processing services, announced today its results for the third

quarter ended September 30, 2013.

Financial Highlights for the Quarter Ended September 30,

2013

- Net revenue for the period increased approximately 6% to $10.5

million compared to $9.9 million in the third quarter of 2012.

- Consolidated gross billings was $26.6 million compared to $26.3

million in the third quarter of 2012. (See Table 3 for explanation

of this metric).

- Gross foreign currency mark-up was $22.7 million compared to

$22.9 million in the third quarter of 2012. (See Table 3 for

explanation of this metric).

- Processing services revenue increased 16% to $3.9 million

compared to $3.4 million in the third quarter of 2012.

- Net loss for the period was $0.8 million compared to a net loss

of $4.0 million in the third quarter of 2012. Included in the third

quarter of 2012 were $2.6 million of IPO costs which were

expensed.

- Adjusted EBITDA for the period was $0.2 million compared to a

loss of $0.4 million in the third quarter of 2012. (See Table 1 for

reconciliation of net income to Adjusted EBITDA).

Operational Highlights for the Quarter Ended September

30, 2013

- Total active merchant locations increased by 22% to

approximately 46,000 (See Table 3 for explanation of this

metric).

- Total settled dollar volume processed increased 13% to $1.7

billion and total settled transactions processed increased 28% to

15.2 million. (See Table 3 for explanation of these metrics).

- Launched Visa's service for Grupo Bimbo and Blue Label Telecom

in Mexico targeting 150,000 merchant locations for processing of

payment card and non-financial transactions on the same

terminal.

- Launched Pay in Your Currency Service with Banorte in

Mexico

- Signed direct acquiring agreements with Discover and UnionPay

International and became a member of UnionPay International.

- Agreed to launch Shop In Your Currency multicurrency e-commerce

services with Cardworks Acquiring and ProPay.

"Our results this Quarter reflect the trends that we highlighted

earlier in the year," said Philip Beck, Chairman and CEO of Planet

Payment. "We are seeing positive secular trends including the shift

from cash to electronic payments – particularly in emerging markets

which remain a strategic focus of the Company. In particular, we

are pleased that Visa has broadened our previously announced

strategic relationship for emerging markets to assist them in

expanding electronic payments in Mexico. Our processing services

are enabling merchants to accept financial and non-financial

transactions such as pre-paid airtime for mobile phones from a

single device. Additionally, new customers and initiatives in the

United States, Mexico and Indonesia should result in further

adoption of our Pay in Your Currency and Shop in Your Currency

solutions and drive increased multi-currency processing volumes.

These efforts, and other initiatives, including Brazil, represent a

solid pipeline of new merchant and ATM locations offering our

services which positions Planet Payment for growth in 2014."

Outlook for Fiscal Year 2013

The Company continues to expect the following for fiscal year

2013:

- Net revenue estimated to be in the range of $48.0 million to

$50.0 million.

- Net income estimated to be in the range of $1.0 million to $2.9

million.

- Adjusted EBITDA estimated to be in the range of $5.4 million to

$7.4 million. (See Table 2 for reconciliation of prospective net

income to Adjusted EBITDA).

- Fully diluted earnings per share estimated to be in the range

of $0.02 to $0.05 based upon 56.0 million fully diluted common

shares outstanding.

Conference Call

The Company will host a conference call to discuss third quarter

2013 financial results today at 5:00 pm New York time. Philip Beck,

Chairman and Chief Executive Officer, and Robert Cox, Chief

Financial Officer will host the call. The call will be webcast live

from the Company's investor relations website at

http://ir.planetpayment.com/. The conference call can also be

accessed live over the phone by dialing (877) 705-6003, or for

international callers (201) 493-6725. A replay will be

available approximately two hours after the call concludes and can

be accessed on our website or by dialing (877) 870-5176, or for

international callers (858) 384-5517, and entering the conference

ID 10000267. The replay will be available until our next

earnings call on our website or via telephone until Tuesday,

November 19, 2013.

