Putnam Investments Launches New Roth IRA Resource Center for Financial Advisors

22 Januar 2010 - 7:10PM

Business Wire

Putnam Investments today announced that it has launched a new,

content-rich Roth IRA Conversion Resource Center with a full range

of information about traditional IRA conversions, how to evaluate

whether they make sense, what investors should consider before

converting, and how Putnam can help an advisor have this important

conversation with their clients. The Roth IRA Conversion Resource

Center is aimed at financial advisors who are responding to a flood

of demand from their clients for advice on conversions, since the

tax law change eliminating income caps that restricted

higher-income investors from converting traditional IRA assets to

Roth IRAs took place on January 1.

The Conversion Resource Center features the innovative Putnam

Roth IRA Conversion Evaluator – an interactive, visually impactful

tool designed to facilitate a conversation between advisors and

their clients. Unlike traditional calculators, the Putnam Roth IRA

Conversion Evaluator is designed to provide a framework for a

deeper financial planning conversation through a consultative

approach. The Conversion Evaluator results, for example, are

displayed upon a spectrum of how strongly or not clients should

consider a Roth IRA conversion, depending upon their current tax

situation, age, legacy wishes, and other factors.

“With all investors becoming eligible to convert to Roth IRAs,

$2 trillion* in traditional IRA assets held by higher-income

investors will qualify for conversion. While Roth IRAs make sense

for many of these investors, a thorough review of their overall

financial assets and goals is critical. Clients are already seeking

guidance – and the demand for help will grow as more investors

become aware of the new conversion opportunity,” said William Cass,

Putnam Investments Senior Vice President and Retirement Products

Marketing Manager. “It’s clear that the demand for assistance is

there among advisors who we think will find great value in the new

Roth IRA Conversion Resource Center.” Cass noted that a recent

informational call conducted for advisors drew over 1,000

participants.

The Roth IRA Conversion Resource Center also provides advisors

with a wide range of support materials and Putnam solutions,

including comprehensive Roth IRA conversion background,

considerations for clients thinking about a conversion, information

on conversion wealth management and tax strategies, “to-do”

checklists and letters than can be adapted to explain the new

changes to clients.

Background on Roth IRAs

Created in 1997, Roth IRAs differ from traditional IRAs in

several respects. While contributions to Roth IRAs are not

tax-deductible, assets typically grow tax free and withdrawals are

also usually tax free. In addition, Roth IRAs do not have required

minimum withdrawals beginning at age 70 1/2, so assets can be

passed on to heirs.

Wealthier investors have had little opportunity to invest in

Roth IRAs because only those with modified adjusted gross incomes

of less than $100,000 currently could convert from a traditional

IRA to a Roth IRA. This restriction was eliminated as of January 1,

2010, allowing these investors to convert some or all of their

traditional IRA assets to Roth IRAs.

Converting to a Roth IRA can make sense for affluent investors

for several reasons. Having a tax-free source of income to draw

from can help investors better manage their personal tax bill, and

a Roth IRA can act as a hedge against the future direction of tax

rates. The lack of required withdrawals beginning at age 70 1/2

means more years of tax free growth for retirees and also enables

income tax free withdrawals by the investor’s heirs, making Roth

IRAs useful wealth transfer vehicles.

Because contributions to Roth IRAs are not tax-deductible, those

converting from a traditional IRA are liable for taxes owed on the

amount converted; those converting in 2010 have the option of

paying the tax owed with their 2010 tax filings or paying it off

equally with their tax filings for 2011 and 2012. This option adds

to the complexity of Roth IRA decision-making.

Roth IRA assets were $165 billion at year-end 2008, although

this was still only about 5 percent of total IRA assets, which were

$3.6 trillion, according to data from the Investment Company

Institute (ICI). The elimination of the income restriction on Roth

IRA conversions beginning in 2010 could make as much as $2 trillion

of IRA assets eligible for conversion to Roth IRAs, according to

calculations by Putnam Investments, based on data from the ICI and

the Employee Benefits Research Institute. Cerulli Associates

projects that assets in Roth IRAs and other nontraditional IRAs

will grow by over 15 percent annually over the next five years.

Putnam Investments and Retirement

The Roth IRA Resource Center is part of Putnam’s deepened

commitment to the retirement market. Putnam’s President and Chief

Executive Officer, Robert L. Reynolds, himself a 30-year retirement

industry veteran, has called for sweeping reforms to help meet the

nation’s emergent retirement savings challenge.

Further, Putnam has expanded the services it offers to

retirement plans and developed products to meet the needs of those

planning for or already in retirement. The firm has created a

platform that provides flexible and scalable services and solutions

for advisors, consultants, and their plan sponsor clients in every

segment of the retirement market.

Putnam RetirementReady® Funds, the firm’s suite of 10

target-date/lifecycle retirement funds, recently added target

Absolute Return Funds** to its mix of underlying investments.

RetirementReady Funds became the only suite of lifecycle funds to

integrate absolute return strategies, which seek positive returns

over time with less volatility than more traditional mutual funds.

Employed in retirement portfolios, Putnam Absolute Return Funds are

intended to pursue positive returns in up and down markets, to

protect against the harmful effects of adverse investment returns

and to reduce volatility, particularly for investors in or near

retirement.

About Putnam Investments

Founded in 1937, Putnam Investments is a leading global money

management firm with over 70 years of investment experience. At the

end of December 2009, Putnam had $115 billion in assets under

management. Putnam has offices in Boston, London, Frankfurt,

Amsterdam, Tokyo, Singapore, and Sydney. For more information, go

to putnam.com.

Putnam mutual funds are distributed by Putnam Retail

Management.

* The elimination of the income restriction on Roth IRA

conversions beginning in 2010 could make as much as $2 trillion of

IRA assets eligible for conversion to Roth IRAs, according to

calculations by Putnam Investments based on data from the ICI and

the Employee Benefits Research Institute.

** Putnam’s target Absolute Return Funds are not intended to

outperform stocks and bonds during strong market rallies.

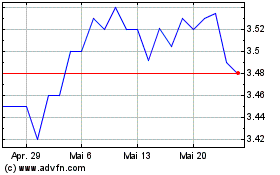

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024