Putnam Investments Ranked #1 in Lipper/Barron’s Best Mutual-Fund Families Survey

01 Februar 2010 - 3:19PM

Business Wire

The 2010 annual Lipper/Barron's Fund Families Survey, which

ranks mutual fund companies based on their performance across a

variety of asset types, both foreign and domestic, has ranked

Putnam Investments #1 out of 61 fund families based on its funds’

performance during 2009. Putnam’s strong move in the rankings is

initial validation of the firm’s investment platform improvements

designed to bolster long-term performance. The rankings are

included in the February 1, 2010 issue of Barron’s.

Putnam’s leap to top ranking reflects significant progress in

the performance of Putnam Investments mutual funds in the wake of

changes announced by Putnam President and Chief Executive Officer

Robert L. Reynolds in November 2008. The performance improvements

included both dramatic gains by individual funds and advancements

across the entire fund complex. For example, the Putnam Voyager

Fund (PVOYX) had one-year returns of 63.98 percent in 2009, ranking

it in the top 2% in its Lipper category. More broadly, 100 percent

of Putnam’s U.S. large-cap equity funds outperformed their Lipper

categories averages in 2009.

“We are honored that the Lipper/Barron's Fund Families Survey

has ranked Putnam Investments first among the nation’s mutual fund

companies. The ranking is recognition of the efforts and commitment

of the portfolio managers, research analysts and other team members

who have worked so hard to improve the performance of our funds and

help investors pursue their goals,” said Reynolds. “But, we

recognize that what is ultimately most important to earning the

trust of investors is a record of solid long-term performance, and

that is what we are working on building at Putnam Investments. For

us, the work has just begun.”

“We congratulate Putnam Investments on their top ranking in this

year’s Lipper/Barron's Fund Families Survey, which provides a way

to evaluate a fund company’s overall performance versus that of its

competitors,” said Edwin A. Finn Jr., Editor and President of

Barron’s. “Of course, as with all such rankings, investors should

consider them to be a starting point in their investment

decisions.”

Since joining Putnam on July 1, 2008, Reynolds has moved

aggressively to improve fund performance and strengthen Putnam’s

investment unit. He restructured Putnam’s equity investment

division to increase individual fund manager accountability and

responsibility, and he realigned manager and analyst incentives to

reward those who deliver top-quartile results for investors.

Putnam has also recruited a number of distinguished industry

veterans in trading, portfolio management and research during the

past 18 months, including Chief Investment Officer Walter Donovan

and Portfolio Managers Robert Ewing, David Glancy, and Nick

Thakore. The company has also built a first-class, high-talent

research team to drive its fundamental investment approach.

Besides turning around the performance of existing funds, Putnam

renewed its claim to leadership in mutual fund innovation during

2009, launching 14 new funds during the year. The products

introduced or enhanced in 2009 include:

- Putnam Absolute Return Funds,* which are

designed to pursue positive, targeted returns above inflation over

three years or more, and with less volatility than more traditional

funds. The absolute return strategies were also combined among the

underlying investments in the Putnam RetirementReady® Funds, Putnam's unique suite of 10

target-date lifecycle retirement funds, the only suite of lifecycle

funds in the industry to integrate these strategies.

- The Putnam Spectrum Funds, which

invest in the securities of leveraged companies, looking to

generate returns through investments across their entire capital

structure;

- The actively managed Putnam

Global Sector Funds, which target stocks in dynamic sectors across

global markets, cover nine sectors across the entire MSCI World

Index, and can be combined to create a highly customized

portfolio.

“We are working hard to pursue sustained, superior investment

performance for our shareholders by putting in place the right

people, products, and pricing,” said Reynolds. “This performance

improvement, as validated by the Lipper/Barron's Fund Families

Survey ranking, showcases what great talent and the right resources

can achieve for shareholders. Importantly, we have attained this

performance through fundamental, value-added research and

diversification, not by ramping up risk. We aim to sustain it.”

About Putnam Investments

Founded in 1937, Putnam Investments is a leading global money

management firm with over 70 years of investment experience. As of

December 31, 2009, Putnam had $115 billion in assets under

management. Putnam has offices in Boston, London, Frankfurt,

Amsterdam, Tokyo, Singapore, and Sydney. For more information, go

to putnam.com.

Putnam mutual funds are distributed by Putnam Retail

Management.

* Putnam's target Absolute Return Funds are not intended to

outperform stocks and bonds during strong market rallies.

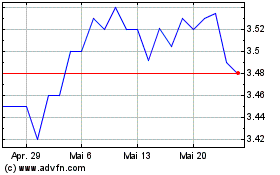

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024