Additional analysis of the Company's performance can be found in

the "Management's Discussion and Analysis of Financial Condition

and Results of Operations," included in the Quarterly Report on

Form 10-Q to be filed at www.sec.gov and posted on the Company's

investor relations website.

Notice Regarding Forward-Looking

Statements.

Information contained in this announcement may include

'forward-looking statements.' All statements other than statements

of historical facts included herein, including, without limitation,

those set forth in "Outlook for Fiscal Year 2013" and those

regarding the financial position, business strategy, plans, trends,

and objectives of management for future operations of both Planet

Payment and its business partners, financial growth, estimated net

revenue, net income, Adjusted EBITDA, diluted earnings per share,

estimated fully diluted common shares outstanding, future service

launches with customers in existing and new markets and new

initiatives and customer pipeline are forward-looking statements.

Such forward-looking statements are based on a number of

assumptions regarding Planet Payment's present and future business

strategies, and the environment in which Planet Payment expects to

operate in future, which assumptions may or may not be fulfilled in

practice. Implementation of some or all of the new services

referred to is subject to regulatory or other third party

approvals. Actual results may vary materially from the results

anticipated by these forward-looking statements as a result of a

variety of risk factors, including the risk that implementation,

adoption and offering of the service by processors, acquirers,

merchants and others may take longer than anticipated, or may not

occur at all, regulatory changes and changes in card association

regulations and practices, changes in domestic and international

economic conditions and changes in volume of international travel

and commerce and others. Additional risks may arise, with respect

to commencing operations in new countries and regions, of which

Planet Payment is not fully aware at this time. See the Company's

Quarterly Report on Form 10-Q, filed at www.sec.gov for other risk

factors which investors should consider. These forward-looking

statements speak only as to the date of this announcement and

cannot be relied upon as a guide to future performance. Planet

Payment expressly disclaims any obligation or undertaking to

disseminate any updates or revisions to any forward-looking

statements contained in this announcement to reflect any changes in

its expectations with regard thereto or any change in events,

conditions or circumstances on which any statement is based.

About Planet Payment

Planet Payment is a leading provider of international payment

and transaction processing and multi-currency processing services.

We provide our services in 22 countries and territories across the

Asia Pacific region, North America, the Middle East, Africa and

Europe, primarily through our more than 60 acquiring bank and

processor customers. Our point-of-sale and e-commerce services help

merchants sell more goods and services to consumers, and together

with our ATM services are integrated within the payment card

transaction flow enabling our acquiring customers, their merchants

and consumers to shop, pay, transact and reconcile payment

transactions in multiple currencies, geographies and channels.

Planet Payment is headquartered in New York and has offices in

Atlanta, Beijing, Bermuda, Delaware, Dubai, Dublin, London, Hong

Kong, Mexico City, Shanghai and Singapore. Visit

www.planetpayment.com for more information about the Company and

its services. For up-to-date information follow Planet Payment on

Twitter at @PlanetPayment or join Planet Payment's Facebook

page.

Non-GAAP Financial Information

The Company provides certain non-GAAP financial measures in this

announcement. Management believes that Adjusted EBITDA, when viewed

with our results under GAAP and the accompanying reconciliations,

provides useful information about our period-over-period results.

Adjusted EBITDA is presented because management believes it

provides additional information with respect to the performance of

our fundamental business activities and is also frequently used by

securities analysts, investors and other interested parties in the

evaluation of comparable companies. We also rely on Adjusted EBITDA

as a primary measure to review and assess the operating performance

of our company and our management team in connection with our

executive compensation. These non-GAAP key business

indicators, which include Adjusted EBITDA, should not be considered

replacements for and should be read in conjunction with the GAAP

financial measures.

We define Adjusted EBITDA as GAAP net income (loss) adjusted to

exclude: (1) interest expense, (2) interest income,

(3) provision (benefit) for income taxes,

(4) depreciation and amortization, (5) stock‑based

expense from options and warrants and (6) certain other items

management believes affect the comparability of operating results.

