UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

__________________________________

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ý

Filed by a party other than the Registrant ¨

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| ý | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

Post Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| ý | No fee required |

| o | Fee paid previously with preliminary materials |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Dear Shareholder:

We are writing to ask for your critical support at Post’s 2025 Annual Meeting of Shareholders to be held on January 30, 2025. We would like to draw your attention specifically to Proposal No. 3, an advisory vote on the Company’s executive compensation, and to express our appreciation for your independent analysis in conducting your evaluation.

Despite the express acknowledgement that Post has put in place successful performance-based programs and “reasonable outcomes in the annual and long-term incentives,” Institutional Shareholder Services (“ISS”) ultimately recommends that shareholders vote against Post’s executive compensation because Post adopted a new supplemental executive retirement program (“SERP”) in 2024. Given the importance of the proposal to our long-standing business and compensation strategy, we believe it is imperative that we highlight the flaws in ISS’ conclusion, which we have described in detail below.

Separately, Glass Lewis (“GL”) has also recommended that you vote against our executive compensation, though for a wholly separate, though equally curious, rationale. GL harnesses the crux of their negative recommendation on minor discretionary adjustments to bonus payouts made to the executive team. However, notably, they are passing judgment on decisions that were only applicable to fiscal 2023 bonus payouts. Either this is an oversight or an error, but either way, GL’s recommendations to you should be made based on fiscal 2024 compensation decisions.

We recognize that as busy shareholders, you likely rely on these proxy advisors’ reports. We would like to assure you of our commitment to continue to increase the value of your shares in Post. We thank you for the time you have focused on this matter and your careful consideration of this proposal, and for all the reasons below, our Board recommends that you vote “FOR” Proposal No. 3.

Post’s Objections to ISS Report

ISS Positively Highlights Numerous Aspects of our Overall Compensation Practices

As a preliminary matter, it is important to recognize that ISS’ adverse recommendation was not due to concerns with the attributes of our overall compensation program or our underlying corporate governance policies. ISS has supported our say-on-pay proposal in recent years, and we have not made any substantive changes to our overall philosophy, nor have we made substantial changes to the compensation opportunity for our executives. In particular, ISS found that the pay and performance of our CEO is reasonably aligned and found that support for our compensation committee members is warranted.

ISS Incorrectly Institutes a Blanket Rejection of SERPs, Without Considering the Relevant Nuanced Benefits of the Program

ISS takes the blanket position that SERPs are simply not appropriate because they are not market, noting that other companies have frozen these benefits. However, that is a simplistic argument of form over substance. The SERP was thoughtfully designed with the following in mind:

•Philosophically, Post Treats All Employees Equitably. Our retirement and other plans aim to treat all of our employees equitably in the benefits space. However, that does not necessarily mean that every employee has exactly the same vehicles in order to achieve that objective. Our hourly employees have the same benefit opportunities as our named executive officers (“NEOs”), including our 401(k) and our health plans. However, the 401(k) is the only qualified retirement plan available to these senior leaders, whereas we have pension, retiree medical and other defined benefit plans applicable to our hourly employees. In the health, life and disability space, our higher earners are significantly less subsidized for the cost of their employee medical plan than are our lower salary earners, as Post uses a salary-banded approach to setting contributions to make coverage affordable. In the retirement benefits space, we are focused on providing a cost-effective and sustainable level of coverage for all employees. None of the NEOs participating in the SERP are eligible for any benefit under a qualified defined benefit pension plan.

•SERP Largely Intended to Restore Retirement Benefits. The SERP was established largely to restore retirement benefits which would otherwise be lost because of IRS discrimination testing rules. Because of Post’s high proportion of hourly and other lower-compensated employees in our production facilities, the tax rules that require discrimination testing of plans have the effect of limiting the amounts that our executives can designate as retirement funds, preventing them from getting the full benefit of 401(k) and Company matches. Because of these limitations, executives cannot realize the full value of their retirement savings benefits and are often “cut off” from maxing out the 401(k). Executives reach the IRS compensation limit much earlier in the year, and the matching contributions must stop when the IRS compensation limit is hit. With no true-up in place, executives at the highest levels do not get the full 6% match. Furthermore, unlike many other consumer packaged goods companies, Post has not made any Company contributions to its nonqualified defined contribution plans in several years. The SERP was designed to bridge these gaps.

