Putnam Investments today announced that it has developed the

industry’s first suite of target date funds that integrate target

absolute return strategies with traditional mutual funds.

This significant enhancement to Putnam’s existing lineup of

target date Putnam RetirementReady® Funds is designed to pursue a

higher level of retirement income for investors. The funds will

seek to mitigate market volatility and create a more stable

sequencing of investment returns by combining target absolute

return strategies with more conventional relative return -- or

benchmark-focused -- mutual fund strategies.

“Integrating absolute return investing into target date funds is

a natural evolution in retirement savings products, bringing

long-established institutional strategies to retail retirement

funds,” said Putnam President and Chief Executive Officer Robert L.

Reynolds. “Given the challenges we face today in saving for

retirement, we believe that incorporating absolute return

strategies will add powerful and much-needed diversification to

target date investing, providing investors with what we think is a

stronger, more grounded long-term retirement savings vehicle.”

Reynolds noted that last year’s market slump highlighted the

need for target date managers across the industry to better shield

investors close to or in retirement from market extremes without

sacrificing the potential for gains in more positive markets.

“We’ve redesigned our RetirementReady Funds to address both of

these critically important needs,” Reynolds said. “Ultimately,

we’re aiming to give America a larger lifetime paycheck -- a raise

in retirement.”

The addition of absolute return strategies to Putnam

RetirementReady Funds has wide-ranging implications for the future

of 401(k) plans and other defined contribution retirement plans.

Lifecycle investing is one of the fastest-growing areas of defined

contribution savings, with more than $300 billion already invested

in such strategies -- much of it through “default” investments that

plan sponsors offer to employees who make no choice of their own.

Putnam believes that target date funds embedded with absolute

return strategies have the potential to become the core default

offering of choice for retirement plans in the years ahead.

“With millions of Americans relying on lifecycle investing as a

key part of their workplace savings plans, the inclusion of

absolute return strategies has the potential to be a truly defining

moment in the full-service defined contribution plan market,” said

Putnam Investments Head of Global Marketing, Products and

Retirement Jeffrey R. Carney. “We believe the prospect of reduced

volatility and higher income potential from their retirement

investments will resonate with plan sponsors, participants, and

advisors, who will definitely want to consider this next generation

of target date fund offerings,” said Carney.

Carney indicated that Putnam wanted to build upon the firm’s

risk-focused rolldown strategy, already among the most conservative

in the industry, through the introduction of strategies that

provide exposure to asset classes needed to generate the types of

investment returns that will fuel sufficient accumulation, as well

as limit the impact of severe market swings. “In the end, the goal

is to produce greater income in retirement with limited levels of

risk by pulling together Putnam’s broad investment capabilities and

best thinking around strategic and tactical asset allocation in a

dynamic offering for the retirement market.”

Putnam RetirementReady Funds

Putnam RetirementReady Funds consist of 10 dynamically managed

funds, each of which has a target date based on when investors

expect to begin withdrawing assets. Currently, there are nine funds

targeted to investors expecting to retire in specified five-year

time bands between now and 2050, and one fund intended for

investors currently in or near retirement. The asset allocation of

each RetirementReady Fund is targeted to match investors’

retirement time horizons, becoming progressively more conservative

as each fund approaches its target year and shifts its focus from

capital appreciation to income generation.

Putnam RetirementReady Funds will continue to be managed by

Putnam’s Global Asset Allocation Team led by Jeffrey Knight, Putnam

Investments Head of Global Asset Allocation. The team has overseen

Putnam’s risk-based portfolios since 1994.

Earlier this year, Putnam changed the structure of Putnam

RetirementReady Funds, shifting from a traditional fund-of-funds

approach to a more comprehensive management style, with Putnam’s

Global Asset Allocation team responsible for all aspects of the

funds’ management, from overall diversification strategy and mix of

investments -- down to individual security selection.

Absolute Return vs. Relative Return Strategies

In January 2009, Putnam launched the industry’s first suite of

target absolute return mutual funds, designed to seek annualized

total returns of 1%, 3%, 5%, or 7% above inflation as measured by

Treasury bills over a period of three years or more. Putnam’s

target Absolute Return Funds are designed to provide positive

returns over time, with less volatility than more traditional

funds, whether markets are rising or falling. Putnam

RetirementReady Funds will make use of varying combinations of

Putnam Absolute Return Funds at different allocation levels,

depending on the proximity to a target date’s maturity.

Unlike traditional long-only mutual funds, which are constrained

to closely follow specific market benchmarks, the absolute return

strategies employed by Putnam RetirementReady Funds enable

portfolio managers to invest anywhere in the world and move

dynamically to be positioned in sectors, asset classes, or

geographies they see as likely to produce positive returns.

Absolute return strategies employ modern investment tools that

enable managers to pursue positive returns whether securities

markets are rising or falling.

America’s Retirement Savings Challenge

Putnam’s addition of absolute return strategies to its suite of

RetirementReady Funds is another active step in Putnam’s response

to America’s retirement savings challenge. Earlier this year,

Reynolds called on employers, plan providers, regulators and

Congress to enact a retirement reform agenda that would

dramatically expand and strengthen 401(k)s and other

defined-contribution savings plans to reliably deliver lifelong

income to workers. Reynolds also recently challenged the financial

services industry to innovate in the areas of lower-volatility

products and lifetime income provision.

Product Innovation

The application of absolute return strategies to lifecycle

investing exemplifies Putnam’s renewed leadership in product

innovation. During the past year, Putnam has launched the

industry’s first suite of target Absolute Return Funds, which

already have attracted nearly $500 million in investments*, the

Spectrum Funds, which invest in the securities of undervalued,

leveraged companies, and the Global Sector Funds, which target

stocks in dynamic sectors across global markets.

Recommitment to the Retirement Market

The first use of absolute return strategies is also the most

recent step in Putnam’s recommitment to the retirement market.

Earlier this year, Putnam launched a new

401(k)/defined-contribution platform for advisors and their plan

sponsor clients that provides highly flexible and scalable services

and solutions.

About Putnam Investments

Founded in 1937, Putnam Investments is a leading global money

management firm with over 70 years of investment experience. As of

August 31, 2009, Putnam had $110 billion in assets under

management. Putnam has offices in Boston, London, Frankfurt,

Amsterdam, Tokyo, Singapore, and Sydney. For more information, go

to putnam.com.

*Putnam’s target Absolute Return Funds are not intended to

outperform stocks and bonds during strong market rallies.

Putnam mutual funds are distributed by Putnam Retail

Management.

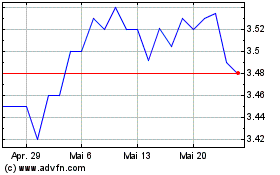

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024