Please see "Adjusted EBITDA" below for more information and for a

reconciliation of Adjusted EBITDA to net income, the most directly

comparable financial measure calculated and presented in accordance

with GAAP.

| |

|

|

| Table 1. Reconciliation of

Historical Net Loss to Adjusted EBITDA |

|

|

| |

|

|

| |

Three months ended |

Nine months ended |

| |

September 30, |

September 30, |

| |

2013 |

2012 |

2013 |

2012 |

| ADJUSTED EBITDA: |

|

|

|

|

| Net loss |

$ (808,554) |

$ (3,961,815) |

$ (131,947) |

$ (4,333,290) |

| Interest expense |

21,394 |

14,163 |

50,305 |

42,738 |

| Interest income |

(278) |

(513) |

(802) |

(926) |

| (Benefit) provision for income taxes |

(33,617) |

(17,076) |

34,950 |

213,622 |

| Depreciation and amortization |

718,116 |

744,602 |

2,123,152 |

2,052,063 |

| Expensing of deferred IPO costs |

— |

2,578,770 |

— |

2,578,770 |

| Stock-based expense |

315,968 |

284,071 |

864,924 |

824,468 |

| Acquisition deal costs |

— |

323 |

— |

122,078 |

| Adjusted EBITDA (non-GAAP) |

$ 213,029 |

$ (357,475) |

$ 2,940,582 |

$ 1,499,523 |

| |

| Table 2. Reconciliation

of Prospective Net Income to Adjusted EBITDA |

| |

|

|

| For the year ending

December 31, 2013 |

| |

|

|

| |

Range |

| ADJUSTED EBITDA: |

Millions |

| |

|

|

| Net income |

$1.0 |

$2.9 |

| Interest expense |

0.1 |

0.1 |

| Interest income |

0.0 |

0.0 |

| Provision for income taxes |

0.1 |

0.2 |

| Depreciation and amortization |

3.0 |

3.0 |

| Stock‑based expense |

1.2 |

1.2 |

| Adjusted EBITDA (non-GAAP) |

$5.4 |

$7.4 |

| |

|

|

|

|

| Table 3. Explanation of

Key Metrics |

|

|

|

|

| |

|

|

|

|

| The following is a table

consisting of non-GAAP financial measures and certain other

business statistics that management monitors: |

|

|

|

|

| |

|

|

| |

Three months ended |

Nine months ended |

| |

September 30, |

September 30, |

| |

2013 |

2012 |

2013 |

2012 |

| KEY METRICS: |

|

|

|

|

| Consolidated gross billings(1) |

$ 26,598,328 |

$ 26,252,591 |

$ 89,507,161 |

$ 83,908,056 |

| Total settled dollar volume processed(2) |

$ 1,693,086,504 |

$ 1,496,207,922 |

$ 5,124,389,640 |

$ 4,366,239,448 |

| Adjusted EBITDA (non-GAAP)(3) |

$ 213,029 |

$ (357,475) |

$ 2,940,582 |

$ 1,499,523 |

| Capitalized expenditures |

$ 526,480 |

$ 453,325 |

$ 2,605,697 |

$ 1,387,970 |

| Total active merchant locations (at period

end)(4) |

46,272 |

37,806 |

46,272 |

37,806 |

| Total settled transactions processed(5) |

$ 15,154,838 |

$ 11,826,465 |

$ 43,215,992 |

$ 33,259,175 |

| Multi-currency processing services

key metrics: |

|

|

|

|

| Active merchant locations (at period

end)(4) |

24,106 |

20,451 |

24,106 |

20,451 |

| Settled transactions processed(6) |

2,983,102 |

2,838,374 |

9,042,446 |

8,659,071 |

| Gross foreign currency mark-up(7) |

$ 22,684,621 |

$ 22,879,097 |

$ 77,020,644 |

$ 73,099,273 |

| Settled dollar volume processed(8) |

$ 560,228,417 |

$ 571,880,110 |

$ 1,895,901,344 |

$ 1,881,188,121 |

| Average net mark-up percentage on settled

dollar volume processed(9) |

1.17% |

1.15% |

1.15% |

1.11% |

| Payment processing services key

metrics: |

|

|

|

|

| Active merchant locations (at period

end)(4) |

22,189 |

17,369 |

22,189 |

17,369 |

| Payment processing services

revenue(10) |

$ 3,913,707 |

$ 3,373,494 |

$ 12,486,517 |

$ 10,808,783 |

| Settled transactions processed(11) |

12,171,736 |

8,988,091 |

34,173,546 |

24,600,104 |

| Settled dollar volume processed(12) |

$ 1,132,858,087 |

$ 924,327,812 |

$ 3,228,488,296 |

$ 2,485,051,327 |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| (1) Represents gross foreign