•Top Post Managers are Critical to Executing Our Strategy; the SERP provides significant retentive value. Post subscribes to the view that our senior-most executives are crucial to executing our strategy. The SERP at inception has 92 participants – it is not limited to NEOs. The SERP is key to retention and attraction. There is significant competition for the best workers (i.e., experienced, technically proficient and career driven). The SERP is intended to secure the future of our executive

workforce. The opening balance credit in the SERP vests over three years and pays out after the employee reaches retirement age, in order to provide retention value to Post.

ISS Wrongly Assumes that the SERP will “Substantially Increase the Cost of Benefits to Shareholders”

We disagree with ISS’ assertion that the SERP is a substantial cost to shareholders. The cost and ongoing liability of the SERP are actually quite low. The opening liability for all 92 participants was less than $12 million, and the annual operating cost is estimated at $1.5 million. In future years, the cost will only go down. The SERP is a very small aspect of Post’s overall compensation program, and hardly warrants such a punitive reaction from ISS.

Post’s Objections to Glass Lewis’ Report

Glass Lewis Wrongly Refers to Fiscal 2023 Bonus Payout Decisions to Justify a Negative Recommendation on Fiscal 2024

Most prominently, GL refers several times to Post’s fiscal 2023 bonus payouts, which did have a minor adjustment to executive bonuses for exemplary performance in that fiscal year. Those objections are misplaced, however, as the adjustments were made across the Post organization – no executive received a higher percentage payout than other salaried employees; in fact, our philosophy has been and continues to be to pay out executives at no greater payout percentage than all other employees. Wherever appropriate, we do just the opposite – lean in to higher payouts at lower compensation levels.

More importantly, however, we remain perplexed as to why GL would issue a negative recommendation for fiscal 2024 based on fiscal 2023 compensation decisions. Importantly, Post’s fiscal 2024 bonuses paid out according to plan, and no discretionary adjustments were made. This reference to fiscal 2023 bonuses throughout their report is either an error or misguided. While we understand that proxy advisors have a natural skepticism regarding “one-time” bonuses, that curiosity should not lead them to pick and choose information from year to year.

We will continue to encourage GL to make their annual recommendations based on the applicable decisions made in that year, and believe shareholders should do the same.

Glass Lewis Vaguely Takes Aim at Post’s Performance, Citing Metrics Not Used By Post or Our Shareholders to Judge Our Performance

More generally, GL takes apparent issue with Post’s performance, despite noting that Post “boasts strong TSR performance, with one- and three-year TSR in the highest percentile.” GL refers to a “continued misalignment between the CEO’s realized pay and the Company’s TSR performance on a five-year basis.” We disagree that our performance, whether on a one, three or five-year basis, is lackluster. The following charts illustrate Post’s TSR returns on these bases. Even on a five-year basis, Post comes in second position amongst our peers on TSR, behind only one other company.

GL further dilutes Post’s performance by instituting metrics such as Return on Invested Capital (“ROIC”) and Return on Assets (“ROA”). We view, and suspect you also view, our stock price as the best metric to judge our long-term performance. That is precisely why our long-term incentives are based on our total shareholder return compared to a peer set. On an annual basis, we focus on our Adjusted EBITDA performance, which is the sole metric for our annual bonus. We do not focus on ROIC or ROA and are unclear how these metrics should steer shareholders away from supporting Post’s compensation programs. These metrics also negatively impact companies that undertake meaningful mergers and acquisitions activity.

Conclusion

In closing, we ask that as you make your voting decision, you consider the points identified in this letter. While we understand the objectives of ISS and GL, we believe a more comprehensive view of our programs is warranted. We thank you for the time you have focused on this matter and your careful consideration, and for all the previously discussed reasons, our Board recommends that you vote “FOR” Proposal No. 3.

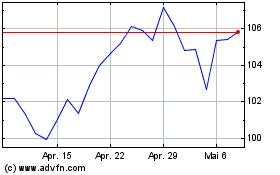

Post (NYSE:POST)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Post (NYSE:POST)

Historical Stock Chart

Von Feb 2024 bis Feb 2025