Current Report Filing (8-k)

10 Februar 2023 - 11:07PM

Edgar (US Regulatory)

0001230245

false

0001230245

2023-02-08

2023-02-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

| |

February 8, 2023 |

|

| |

Date of report (Date of earliest event reported) |

|

| |

PIPER

SANDLER COMPANIES |

|

| |

(Exact Name of Registrant as Specified in its

Charter) |

|

| Delaware |

|

1-31720 |

|

30-0168701 |

| (State of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

800 Nicollet Mall, Suite 900

Minneapolis, Minnesota |

|

55402 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| |

(612) 303-6000 |

|

| |

(Registrant’s Telephone Number, Including Area Code) |

|

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class | |

Trading

Symbol(s) | |

Name

of each exchange on which

registered |

| Common Stock, par value $0.01 per share | |

PIPR | |

The New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02. | Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On February 8, 2023, the Compensation Committee (the “Committee”) of the Board of Directors of Piper Sandler Companies

(the “Company”) approved the grant of a special performance-based non-qualified stock option (an “Option”) to

purchase 75,000 shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), to the Company’s

Chairman and CEO, Chad R. Abraham, with an expected grant date fair value of approximately $3,375,000. The Option was granted in order

to incentivize Mr. Abraham to further drive the Company’s growth and performance. Mr. Abraham was last awarded a special

option grant in connection with his promotion to CEO in February 2018, which fully vested in February 2023.

Under the terms of the

non-qualified stock option agreement (the “Option Agreement”) to be entered into between the Company and

Mr. Abraham, the Option has a ten-year term from February 15, 2023 (the “Effective Date”), and vests in equal

installments on each of the third, fourth and fifth anniversaries of the Effective Date as long as Mr. Abraham remains continuously

employed by the Company during such period. The Option is premium-priced, with the exercise price per share of Common Stock

underlying the Option equal to the closing price per share of Common Stock on the New York Stock Exchange on the Effective Date,

plus 10% per share. The Option was granted pursuant to the Company’s Amended and Restated 2003 Annual and Long-Term Incentive

Plan.

The foregoing description

of the Option Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the form of

Option Agreement, a copy of which is filed hereto as Exhibit 10.1 and incorporated by reference in this Current Report on Form 8-K.

| Item 9.01. |

Financial Statements and Exhibits. |

| |

104 |

Cover Page Interactive Data File (the cover page XBRL tags are embedded in the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

| |

PIPER SANDLER COMPANIES |

| |

| Date: February 10, 2023 |

By |

/s/ John W. Geelan |

| |

|

John W. Geelan |

| |

|

General Counsel and Secretary |

| |

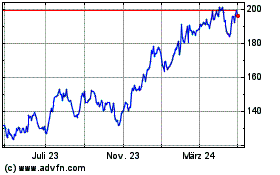

Piper Sandler Companies (NYSE:PIPR)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Piper Sandler Companies (NYSE:PIPR)

Historical Stock Chart

Von Apr 2023 bis Apr 2024