currency mark-up (see footnote 7) plus payment processing

services revenue (see footnote 10). |

| |

|

|

|

|

| (2) Represents total settled

dollar volume processed through both our multi-currency and payment

processing services. |

| |

|

|

|

|

| (3) We define Adjusted EBITDA as

GAAP net income (loss) adjusted to exclude (1) interest

expense, (2) interest income, (3) provision (benefit) for

income taxes, (4) depreciation and amortization,

(5) stock-based expense from options and warrants and

(6) certain other items management believes affect the

comparability of operating results. Please see "—Adjusted EBITDA"

below for more information and for a reconciliation of Adjusted

EBITDA to net income, the most directly comparable financial

measure calculated and presented in accordance with GAAP. |

| |

|

|

|

|

| (4) We consider a merchant

location to be active as of a date if the merchant completed at

least one revenue-generating transaction at the location during the

90-day period ending on such date. The total number of active

merchant locations exceeds the total number of merchants, as

merchants may have multiple locations. As of September 30,

2013 and 2012, there were 23 and 14 active merchant locations,

respectively, included in both multi-currency and payment

processing active merchant locations but are not included in total

active merchant locations, in order to eliminate counting these

locations twice. |

| |

|

|

|

|

| (5) Represents total settled

transactions (excluding other transaction types such as

authorizations, rate look-ups and non-financial transactions). |

| |

|

|

|

|

| (6) Represents settled

transactions processed using our multi-currency processing services

(excluding other transaction types such as authorizations, rate

look-ups and non-financial transactions). |

| |

|

|

|

|

| (7) Represents the gross foreign

currency mark-up amount on settled dollar volume processed using

our multi-currency processing services. Gross foreign currency

mark-up represents multi-currency processing services net revenue

plus amounts paid to acquiring banks and their merchants associated

with such multi-currency processing transactions. Management

believes this metric is relevant because it provides the reader an

indication of the gross mark-up derived from multi-currency

transactions processed through our platform during a given

period. |

| |

|

|

|

|

| (8) Represents the total settled

dollar volume processed using our multi-currency processing

services. |

| |

|

|

|

|

| (9) Represents the average net

foreign currency mark-up percentage earned on settled dollar volume

processed using our multi-currency processing services. The average

net mark-up percentage on settled dollar volume processed is

calculated by taking the reported total multi-currency processing

services net revenue ($6.6 million for the three months ended

both September 30, 2013 and 2012, and $21.8 million and $20.9

million for the nine months ended September 30, 2013 and 2012,

respectively) and dividing by settled dollar volume processed (see

footnote 8). |

| |

|

|

|

|

| (10) Represents revenue earned

and reported on payment processing services. |

| |

|

|

|

|

| (11) Represents settled

transactions processed using our payment processing services

(excluding other transaction types such as authorizations and rate

look-ups). |

| |

|

|

|

|

| (12) Represents the total settled

dollar volume processed using our payment processing services. |

| |

|

|

|

|

| |

| Planet Payment, Inc.

Condensed Consolidated Balance Sheets |

| |

|

|

| |

As of September 30, |

As of December 31, |

| |

2013 |

2012 |

| |

(unaudited) |

|

| Current assets: |

|

|

| Cash and cash equivalents |

$ 4,715,206 |

$ 6,002,457 |

| Restricted cash |

2,773,485 |

2,517,616 |

| Accounts receivable, net of allowances of

$0.2 million as of September 30, 2013

and $1.5 million as of December 31, 2012 |

6,419,717 |

5,585,815 |

| Prepaid expenses and other

assets |

1,975,654 |

2,395,137 |

| Total current assets |

15,884,062 |

16,501,025 |

| Other assets: |

|

|

| Restricted cash |

429,360 |

669,406 |

| Property and equipment, net |

2,124,950 |

1,396,154 |

| Software development costs,

net |

5,026,711 |

4,776,320 |

| Intangible assets, net |

2,890,315 |

3,289,590 |

| Goodwill |

355,673 |

347,599 |

| Security deposits and other

assets |

1,207,737 |

338,408 |

| Total other assets |

12,034,746 |

10,817,477 |

| Total assets |

$ 27,918,808 |

$ 27,318,502 |

| Liabilities and stockholders'

equity |

|

|

| Current liabilities: |

|

|

| Accounts payable |

$ 1,215,656 |

$ 889,118 |

| Accrued expenses |

3,314,284 |

5,298,789 |

| Due to merchants |

2,351,156 |

2,546,140 |

| Current portion of capital leases

liability |

442,657 |

337,588 |

| Total current liabilities |

7,323,753 |

9,071,635 |

| Long-term liabilities: |

|

|

| Long-term portion of capital leases

liability and deferred income |

1,407,690 |

364,010 |

| Total long-term liabilities |

1,407,690 |

364,010 |

| Total liabilities |

8,731,443 |

9,435,645 |

| Commitments and

contingencies |

|

|

| Stockholders' equity: |

|

|

| Convertible preferred stock— 10,000,000

shares authorized as of September 30, 2013 and

December 31, 2012, $0.01 par value: Series A— 2,243,750

issued and outstanding as of September 30, 2013 and

December 31, 2012; $8,975,000 aggregate liquidation

preference |

22,438 |

22,438 |

| Common stock—250,000,000 shares authorized as

of September 30, 2013 and December 31, 2012, $0.01 par

value, and 54,570,679 and 53,658,857 issued and outstanding as of

September 30, 2013 and December 31, 2012,

respectively |

545,707 |

536,589 |

| Additional paid-in capital |

100,578,442 |

99,199,149 |

| Accumulated other comprehensive

gain |

85,969 |

37,925 |

| Accumulated deficit |

(82,045,191) |

(81,913,244) |

| Total stockholders' equity |

19,187,365 |

17,882,857 |

| Total liabilities and stockholders'

equity |

$ 27,918,808 |

$ 27,318,502 |

| |

|

|

| The accompanying notes are an

integral part of these financial statements |

| |

| Planet Payment, Inc.

Condensed Consolidated Statements of Operations

(unaudited) |

| |

|

|

|

|

| |

Three months ended |

Nine months ended |

| |

September 30, |

September 30, |

| |

2013 |

2012 |

2013 |

2012 |

| Revenue: |

|

|

|

|

| Net revenue |

$ 10,472,912 |

$ 9,925,137 |

$ 34,323,638 |

$ 31,723,111 |

| Operating expenses: |

|

|

|

|

| Cost of revenue: |

|

|

|

|

| Payment processing services

fees |

2,742,520 |

2,724,030 |

8,293,744 |

7,941,869 |

| Processing and service costs |

3,230,876 |

2,936,471 |

9,585,178 |

8,309,890 |

| Total cost of revenue |

5,973,396 |

5,660,501 |

17,878,922 |

16,251,759 |

| Selling, general and administrative

expenses |

5,320,571 |

8,229,877 |

16,492,210 |

19,549,208 |

| Total operating expenses |

11,293,967 |

13,890,378 |

34,371,132 |

35,800,967 |

| Loss from operations |

(821,055) |

(3,965,241) |

(47,494) |

(4,077,856) |

| Other (expense) income: |

|

|

|

|

| Interest expense |

(21,394) |

(14,163) |

(50,305) |

(42,738) |

| Interest income |

278 |

513 |

802 |

926 |

| Total other expense, net |

(21,116) |

(13,650) |

(49,503) |

(41,812) |

| Loss before benefit (provision) for

income taxes |

(842,171) |

(3,978,891) |

(96,997) |

(4,119,668) |

| Benefit (provision) for income

taxes |

33,617 |

17,076 |

(34,950 |

(213,622) |

| Net loss |

$ (808,554) |

$ (3,961,815) |

$ (131,947) |

$ (4,333,290) |

| Basic net loss per share applicable to

common stockholders |

$ (0.02) |

$ (0.08) |

$ (0.00) |

$ (0.08) |

| Diluted net loss per share applicable to

common stockholders |

$ (0.02) |

$ (0.08) |

$ (0.00) |

$ (0.08) |

| Weighted average common stock outstanding

(basic) |

53,051,626 |

52,366,739 |

52,888,734 |

52,062,429 |

| Weighted average common stock outstanding

(diluted) |

53,051,626 |

52,366,739 |

52,888,734 |

52,062,429 |

| |

|

|

|

|

| The accompanying notes are an

integral part of these financial statements |

| |

| Planet Payment, Inc.

Condensed Consolidated Statements of Cash Flows

(unaudited) |

| |

|

|

| |

Nine months ended |

| |

September 30, |

| |

2013 |

2012 |

| Cash flows from operating

activities: |

|

|

| Net loss |

$ (131,947) |

$ (4,333,290) |

| Adjustments to reconcile net loss to net

cash provided by operating activities: |

|

|

| Stock option expense |

864,924 |

824,468 |

| Depreciation and amortization

expense |

2,123,152 |

2,052,063 |

| Provision for doubtful

accounts |

259,443 |

85,052 |

| Expensing deferred IPO costs |

— |

2,346,210 |

| Deferred tax liability |

— |

(66,009) |

| Loss on disposal of equipment |

4,979 |

— |

| Gain on insurance settlement |

(301,281) |

— |

| Changes in operating assets and

liabilities, net of effects of acquisition |

|

|

| Increase in settlement assets |

(5,869) |

(358,033) |

| (Increase) decrease in accounts

receivables, prepaid expenses and other current assets |

(1,038,277) |

544,110 |

| Increase in security deposits and other

assets |

(604,914) |

(8,066) |

| Decrease in accounts payable, accrued

expenses and other long-term liabilities |

(777,209) |

(250,142) |

| (Decrease) increase in due to

merchants |

(194,984) |

245,047 |

| Other |

(22,082) |

(17,226) |

| Net cash provided by operating

activities |

175,935 |

1,064,184 |

| Cash flows from investing

activities: |

|

|

| Insurance proceeds |

401,281 |

— |

| (Increase) decrease in restricted

cash |

(9,954) |

9,984 |

| Purchase of property and

equipment |

(761,372) |

(189,685) |

| Capitalized software

development |

(1,132,921) |

(1,037,742) |

| Purchase of intangible assets |

(99,107) |

(75,490) |

| Cash paid for business combination, net

of cash acquired |

— |

(1,577,829) |

| Net cash used in investing

activities |

(1,602,073) |

(2,870,762) |

| Cash flows from financing

activities: |

|

|

| Proceeds from the exercise of stock

options and warrants |

483,184 |

67,680 |

| Principal payments on capital lease

obligations |

(344,297) |

(258,584) |

| Payment of IPO costs |

— |

(354,531) |

| Net cash provided by (used in) financing

activities |

138,887 |

(545,435) |

| Effect of exchange rate changes on cash and

cash equivalents(*) |

— |

— |

| Net decrease in cash and cash

equivalents |

(1,287,251) |

(2,352,013) |

| Beginning of period |

6002457 |

7671963 |

| End of period |

$ 4,715,206 |

$ 5,319,950 |

| Supplemental

disclosure: |

|

|

| Cash paid for: |

|

|

| Interest |

$ 48,431 |

$ 41,804 |

| Income taxes |

294,687 |

304,989 |

| Non-cash investing and financing

activities: |

|

|

| Assets acquired under capital

leases |

$ 561,469 |

$ 550,878 |

| Common stock issued for BPS

acquisition |

— |

1,596,862 |

| Accrued capitalized hardware, software

and fixed assets |

50,828 |

85,053 |

| Capitalized stock-based

compensation |

40,303 |

— |

| |

|

|

| |

|

|

| (*) For the nine months ended

September 30, 2013 and 2012, the effect of exchange rate

changes on cash and cash equivalents was inconsequential. |

| |

|

|

| The accompanying notes are an

integral part of these financial statements |

Notes to Condensed Consolidated Financial Statements

(unaudited)

1. Business description and basis of

presentation

Business description

Planet Payment, Inc. together with its wholly owned

subsidiaries ("Planet Payment," the "Company," "we," or "our") is a

provider of international payment and transaction processing and

multi-currency processing services. The Company provides its

services to approximately 46,000 active merchant locations in more

than 20 countries and territories across the Asia Pacific region,

North America, the Middle East, Africa and Europe, primarily

through its acquiring bank and processor customers, as well as

through its own direct sales force. The Company's point-of-sale,

e-commerce and ATM services are integrated within the payment card

transaction flow and enable its acquiring customers to process and

reconcile payment transactions in multiple currencies, geographies

and channels. The Company is a registered third party processor

with the major card associations and operates in accordance with

industry standards, including the Payment Card Industry, or PCI,

Security Council's Data Security Standards.

Company structure

Planet Payment was incorporated in the State of Delaware on

October 12, 1999 as Planet Group Inc. and changed its name to

Planet Payment, Inc. on June 18, 2007.

Since March 20, 2006, shares of the Company's common stock

have traded on the Alternative Investment Market of the London

Stock Exchange, or AIM, under the symbol "PPT." From

March 2006 until June 2013 shares of our common stock

were also traded on AIM under the symbol "PPTR." From

November 19, 2008 until December 14, 2012, shares of our

common stock were traded on the OTCQX under the symbol "PLPM." On

December 17, 2012 shares of our common stock began trading on

NASDAQ under the symbol "PLPM."

Basis of presentation

The condensed consolidated financial statements of the Company

have been prepared in accordance with accounting principles

generally accepted in the United States of America ("GAAP").

The accompanying condensed consolidated financial statements

include the accounts of Planet Payment, Inc. and its

wholly-owned subsidiaries. All intercompany transactions and

balances have been eliminated.

Unaudited consolidated interim financial

information

The accompanying unaudited condensed consolidated interim

financial statements as of September 30, 2013 and for the

periods ended September 30, 2013 and 2012 have been prepared

on the same basis as the annual consolidated financial statements.

In the opinion of management, the unaudited financial information

for the interim periods presented reflects all adjustments, which

are normal and recurring, necessary for a fair presentation of the

statement of operations, financial position and cash flows. The

accompanying unaudited condensed consolidated interim financial

statements should be read in conjunction with the audited

consolidated financial statements included in the Company's Annual

Report on Form 10-K for the year ended December 31, 2012.

Operating results for the interim periods ended September 30,

2013 are not necessarily indicative of the results that may be

expected for the year ending December 31, 2013. The

December 31, 2012 balance sheet information has been derived

from the audited financial statements at that date. Certain

information and disclosures normally included in annual

consolidated financial statements have been omitted pursuant to the

rules and regulation of the Securities and Exchange

Commission, or SEC.

CONTACT: Planet Payment, Inc.

Robert Cox (CFO)

Tel: + 1 516 670 3200

www.planetpayment.com

Redleaf Polhill (UK PR for Planet Payment)

Emma Kane / Rebecca Sanders-Hewett / David Ison

Tel: +44 207 382 4730

planet@redleafpr.com

ICR (USA IR for Planet Payment)

Don Duffy / Dara Dierks

Tel: +1 646-277-1212

Canaccord Genuity Ltd (Nomad for Planet Payment)

Simon Bridges / Andrew Chubb

Tel: +44 20 7523 8000

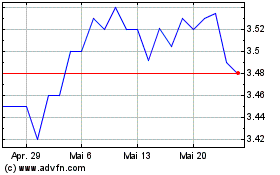

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024